Silver exchange traded funds (ETFs) closely track the price of silver and are generally more liquid than the precious metal itself. Like other precious metals, silver tends to be favoured by investors seeking a hedge against inflation or a safe haven in times of market turmoil.

What is the Best Silver Bullion ETF?

- SIVR: abrdn Physical Silver Shares ETF

- SLV: iShares Silver Trust

- PSLV: Sprott Physical Silver Trust

- SLVP: iShares MSCI Global Silver and Metals Miners ETF

- AGQ: ProShares Ultra Silver

- SILJ: ETFMG Prime Junior Silver Miners ETF

- SIL: Global X Silver Miners ETF

- ZSL: ProShares UltraShort Silver

Here is a table comparing silver ETFs as of October 31, 2023.

| Manager |  |  |  |  |  |  |  |  |

| ETF | SIVR | SLV | SLVP | SILJ | SIL | AGQ | ZSL | PSLV |

| Inception | 2009-07-24 | 2006-04-21 | 2012-01-31 | 2012-11-28 | 2010-04-19 | 2008-12-01 | 2008-12-01 | 2010-10-27 |

| MER | 0.30% | 0.50% | 0.39% | 0.69% | 0.65% | 0.95% | 0.95% | 0.58% |

| AUM | $1,044,790,151 | $10,387,441,761 | $176,655,893 | $707,069,593 | $933,200,000 | $327,970,000 | $16,970,000 | $4,070,529,168 |

| 1Y | 20.69% | 20.46% | -3.99% | -9.36% | -2.44% | 12.13% | -29.26% | 18.11% |

| 3Y | -0.90% | -1.09% | -10.36% | -9.98% | -10.44% | -6.35% | -25.10% | -2.32% |

| 5Y | 9.77% | 9.55% | 8.20% | 6.05% | 5.18% | 6.87% | -37.89% | 8.42% |

| 10Y | 0.14% | -0.06% | 0.81% | N/A | -1.15% | -7.38% | -21.07% | -0.64% |

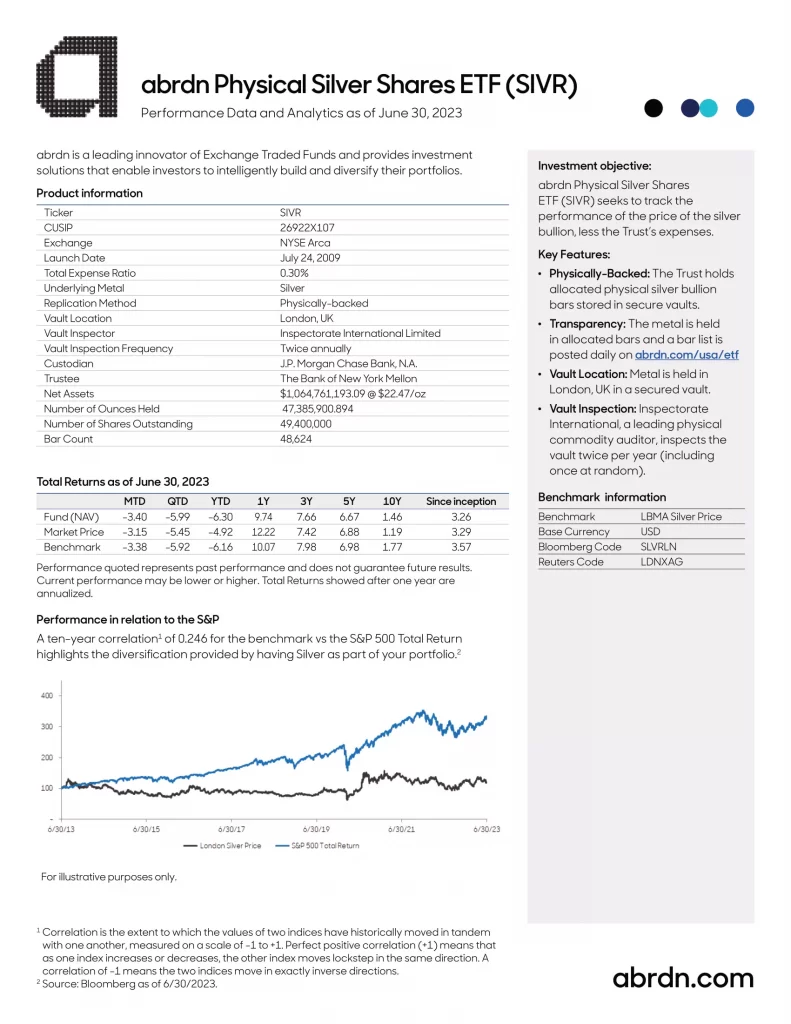

1. SIVR: abrdn Physical Silver Shares ETF

abrdn Physical Silver Shares ETF (“the Shares”) are issued by abrdn Silver ETF Trust (“the Trust”). The investment objective of the Trust is for the Shares to reflect the performance of the price of silver less the expenses of the Trust’s operations. The Shares are designed for investors who want a cost effective and convenient way to invest in silver.

2. SLV: iShares Silver Trust

The iShares Silver Trust seeks to reflect generally the performance of the price of silver. The iShares Silver Trust is not an investment company registered under the Investment Company Act of 1940, and therefore is not subject to the same regulatory requirements as mutual funds or ETFs registered under the Investment Company Act of 1940. The Trust is not a commodity pool for purposes of the Commodity Exchange Act. Before making an investment decision, you should carefully consider the risk factors and other information included in the prospectus.

- Exposure to the day-to-day movement of the price of silver bullion

- Convenient, cost-effective access to physical silver

- Use to diversify your portfolio and help protect against inflation

3. PSLV: Sprott Physical Silver Trust

The Sprott Physical Silver Trust (PSLV) is a closed-end trust that invests in unencumbered and fully-allocated London Good Delivery (“LGD”) silver bars. Provide a secure, convenient and exchange-traded investment alternative for investors who want to hold physical silver.

- Fully Allocated Silver Bullion

- Redeemable for Metals

- Trustworthy Storage

- Potential Tax Advantage

- Easy to Buy, Sell and Own

- A Liquid Investment

4. SLVP: iShares MSCI Global Silver and Metals Miners ETF

The iShares MSCI Global Silver and Metals Miners ETF seeks to track the investment results of an index composed of global equities of companies primarily engaged in the business of silver exploration or metals mining.

- Exposure to companies that derive the majority of their revenues from silver exploration or metals mining

- Targeted access to global silver or metals mining stocks

- Use to diversify your portfolio and to express a global sector view

5. AGQ: ProShares Ultra Silver

This ProShares ETF seeks daily investment results that correspond, before fees and expenses, to 2x the daily performance of its underlying benchmark. While the Fund has a daily investment objective, you may hold Fund shares for longer than one day if you believe it is consistent with your goals and risk tolerance.

For any holding period other than a day, your return may be higher or lower than the Daily Target. These differences may be significant. Smaller index gains/losses and higher index volatility contribute to returns worse than the Daily Target. Larger index gains/losses and lower index volatility contribute to returns better than the Daily Target.

6. SILJ: ETFMG Prime Junior Silver Miners ETF

The ETFMG Prime Junior Silver Miners ETF (SILJ) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Prime Junior Silver Miners & Explorers Index. The Index provides a benchmark for investors interested in tracking public, small-cap companies that are active in the silver mining exploration and production industry.

7. SIL: Global X Silver Miners ETF

The Global X Silver Miners ETF (SIL) provides investors access to a broad range of silver mining companies. The Global X Silver Miners ETF (SIL) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Silver Miners Total Return Index.

8. ZSL: ProShares UltraShort Silver

This ProShares ETF seeks daily investment results that correspond, before fees and expenses, to -2x the daily performance of its underlying benchmark. While the Fund has a daily investment objective, you may hold Fund shares for longer than one day if you believe it is consistent with your goals and risk tolerance.

For any holding period other than a day, your return may be higher or lower than the Daily Target. These differences may be significant. Smaller index gains/losses and higher index volatility contribute to returns worse than the Daily Target. Larger index gains/losses and lower index volatility contribute to returns better than the Daily Target.