QCN ETF Review

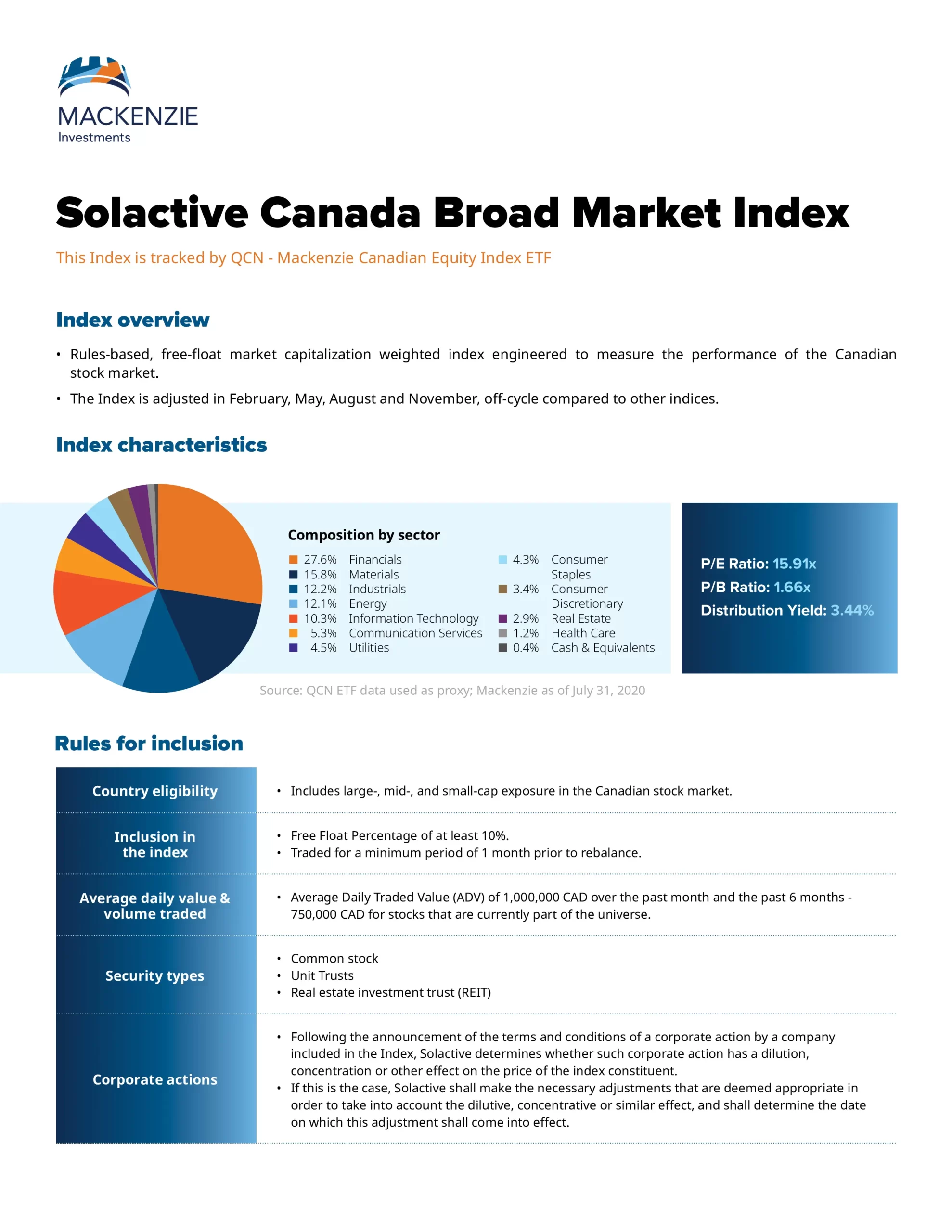

Mackenzie Canadian Equity Index ETF (QCN) seeks to replicate, to the extent reasonably possible and before fees and expenses, the performance of the Solactive Canada Broad Market Index. It invests primarily in Canadian equity securities. The Solactive Canada Broad Market Index is a market capitalization-weighted index of securities that broadly represent the Canadian stock market. It includes common stocks and income trust units.

Top 10 QCN Holdings

The top 10 investments of QCN account for 34.6%% of the 304 holdings. This table shows the investment names of the individual holdings that are subject to change.

| Ticker | Name | Weight |

|---|---|---|

| RY | Royal Bank of Canada | 6.53% |

| TD | TORONTO-DOMINION BANK | 4.16% |

| CP | CANADIAN PACIFIC KANSAS | 3.24% |

| CNQ | CANADIAN NATURAL RESOURCE | 3.21% |

| ENB | Enbridge Inc | 3.18% |

| SHOP | SHOPIFY INC | 3.16% |

| BN | BROOKFIELD CORPORATION | 2.91% |

| CNR | CANADIAN NATL RAILWAY CO | 2.90% |

| BMO | Bank of Montreal | 2.62% |

| CSU | CONSTELLATION SOFTWARE INC | 2.51% |

Is QCN a Good Investment?

Quickly compare QCN to similar investments focused on Canadian equity ETFs by risk, fees, performance, yield, volatility, and other metrics to decide which ETF will fit into your portfolio.

| Manager | ETF | Risk | Inception | MER | AUM | Holdings | Beta | P/E | Yield | Distributions | 1Y | 3Y | 5Y | 10Y | 15Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| XIC | Medium | 2001-02-16 | 0.06% | $12,748,173,743 | 227 | 1.00 | 13.40 | 2.82% | Quarterly | 12.06% | 5.92% | 9.26% | 6.93% | 8.18% |

| ZCN | Medium | 2009-05-29 | 0.06% | $8,224,580,000 | 228 | 1.00 | N/A | 3.15% | Quarterly | 12.04% | 5.92% | 9.26% | 6.93% | 7.71% |

| KNGC | Medium to High | 2024-05-30 | N/A | N/A | N/A | N/A | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| FXM | Medium to High | 2012-02-13 | 0.65% | $305,610,000 | 31 | 0.86 | 9.47 | 2.96% | Quarterly | 10.45 | 7.04% | 11.60% | 6.31% | N/A |

| CCEI | Medium | 2021-03-31 | 0.05% | $311,119,756 | 222 | N/A | 12.66 | 3.22% | Quarterly | 6.46% | N/A | N/A | N/A | N/A |

| DRFC | Medium | 2018-09-27 | 0.47% | $227,310,000 | 77 | 0.91 | 13.24 | 2.38% | Quarterly | 14.21% | 10.43% | 9.91% | N/A | N/A |

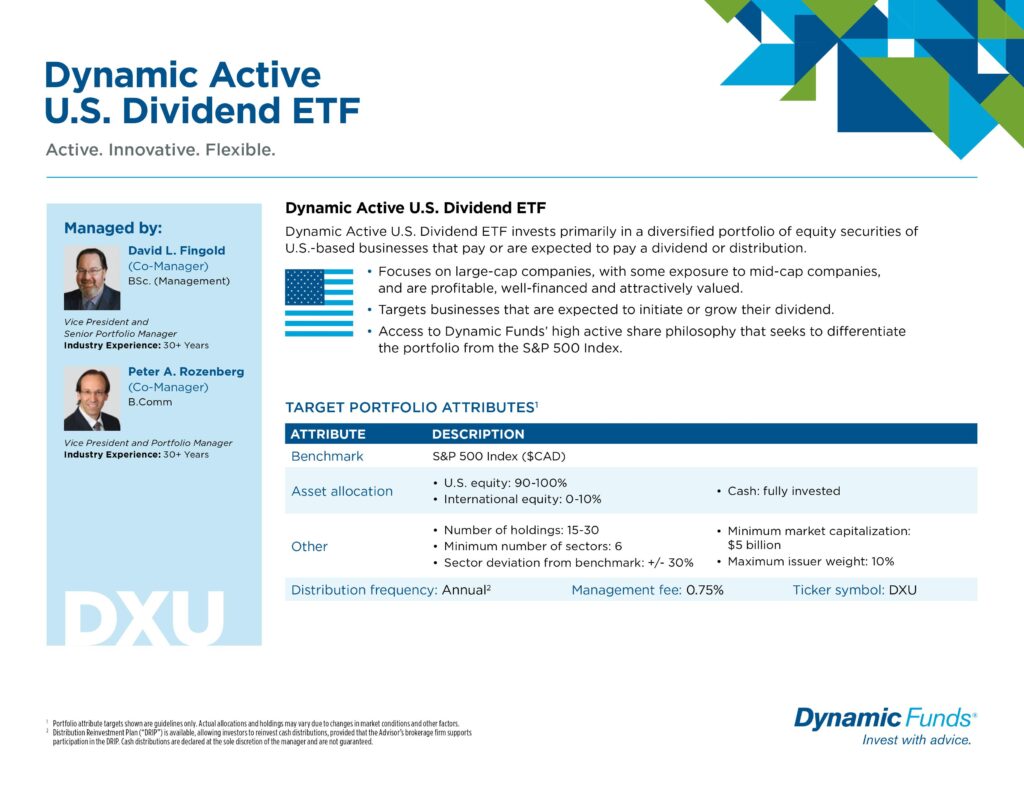

| DXC | Low to Medium | 2017-01-20 | 0.72% | $243,160,000 | 40 | 0.84 | N/A | 2.55% | Monthly | 6.05% | 8.27% | 9.90% | N/A | N/A |

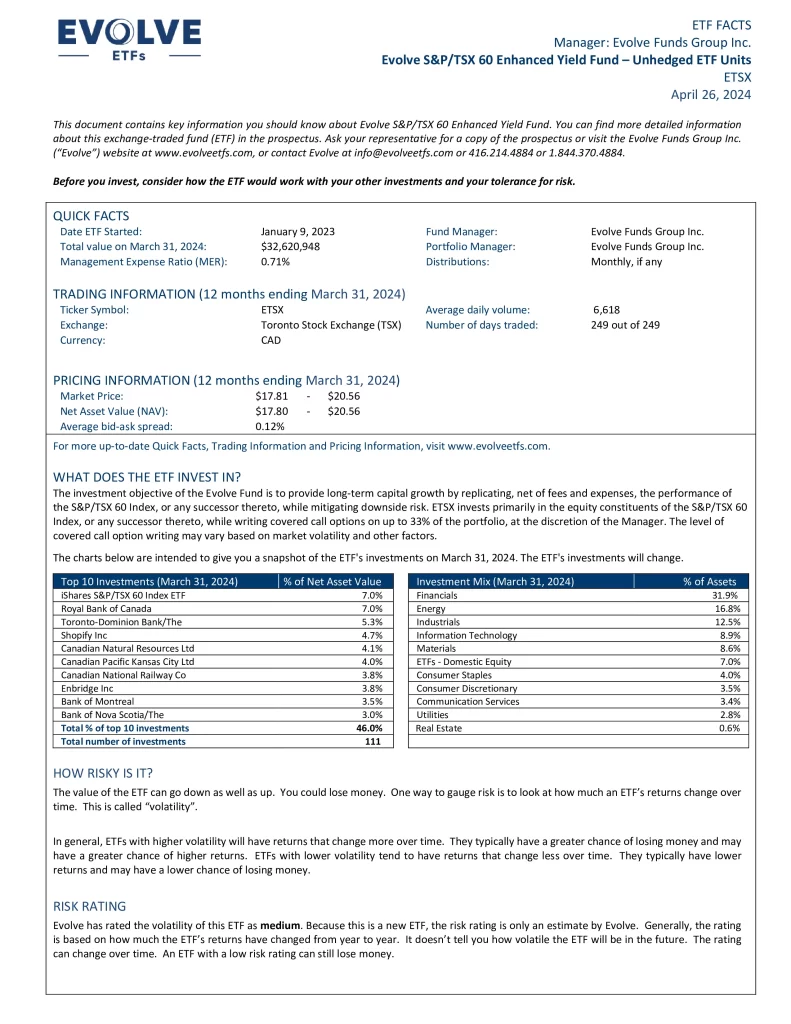

| ETSX | Medium | 2023-01-09 | 0.71% | $29,614,000 | 95 | N/A | N/A | 9.91% | Monthly | 4.01% | N/A | N/A | N/A | N/A |

| FCCV | Medium | 2020-06-05 | 0.39% | $139,700,000 | 66 | 1.11 | 7.06 | 3.08% | Quarterly | 4.77% | 9.60% | N/A | N/A | N/A |

| FST | Medium | 2001-11-30 | 0.67% | $69,965,022 | 26 | 0.94 | 11.56 | 1.60% | Quarterly | 18.01% | 11.11% | 10.05% | 7.91% | 8.31% |

| FLCD | Medium | 2019-02-13 | 0.06% | $198,070,000 | 172 | 0.99 | 12.77 | 3.20% | Quarterly | 6.05% | 9.70% | N/A | N/A | N/A |

| HXT | Medium | 2010-09-13 | 0.04% | $3,745,125,989 | 60 | 1.01 | N/A | N/A | N/A | 11.09% | 5.90% | 9.34% | 7.47% | N/A |

| GCSC | Medium | 2021-03-31 | 0.67% | $22,325,359 | 38 | 0.88 | 16.57 | 1.64% | Quarterly | 14.39% | 6.95% | N/A | N/A | N/A |

| HLIF | Medium | 2022-06-08 | 0.79% | $107,270,000 | 30 | N/A | N/A | 8.00% | Monthly | 0.24% | N/A | N/A | N/A | N/A |

| PXC | Medium | 2012-01-26 | 0.49% | $174,577,110 | 91 | 0.96 | 12.67 | 3.52% | Quarterly | 8.93% | 10.68% | 9.62% | 7.38% | N/A |

| QCN | Medium | 2018-01-24 | 0.04% | $1,471,956,609 | 304 | 0.99 | 13.28 | 3.29% | Quarterly | 12.22% | 6.12% | 9.48% | N/A | N/A |

| MCLC | Medium | 2017-04-10 | 0.40% | $321,170,000 | 82 | 0.96 | N/A | 2.75% | Semi-Annually | 10.12% | 10.33% | 9.30% | N/A | N/A |

| NSCE | Medium | 2020-01-23 | 0.69% | $1,645,300,000 | 34 | 0.73 | 20.43 | 1.11% | Quarterly | 11.28% | 9.86% | N/A | N/A | N/A |

| RCD | Medium | 2014-01-09 | 0.42% | $140,520,000 | 59 | 0.93 | 13.24 | 3.98% | Monthly | 7.74% | 8.41% | 8.63% | 5.84% | N/A |

| SITC | Medium | 2020-11-03 | 0.06% | $71,560,000 | 57 | 0.99 | 12.87 | 2.86% | Quarterly | 12.20% | 6.37% | N/A | N/A | N/A |

| TTP | Medium | 2016-03-22 | 0.05% | $1,620,910,000 | 279 | 0.99 | N/A | 2.89% | Quarterly | 4.74% | 10.04% | 9.63% | N/A | N/A |

| VCN | Medium | 2013-08-02 | 0.05% | $6,730,000,000 | 173 | 0.99 | 13.46 | 2.97% | Quarterly | 12.37% | 6.20% | 9.31% | 6.73% | N/A |