SJNK ETF Review

The SPDR Bloomberg Short Term High Yield Bond ETF (SJNK) tracks short-term, publicly issued U.S. dollar-denominated high yield corporate bonds with under 5 years to maturity and at least $350 million outstanding. Bonds must have fixed rates, be taxable, and rated between Caa3/CCC-/CCC- and Ba1/BB+/BB+. The index covers Industrial, Utility, and Financial Institutions sectors, excluding various other bond types. It is issuer-capped and updated monthly.

- Offers broad exposure to short-term, U.S. dollar-denominated high-yield corporate bonds.

- May offer reduced interest rate risk compared to longer-duration high-yield bonds.

- Provides a potentially more cost-effective approach to gaining high-yield exposure than investing in individual bonds.

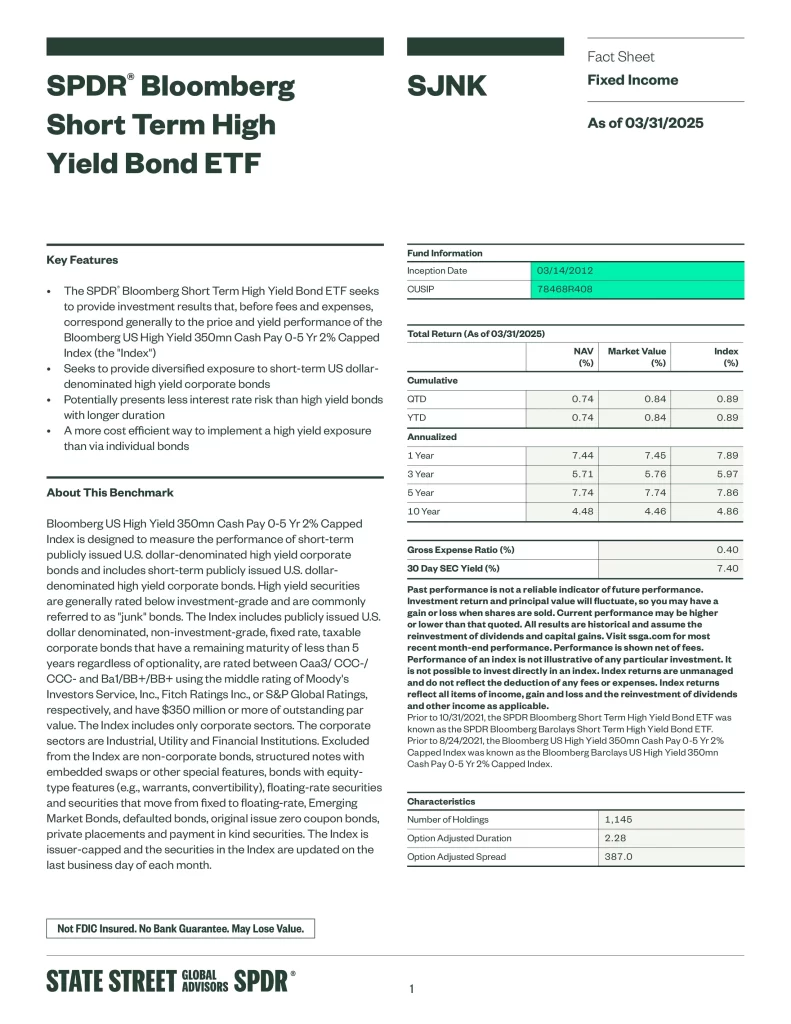

| Manager | Ticker | Inception | AUM | MER | Distributions | Yield |

|---|---|---|---|---|---|---|

| State Street | SJNK | 2012-03-14 | $4,165,430,000 | 0.40% | Monthly | 7.47% |