Putting your hard-earned money into the stock market can feel risky, especially for those who are more risk-averse. But what should you do with short-term savings to make that money work harder for you? Investing money you’ll need soon in the stock market isn’t always wise. Market volatility or a downturn could force you to sell at a loss, which is the last thing you want when you’re on a tight timeline. I believe it’s important to keep some cash reserves and high-interest savings account (HISA) ETFs available today are a fantastic option.

What is a High Interest Savings Account ETF?

High-interest savings exchange traded funds (ETFs) offer investors an opportunity to save money and earn competitive interest rates, providing better returns than traditional savings accounts or money market funds. They prioritize liquidity and safety, making them an appealing option. Compared to riskier investments like stocks, high-interest cash ETFs in Canada are considered extremely low-risk. They aim to preserve capital, offer some potential appreciation, and keep risk exposure minimal.

What is the Best High Interest Savings ETF in Canada?

- PSA: Purpose High Interest Savings Fund

- CSAV: CI High Interest Savings ETF

- HISA: High Interest Savings Account Fund

- HSAV: Global X Cash Maximizer Corporate Class ETF

- NSAV: Ninepoint High Interest Savings Fund

- CASH: Global X High Interest Savings ETF

Canadian High Interest Savings ETF Comparison

Quickly compare Canadian high-interest savings ETFs by fees, performance, yield, and other metrics to decide which ETF fits in your portfolio.

| Manager | ETF | Name | Inception | MER | AUM | Yield | 5Y |

|---|---|---|---|---|---|---|---|

| CI | CSAV | CI High Interest Savings ETF | 2019-06-14 | 0.16% | $7,720,000,000 | 4.40% | 2.63% |

| Evolve | HISA | High Interest Savings Account Fund | 2019-11-19 | 0.16% | $4,102,549,056 | 4.12% | 2.60% |

| Global X | CASH | Global X High Interest Savings ETF | 2021-11-01 | 0.11% | $4,868,410,812 | 4.37% | N/A |

| Global X | HSAV | Global X Cash Maximizer Corporate Class ETF | 2020-02-05 | 0.20% | $2,236,840,976 | N/A | N/A |

| Ninepoint | NSAV | Ninepoint High Interest Savings Fund | 2020-11-17 | 0.16% | $501,650,000 | 4.54% | N/A |

| Purpose | PSA | Purpose High Interest Savings Fund | 2013-10-15 | 0.16% | $5,500,000,000 | 4.46% | 2.69% |

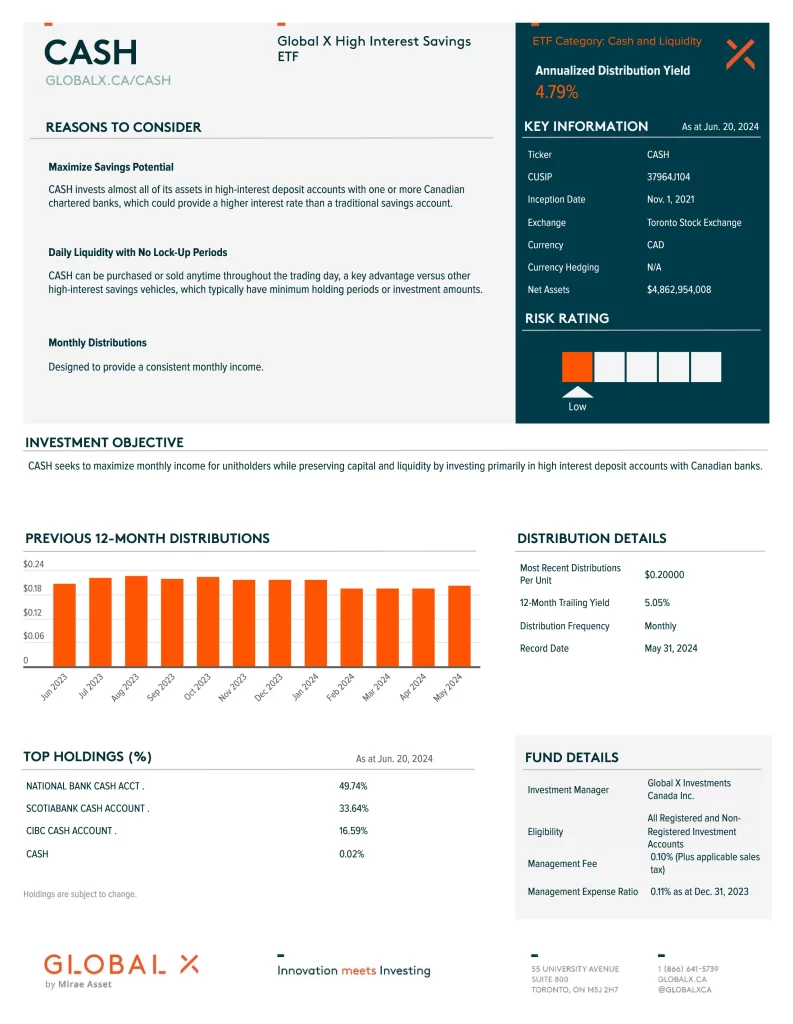

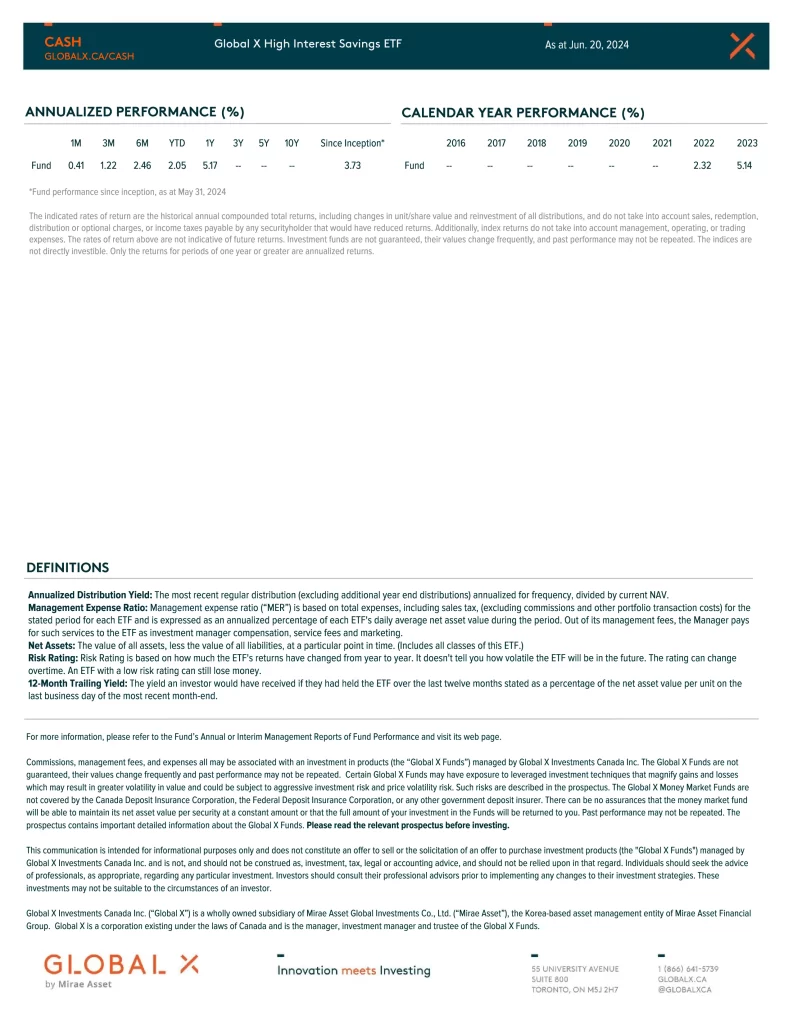

6. Global X High Interest Savings ETF

Global X High Interest Savings ETF (CASH) seeks to maximize monthly income for unitholders while preserving capital and liquidity by investing primarily in high-interest deposit accounts with Canadian banks.

- Enhanced Savings Potential: CASH invests almost all of its assets in high-interest deposit accounts with one or more Canadian chartered banks which provide a higher interest rate than a traditional savings account

- Daily Liquidity: CASH is an ETF so it can be purchased or sold anytime throughout the trading day. This is a key advantage versus other high-interest savings vehicles, which typically have minimum holding periods or investment amounts

- Monthly Income: It is anticipated that CASH will make distributions to its Unitholders every month

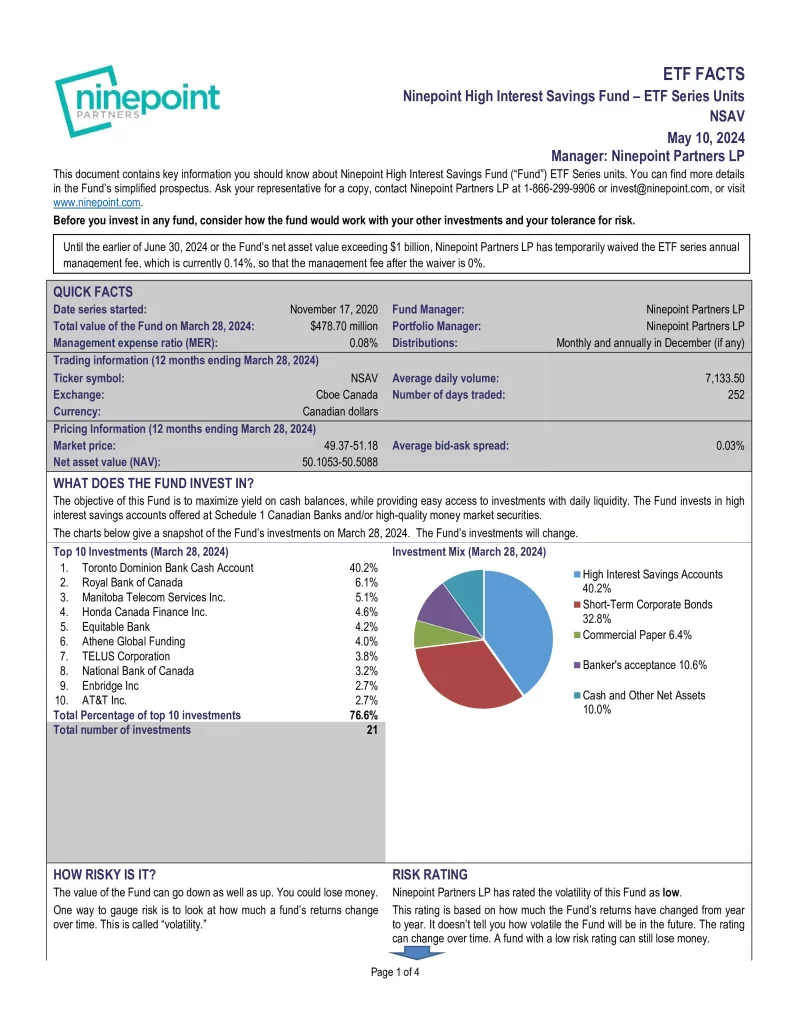

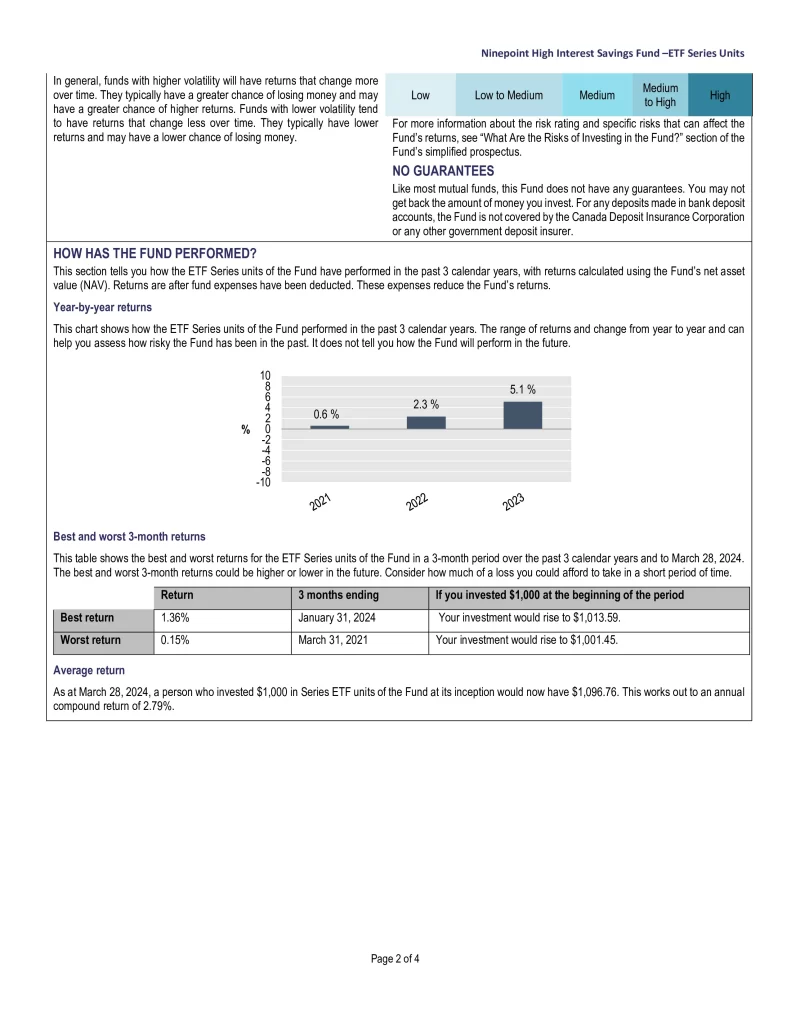

5. Ninepoint High Interest Savings Fund

The Ninepoint High Interest Savings Fund (NSAV) is a high-quality, short-term vehicle for investors who want to earn a better rate of return on their idle cash.

- Invests in high-interest saving accounts at Schedule 1 banks, and/or high-quality money market securities

- No Term Commitments

- Daily Liquidity

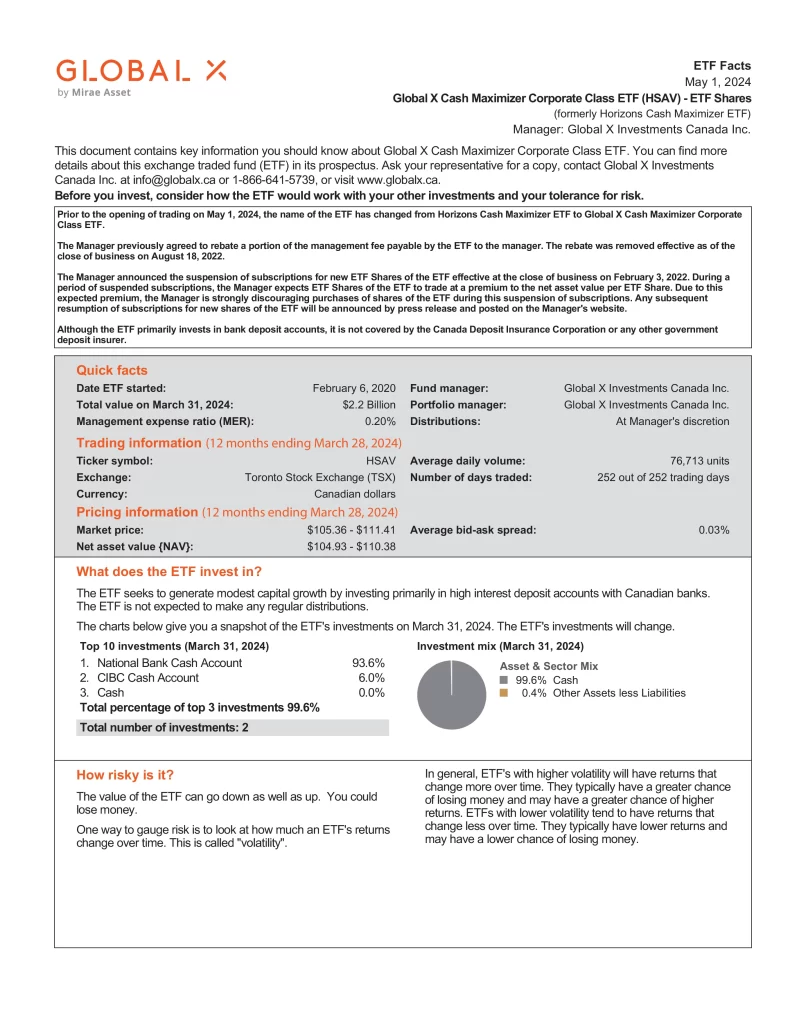

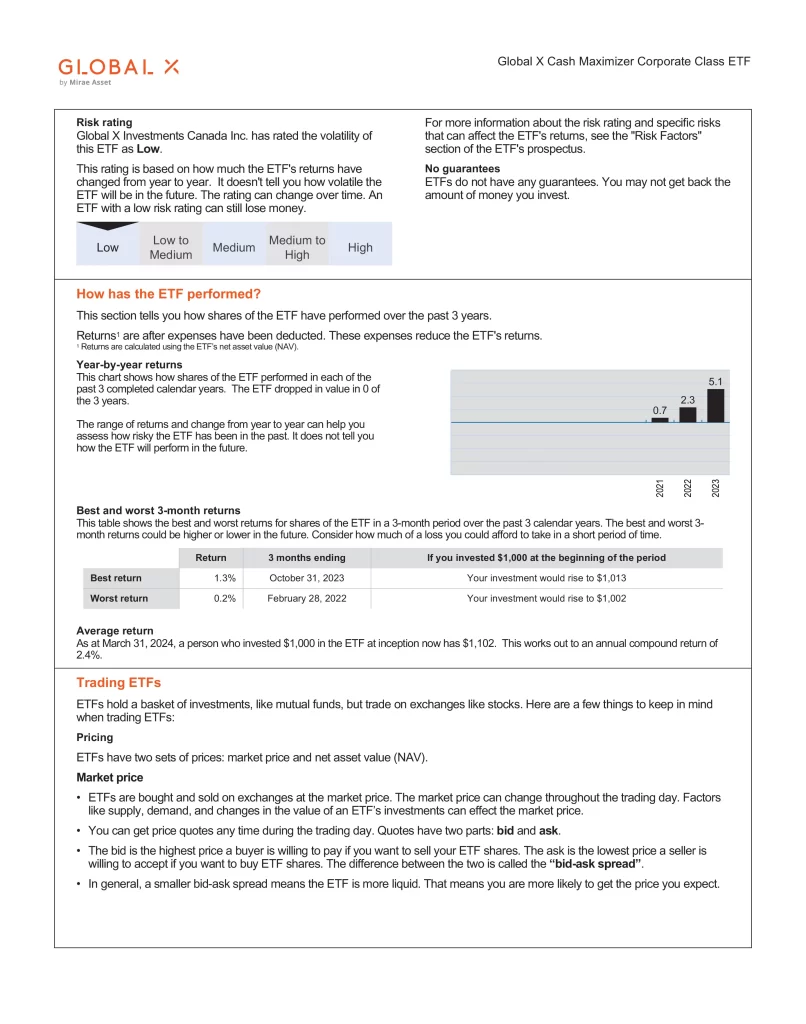

4. Global X Cash Maximizer Corporate Class ETF

Global X Cash Maximizer Corporate Class ETF (HSAV) seeks to generate modest capital growth by investing primarily in high-interest deposit accounts with Canadian banks. While any decision to pay dividends or other distributions is within the discretion of the Manager, HSAV is not currently expected to make any regular distributions. Horizons Cash Maximizer ETF Suspends New Subscriptions After Reaching Approximately $2 Billion in Assets.

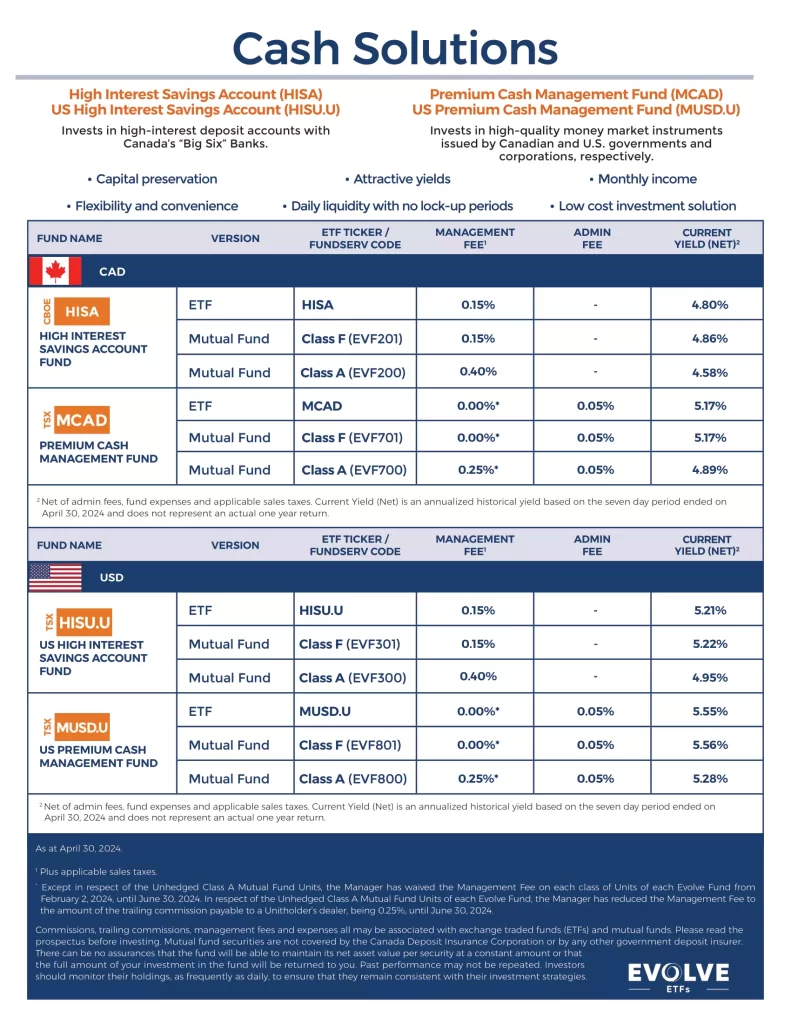

3. High Interest Savings Account Fund

Maximize Monthly Income with High Interest Savings Account Fund (HISA). HISA seeks to maximize monthly income while preserving capital and liquidity by investing primarily in high-interest deposit accounts.

Cash has always been an important component of a well-diversified portfolio. The cash portion of a portfolio helps preserve capital during market downturns and may act as a temporary hold until new investment opportunities become available. HISA preserves your capital and liquidity by investing in high-interest deposit accounts.

- Exposure to high-interest deposit accounts

- Liquid, short term investment

- Receive regular monthly cash flows

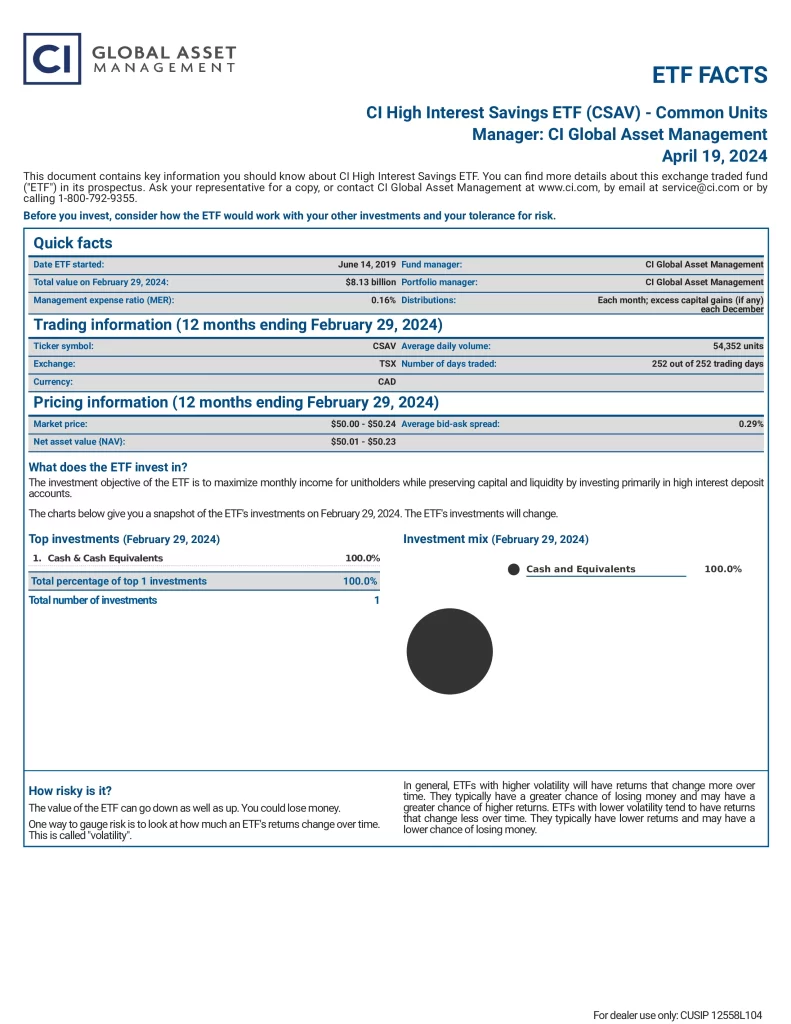

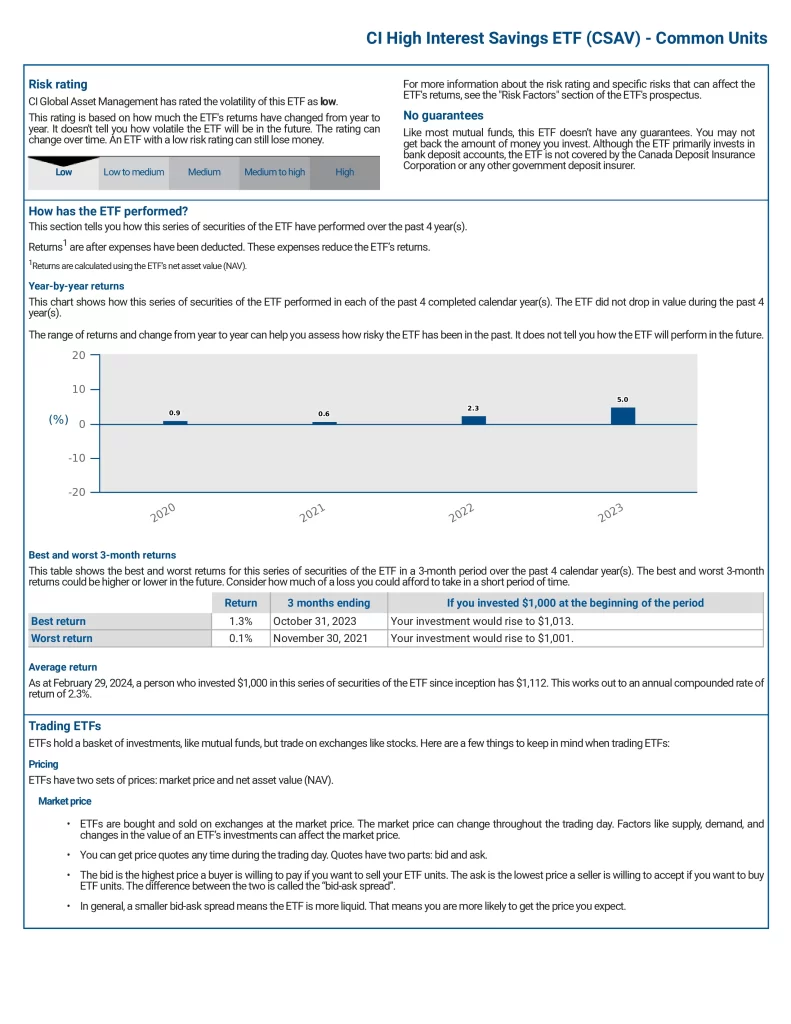

2. CI High Interest Savings ETF

CI High Interest Savings ETF (CSAV) seeks to maximize monthly income for unitholders while preserving capital and liquidity by investing primarily in high-interest deposit accounts.

- seeking higher yields on cash balances through high-interest deposit accounts

- looking for a liquid, short-term investment

- want to receive monthly cash flows

- can tolerate low risk

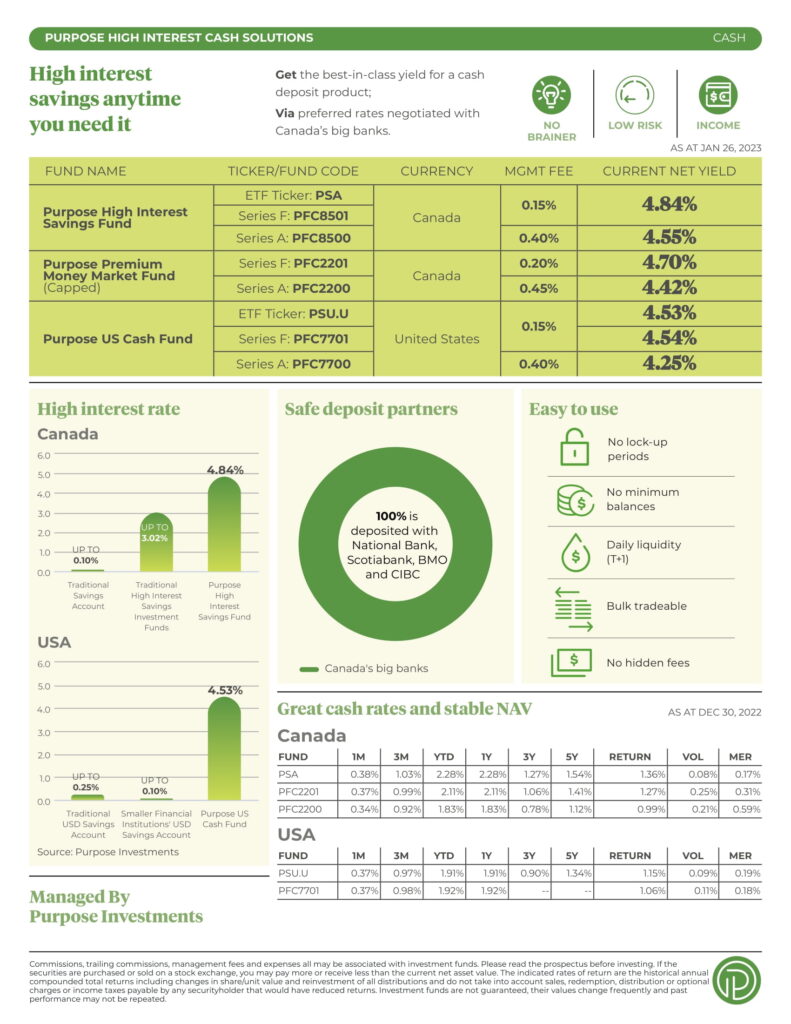

1. Purpose High Interest Savings Fund

Purpose High Interest Savings Fund (PSA) gets the best-in-class yield for a cash deposit product with preferred rates negotiated with Canada’s big banks.

- Deposits securely invested in high-interest deposit accounts with Schedule 1 Canadian banks

- Generate best-in-class yields and access your cash anytime

- No hidden fees, no lock-up periods, or minimum balances

- Premium interest rate calculated daily and paid monthly

- Daily liquidity (T+1)

Why Should You Keep Some Cash Reserves in a Portfolio?

I believe it’s crucial to maintain some cash reserves. The main reason to keep cash reserves is to maintain liquidity. It’s crucial—you don’t want to be forced to sell your investments during a market downturn just because you need access to the funds. The amount you set aside will depend on a variety of factors, including:

- How much money do you feel you need in your bank account to sleep soundly at night?

- Do you have a high-interest savings account at a bank paying a lower interest rate?

- Are there any major expenses planned for the upcoming year?

- Are you currently working or retired?

- Do you have any outstanding debt?

What are the Advantages of High Interest Savings ETFs?

- Attractive Interest Rates: Interest rates comparable to high-interest savings accounts.

- Diversification: ETF managers typically invest in a selection of high-interest savings accounts from top banks.

- Easy Access to Funds: Withdraw your money effortlessly and reinvest it elsewhere.

- Minimal Risk: Nearly no exposure to market or credit risk, as the funds are held in cash.

- No Minimum Balance: Purchase as many shares as your budget allows.

What are the Disadvantages of High Interest Savings ETFs?

An ETF differs from high-interest savings accounts in that it is not protected by CDIC insurance. In the event of any mishap with the ETF’s assets, there is no government-backed insurance to safeguard your investment. Funds held in a bank that went under could potentially face significant losses, however, such occurrences are highly improbable. The yields on these ETFs are closely tied to prevailing interest rates. In a rising interest rate environment, or when rates are expected to remain high for an extended period, these ETFs become more lucrative as they earn higher interest on their cash holdings. These are a superior alternative to a GIC.

Conclusion

Canadian high-interest savings ETFs currently offer strong yields while maintaining liquidity, making them an ideal choice for holding cash reserves. Definitely a better alternative than stashing your money under the mattress. The best-performing Canadian dividend ETF is Purpose High Interest Savings Fund (PSA) which offers reliable income. Ultimately, it’s up to you to decide whether to take advantage of them.