A high dividend ETF focused investment strategy aims to invest in companies that offer higher dividends with the potential to sustain and grow these payments. Historically, securities with higher dividend yields tend to provide superior returns. Investors can choose to use dividend distributions as a source of income or reinvest them for portfolio growth. Targeting stocks with high dividend yields is a common approach in factor-based investment strategies.

The dividend yield is calculated by dividing the most recent dividend payment by the ETF’s latest closing price. Investing in ETFs has never been easier, but with the vast number of options available, it can be overwhelming for some investors. Here, we focus on high-dividend-paying ETFs that are particularly appealing to income-seeking investors.

What is the Best High Dividend ETF?

- TSL: GraniteShares 1.25x Long Tsla Daily ETF

- TSLY: YieldMax TSLA Option Income Strategy ETF

- KLIP: Kraneshares China Internet And Covered Call Strategy ETF

- TILL: Teucrium Agricultural Strategy No K-1 ETF

- KMET: KraneShares Electrification Metals Strategy ETF

- OARK: YieldMax ARKK Option Income Strategy ETF

- FBL: GraniteShares 2x Long META Daily ETF

- APLY: YieldMax AAPL Option Income Strategy ETF

- MAXI: Simplify Bitcoin Strategy PLUS Income ETF

- BITO: ProShares Bitcoin Strategy ETF

| Ticker | Name | MER | AUM | Dividend Yield |

|---|---|---|---|---|

| TSL | GraniteShares 1.25x Long Tsla Daily ETF | 1.15% | $5,770,000 | 92.75% |

| TSLY | YieldMax TSLA Option Income Strategy ETF | 1.01% | $713,590,000 | 91.05% |

| KLIP | Kraneshares China Internet And Covered Call Strategy ETF | 0.95% | $182,380,000 | 58.31% |

| TILL | Teucrium Agricultural Strategy No K-1 ETF | 1.03% | $2,390,000 | 53.53% |

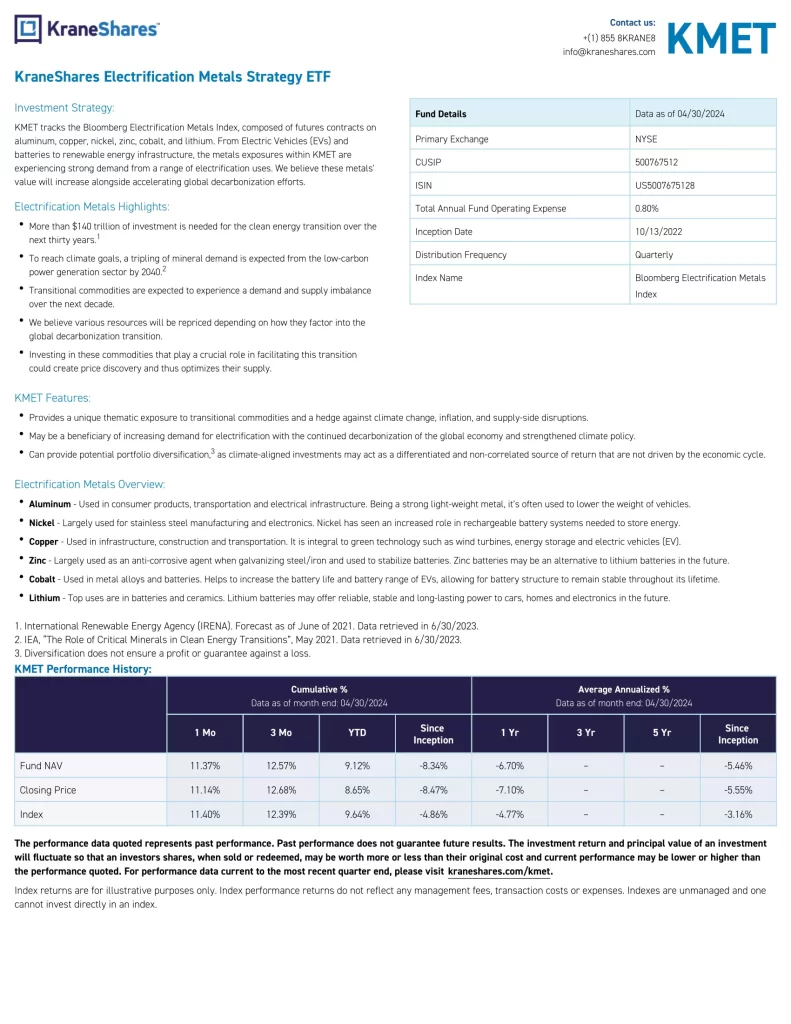

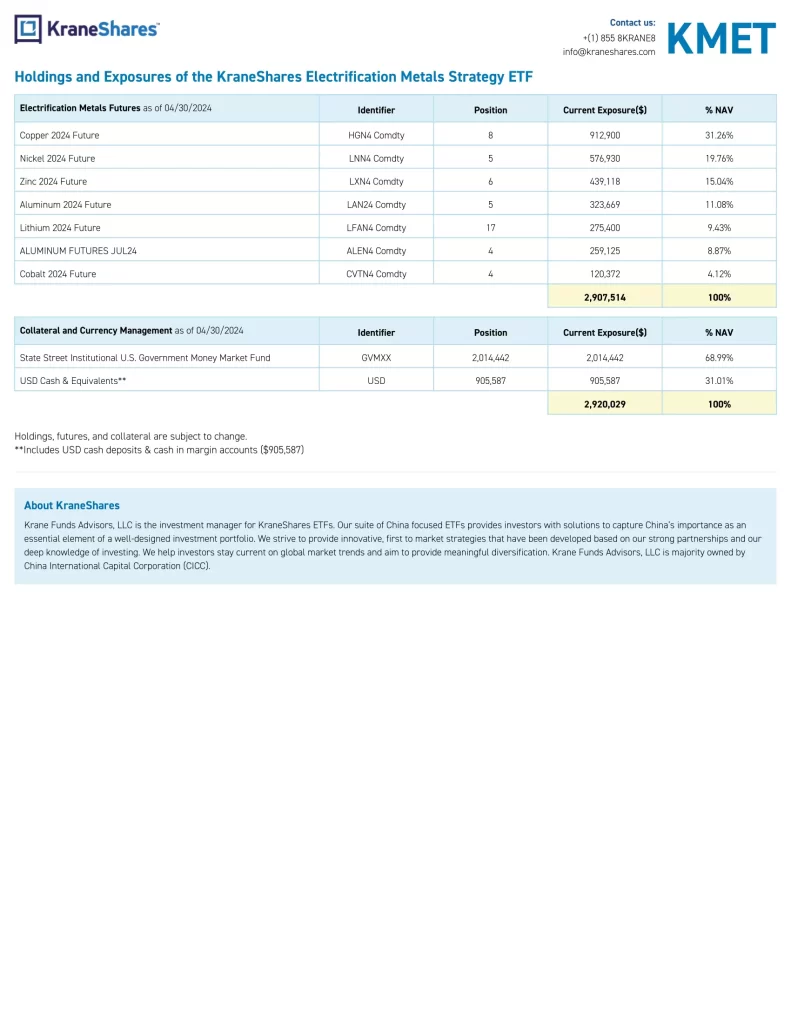

| KMET | KraneShares Electrification Metals Strategy ETF | 0.80% | $2,920,000 | 51.24% |

| OARK | YieldMax ARKK Option Income Strategy ETF | 1.19% | $69,040,000 | 43.97% |

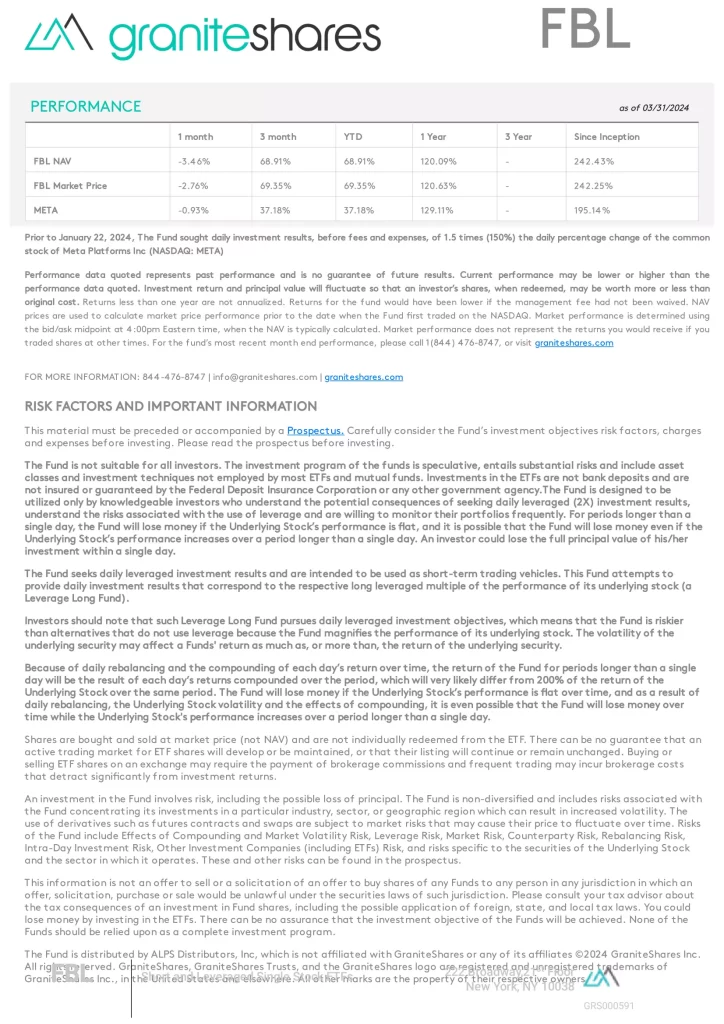

| FBL | GraniteShares 2x Long META Daily ETF | 1.15% | $92,960,000 | 39.30% |

| APLY | YieldMax AAPL Option Income Strategy ETF | 1.06% | $56,100,000 | 26.18% |

| BITO | ProShares Bitcoin Strategy ETF | 0.95% | $2,130,000,000 | 18.01% |

| MAXI | Simplify Bitcoin Strategy PLUS Income ETF | 11.18% | $18,580,000 | 23.22% |

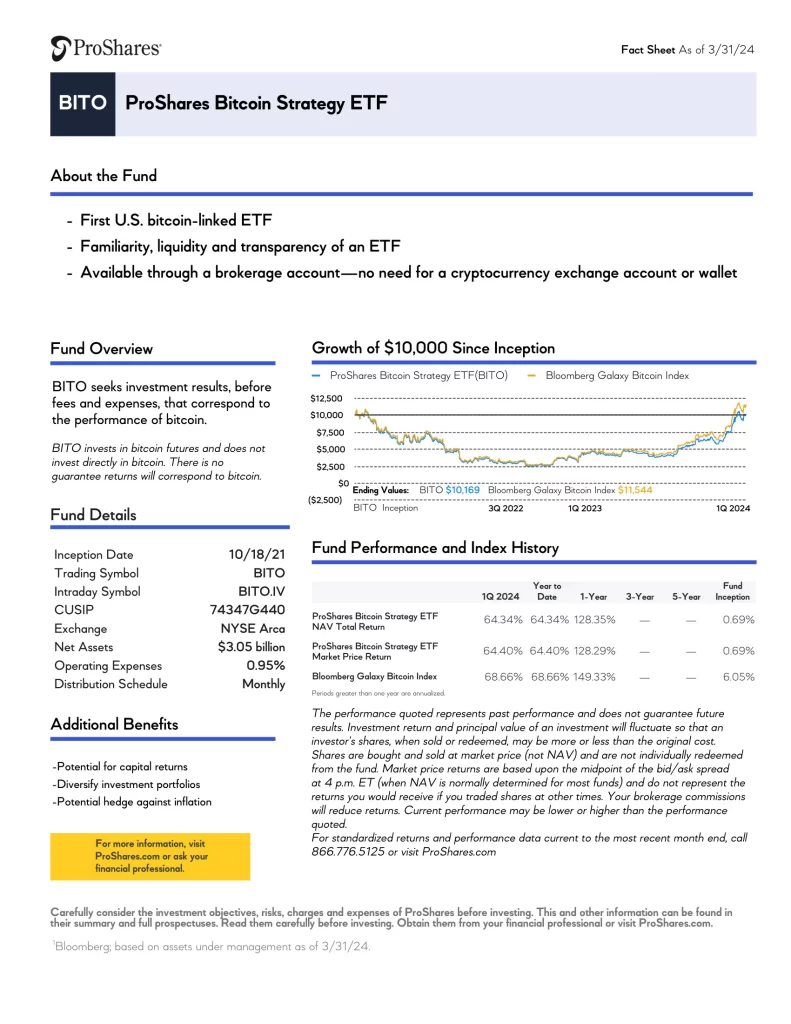

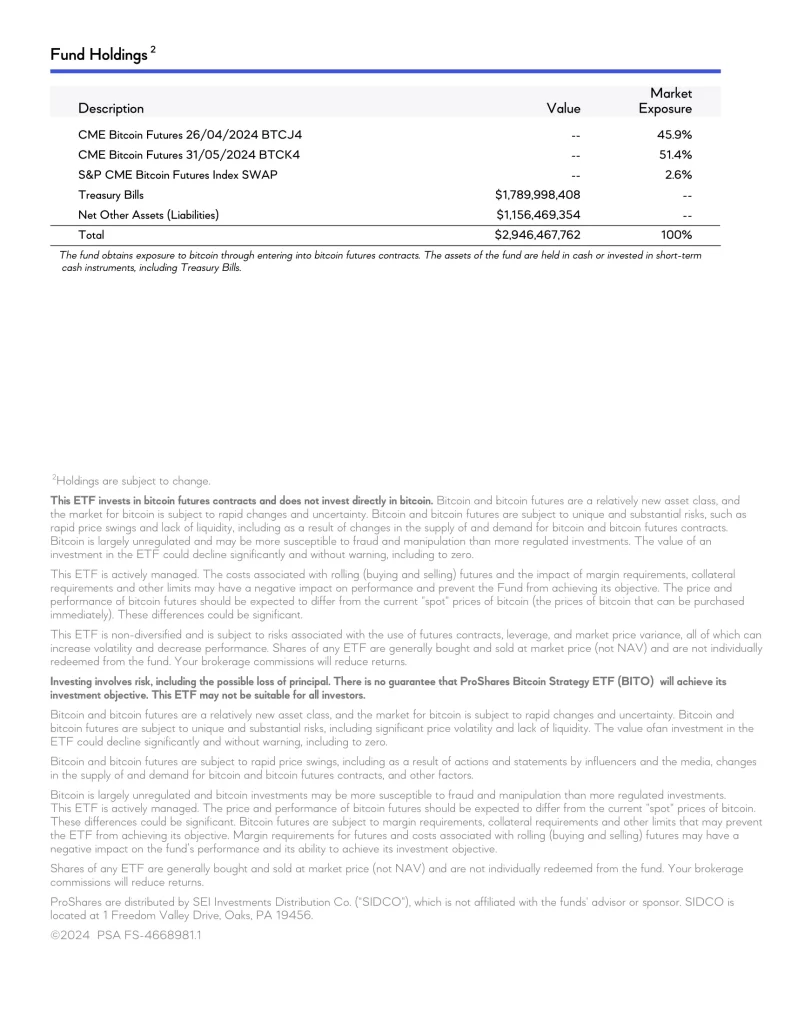

10. ProShares Bitcoin Strategy ETF

ProShares Bitcoin Strategy ETF (BITO) aims to produce returns that correspond to Bitcoin. BITO invests in bitcoin futures and does not invest in bitcoin. There is no guarantee the fund will closely track Bitcoin returns.

- First U.S. bitcoin-linked ETF

- Familiarity, liquidity and transparency of an ETF

- Available through a brokerage account—no need for a cryptocurrency exchange account or wallet

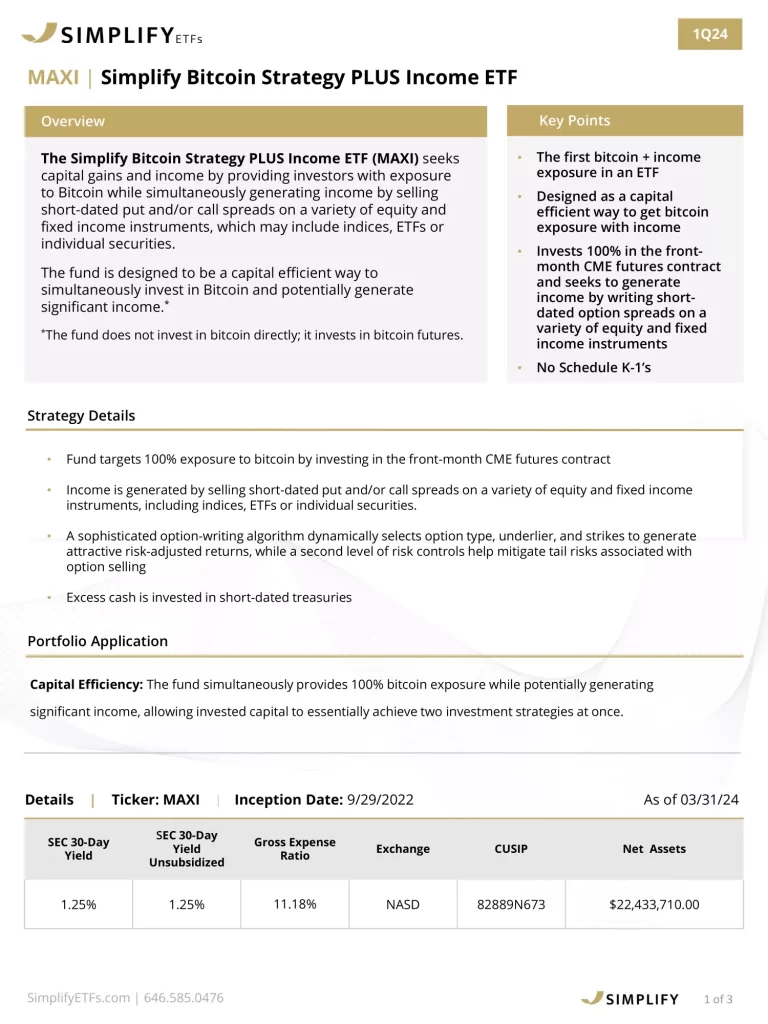

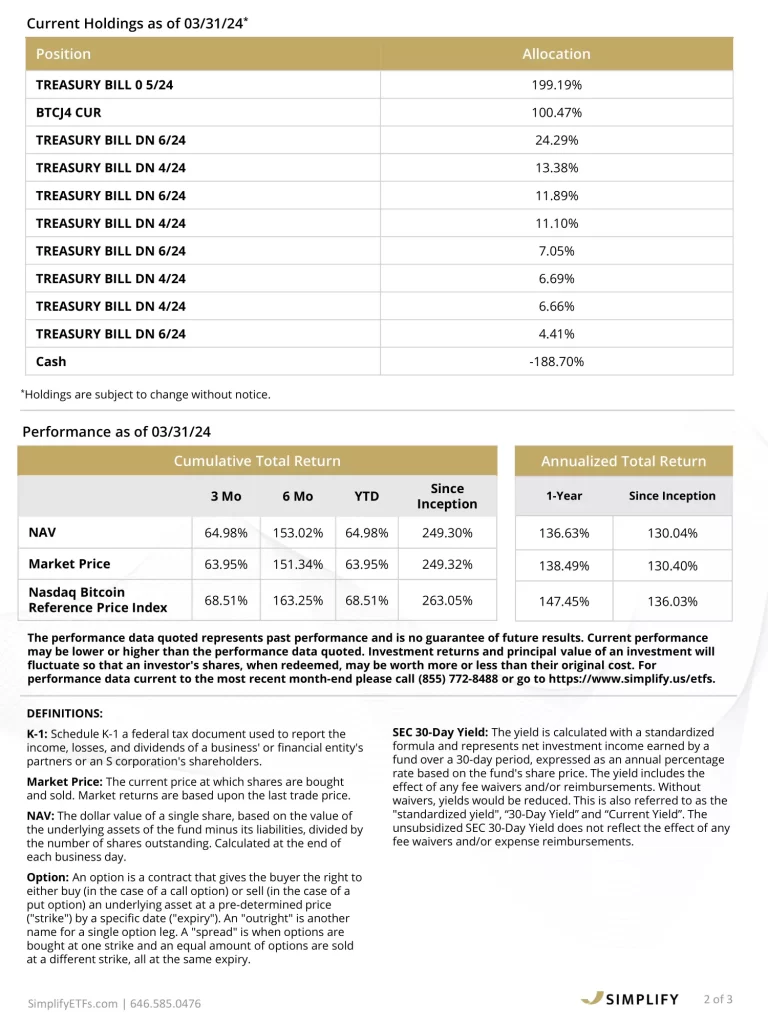

9. Simplify Bitcoin Strategy PLUS Income ETF

Simplify Bitcoin Strategy PLUS Income ETF (MAXI) seeks capital gains and income by providing investors with exposure to bitcoin while simultaneously generating income by selling short-dated put and/or call spreads on a variety of equity and fixed income instruments, which may include indices, ETFs or individual securities.

The fund is designed to be a capital-efficient way to simultaneously invest in Bitcoin and potentially generate significant income. The fund can also be viewed as bitcoin exposure with a downside buffer, by the padding the income may create to any bitcoin drawdowns. The fund does not invest in bitcoin directly; it invests in bitcoin futures.

8. YieldMax AAPL Option Income Strategy ETF

YieldMax AAPL Option Income Strategy ETF (APLY) does not invest directly in AAPL. Investing in the fund involves a high degree of risk. The value of the Fund, which focuses on an individual security AAPL, may be more volatile than a traditional pooled investment or the market as a whole and may perform differently from the value of a traditional pooled investment or the market as a whole.

The Fund’s strategy will cap its potential gains if AAPL shares increase in value. The Fund’s strategy is subject to all potential losses if AAPL shares decrease in value, which may not be offset by income received by the Fund. The Fund may not be suitable for all investors.Shareholders of the Fund are not entitled to any dividends paid by AAPL.

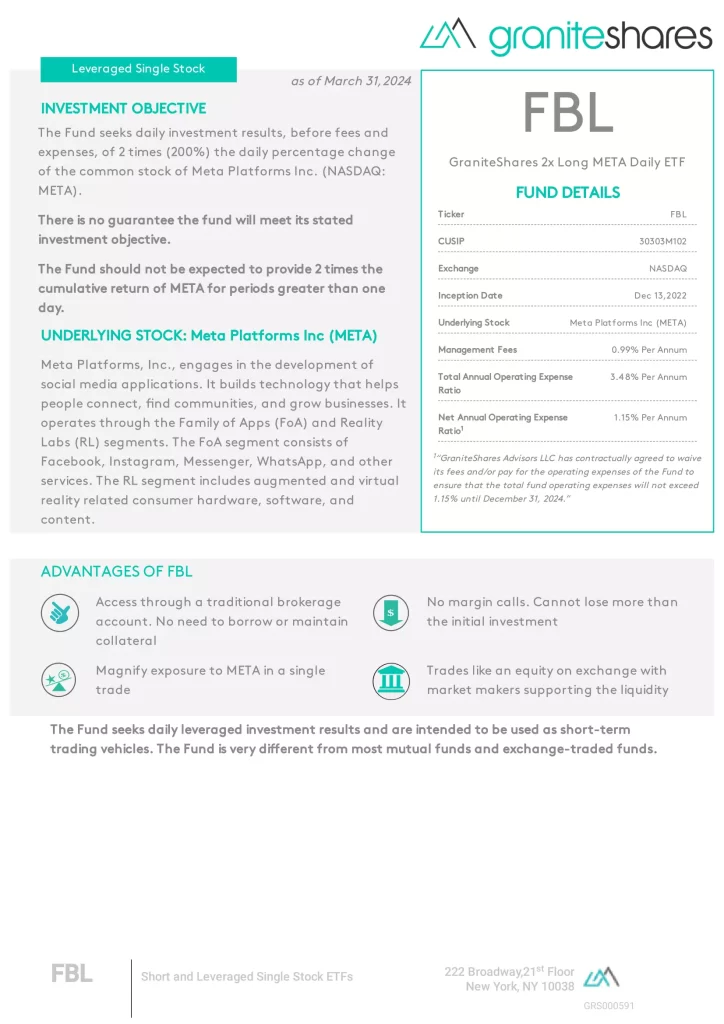

7. GraniteShares 2x Long META Daily ETF

GraniteShares 2x Long META Daily ETF (FBL) seeks daily investment results, before fees and expenses, of 2 times (200%) the daily percentage change of the common stock of Meta Platforms Inc, (NASDAQ: META). There is no guarantee that the Fund will meet its stated objective. The fund should not be expected to provide 2 times the cumulative return of META for periods greater than a day.

6. YieldMax ARKK Option Income Strategy ETF

YieldMax ARKK Option Income Strategy ETF (OARK) does not invest directly in ARKK. Investing in the fund involves a high degree of risk. The value of the Fund, which focuses on an individual security ARKK, may be more volatile than a traditional pooled investment or the market as a whole and may perform differently from the value of a traditional pooled investment or the market as a whole.

The Fund’s strategy will cap its potential gains if ARKK shares increase in value. The Fund’s strategy is subject to all potential losses if ARKK shares decrease in value, which may not be offset by income received by the Fund. The Fund may not be suitable for all investors. Shareholders of the Fund are not entitled to any dividends paid by ARKK.

5. KraneShares Electrification Metals Strategy ETF

KraneShares Electrification Metals Strategy ETF (KMET) tracks the Bloomberg Electrification Metals Index, composed of futures contracts on aluminum, copper, nickel, zinc, cobalt, and lithium. From Electric Vehicles (EVs) and batteries to renewable energy infrastructure, the metals exposures within KMET are experiencing strong demand from a range of electrification uses. We believe these metals’ value will increase alongside accelerating global decarbonization efforts.

- More than $140 trillion of investment is needed for the clean energy transition over the next thirty years

- To reach climate goals, a tripling of mineral demand is expected from the low-carbon power generation sector by 2040

- Transitional commodities are expected to experience a demand and supply imbalance over the next decade

- Provides a unique thematic exposure to transitional commodities and a hedge against climate change, inflation, and supply-side disruptions

- May be a beneficiary of increasing demand for electrification with the continued decarbonization of the global economy and strengthened climate policy

- Can provide potential portfolio diversification, as climate-aligned investments may act as a differentiated and non-correlated source of return that is not driven by the economic cycle

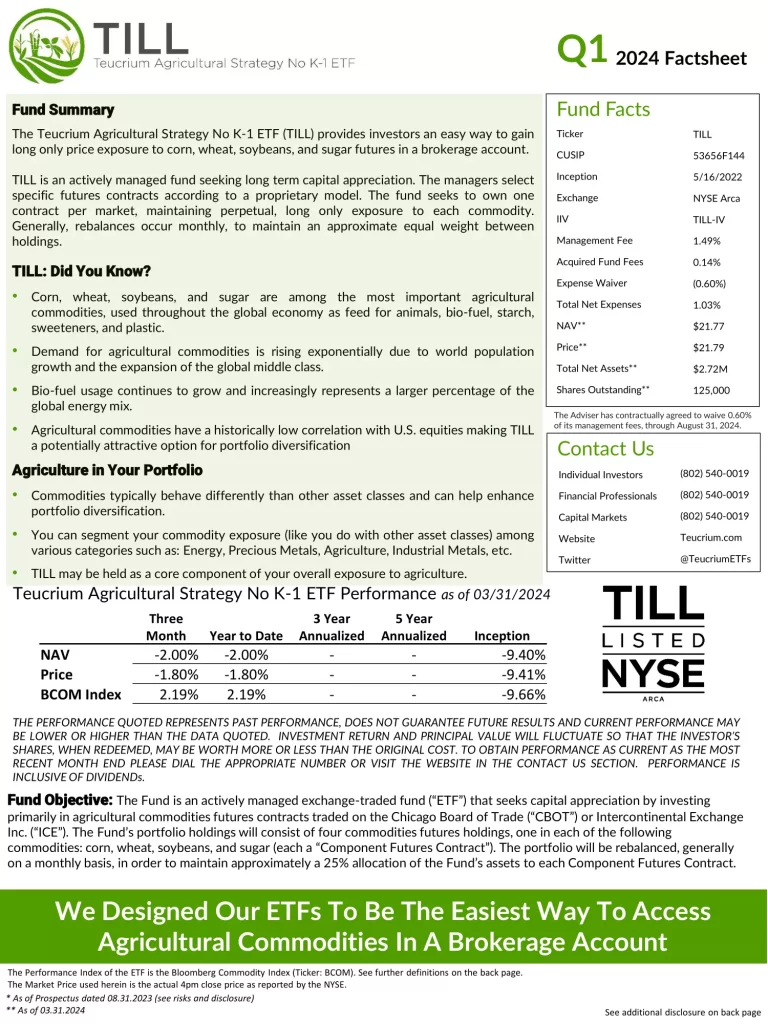

4. Teucrium Agricultural Strategy No K-1 ETF

Teucrium Agricultural Strategy No K-1 ETF (TILL) provides investors an easy way to gain long only price exposure to corn, wheat, soybeans, and sugar futures in a brokerage account. TILL is an actively managed fund seeking long term capital appreciation. The managers select specific futures contracts according to a proprietary model. The fund seeks to own one contract per market, maintaining perpetual, long only exposure to each commodity. Generally, rebalances occur monthly, to maintain an approximate equal weight between holdings.

- Corn, wheat, soybeans, and sugar are among the most important agricultural commodities, used throughout the global economy as feed for animals, bio-fuel, starch, sweeteners, and plastic

- Demand for agricultural commodities is rising exponentially due to world population growth and the expansion of the global middle class

- Bio-fuel usage continues to grow and increasingly represents a larger percentage of the global energy mix

- Agricultural commodities have a historically low correlation with U.S. equities making TILL a potentially attractive option for portfolio diversification

- Commodities typically behave differently than other asset classes and can help enhance portfolio diversification

- You can segment your commodity exposure (like you do with other asset classes) among various categories such as: Energy, Precious Metals, Agriculture, Industrial Metals, etc.

- TILL may be held as a core component of your overall exposure to agriculture

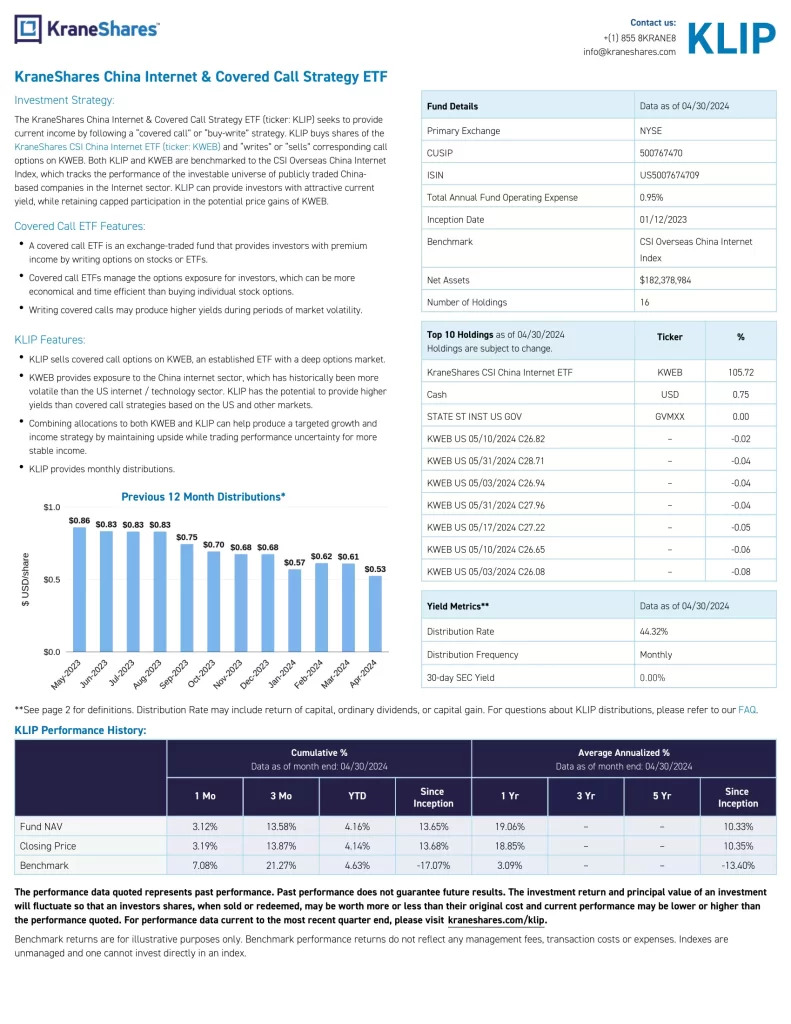

3. Kraneshares China Internet And Covered Call Strategy ETF

Kraneshares China Internet And Covered Call Strategy ETF (KLIP) seeks to provide current income by following a “covered call” or “buy-write” strategy. KLIP buys shares of the KraneShares CSI China Internet ETF (KWEB) and “writes” or “sells” corresponding call options on KWEB. Both KLIP and KWEB are benchmarked to the CSI Overseas China Internet Index, which tracks the performance of the investable universe of publicly traded China-based companies in the Internet sector. KLIP can provide investors with attractive current yield, while retaining capped participation in the potential price gains of KWEB.

- A covered call ETF is an exchange-traded fund that provides investors with premium income by writing options on stocks or ETFs

- Covered call ETFs manage the options exposure for investors, which can be more economical and time efficient than buying individual stock options

- Writing covered calls may produce higher yields during periods of market volatility

- KLIP sells covered call options on KWEB, an established ETF with a deep options market

- KWEB provides exposure to the China internet sector, which has historically been more volatile than the US internet / technology sector. KLIP has the potential to provide higher yields than covered call strategies based on the US and other markets

- Combining allocations to both KWEB and KLIP can help produce a targeted growth and income strategy by maintaining upside while trading performance uncertainty for more stable income

- KLIP provides monthly distributions

2. YieldMax TSLA Option Income Strategy ETF

YieldMax TSLA Option Income Strategy ETF (TSLY) does not invest directly in TSLA. Investing in the fund involves a high degree of risk. The value of the Fund, which focuses on an individual security TSLA, may be more volatile than a traditional pooled investment or the market as a whole and may perform differently from the value of a traditional pooled investment or the market as a whole.

The Fund’s strategy will cap its potential gains if TSLA shares increase in value. The Fund’s strategy is subject to all potential losses if TSLA shares decrease in value, which may not be offset by income received by the Fund. The Fund may not be suitable for all investors. Shareholders of the Fund are not entitled to any dividends paid by TSLA.

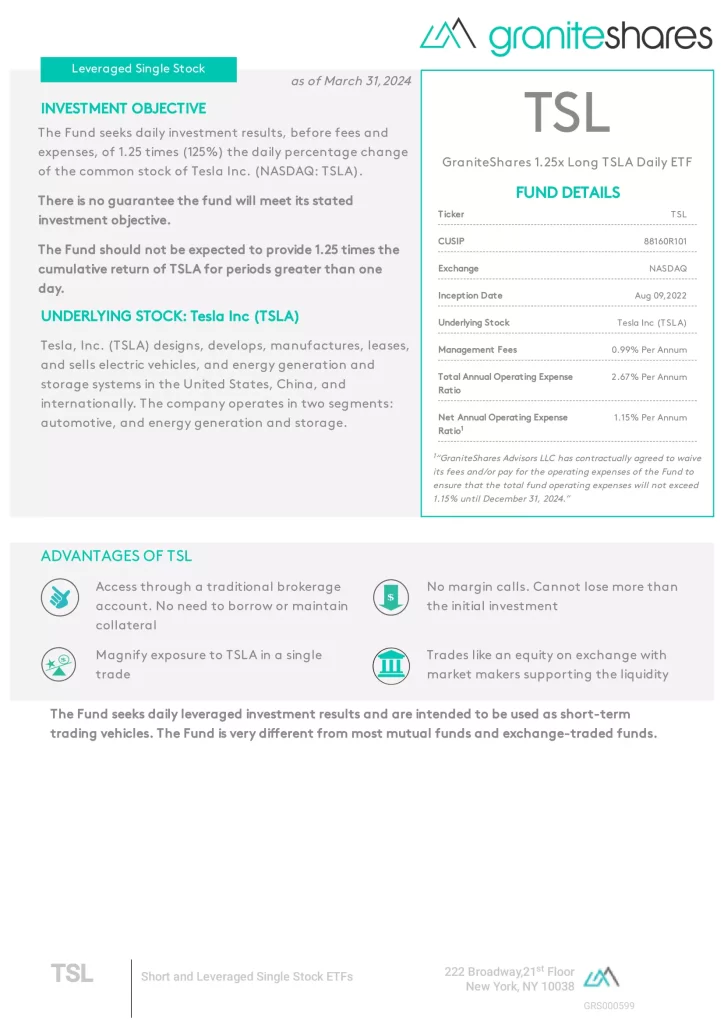

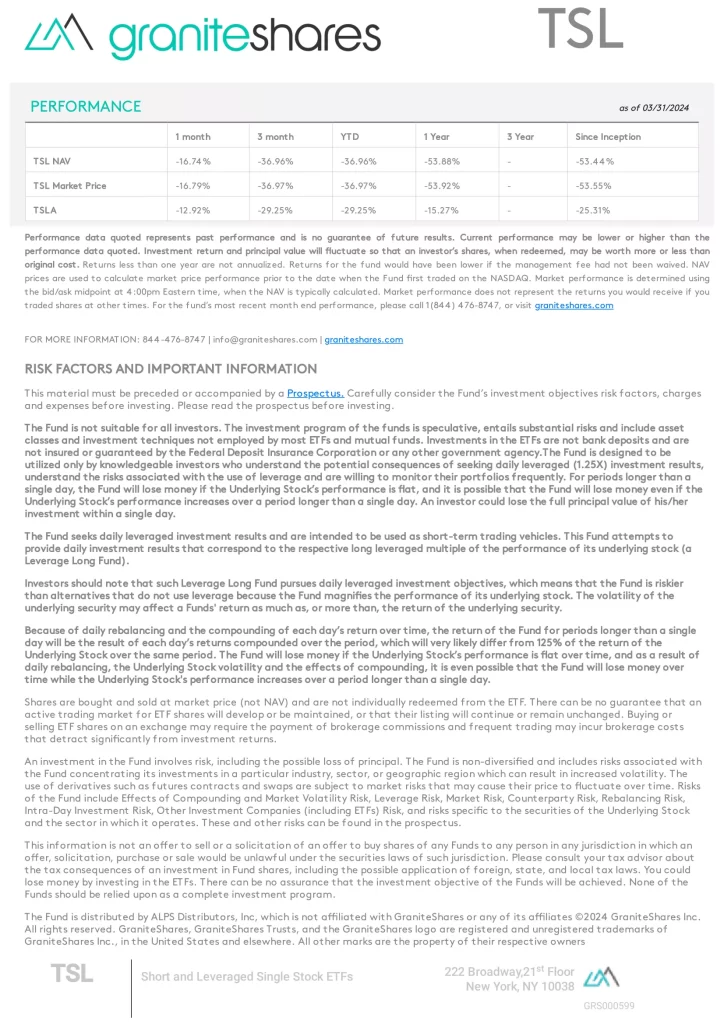

1. TSL: GraniteShares 1.25x Long Tsla Daily ETF

GraniteShares 1.25x Long Tsla Daily ETF (TSL) seeks daily investment results, before fees and expenses, of 1.25 times (125%) the daily percentage change of the common stock of Tesla Inc, (TSLA) There is no guarantee that the Fund will meet its stated objective. The fund should not be expected to provide 1.25 times the cumulative return of TSLA for periods greater than a day. Tesla, Inc. (TSLA) designs, develops, manufactures, leases, and sells electric vehicles, energy generation and storage systems in the United States, China, and internationally. The company operates in two segments: automotive, energy generation and storage.