You can find more details about this Exchange Traded Fund (ETF) in its prospectus. Before you invest, consider how the ETF would work with your other investments and your risk tolerance. The value of the ETF can go down as well as up. You could lose money. ETFs do not have any guarantees. You may not get back the amount of money you invest. You may have to pay a commission every time you buy and sell units of the ETF. Commissions may vary by brokerage firm.

CASH ETF Review

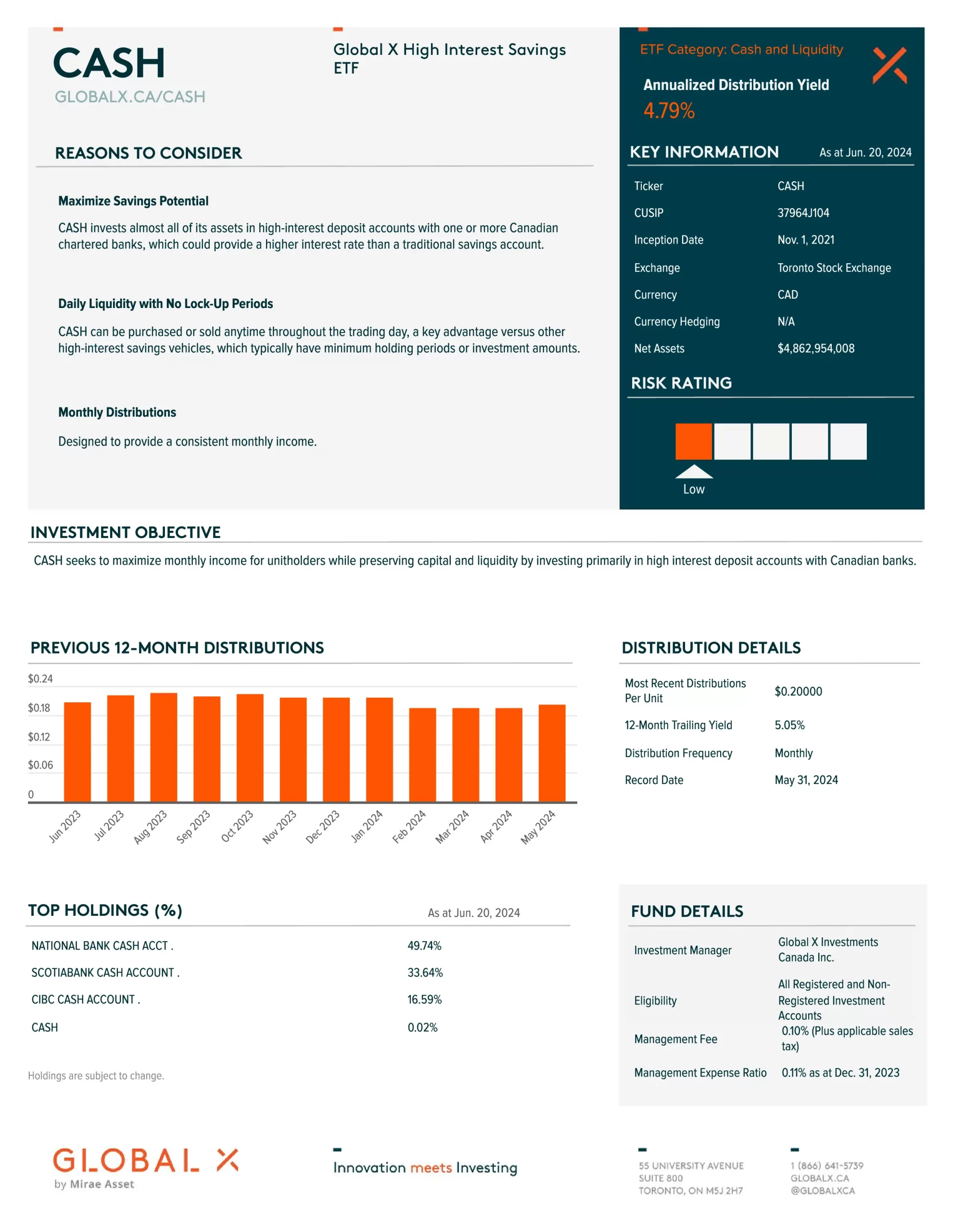

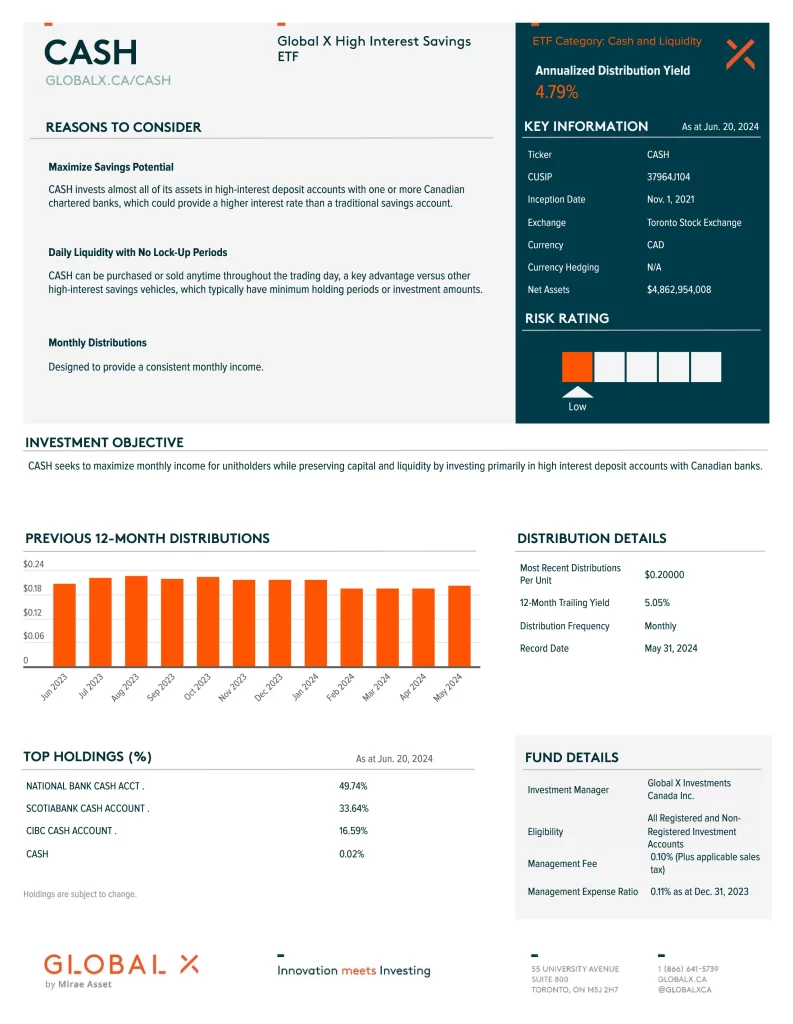

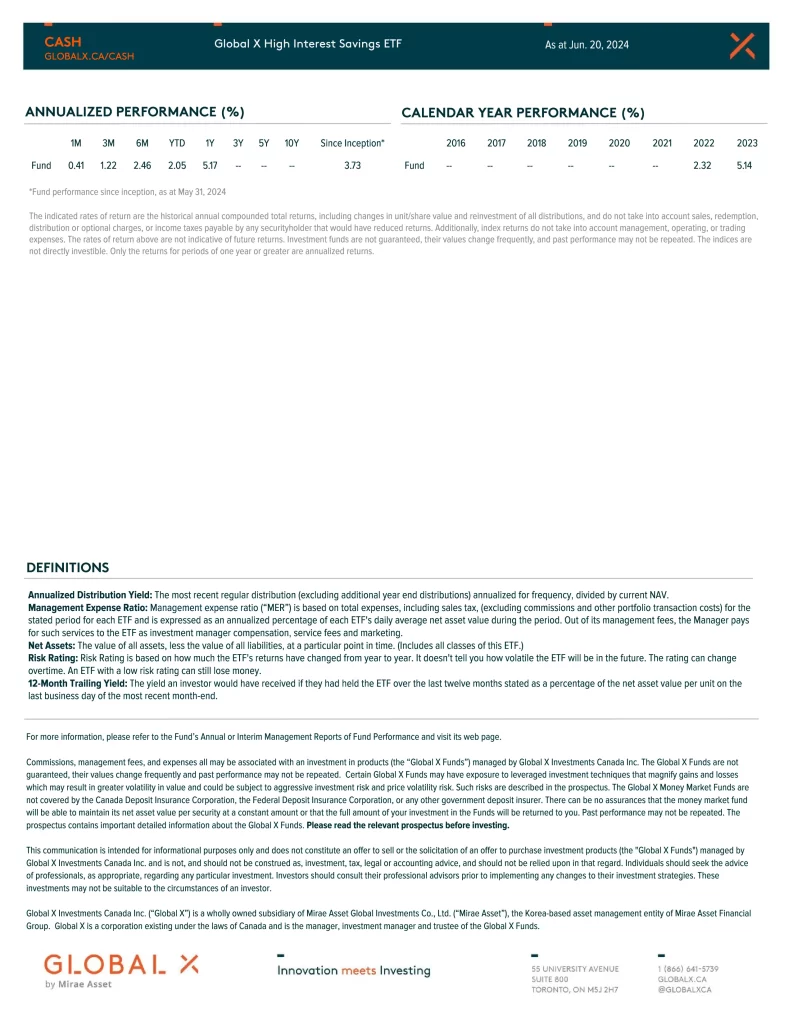

Global X High Interest Savings ETF (CASH) seeks to maximize monthly income for investors while preserving capital and liquidity by investing primarily in high-interest deposit accounts with Canadian banks. The biggest challenge when holding cash is that interest rates offered by traditional liquid savings vehicles can be quite low, whereas yields can potentially increase with the use of savings vehicles like GICs or high-interest savings accounts.

- Enhanced Savings Potential: CASH invests almost all of its assets in high-interest deposit accounts with one or more Canadian chartered banks which provide a higher interest rate than a traditional savings account

- Daily Liquidity: CASH is an ETF so it can be purchased or sold anytime throughout the trading day. This is a key advantage versus other high-interest savings vehicles, which typically have minimum holding periods or investment amounts

- Monthly Income: It is anticipated that CASH will make distributions to its Unitholders on a monthly basis

Is CASH a Good Investment?

Quickly compare CASH to other investments focused on Canadian high-interest savings and money market ETFs by fees, performance, yield, and other metrics to decide which ETF fits in your portfolio.

| Manager | ETF | Risk | Inception | MER | AUM | Beta | Yield | Distributions | 1Y | 3Y | 5Y | 10Y | 15Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BlackRock | CMR | Low | 2008-02-19 | 0.27% | $577,823,203 | N/A | 4.72% | Monthly | 4.83% | 2.27% | 1.75% | 1.24% | 1.04% |

| BMO | ZST.L | Low | 2017-02-09 | 0.16% | $226,640,000 | 0.14 | 1.13% | Monthly | 6.52% | 2.74% | 2.45% | N/A | N/A |

| CI | CSAV | Low | 2019-06-14 | 0.16% | $7,180,000,000 | N/A | 4.95% | Monthly | 5.08% | 2.74% | N/A | N/A | N/A |

| CIBC | CAFR | Low | 2019-01-22 | 0.34% | $366,674,171 | 0.04 | 4.59% | Monthly | 5.72% | 2.57% | 2.09% | N/A | N/A |

| Dynamic | DXV | Low | 2018-03-23 | 0.33% | $128,710,000 | 0.09 | 6.34% | Monthly | 5.97% | 2.74% | 2.91% | N/A | N/A |

| Evolve | HISA | Low | 2019-11-19 | 0.07% | $4,062,711,000 | N/A | 5.03% | Monthly | 5.14% | 2.79% | N/A | N/A | N/A |

| Franklin | FHIS | Low | 2022-09-12 | 0.18% | $120,910,000 | N/A | 3.47% | Monthly | 5.41% | N/A | N/A | N/A | N/A |

| Global X | CASH | Low | 2021-11-01 | 0.11% | $4,873,587,462 | N/A | 5.05% | Monthly | 5.21% | N/A | N/A | N/A | N/A |

| Guardian | GCTB | Low | 2023-07-11 | N/A | $137,892,198 | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| Harvest | TBIL | Low | 2024-01-16 | N/A | $32,590,000 | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| Mackenzie | QASH | Low | 2023-11-20 | N/A | $38,086,683 | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| Ninepoint | NSAV | Low | 2020-11-17 | 0.16% | $501,650,000 | N/A | 4.73% | Monthly | 5.22% | 2.80% | N/A | N/A | N/A |

| Purpose | PSA | Low | 2013-11-15 | 0.16% | $5,209,000,000 | N/A | 5.11% | Monthly | 5.19% | 2.79% | 2.27% | 1.76% | N/A |

CASH vs HSAV

CASH is a better performing, higher-yielding, more popular and less expensive ETF than HSAV which is older.

CASH vs PSA

PSA is a better performing, higher-yielding, more popular and older ETF than CASH which is less expensive.

CASH vs CSAV

CASH is a better-performing, higher-yielding and less expensive ETF than CSAV which is more popular and older.

What is CASH?

CASH efficiently manages your funds by identifying the highest-interest savings accounts and allocating your money to those High-Interest Savings Account (HISA) options. The earned interest is then returned to you, with the ETF deducting a small fee for its services. This approach simplifies the process of maintaining savings without the need to navigate various banks. By depositing your funds into CASH, you receive monthly interest payments based on prevailing interest rates. The flexibility to withdraw your money at any time without incurring penalties adds to the convenience of this investment.

How is CASH Taxed?

The monthly payout from CASH is categorized as interest income in non-registered accounts and is accordingly subject to taxation. When filing your taxes, this interest income is simply included as part of your overall income. Additionally, if you realize a profit from selling shares at a higher price than the purchase price, it results in a capital gain. Individuals are taxed on 50% of their capital gains, which doesn’t imply a direct 50% tax rate. To illustrate, if you have a $100 profit from capital gains, 50% of that amount is added to your income and taxed at your marginal rate.

What is the Difference Between GIC and CASH?

A GIC is characterized by a predetermined investment period. Upon the conclusion of this fixed term, the investor receives both the initial invested principal and the accrued interest based on the specified annual rate and term. In contrast, CASH does not impose a set timeframe for holding the investment.

Conclusion

Global X High Interest Savings ETF (CASH) is a great short-term income investment to safely invest in high-interest savings accounts. CASH is a convenient and low-cost way to invest your cash allocation of your portfolio.