DFIV ETF Review

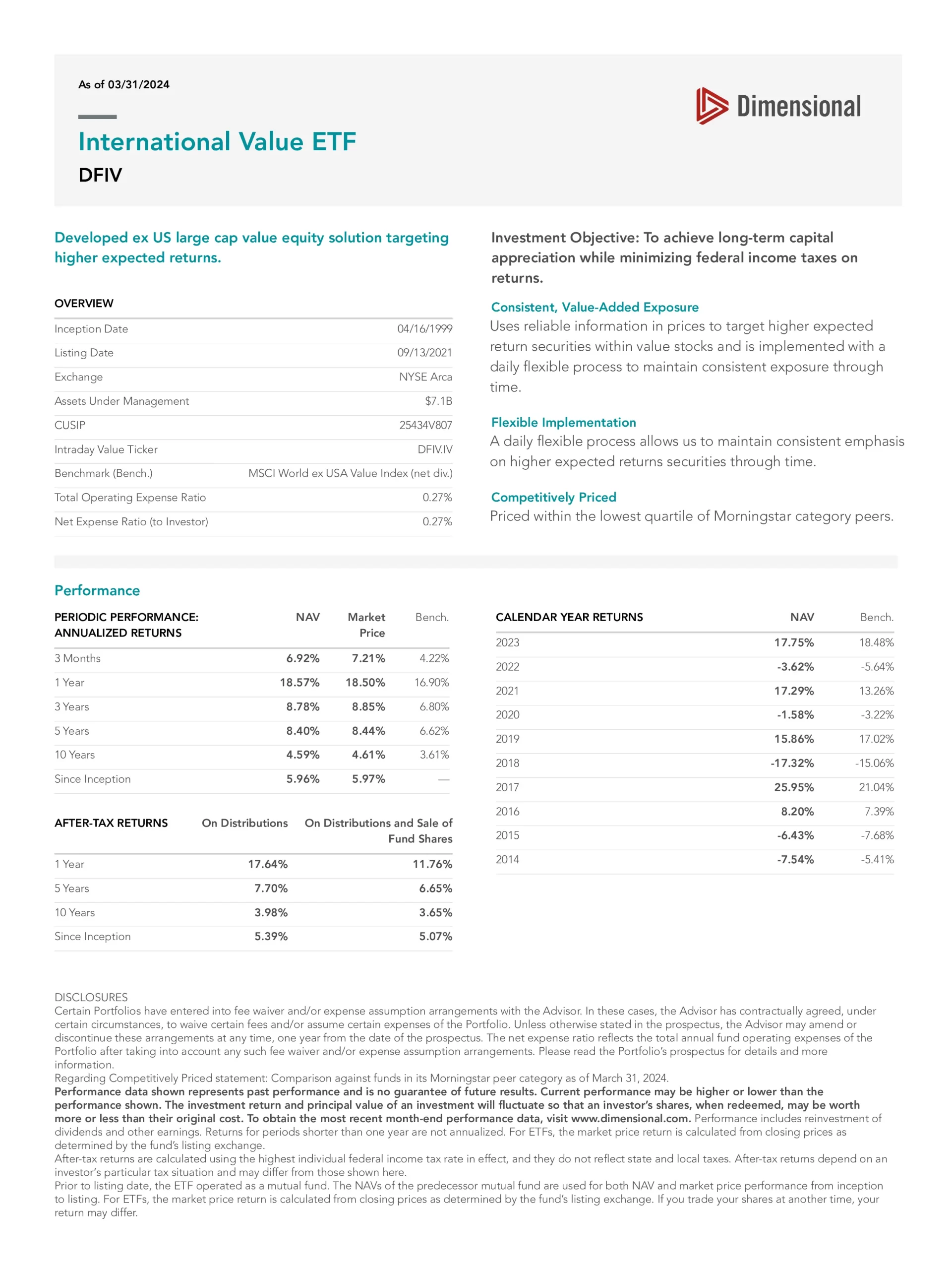

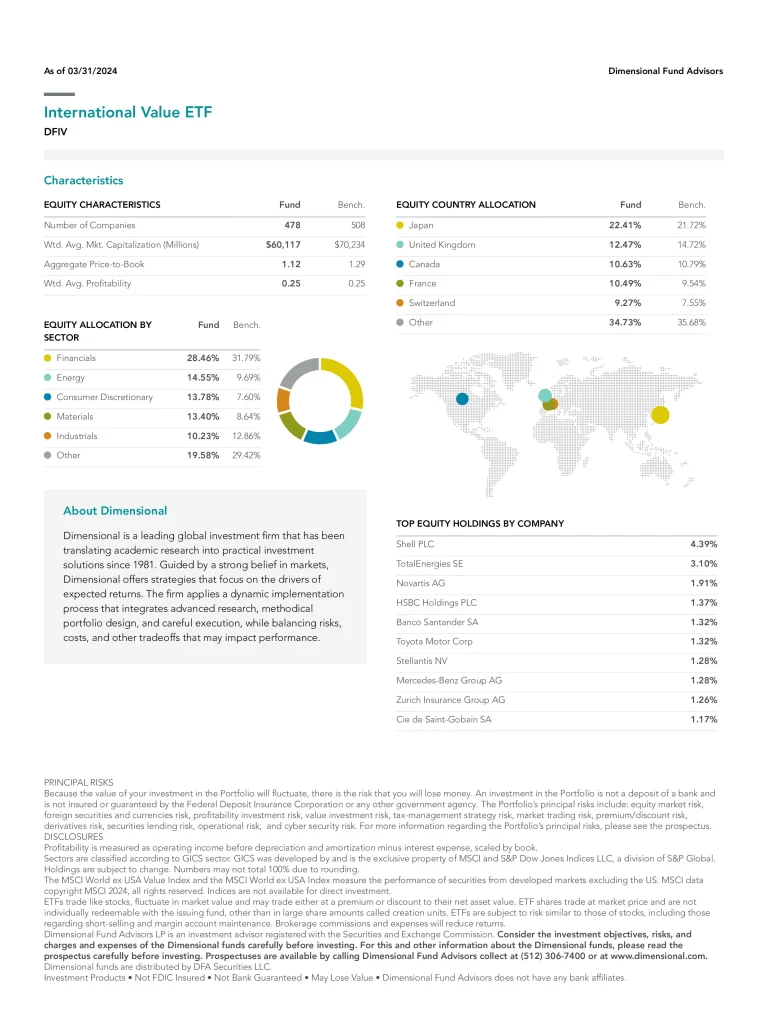

The investment objective of the Dimensional International Value ETF (DFIV) is to achieve long-term capital appreciation while minimizing federal income taxes on returns. It uses reliable information in prices to target higher expected return securities within value stocks and is implemented with a daily flexible process to maintain consistent exposure through time.

Is DFIV a Good ETF?

| ETF | Inception | MER | AUM | Holdings | Beta | P/E | Yield | Distributions | 1Y | 3Y | 5Y | 10Y | 15Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DMDV | 2018-11-27 | 0.39% | $1,999,277 | 55 | 0.98 | 4.75 | 7.15% | Monthly | 19.68% | 2.90% | 4.94% | N/A | N/A |

| QINT | 2018-09-10 | 0.39% | $220,297,016 | 376 | 1.07 | 11.12 | 3.13% | Semi-Annually | 22.88% | 1.56% | 9.15% | N/A | N/A |

| IDVO | 2022-09-07 | 0.66% | $124,350,634 | 50 | N/A | 9.93 | 5.49% | Monthly | 28.44% | N/A | N/A | N/A | N/A |

| AVDV | 2019-09-24 | 0.36% | $5,098,433,669 | 1329 | 1.06 | 7.38 | 3.35% | Semi-Annually | 25.99% | 3.95% | N/A | N/A | N/A |

| EDEN | 2012-01-25 | 0.53% | $247,286,346 | 46 | 1.07 | 13.82 | 1.87% | Semi-Annually | 23.72% | 7.56% | 17.75% | 11.05% | N/A |

| BKIE | 2020-04-22 | 0.04% | $635,202,680 | 1000 | 1.01 | 14.57 | 2.77% | Quarterly | 18.75% | 3.47% | N/A | N/A | N/A |

| CVIE | 2023-01-30 | 0.18% | $102,100,000 | 762 | N/A | 16.95 | 1.89% | Quarterly | 17.98% | N/A | N/A | N/A | N/A |

| CGXU | 2022-02-22 | 0.54% | $2,096,900,000 | 70 | N/A | 18.27 | 0.99% | Semi-Annually | 16.85% | N/A | N/A | N/A | N/A |

| FNDF | 2013-08-15 | 0.25% | $12,004,110,490 | 932 | 0.97 | 10.47 | 3.42% | Semi-Annually | 21.40% | 5.26% | 9.75% | 5.02% | N/A |

| INEQ | 2016-06-13 | 0.45% | $7,850,000 | 100 | 0.90 | N/A | 3.12% | Quarterly | 23.74% | 7.02% | 8.92% | N/A | N/A |

| DFIV | 1999-04-16 | 0.27% | $6,400,000,000 | 478 | 0.97 | 21.51 | 1.48% | Quarterly | 25.53% | 7.53% | 10.08% | 4.65% | 6.61% |

| DSTX | 2020-12-14 | 0.55% | $34,422,850 | 150 | 1.06 | 14.41 | 1.80% | Quarterly | 12.28% | -1.71% | N/A | N/A | N/A |

| FIDI | 2018-01-16 | 0.18% | $94,860,000 | 122 | 0.92 | 14.82 | 1.69% | Quarterly | 21.62% | 5.18% | 6.31% | N/A | N/A |

| FJP | 2011-04-18 | 0.80% | $196,319,901 | 100 | 0.85 | 6.87 | 3.37% | Semi-Annually | 22.87% | 3.42% | 5.16% | 3.56% | N/A |

| IQDY | 2013-04-12 | 0.48% | $75,560,000 | 196 | 1.16 | 8.09 | 6.48% | Quarterly | 24.53% | 3.08% | 9.97% | 4.79% | N/A |

| FLJH | 2017-11-02 | 0.09% | $38,240,000 | 485 | 0.44 | 13.09 | 6.50% | Semi-Annually | 39.92% | 18.44% | 18.27% | N/A | N/A |

| DAX | 2014-10-22 | 0.21% | $55,410,000 | 41 | 1.23 | 14.28 | 2.49% | Semi-Annually | 19.38% | 1.31% | 8.30% | N/A | N/A |

| GSIE | 2015-11-06 | 0.25% | $3,455,950,000 | 718 | 0.99 | 12.92 | 2.85% | Quarterly | 18.21% | 2.30% | 7.67% | N/A | N/A |

| RODE | 2017-05-10 | 0.29% | $18,352,728 | 314 | 0.90 | 8.01 | 4.85% | Semi-Annually | 20.32% | 3.81% | 5.89% | N/A | N/A |

| PID | 2005-09-15 | 0.53% | $835,000,000 | 49 | 0.95 | 18.24 | 3.28% | Quarterly | 10.15% | 4.23% | 7.20% | 3.49% | 6.84% |

| BBCA | 2018-08-07 | 0.19% | $6,690,000,000 | 80 | 1.03 | 14.45 | 2.53% | Quarterly | 17.87% | 3.09% | 9.80% | N/A | N/A |

| JHMD | 2016-12-15 | 0.39% | $713,460,000 | 633 | 1.00 | 13.45 | 2.83% | Semi-Annually | 19.07% | 3.16% | 7.99% | N/A | N/A |

| NUDM | 2017-06-06 | 0.31% | $429,600,000 | 150 | 1.04 | 17.33 | 2.95% | Annually | 16.21% | 2.44% | 8.36% | N/A | N/A |

| OEUR | 2015-08-18 | 0.48% | $36,460,569 | 53 | 1.04 | 17.97 | 4.25% | Quarterly | 17.13% | 5.66% | 8.91% | N/A | N/A |

| PTEU | 2015-12-14 | 0.65% | $40,175,771 | 303 | 0.53 | 13.58 | 2.75% | Annually | 10.68% | 3.89% | 3.28% | N/A | N/A |

| PJIO | 2023-12-14 | 0.90% | $12,833,038 | 29 | N/A | N/A | N/A | Annually | N/A | N/A | N/A | N/A | N/A |

| EUDV | 2015-09-09 | 0.55% | $8,520,000 | 44 | 0.98 | N/A | 1.84% | Quarterly | 12.42% | 0.01% | 6.71% | N/A | N/A |

| SPDW | 2007-04-20 | 0.03% | $18,602,980,000 | 2480 | 1.04 | 13.73 | 2.75% | Semi-Annually | 17.74% | 1.63% | 7.93% | 4.68% | 6.81% |

| TOUS | 2023-06-14 | 0.50% | $78,820,000 | 167 | N/A | N/A | N/A | Annually | N/A | N/A | N/A | N/A | N/A |

| MOTI | 2015-07-13 | 0.63% | $227,250,000 | 73 | 1.07 | 11.36 | 2.46% | Annually | 11.07% | -0.75% | 5.70% | N/A | N/A |

| VXUS | 2011-01-26 | 0.08% | $68,300,000,000 | 8616 | 1.03 | 13.48 | 3.37% | Quarterly | 16.91% | 0.52% | 7.19% | 4.32% | 6.30% |

| UIVM | 2017-10-24 | 0.41% | $233,977,940 | 210 | 0.94 | 10.08 | 3.93% | Monthly | 23.29% | 3.10% | 6.37% | N/A | N/A |

| VWID | 2017-10-10 | 0.49% | $9,756,066 | 127 | 0.87 | 11.33 | 4.80% | Quarterly | 17.29% | 4.16% | 8.52% | N/A | N/A |

| DXJ | 2006-06-16 | 0.48% | $3,023,020,680 | 444 | 0.45 | 11.18 | 3.13% | Quarterly | 50.50% | 25.45% | 22.06% | 13.12% | 10.90% |

| DBEZ | 2014-12-10 | 0.45% | $36,890,000 | 627 | 0.86 | 14.66 | 1.80% | Semi-Annually | 20.95% | 8.94% | 11.73% | N/A | N/A |