GLD ETF Review

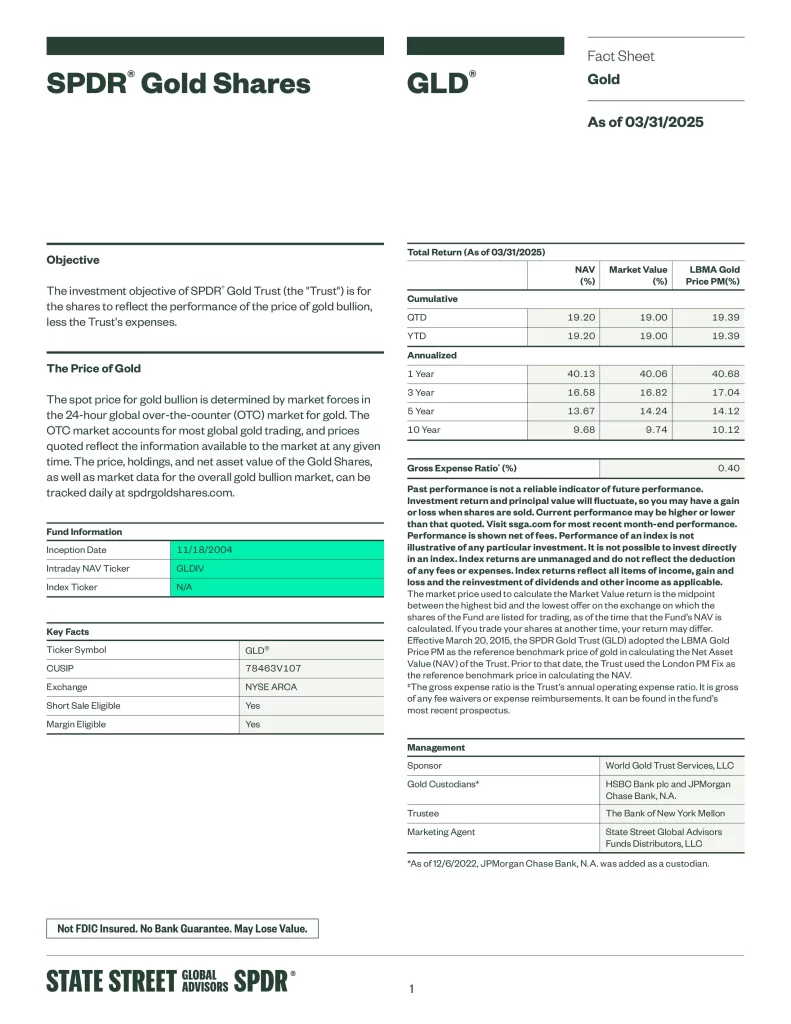

The investment objective of SPDR Gold Shares (GLD) is for the shares to reflect the performance of the price of gold bullion. Over the long term, gold stands out as a persistent source of portfolio diversification. Gold’s diverse, global demand among cyclical and countercyclical sectors can help drive two key strategic benefits for portfolios: its persistently low correlations to other asset classes and its ability to protect against tail risks. These characteristics may aid in efficient portfolio diversification while reducing portfolio drawdowns and volatility, resulting in improved risk-adjusted portfolio performance.

- The first US traded gold ETF and the first US-listed ETF backed by a physical asset

- For many investors, the costs associated with buying GLD shares in the secondary market and the payment of the Trust’s ongoing expenses may be lower than the costs associated with buying, storing and insuring physical gold in a traditional allocated gold bullion account