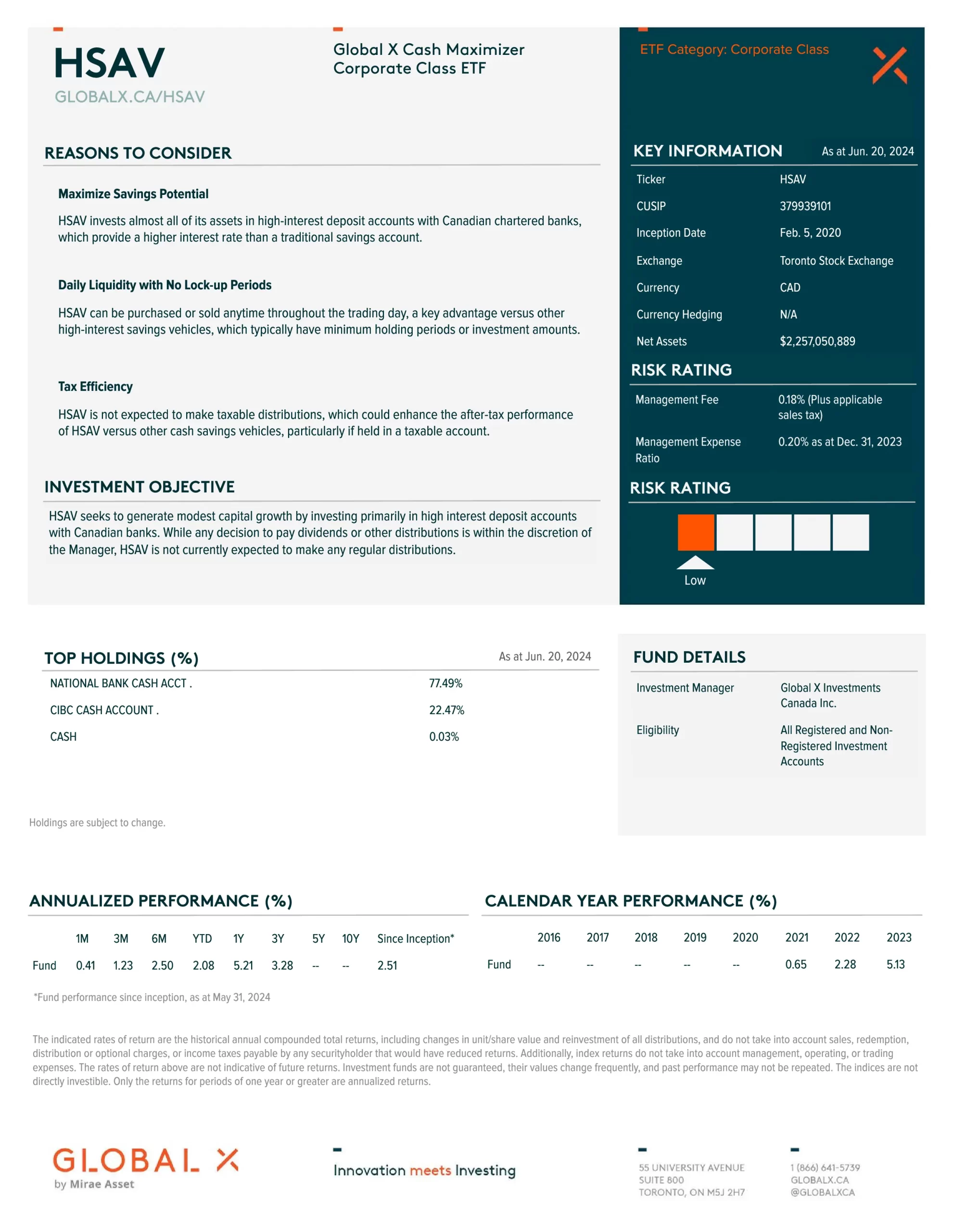

The Global X Cash Maximizer Corporate Class ETF (HSAV) seeks to generate modest capital growth by investing primarily in high-interest deposit accounts with Canadian banks. While any decision to pay dividends or other distributions is within the discretion of the Manager, and is not currently expected to make any regular distributions. Cash is an important asset class for practically any investment portfolio as it serves two important functions.

HSAV ETF Review

The biggest challenge when holding cash is that interest rates offered by traditional liquid savings vehicles can be quite low, whereas yields can potentially increase using savings vehicles like GICs or high-interest savings accounts. These types of products typically have investment minimums or lock-up periods. The Horizons Cash Maximizer ETF offers the best of both worlds, providing daily liquidity for cash holdings while offering an interest rate that is expected to be competitive with other high-interest savings vehicles.

- Daily Liquidity: it can be purchased or sold anytime throughout the trading day. This is a key advantage versus other high-interest savings vehicles, which typically have minimum holding periods or investment amounts

- Enhanced Savings Potential: invests substantially all of its assets in high-interest deposit accounts with one or more Canadian chartered banks, which provide a higher interest rate than a traditional savings account

- Tax Efficiency: not expected to make taxable distributions, which should enhance the after-tax performance.

- It can potentially reduce risk in the portfolio

- It is used for liquidity to fund expenses or potentially new acquisitions in a portfolio

Is HSAV a Good ETF?

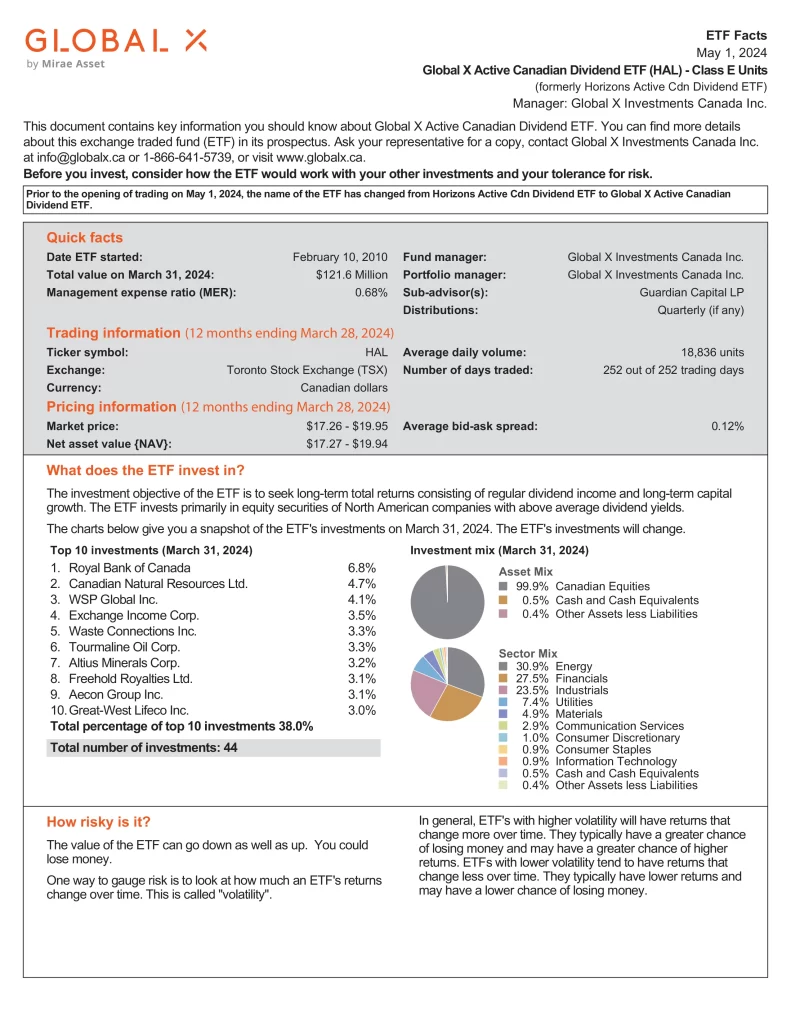

Quickly compare HSAV to other investments focused on Canadian equities by fees, performance, yield, and other metrics to decide which ETF fits in your portfolio.

| Manager | ETF | Name | Risk | Inception | MER | AUM | Beta | Dividend Yield | Distributions | 1Y | 3Y | 5Y | 10Y | 15Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BlackRock | CMR | iShares Premium Money Market ETF | Low | 2008-02-19 | 0.27% | $577,823,203 | N/A | 4.72% | Monthly | 4.83% | 2.27% | 1.75% | 1.24% | 1.04% |

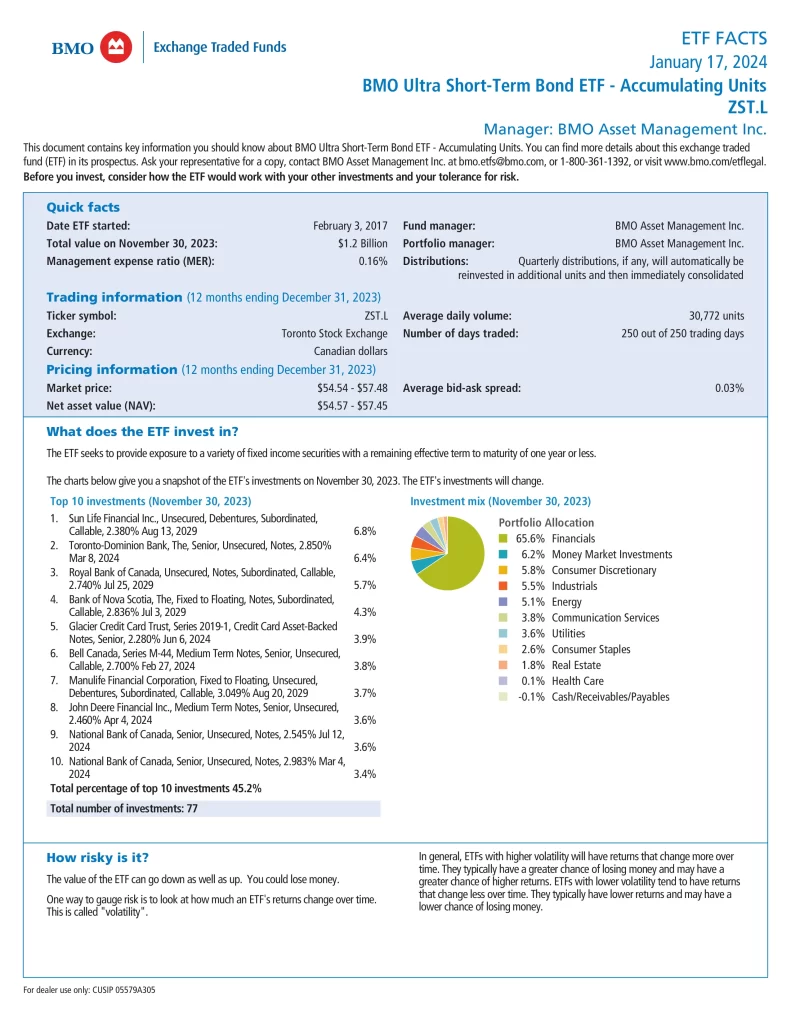

| BMO | ZST.L | BMO Ultra Short-Term Bond ETF (Accumulating Units) | Low | 2017-02-09 | 0.16% | $226,640,000 | 0.14 | 1.13% | Monthly | 6.78% | 3.32% | 2.45% | N/A | N/A |

| CI | CSAV | CI High Interest Savings ETF | Low | 2019-06-14 | 0.16% | $7,180,000,000 | N/A | 4.95% | Monthly | 5.08% | 2.74% | N/A | N/A | N/A |

| CIBC | CAFR | CIBC Active Investment Grade Floating Rate Bond ETF | Low | 2019-01-22 | 0.34% | $366,674,171 | 0.04 | 4.59% | Monthly | 5.72% | 2.57% | 2.09% | N/A | N/A |

| Dynamic | DXV | Dynamic Active Investment Grade Floating Rate ETF | Low | 2018-03-23 | 0.33% | $128,710,000 | 0.09 | 6.34% | Monthly | 5.97% | 2.74% | 2.91% | N/A | N/A |

| Evolve | HISA | High Interest Savings Account Fund | Low | 2019-11-19 | 0.07% | $4,062,711,000 | N/A | 5.03% | Monthly | 5.14% | 2.79% | N/A | N/A | N/A |

| Franklin | FHIS | Franklin Canadian Ultra Short Term Bond Fund | Low | 2022-09-12 | 0.18% | $120,910,000 | N/A | 3.47% | Monthly | 5.67% | N/A | N/A | N/A | N/A |

| Global X | HSAV | Global X Cash Maximizer Corporate Class ETF | Low | 2020-02-05 | 0.20% | $2,257,331,297 | N/A | N/A | N/A | 5.21% | 3.28% | N/A | N/A | N/A |

| Guardian | GCTB | Guardian Ultra-Short Canadian T-Bill Fund | Low | 2023-07-11 | N/A | $137,892,198 | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| Harvest | TBIL | Harvest Canadian T-Bill ETF | Low | 2024-01-16 | N/A | $32,590,000 | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| Mackenzie | QASH | Mackenzie Canadian Ultra Short Bond Index ETF | Low | 2023-11-20 | N/A | $38,086,683 | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| Ninepoint | NSAV | Ninepoint High Interest Savings Fund | Low | 2020-11-17 | 0.16% | $501,650,000 | N/A | 4.73% | Monthly | 5.22% | 2.80% | N/A | N/A | N/A |

| Purpose | PSA | Purpose High Interest Savings Fund | Low | 2013-11-15 | 0.16% | $5,209,000,000 | N/A | 5.11% | Monthly | 5.22% | 3.27% | 2.46% | 1.88% | N/A |

HSAV vs CASH

CASH is the better ETF. CASH is a better performing, higher-yielding, more popular and less expensive ETF than HSAV which is older.

HSAV vs CSAV

HSAV is the better ETF. HSAV is a better performing, higher-yielding and less expensive ETF than CSAV which is more popular and older.

HSAV vs PSA

PSA is the better ETF. PSA is a better performing, higher-yielding, more popular and older ETF than CSAV which is less expensive.

Conclusion

Horizons Cash Maximizer ETF is a great option for investors looking to only have capital gains from their cash investments. This is a great tax strategy for non-registered and corporate accounts. Currently, my preferred high-interest ETF offered in Canada is Purpose High Interest Savings Fund (PSA).