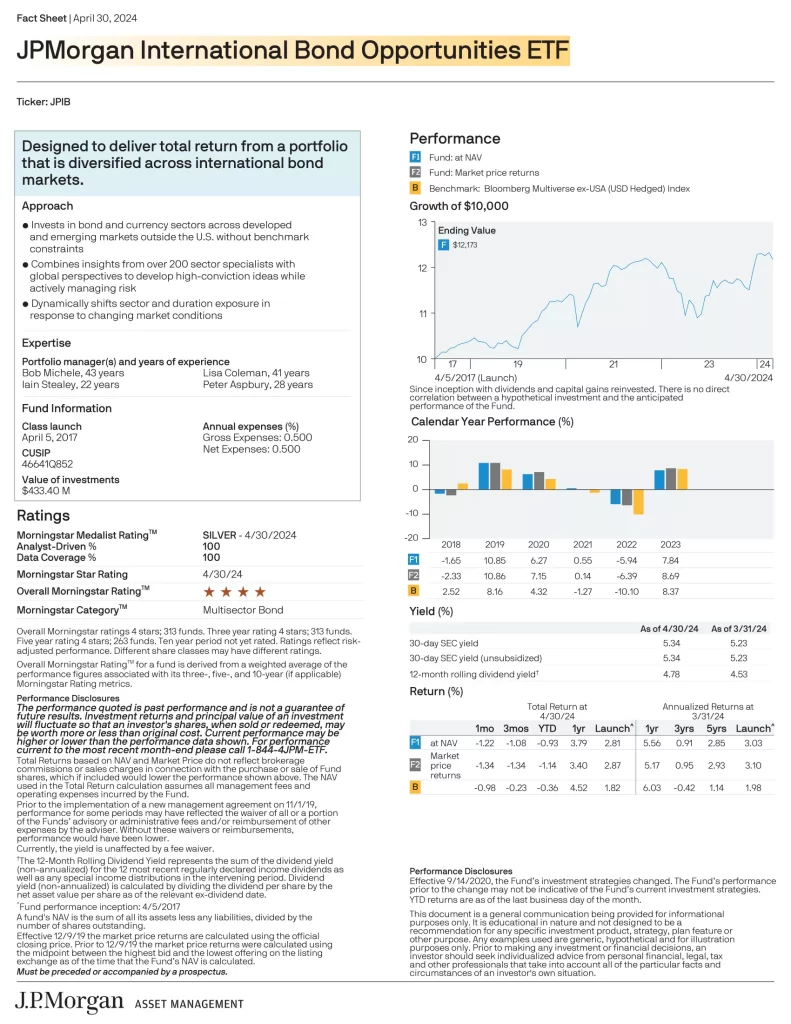

IAUM ETF Review

iShares Gold Trust Micro (IAUM) generally seeks to reflect the performance of the price of gold. The iShares Gold Trust Micro is not an investment company registered under the Investment Company Act of 1940, and therefore is not subject to the same regulatory requirements as mutual funds or ETFs registered under the Investment Company Act of 1940. The Trust is not a commodity pool for purposes of the Commodity Exchange Act. Before making an investment decision, you should carefully consider the risk factors and other information included in the prospectus.

- The lowest cost physical gold ETF currently on the market

- Exposure to the day-to-day movement of the price of gold bullion

- Use to diversify your portfolio and help protect against inflation

Is IAUM a Good Investment?

Quickly compare this ETF to similar funds by fees, performance, yield, and other metrics to decide which investment fits your portfolio.

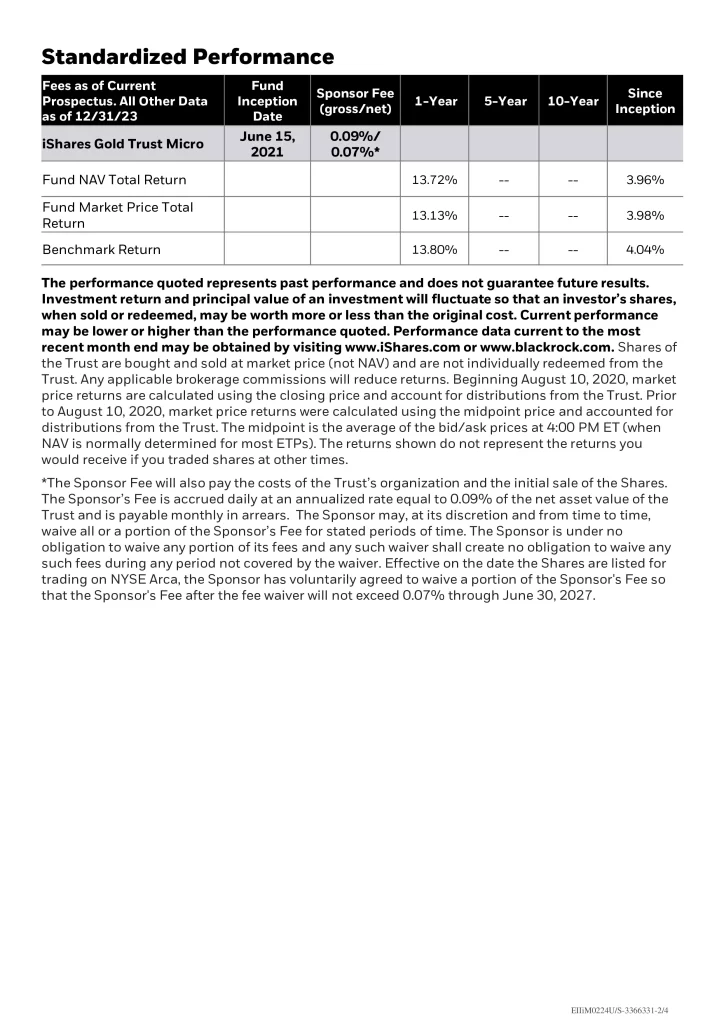

| Manager | ETF | Name | Inception | AUM | MER | Distributions |

|---|---|---|---|---|---|---|

| abrdn | SGOL | abrdn Physical Gold Shares ETF | 2009-09-09 | $3,771,950,000 | 0.17% | N/A |

| BlackRock | IAU | iShares Gold Trust | 2005-01-21 | $33,341,963,125 | 0.25% | N/A |

| BlackRock | IAUM | iShares Gold Trust Micro | 2021-06-15 | $1,384,398,695 | 0.09% | N/A |

| State Street | GLD | SPDR Gold Shares | 2004-11-18 | $74,571,640,000 | 0.40% | N/A |

| State Street | GLDM | SPDR Gold MiniShares | 2018-06-25 | $9,113,050,000 | 0.10% | N/A |

Conclusion

There are risks involved with investing in ETFs, including possible loss of money. Ordinary brokerage commissions apply. The Fund’s return may not match the return of the Underlying Index. Growth stocks tend to be more sensitive to changes in their earnings and can be more volatile. Investments focused on a particular sector, such as healthcare, are subject to greater risk, and are more greatly impacted by market volatility than more diversified investments. A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets. Beta is a measure of risk representing how a security is expected to respond to general market movements.