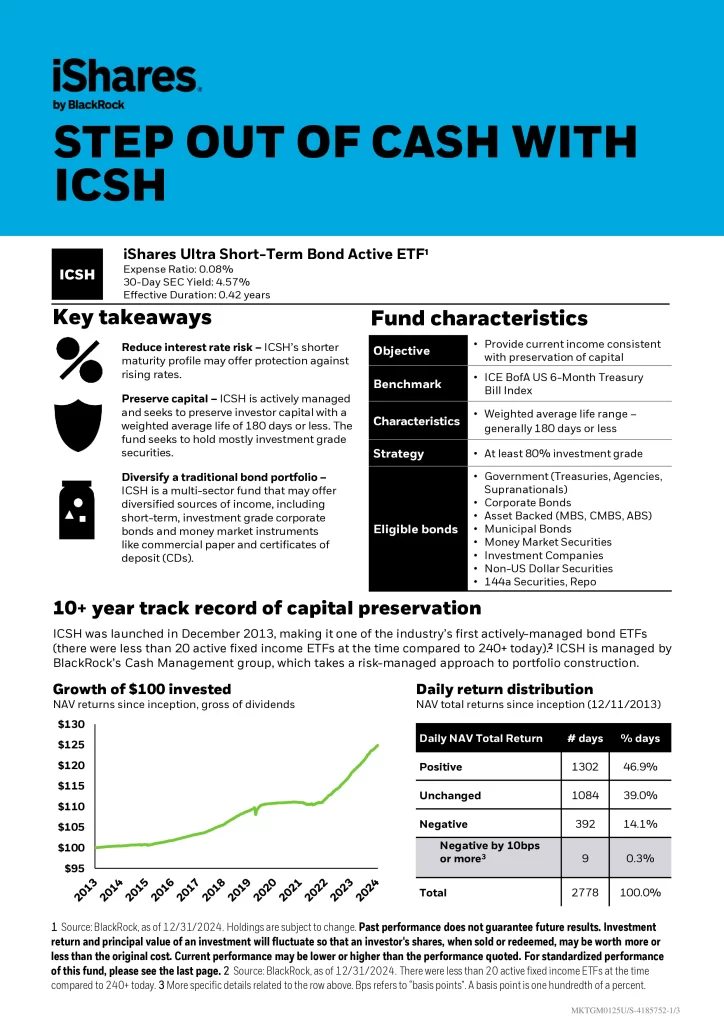

ICSH ETF Review

The iShares Ultra Short-Term Bond Active ETF (ICSH) seeks to provide current income consistent with capital preservation. The fund seeks to hold mostly investment-grade securities. ICSH seeks to provide income by investing in a broad range of short-term U.S. dollar-denominated fixed-income instruments. Use ICSH to help meet current income and liquidity needs and help manage interest rate risk.

- Capital Preservation: Actively managed to protect capital with a weighted average life under 180 days.

- Diversified Income: Invests in short-term investment-grade corporate bonds and money market instruments for varied income streams.

- Reduced Interest Rate Risk: Focuses on short-term bonds to limit exposure to rising interest rates.

| Manager | Ticker | Inception | AUM | MER | Distributions | Yield |

|---|---|---|---|---|---|---|

| BlackRock | ICSH | 2013-12-11 | $5,954,586,493 | 0.08% | Monthly | 5.08% |