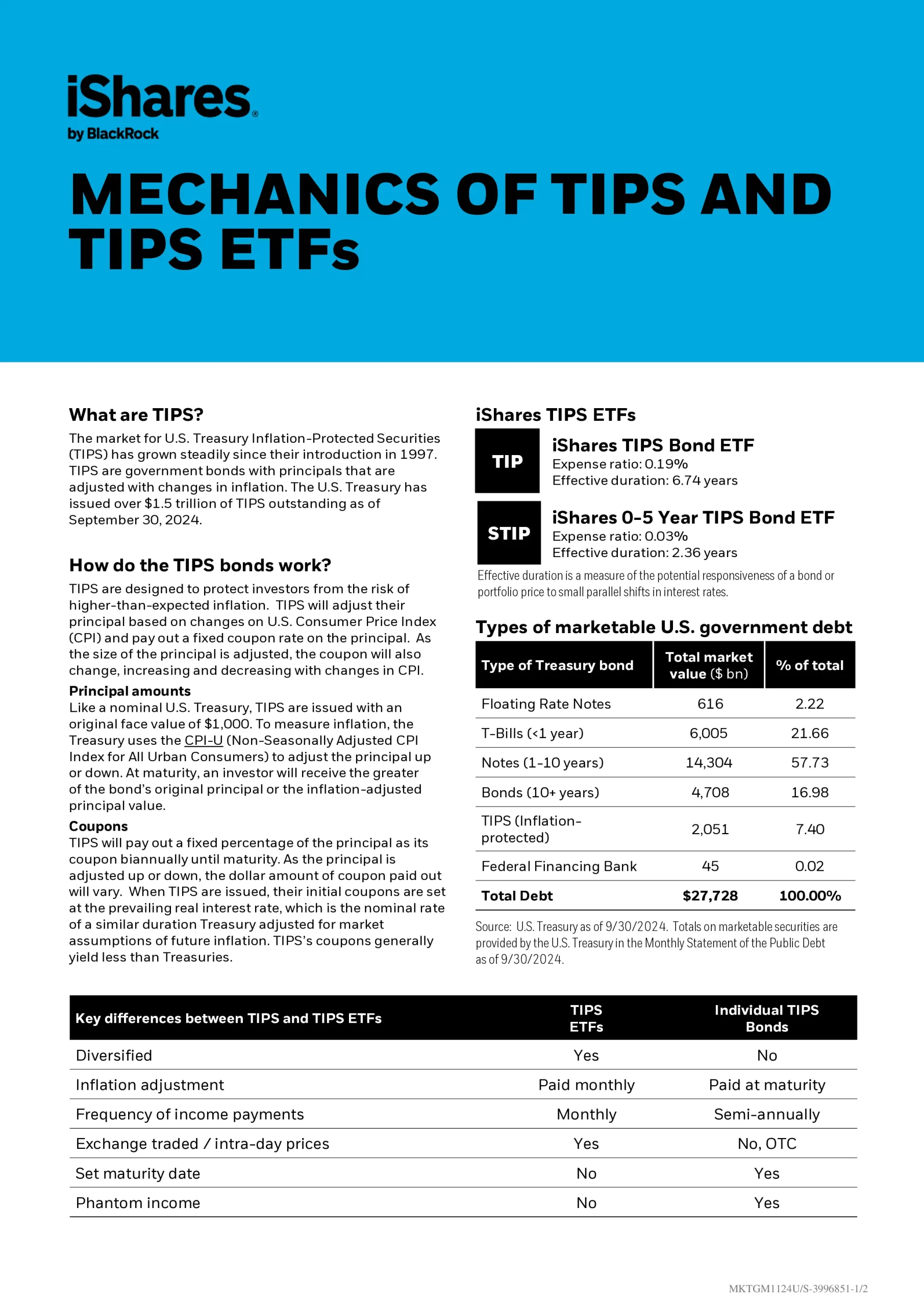

What are TIPS?

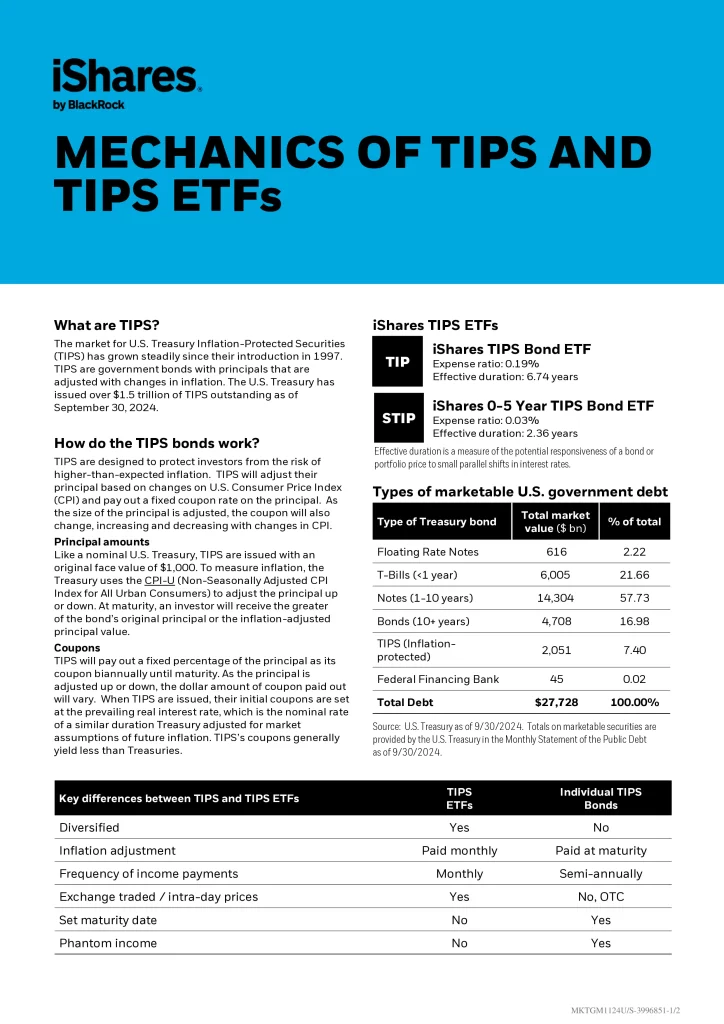

The market for U.S. Treasury Inflation-Protected Securities (TIPS) has grown steadily since their introduction in 1997. TIPS are government bonds with principals that are adjusted with changes in inflation. The U.S. Treasury has issued over $1.5 trillion of TIPS outstanding as of September 30, 2024.

How Do the TIPS Bonds Work?

TIPS are designed to protect investors from the risk of higher-than-expected inflation. TIPS will adjust their principal based on changes on U.S. Consumer Price Index (CPI) and pay out a fixed coupon rate on the principal. As the size of the principal is adjusted, the coupon will also change, increasing and decreasing with changes in CPI.

Principal Amounts

Like a nominal U.S. Treasury, TIPS are issued with an original face value of $1,000. To measure inflation, the Treasury uses the CPI-U (Non-Seasonally Adjusted CPI Index for All Urban Consumers) to adjust the principal up or down. At maturity, an investor will receive the greater of the bond’s original principal or the inflation-adjusted principal value.

Coupons

TIPS will biannually pay out a fixed percentage of the principal as its coupon until maturity. As the principal is adjusted up or down, the dollar amount of the coupon paid out will vary. When TIPS are issued, their initial coupons are set at the prevailing real interest rate, which is the nominal rate of a similar duration Treasury adjusted for market assumptions of future inflation. TIPS’s coupons generally yield less than Treasuries.

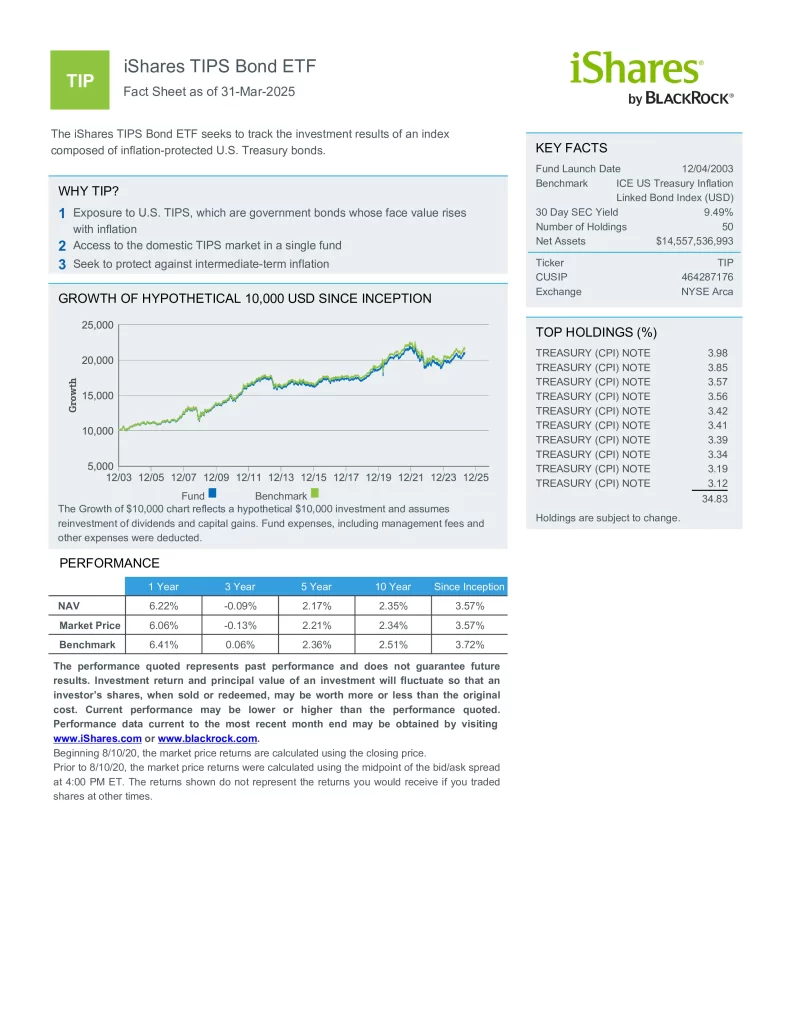

STIP ETF Review

iShares 0-5 Year TIPS Bond ETF (STIP) seeks to track the investment results of an index composed of inflation-protected U.S. Treasury bonds with less than five years remaining.

- Exposure to short-term U.S. TIPS, which are government bonds whose face value rises with inflation

- Targeted access to a specific segment of the domestic TIPS market

- Seek to protect against near-term inflation

Is STIP a Good Investment?

Quickly compare this ETF to similar funds by fees, performance, yield, and other metrics to decide which investment fits your portfolio.

| Manager | ETF | Name | Inception | AUM | MER | Distributions |

|---|---|---|---|---|---|---|

| BlackRock | STIP | iShares 0-5 Year TIPS Bond ETF | 2010-12-01 | $9,340,033,892 | 0.03% | Monthly |

| BlackRock | TIP | iShares TIPS Bond ETF | 2003-12-04 | $15,497,157,591 | 0.19% | Monthly |

| Vanguard | VTIP | Vanguard Short-Term Inflation-Protected Securities ETF | 2012-12-10 | $11,700,000,000 | 0.04% | Quarterly |

Conclusion

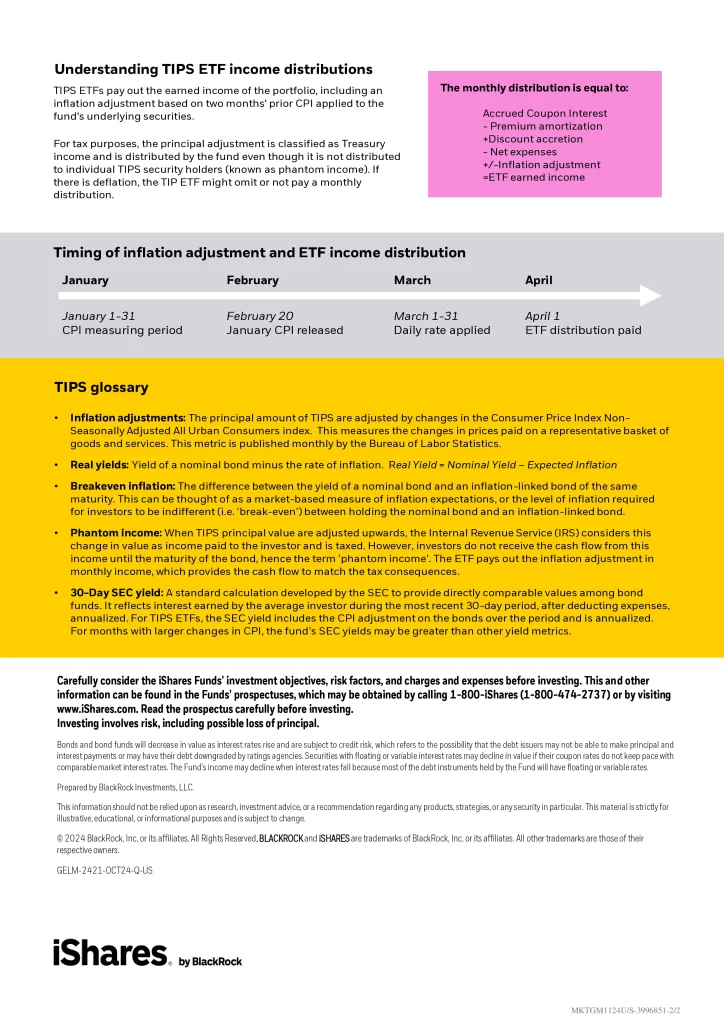

There are risks involved with investing in ETFs, including possible loss of money. Ordinary brokerage commissions apply. The Fund’s return may not match the return of the Underlying Index. Growth stocks tend to be more sensitive to changes in their earnings and can be more volatile. Investments focused on a particular sector, such as healthcare, are subject to greater risk, and are more greatly impacted by market volatility than more diversified investments. A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets. Beta is a measure of risk representing how a security is expected to respond to general market movements.