More information about this Exchange Traded Fund (ETF) is in its prospectus. Before investing, assess how the ETF aligns with your portfolio and risk tolerance. Remember that the value of ETFs can fluctuate, meaning you might lose money. They do not offer guarantees, and you may not recover the full amount of your investment. Additionally, purchasing or selling ETF units may incur commission fees, which can vary between brokerage firms. ETF market prices can also experience higher volatility, especially during the opening and closing of trading sessions. Even ETFs rated as low-risk may experience losses under certain market conditions. Always consider these factors carefully when making investment decisions.

VFV: Vanguard S&P 500 Index ETF

VFV ETF Review

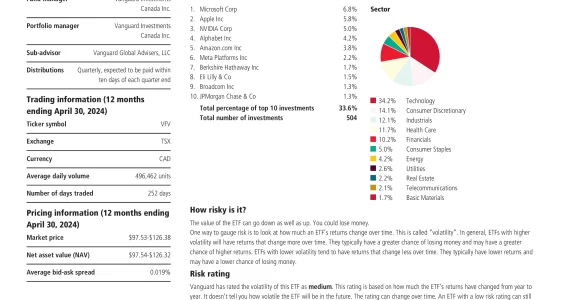

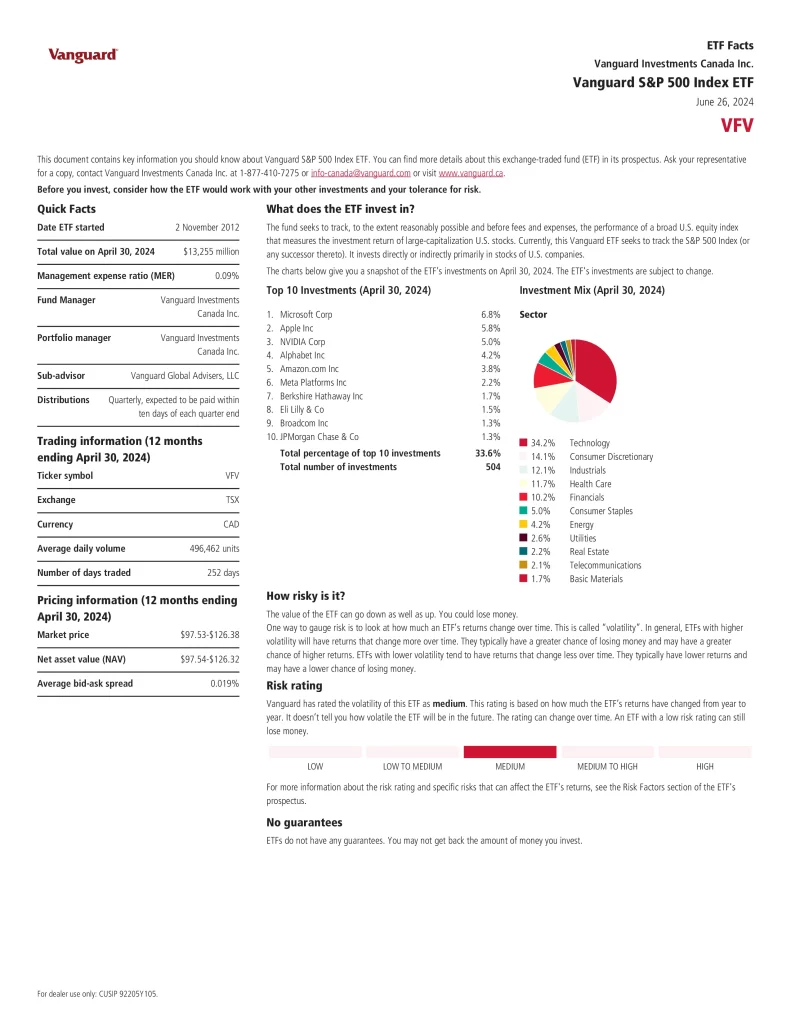

Vanguard S&P 500 Index ETF (VFV) seeks to track the performance of a broad U.S. equity index that measures the investment return of large-capitalization U.S. stocks. Currently, this Vanguard ETF seeks to track the S&P 500 Index. It invests directly or indirectly primarily in stocks of U.S. companies.

- Employs a passively managed, full-replicated index strategy to provide exposure of large U.S. companies.

- Uses efficient, cost effective index management techniques

Top 10 VFV Holdings

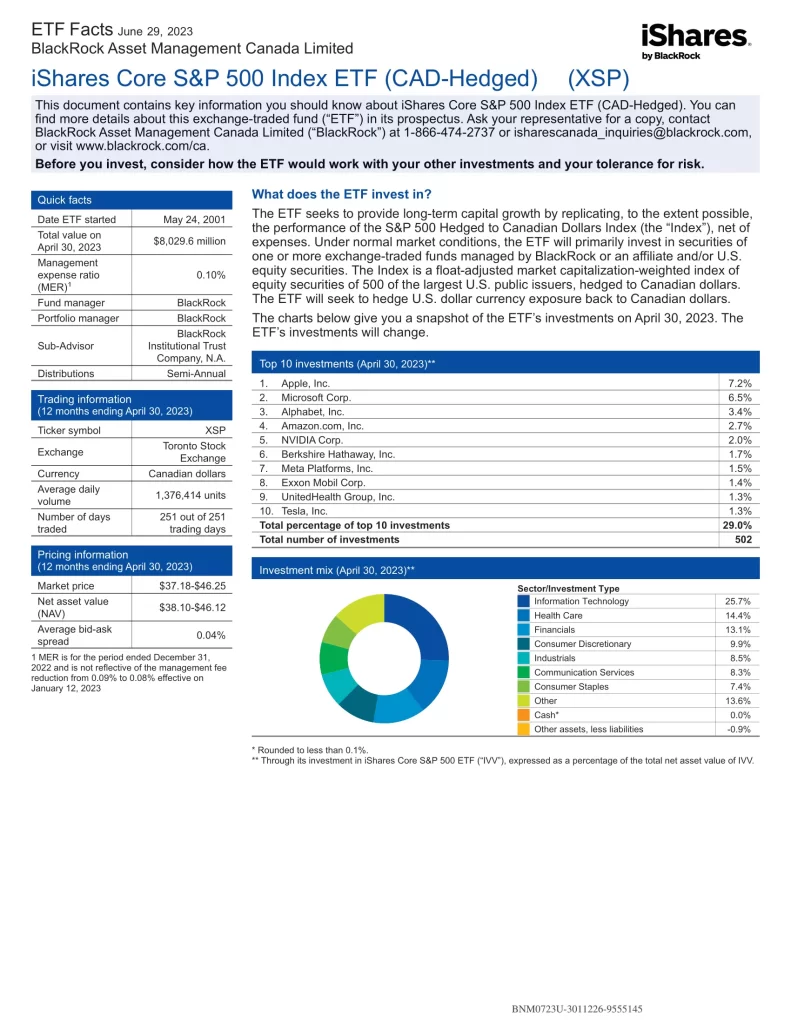

The top 10 VFV holdings account for 29.0% of the total investments. VFV invests primarily in stocks of U.S. companies located in the S&P 500 Index weighted based on market capitalization.

| Ticker | Name | Weight |

|---|---|---|

| AAPL | Apple Inc. | 7.19% |

| MSFT | Microsoft Corporation | 6.52% |

| AMZN | Amazon.com, Inc. | 2.68% |

| NVDA | NVIDIA Corporation | 1.95% |

| GOOGL | Alphabet Inc Class A | 1.82% |

| BRK.B | Berkshire Hathaway Inc. | 1.69% |

| GOOG | Alphabet Inc. Class C | 1.60% |

| META | Meta Platforms Inc | 1.52% |

| XOM | Exxon Mobil Corporation | 1.39% |

| UNH | UnitedHealth Group Incorporated | 1.31% |

Is VFV a Good Investment?

Quickly compare VFV to other investments focused on American equities by fees, performance, yield, and other metrics to decide which ETF fits in your portfolio.

| Manager | ETF | Name | Risk | Inception | AUM | MER | Distributions | Spread | Holdings | P/E | P/B | P/S | Yield |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BlackRock | XSP | iShares Core S&P 500 Index ETF (CAD-Hedged) | Medium | 2001-05-24 | $11,286,674,729 | 0.09% | Semi-Annual | 0.03% | 500 | 21.32 | 4.28 | 2.82 | 1.41% |

| BlackRock | XUS | iShares Core S&P 500 Index ETF | Medium | 2013-04-10 | $8,072,930,223 | 0.09% | Semi-Annual | 0.03% | 500 | 21.32 | 4.28 | 2.82 | 1.41% |

| BMO | ZSP | BMO S&P 500 Index ETF | Medium | 2012-11-14 | $17,611,200,000 | 0.09% | Quarterly | 0.02% | 501 | 21.59 | 4.36 | 2.91 | 1.42% |

| BMO | ZUE | BMO S&P 500 Hedged to CAD Index ETF | Medium | 2009-05-29 | $2,906,380,000 | 0.09% | Quarterly | 0.05% | 500 | 21.29 | 4.23 | 2.80 | 1.43% |

| Vanguard | VFV | Vanguard S&P 500 Index ETF | Medium | 2012-11-02 | $18,270,000,000 | 0.09% | Quarterly | 0.02% | 504 | 21.20 | 4.27 | 2.82 | 1.45% |

| Vanguard | VSP | Vanguard S&P 500 Index ETF (CAD-hedged) | Medium | 2012-11-02 | $3,540,000,000 | 0.09% | Quarterly | 0.03% | 504 | 21.20 | 4.27 | 2.82 | 1.45% |

VFV vs VEQT

VFV is the superior performing, older, less expensive and more popular ETF than VEQT less volatile, more diversified and higher yielding.

VFV vs VOO

VFV is the superior performing and less volatile ETF than VOO which is older, less expensive, more popular, more diversified and higher yielding. VOO avoids the 15% withholding tax on dividends in RRSP and RRIF accounts, but the minimal savings are not worth the difference of purchasing VFV, an un-hedged ETF.

VFV vs VSP

VFV is the superior performing, less expensive and more popular ETF than VSP less volatile, higher yielding and hedged to the Canadian dollar.

VFV vs VUN

VFV is the superior performing, older, less expensive and more popular ETF than VUN less volatile, more diversified and higher yielding.

VFV vs XEQT

VFV is the superior performing, older, less expensive and more popular ETF than XEQT less volatile, more diversified and higher yielding.

VFV vs XUS

XUS is the superior performing ETF than VFV, older, more popular, less volatile, less expensive and higher yielding.

VFV vs XUU

VFV is the superior performing, older, less expensive and more popular ETF than XUU less volatile, more diversified and higher yielding.

VFV vs ZSP

VFV is the superior performing and more popular ETF than ZSP less volatile and higher yielding.

Conclusion

To assess risk, you can examine an ETF’s volatility, which measures how much its returns fluctuate over time. ETFs with higher volatility typically experience greater swings in returns, increasing both the potential for higher gains and the risk of losses. Conversely, ETFs with lower volatility tend to have more stable returns, often with lower risks and returns. However, even a low-risk ETF can lose value under certain market conditions.

When trading ETFs, it’s essential to understand the bid, ask, and bid-ask spread. The bid represents the highest price a buyer is willing to pay for ETF units, while the ask is the lowest price a seller is willing to accept. The bid-ask spread is the difference between these two prices. A narrower spread generally indicates higher liquidity, meaning you’re more likely to execute trades at expected prices.