What is the Warren Buffet Portfolio?

There are several key principles at the core of Warren Buffett’s investing philosophy. Foremost among these is the idea of holding onto stocks for the long term, allowing them to build wealth through compound interest. He has famously stated, “When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.”

Although the 93-year-old co-founder, chairman, and CEO of Berkshire Hathaway built his wealth by investing in strong brands with excellent financials, such as Coca-Cola and American Express, he also recognizes the value of other investments like exchange-traded funds (ETFs). For most people, ETFs are a sensible choice. While we might not have the capacity to invest billions into major corporations, we can invest in low-cost, low-maintenance index funds. These can serve as foundational holdings for long-term, buy-and-hold portfolios. Investing in S&P 500 ETFs is a secure way to own shares of the 500 largest U.S. companies across multiple sectors.

- Short Term Bonds

- S&P 500

Warren Buffet Portfolio Allocation

The Warren Buffett Portfolio can be implemented with 2 ETFs. This portfolio is high-risk, meaning it can experience significant fluctuations in value.

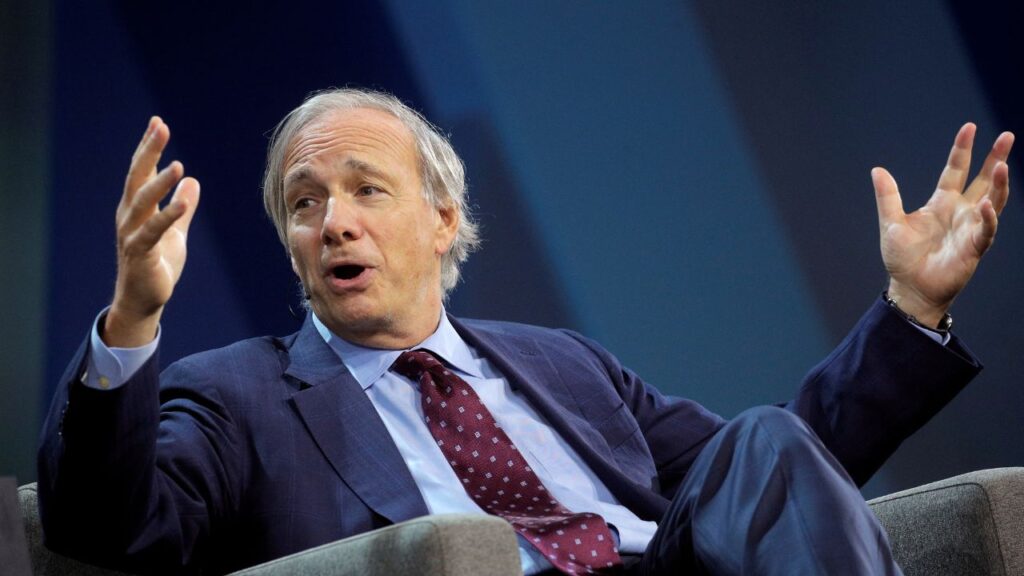

Vanguard S&P 500 ETF (VOO)

VOO is an S&P 500 Index Fund that seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. With respect to 75% of its total assets, the fund may not: (1) purchase more than 10% of the outstanding voting securities of any one issuer or (2) purchase securities of any issuer if, as a result, more than 5% of the fund’s total assets would be invested in that issuer’s securities; except as may be necessary to approximate the composition of its target index. This limitation does not apply to obligations of the U.S. government or its agencies or instrumentalities.

- Employs a passively managed, full-replication strategy

- Seeks to track the performance of the S&P 500 Index

- Low expenses minimize net tracking error

- Fund remains fully invested

- Large-cap equity

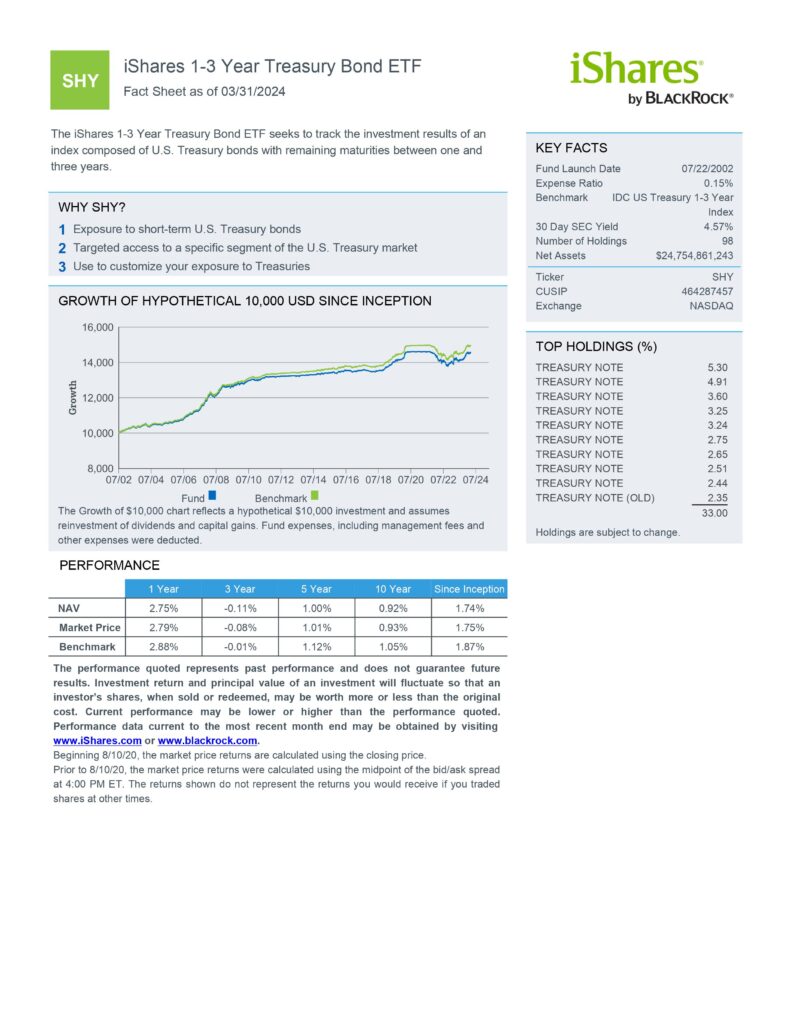

iShares 1-3 Year Treasury Bond ETF (SHY)

SHY seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between one and three years.

- Exposure to short-term U.S. Treasury bonds

- Targeted access to a specific segment of the U.S. Treasury market

- Use to customize your exposure to Treasuries