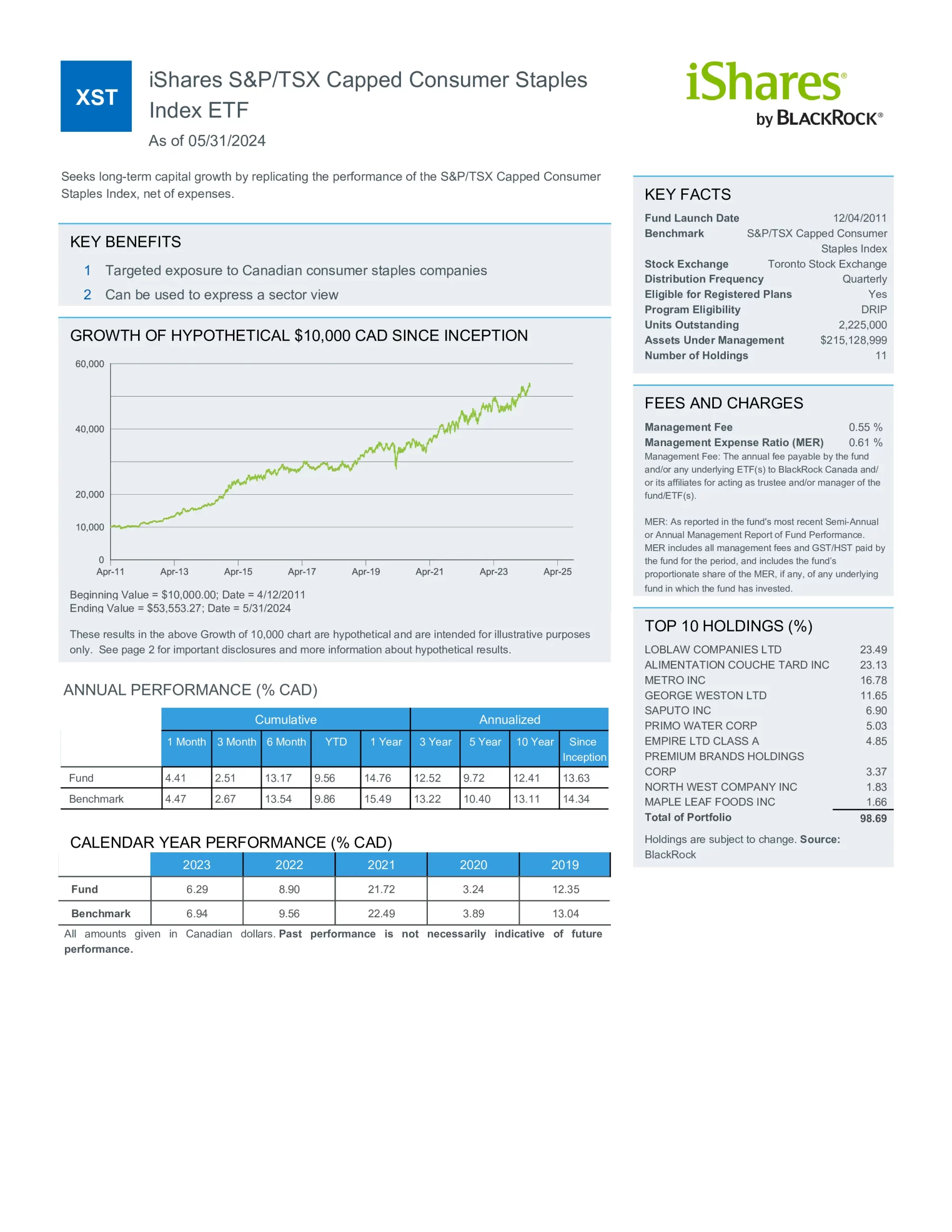

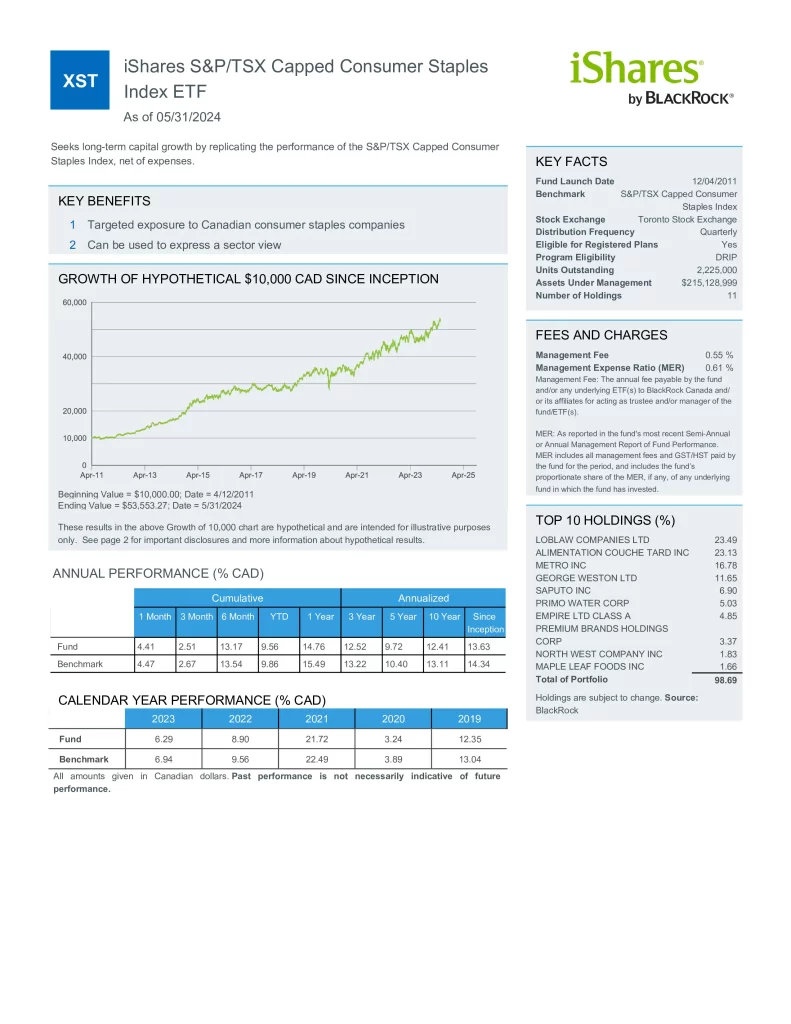

iShares S&P/TSX Capped Consumer Staples Index ETF (XST.TO) seeks long-term capital growth by replicating the performance of the S&P/TSX Capped Consumer Staples Index, net of expenses.

- Targeted exposure to Canadian consumer staples companies

- Can be used to express a sector view

| Manager | ETF | Inception | MER | AUM | Holdings | Beta | P/E | Yield | Distributions | 1Y | 3Y | 5Y | 10Y | 15Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CEW | 2008-02-06 | 0.61% | $190,590,859 | 10 | 0.98 | 9.64 | 4.03% | Monthly | 17.24% | 7.12% | 11.39% | 9.63% | 10.91% |

| XEG | 2001-03-19 | 0.60% | $1,602,140,597 | 30 | 0.95 | 7.06 | 3.04% | Quarterly | 42.52% | 36.55% | 20.11% | 2.44% | 3.29% |

| XFN | 2001-03-23 | 0.61% | $1,364,515,670 | 27 | 1.01 | 10.27 | 3.88% | Monthly | 20.80% | 6.22% | 9.99% | 8.67% | 10.36% |

| XIT | 2001-03-19 | 0.60% | $616,517,459 | 23 | 1.73 | 47.92 | N/A | Semi-Annually | 9.97% | 2.81% | 14.94% | 18.80% | 15.29% |

| XMA | 2005-12-19 | 0.61% | $156,760,034 | 50 | 1.04 | 10.85 | 1.16% | Quarterly | 16.93% | 4.84% | 12.36% | 5.85% | 2.54% |

| XST | 2011-04-12 | 0.61% | $214,048,770 | 11 | 0.57 | 19.39 | 0.83% | Quarterly | 14.76% | 12.52% | 9.72% | 12.41% | N/A |

| XUT | 2011-04-12 | 0.61% | $244,454,786 | 15 | 0.60 | 22.08 | 3.86% | Monthly | -5.93% | -0.86% | 5.29% | 6.54% | N/A |

| ZEB | 2009-10-20 | 0.28% | $3,651,530,000 | 7 | 1.02 | N/A | 4.64% | Monthly | 16.97% | 4.42% | 10.04% | 8.99% | N/A |

| ZEO | 2009-10-20 | 0.61% | $211,730,000 | 12 | 0.71 | N/A | 4.12% | Quarterly | 34.64% | 27.56% | 16.72% | 2.42% | N/A |

| ZIN | 2012-11-14 | 0.62% | $46,880,000 | 39 | 1.02 | N/A | 1.62% | Quarterly | 11.99% | 5.38% | 8.75% | 7.55% | N/A |

| ZRE | 2010-05-19 | 0.61% | $517,880,000 | 22 | 0.88 | N/A | 5.47% | Monthly | -1.55% | -2.75% | 1.43% | 5.14% | N/A |

| ZUT | 2010-01-19 | 0.61% | $431,730,000 | 15 | 0.61 | N/A | 4.44% | Monthly | -7.49% | -2.24% | 6.23% | 7.12% | N/A |

| ZWB | 2022-01-24 | 0.71% | $2,852,300,000 | 41 | 0.96 | N/A | 7.34% | Monthly | 12.78% | 2.28% | 7.07% | 6.83% | N/A |

| CIC | 2010-08-18 | 0.93% | $187,870,000 | 6 | 0.93 | 9.64 | 7.20% | Monthly | 13.29% | 2.47% | 7.45% | 7.05% | N/A |

| RIT | 2004-11-15 | 0.87% | $447,220,000 | 36 | 0.92 | N/A | 5.34% | Monthly | 0.43% | -1.71% | 1.79% | 6.71% | 10.10% |

| BANK | 2024-02-05 | 2.16% | $182,467,000 | 10 | N/A | 8.09 | 16.00% | Monthly | N/A | N/A | N/A | N/A | N/A |

| BKCC | 2011-05-16 | 0.82% | $158,999,250 | 14 | N/A | 7.65 | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| ENCC | 2011-04-11 | 0.80% | $320,681,008 | 37 | N/A | 7.58 | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| HBNK | 2023-07-05 | 0.00% | $777,638,831 | 6 | N/A | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| HEWB | 2019-01-22 | 0.28% | $140,615,994 | 35 | 1.02 | N/A | N/A | N/A | 16.88% | 4.46% | 10.22% | N/A | N/A |

| HXE | 2013-09-16 | 0.27% | $90,768,446 | 25 | 0.96 | 7.41 | N/A | N/A | 42.99% | 37.04% | 20.37% | 2.65% | N/A |

| HXF | 2013-09-16 | 0.28% | $76,485,658 | 6 | 1.01 | 10.84 | N/A | N/A | 21.25% | 6.60% | 10.38% | 9.03% | N/A |

| PPLN | 2014-07-14 | 0.74% | $29,389,532 | 12 | 0.39 | N/A | 3.69% | Quarterly | 19.72% | 11.90% | 9.31% | N/A | N/A |

| UTIL | 2022-08-09 | 0.61% | $10,384,580 | 12 | N/A | 16.09 | 4.58% | Monthly | -2.34% | N/A | N/A | N/A | N/A |

| TBNK | 2023-04-20 | 0.28% | $14,990,000 | 7 | N/A | N/A | 4.56% | Monthly | 17.95% | N/A | N/A | N/A | N/A |