ZST.L ETF Review

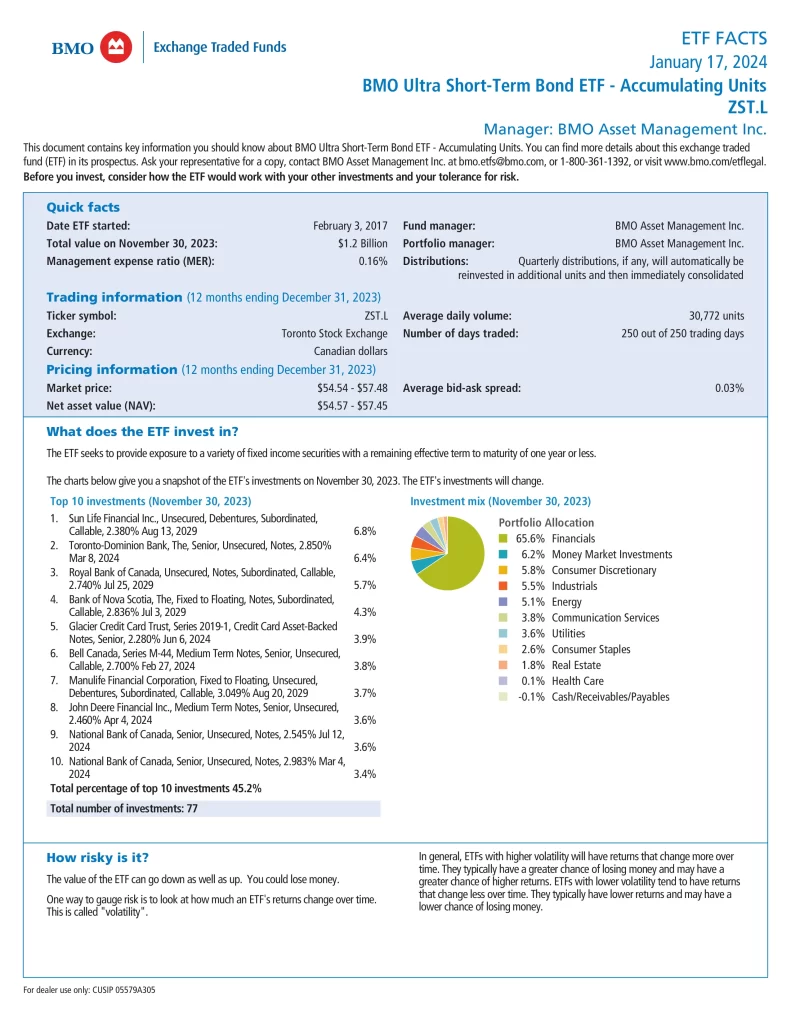

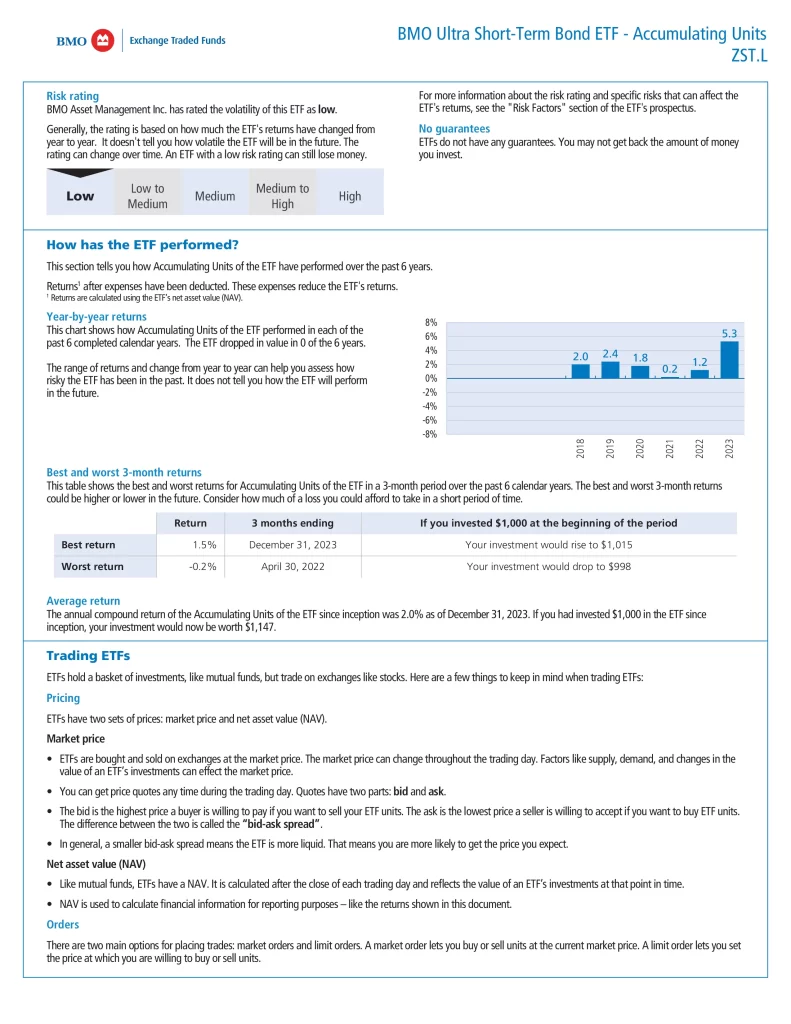

BMO Ultra Short-Term Bond ETF (AU) (ZST.L) seeks to provide exposure to various fixed-income securities with a remaining effective term to maturity of one year or less. The Fund invests in investment-grade corporate bonds and can add exposure to government bonds, high-yield bonds, floating-rate notes, and preferred shares. The portfolio is rebalanced based on the manager’s fundamental analysis, relative strength indicators, and risk-adjusted yield expectations.

- Invested in a diversified portfolio of federal, provincial, corporate bonds, and preferred shares

- Designed for investors looking for accumulating defensive income

- Includes bonds with less than one year to maturity

ZST.L Dividend History

ZST.L currently has a yield of 2.32% and pays distributions quarterly. Most ETFs will distribute net taxable income to investors at least once a year. This is taxable income if the income is generated from interest, dividends and capital gains by the securities within the ETF. The distributions will either be paid in cash or reinvested in the ETF at the discretion of the manager. This information will be reported in an official tax receipt provided to investors by their broker.

| Ex-Dividend Date | Record Date | Payable Date | Dividend |

|---|---|---|---|

| 2024-12-30 | 2024-12-30 | 2025-01-03 | – |

| 2024-09-27 | 2024-09-27 | 2024-10-02 | – |

| 2024-06-27 | 2024-06-27 | 2024-07-03 | $0.72 |

| 2024-03-27 | 2024-03-28 | 2024-04-02 | $0.73 |

| 2023-12-27 | 2023-12-28 | 2024-01-03 | $0.65 |

| 2023-09-27 | 2023-09-28 | 2023-10-04 | $0.65 |

| 2023-06-28 | 2023-06-29 | 2023-07-05 | $0.65 |

| 2023-03-29 | 2023-03-30 | 2023-04-04 | $0.65 |

| 2022-12-28 | 2022-12-29 | 2023-01-03 | $0.3 |

| 2022-09-28 | 2022-09-29 | 2022-10-05 | $0.45 |

Is ZST.L a Good Investment?

ZST.L is an unpopular ultra-short bond ETF with low risk, negligible fees, minimal volatility, and great performance making it a strong buy. Quickly compare this ETF to similar investments by numerous metrics to decide if this investment will fit into your portfolio.

| ETF | Risk | Inception | MER | AUM | Beta | Yield | Distributions | 1Y | 3Y | 5Y | 10Y | 15Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CMR | Low | 2008-02-19 | 0.27% | $577,823,203 | N/A | 4.72% | Monthly | 4.83% | 2.27% | 1.75% | 1.24% | 1.04% |

| ZST.L | Low | 2017-02-09 | 0.16% | $226,640,000 | 0.14 | 1.13% | Quarterly | 6.52% | 2.74% | 2.45% | N/A | N/A |

| CSAV | Low | 2019-06-14 | 0.16% | $8,860,000,000 | N/A | 4.95% | Monthly | 5.08% | 2.74% | N/A | N/A | N/A |

| CAFR | Low | 2019-01-22 | 0.34% | $366,674,171 | 0.04 | 4.59% | Monthly | 5.72% | 2.57% | 2.09% | N/A | N/A |

| DXV | Low | 2018-03-23 | 0.33% | $128,710,000 | 0.09 | 6.34% | Monthly | 5.97% | 2.74% | 2.91% | N/A | N/A |

| HISA | Low | 2019-11-19 | 0.07% | $4,680.638 | N/A | 5.03% | Monthly | 5.14% | 2.79% | N/A | N/A | N/A |

| FHIS | Low | 2022-09-12 | 0.18% | $120,910,000 | N/A | 3.47% | Monthly | 5.41% | N/A | N/A | N/A | N/A |

| CBIL | Low | 2023-04-12 | 0.11% | $762,399,496 | N/A | 5.03% | Monthly | 4.86% | N/A | N/A | N/A | N/A |

| GCTB | Low | 2023-07-11 | N/A | $137,892,198 | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| TBIL | Low | 2024-01-16 | N/A | $32,590,000 | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| QASH | Low | 2023-11-20 | N/A | $38,086,683 | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| NSAV | Low | 2020-11-17 | 0.16% | $501,650,000 | N/A | 4.73% | Monthly | 5.22% | 2.80% | N/A | N/A | N/A |

| PSA | Low | 2013-11-15 | 0.16% | $5,209,000,000 | N/A | 5.11% | Monthly | 5.19% | 2.79% | 2.27% | 1.76% | N/A |