Financial advice often serves as an enabler of risk-taking, empowering individuals to make informed investment decisions. For those with limited knowledge or experience in financial markets, the lack of confidence to design well-structured investment portfolios can hinder their ability to act rationally. Financial advisors play a critical role in addressing this by instilling confidence and helping clients overcome their fears. In recent years, robo-advisors, automated platforms providing investment advice without human intervention, have emerged as an alternative to traditional advisors. However, critics argue that these platforms cannot fully mitigate harmful behaviours, such as poor market timing, which may offset the benefits they provide.

Over the past 15 years, the growth and refinement of the robo-advisory industry have democratized access to diversified, professionally managed portfolios, particularly for individuals of modest means. With low account balance requirements, affordable fees, and user-friendly interfaces, robo-advisors are especially appealing to young investors with straightforward financial needs. However, selecting the right platform can be challenging.

Most platforms use questionnaires to gather client information on goals, time horizons, and risk tolerance. This data is processed by algorithmic engines to recommend portfolios, typically composed of low-cost, passively managed funds. The primary differentiators lie in the breadth of financial planning options and cost structures. While many platforms focus on digital investment management with basic financial tools, top providers integrate advanced features, ranging from comprehensive online advice to human advisor access.

What is a Robo-Advisor?

The robo-advisor industry, now more than 25 years old, continues to hold significant untapped potential for both providers and investors. As of early 2022, industry assets totaled around $740 billion, just a small fraction of the retail investment market. Despite the widespread availability of low-cost, diversified portfolios, leading providers have only recently begun to incorporate advanced features like non-retirement goal planning and tax-loss harvesting, which remain inconsistently offered.

The competitive landscape is evolving, with providers adding capabilities to attract new clients. However, varied pricing models and limited transparency into underlying investments create challenges for investors seeking to navigate the market. Robo-advisors emerged from a confluence of technological and market trends, including the rise of the internet, the popularity of ETFs, and the decline of defined-benefit pension plans. The concept combines Modern Portfolio Theory (MPT) with advanced computing power.

Today, robo-advisors are defined as platforms delivering automated, semi-customized, and strategically allocated portfolios directly to retail clients. Many also provide additional services such as financial planning tools and optional access to human advisors, despite their “robotic” branding. By harnessing these advanced systems, robo-advisors represent a middle ground between do-it-yourself trading platforms and high-touch wealth management, making them a transformative force in the financial services landscape.

- Despite its rapid growth, the digital advice industry still represents a small share of investable assets in the U.S., comprising only a fraction of the $31.4 trillion retail market as of early 2022

- Independent digital advice firms often face challenges in achieving profitability at scale, while large brokerage firms that acquire them frequently struggle to integrate these capabilities effectively

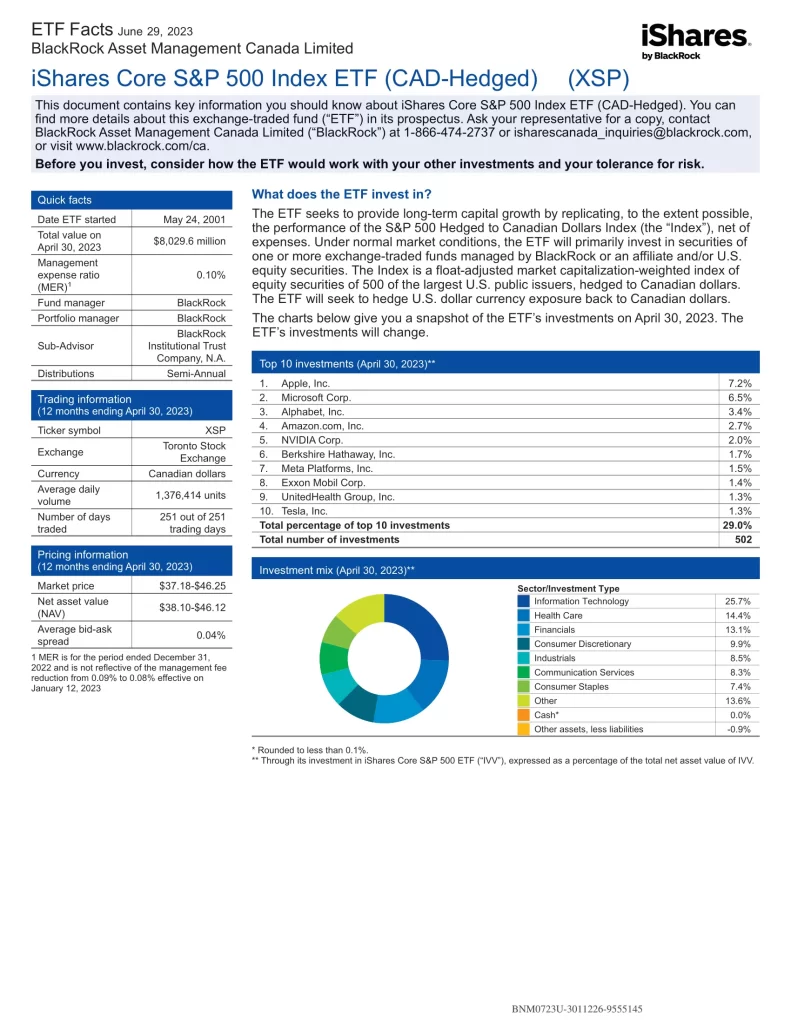

- The standard robo-advisor strategy involves portfolios of passively managed, low-cost exchange-traded funds (ETFs) tailored to varying risk levels

- The boundaries between robo-advisors and traditional financial advice are becoming increasingly blurred as hybrid models emerge

- Some providers now incorporate active or quasi-active investment strategies

How Do Robo-Advisors Work?

Robo-advisors assist with investment decisions by tailoring strategies to individual goals and risk profiles. The process usually begins with potential clients answering questions about their investment purpose and time horizon. These goals can range from retirement savings to building an emergency fund, saving for a major expense, or generating income to cover ongoing costs. Robo-advisors also provide continuous portfolio monitoring and automatic rebalancing. When deviations from the targeted risk profile occur (such as an increase in equity value outpacing bonds) portfolios are rebalanced to realign with the client’s risk tolerance. Additionally, portfolios may be adjusted as investors approach their goal timeline or if they modify their risk preferences or objectives.

To assess a client’s risk tolerance, robo-advisors use a combination of objective and subjective questions. Objective metrics include factors like income and years until retirement, while subjective questions explore reactions to market fluctuations and comfort with financial risk. Based on these inputs, robo-advisors employ automated algorithms to recommend optimal asset allocations.

- Construct higher-risk portfolios by increasing the equity-to-bond ratio and selecting riskier assets (e.g., shifting from government bonds to municipal bonds or from domestic stocks to emerging market equities).

- Tailor asset allocation to specific goals—for instance, generating income for short-term expenses versus long-term savings

- Allow investors to achieve broad market exposure with minimal trading

- Keep trading costs low by adopting a passive investment approach

- Focus on funds with strong market liquidity, extensive track records, and consistent performance

The Rise of Robo Advice and Its Implications

The emergence of robo-advisors represents a broader shift in the financial industry, driven by technology and stricter post-crisis regulations. Following the 2007–2008 global financial crisis, advancements in computer science spurred the growth of technology-based, non-bank financial services. Innovations like ATMs, mobile payments, and blockchain-enabled trade finance have reshaped the financial landscape, and robo-advisors are now revolutionizing wealth management. Robo-advisors use advanced algorithms to deliver cost-effective, automated financial planning tailored to individual investor profiles. By analyzing factors like risk tolerance, investment goals, financial experience, and market trends, these platforms offer personalized advice.

Initially introduced by fintech startups as cost-effective alternatives to human advisors, robo-advisors have since been embraced by established financial institutions. Robo-advisors exemplify the fusion of technological innovation and modern investment theory. Their ability to democratize access to professional wealth management, coupled with ongoing advancements in AI and global expansion, positions them as a transformative force in the financial services industry. Their popularity is fueled by advancements in artificial intelligence (AI) and machine learning, enabling customized solutions and the convenience of managing portfolios through computers or mobile devices. As robo-advisors continue to evolve, they are set to play an increasingly significant role in shaping the future of finance, delivering efficient, accessible, and cost-effective investment solutions to a wider audience.

Robo-Advisor Pros

Robo-advisors offer several advantages over traditional wealth management services, primarily in terms of accessibility, affordability, and efficiency.

- Accessibility: Robo-advisors enable users to access financial advice and manage investments anytime and anywhere with an internet connection. This eliminates the need for physical meetings or scheduled appointments with human advisors, making the process more convenient for clients.

- Cost Efficiency: Robo-advisors significantly reduce costs by automating processes and eliminating the need for human advisors or physical office spaces.

- Enhanced Efficiency: Robo-advisors automate and streamline manual processes, resulting in cost and time savings while improving accuracy. These AI-driven systems enable financial advisors to focus on strategic, high-value tasks, fostering scalability and delivering enhanced client services through hybrid advisory models.

- Reduced Behavioral Biases: By relying on algorithms rather than human judgment, robo-advisors can help mitigate biases like favoritism toward commission-paying products or over-reliance on domestic securities. However, algorithmic biases may still exist, as they are programmed by humans.

- Tax Optimization: Robo-advisors can efficiently execute tax-loss harvesting, where assets with losses are sold to offset taxable gains while maintaining a similar portfolio risk profile. This complex process, involving multiple trades and asset substitutions, is performed more frequently and precisely by robo-advisors than by human advisors.

Robo-Advisor Cons

Robo-advisors also come with notable limitations that require careful consideration.

- Impersonal Approach: Robo-advisors lack the personalized touch of human advisors. Their reliance on standardized questionnaires may fail to capture the full complexity of a client’s financial situation, including other investments, liabilities, or life changes.

- Narrow Risk Assessment: Questionnaires assume that clients with similar risk profiles will provide identical answers, which may not be true. Additionally, robo-advisors might not account for external factors such as real estate holdings, pension funds, or spousal finances, potentially leading to incomplete recommendations.

- Limited Emotional Support: Human advisors can offer reassurance during market downturns or help redefine goals during life changes. Robo-advisors lack this counseling ability, leaving clients to navigate emotional and financial uncertainty on their own.

- Consumer Disengagement: Automation may lead to passive involvement by clients, who might not take the time to understand how robo-advisors operate or actively monitor their investments. This is especially concerning for inexperienced investors with limited financial knowledge.

- Algorithmic Biases and Conflicts: Like human advisors, robo-advisors may prioritize partnerships with certain brokers or financial firms based on commissions rather than cost-effectiveness, introducing conflicts of interest.

- Unproven Longevity: Robo-advisors are relatively new, and their business models remain untested under prolonged financial stress or economic downturns. Consumer protection in the event of a robo-advisor’s failure is an area of concern.

Conclusion

The entire robo-advisory process, from account setup to portfolio monitoring and rebalancing, can be completed online, often with no human interaction. Many robo-advisors are fully automated, making them more affordable and accessible to the mass market. By lowering costs and simplifying the investment process, they can encourage broader participation in capital markets. Alternatively, some platforms operate on a hybrid model, offering limited human interaction, typically via online communication rather than in-person meetings. While hybrid models involve slightly higher fees, they remain less expensive than traditional financial advisors, offering clients a balance between affordability and personalized service. By combining advanced algorithms, cost efficiency, and accessibility, robo-advisors are reshaping how individuals approach investment management. Robo-advisors could revolutionize wealth management and make professional-grade financial planning more accessible worldwide.