Index funds are particularly well-suited for long-term investors, as their periods of volatility are often offset by extended stretches of positive returns. This makes them an excellent choice for retirement savings. You can easily hold index funds within tax-advantaged accounts like a Tax-Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP) in Canada. The best index funds in Canada tend to have low Management Expense Ratios (MERs) and no trading commissions. They track established markets and typically boast a strong history of consistent, positive returns.

You can invest month after month and ignore short-term ups and downs, confident that you’ll share in the market’s long-term growth and build your nest egg. Passive investment means investment is done by the fund manager in the same securities as are there in the underlying index and in the same proportion too without changing the composition of the portfolio.

What is an Index Fund?

Index funds are investment vehicles designed to replicate the performance of a specific market index, such as the S&P/TSX Capped Composite in Canada or the S&P 500 in the United States. These funds typically hold the same securities as the index they track, providing broad market exposure and aiming to mirror the index’s returns. Research different funds to understand their performance history, management fees, and the indexes they track. Consider diversifying your portfolio by investing in several index funds.

What is the Best Index Fund?

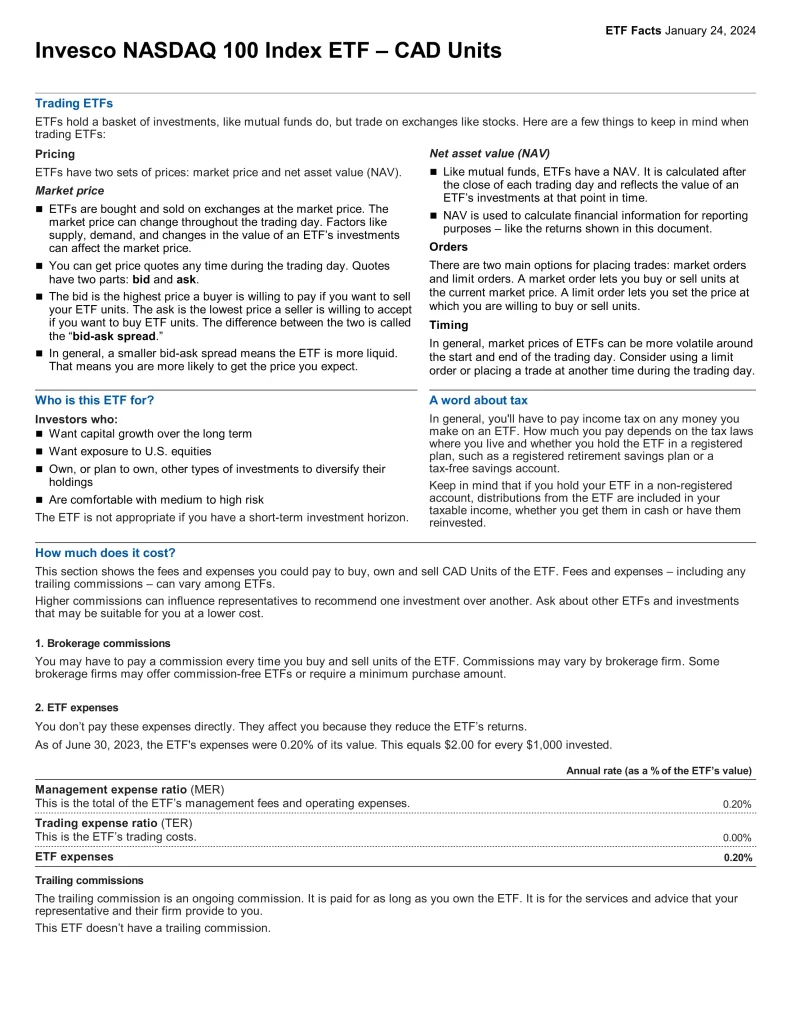

- QQC: Invesco NASDAQ 100 Index ETF

- VFV: Vanguard S&P 500 Index ETF

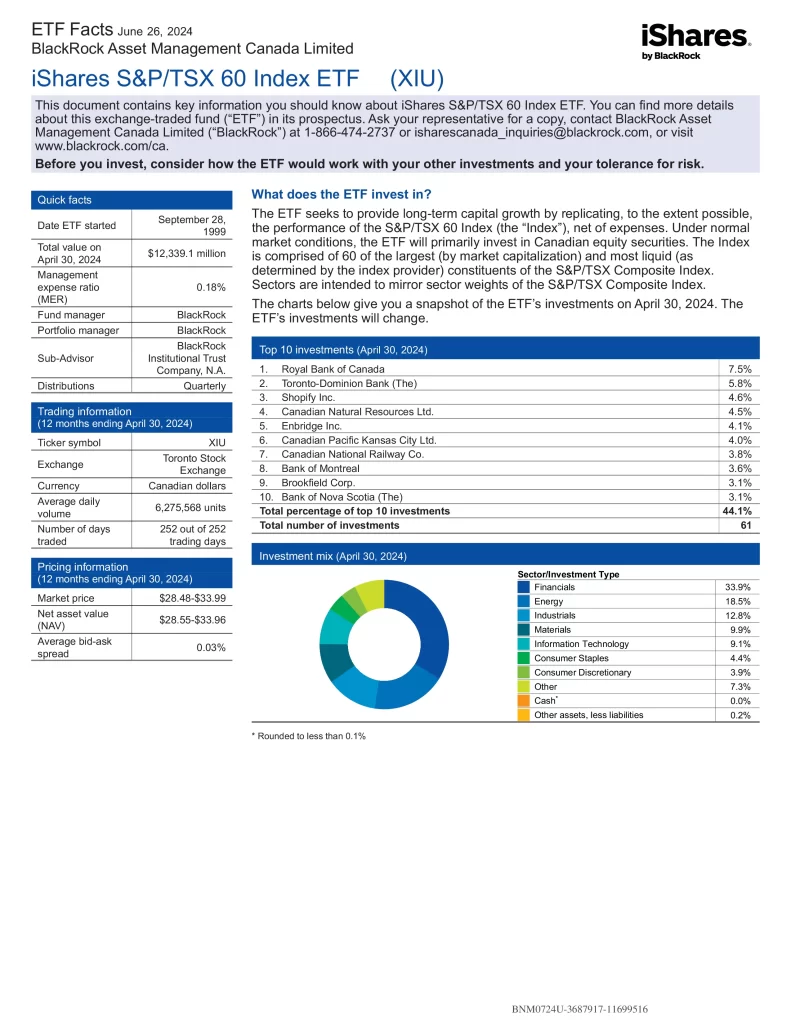

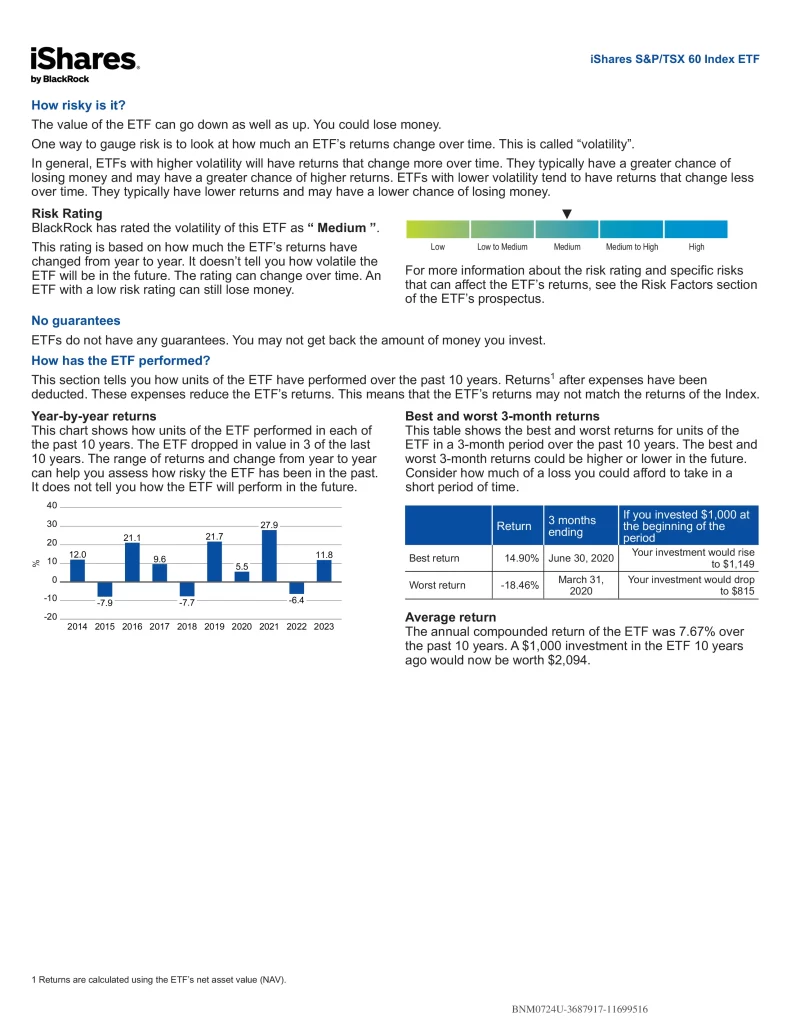

- XIU: iShares S&P/TSX 60 Index ETF

The Best S&P/TSX 60 Index Fund

iShares S&P/TSX 60 Index ETF (XIU) seeks to provide long-term capital growth by replicating, to the extent possible, the performance of the S&P/TSX 60 Index. Under normal market conditions, the ETF will primarily invest in Canadian equity securities. The Index is comprised of 60 of the largest (by market capitalization) and most liquid (as determined by the index provider) constituents of the S&P/TSX Composite Index. Sectors are intended to mirror sector weights of the S&P/TSX Composite Index.

- Started trading in 1990, making it the first ETF in the world

- Exposure to large, established Canadian companies

- One of the largest and most liquid ETFs in Canada

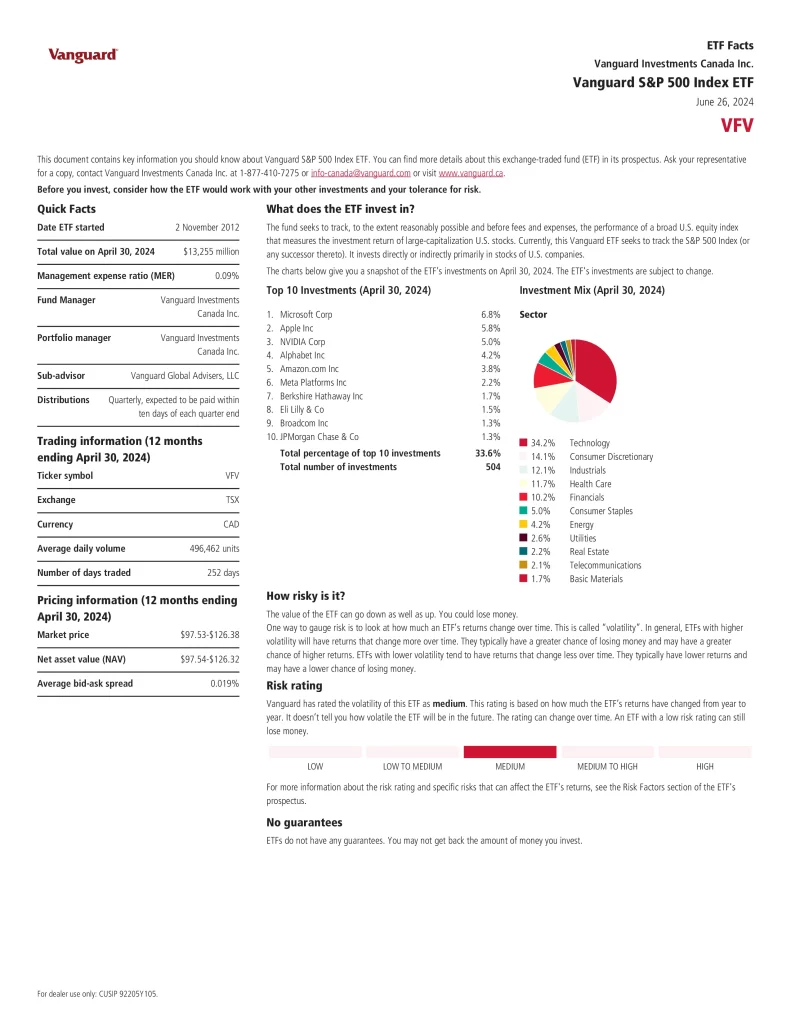

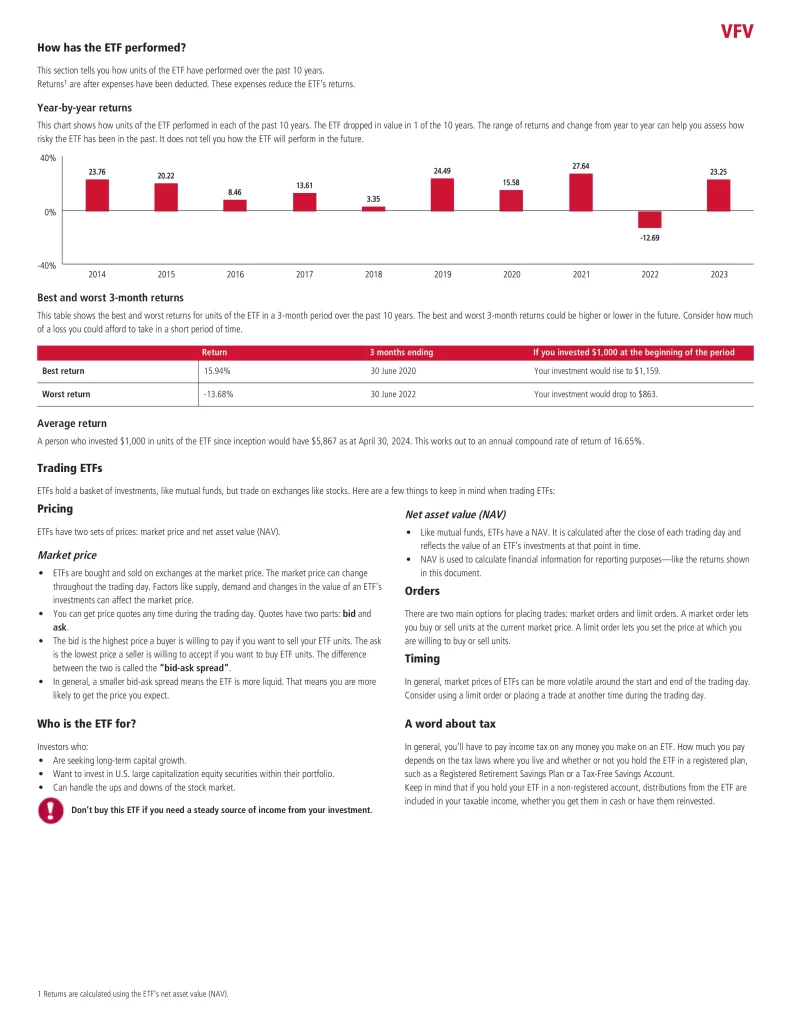

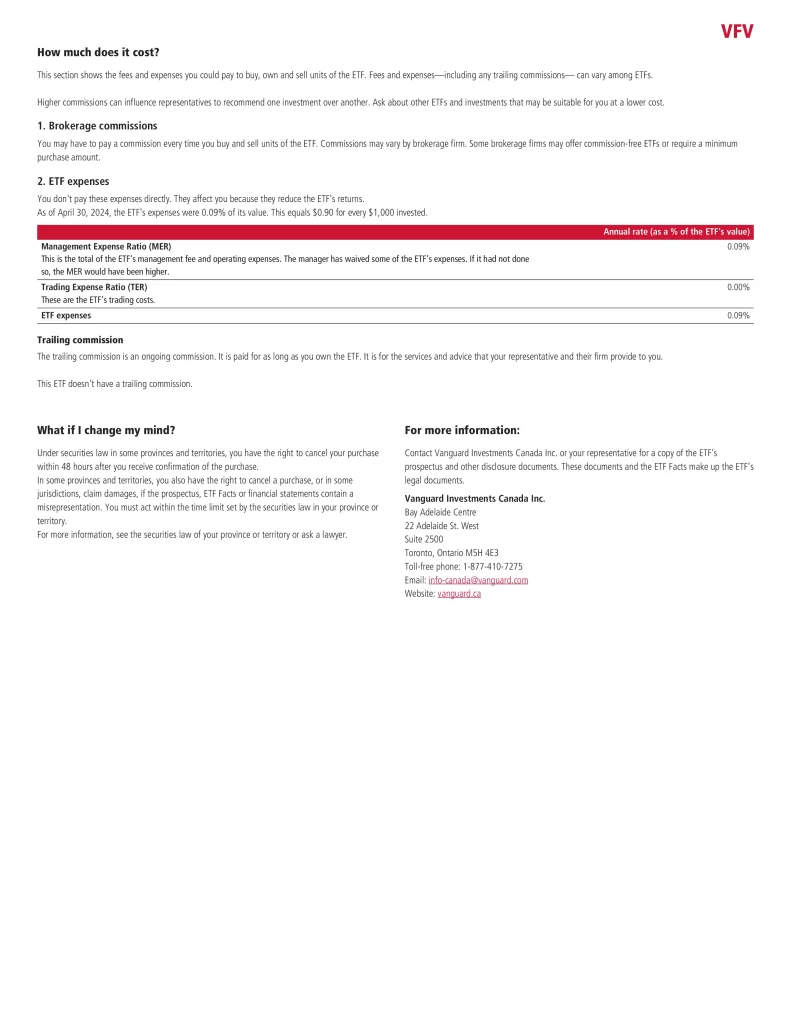

The Best S&P 500 Index Fund

Vanguard S&P 500 Index ETF (VFV) seeks to track the performance of a broad U.S. equity index that measures the investment return of large-capitalization U.S. stocks. Currently, this Vanguard ETF seeks to track the S&P 500 Index. It invests directly or indirectly primarily in stocks of U.S. companies.

- Employs a passively managed, full-replicated index strategy to provide exposure of large U.S. companies

- Uses efficient, cost-effective index management techniques

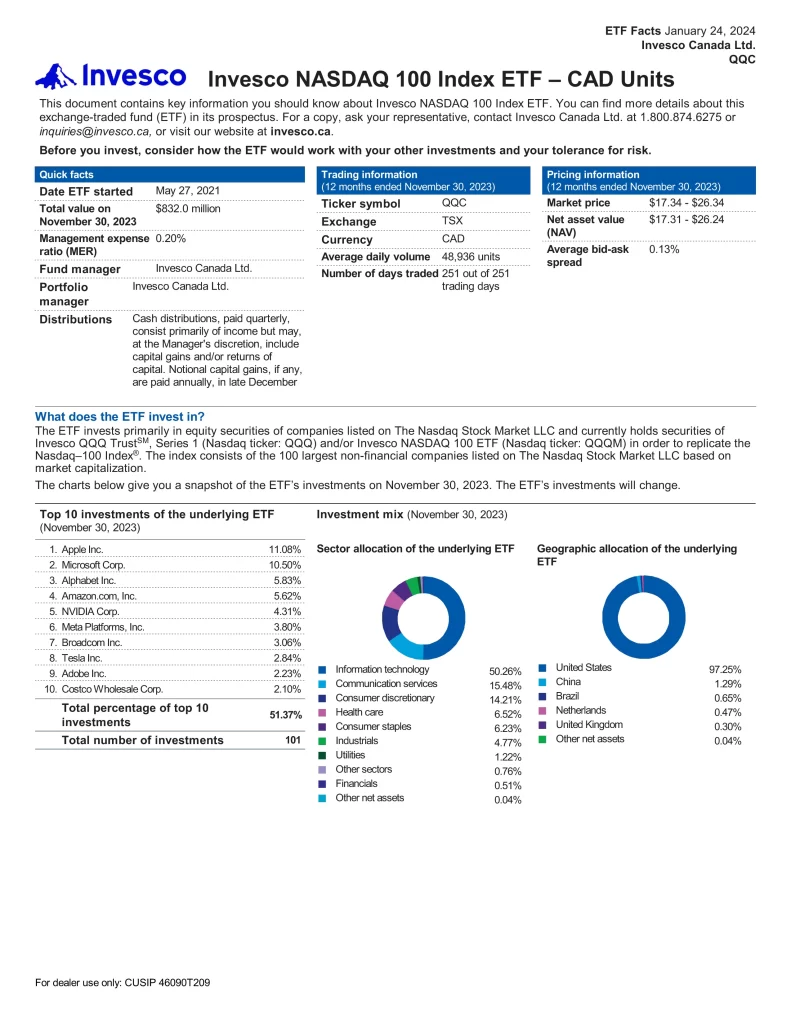

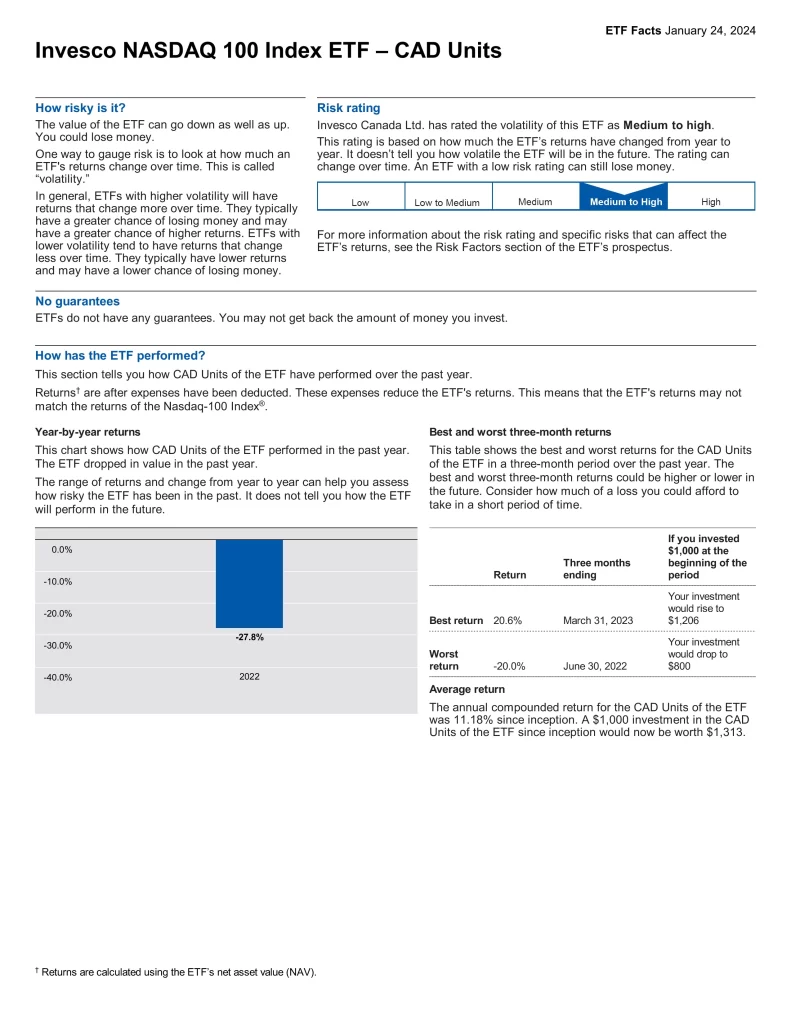

The Best NASDAQ 100 Index Fund

Invesco NASDAQ 100 Index ETF CAD Units (QQC) invests primarily in equity securities of companies listed on The Nasdaq Stock Market LLC and currently holds securities of Invesco QQQ Trust (QQQ) and/or Invesco NASDAQ 100 ETF (QQQM) in order to replicate the Nasdaq–100 Index. The index consists of the 100 largest non-financial companies listed on The Nasdaq Stock Market LLC based on market capitalization.

- Want capital growth over the long term

- Want exposure to U.S. equities

- Own, or plan to own, other types of investments to diversify their holdings

- Are comfortable with medium to high-risk

Conclusion

Index funds provide broad market exposure and diversification across various sectors and asset classes according to their underlying index. If you’re seeking a low-cost investment that provides exposure to top companies in the Canadian economy while minimizing risk, index funds could be a great choice. Adding index funds to your investment strategy can strengthen the safety of a diversified portfolio, thanks to their broad market coverage and cost-efficient structure.