More information about Global X Active Canadian Dividend ETF (HAL) is in its prospectus. Before investing in an Exchange Traded Fund (ETF), it’s important to assess how it fits within your portfolio and aligns with your risk tolerance. ETF prices can also experience higher volatility during market openings and closings and there is always the possibility of losing money. It’s also worth noting that a narrower bid-ask spread generally indicates higher liquidity, meaning you’re more likely to execute trades at expected prices. Always consider these factors carefully when making investment decisions, as even ETFs considered low-risk can experience losses under certain market conditions.

HAL ETF Review

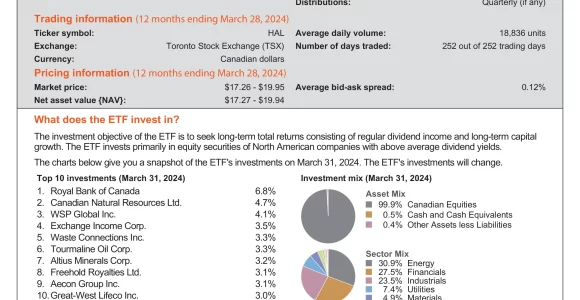

Global X Active Canadian Dividend ETF (HAL) seeks long-term total returns consisting of regular dividend income and long-term capital growth. HAL invests primarily in equity securities of North American companies with above-average dividend yields.

- Dividend Income Focus: Aims to provide investors with regular dividend income by selecting some of Canada’s best dividend-paying companies that exhibit a consistent pattern of growing dividends, offering a potential source of steady cash flow through all market cycles.

- Proprietary Stock Selection: Guardian’s proprietary GPS Stock Selection Process targets dividend stocks that offer a combination of Growth of dividends, Payout of cash flow, and Sustainability of the payout profile.

- Active Management: Sub-advised by Guardian Capital, HAL is actively managed to navigate all market cycles by identifying a broader range of opportunities compared to an approach that focuses on yield alone.

Top 10 HAL Holdings

Total percentage of top 10 investments 38.0%

| Ticker | Name | Weight |

|---|---|---|

| RY | Royal Bank of Canada | 6.71% |

| CNQ | Canadian Natural Resources Ltd | 4.67% |

| WSP | WSP Global Inc | 4.03% |

| EIF | Exchange Income Corp | 3.48% |

| WCN | Waste Connections Inc | 3.29% |

| TOU | Tourmaline Oil Corp | 3.28% |

| ALS | Altius Minerals Corp | 3.17% |

| FRU | Freehold Royalties Ltd | 3.13% |

| ARE | Aecon Group Inc | 3.10% |

| POW | Power Corp of Canada | 3.04% |