The covered call strategy is implemented by writing a call option contract while owning the equivalent shares of the underlying stock. The purpose of the strategy is to provide additional income and reduce the risks of stock ownership. Instead of stretching for additional yield with fixed-income investments (and increasing risks), the covered call strategy effectively creates an additional income stream from equity investments. Additionally, it also has the added benefit of reducing equity risk making it a valuable portfolio construction tool.

What is a Covered Call ETF?

Covered call ETFs have recently gained popularity with Canadian investors. Millions of dollars have flowed into this underperforming strategy for its high dividend yield. The call writing reduces volatility at the cost of passive monthly income that may have a return of capital component returning some of the investor’s original investment.

A covered call ETF writes call options on the stocks held within the fund to help reduce investment risk. This also allows investors to take advantage of upside potential in the same way an individual investor trading stock options would do. This is a great strategy during market volatility while still bringing in monthly income from option writing and regular dividends.

What is the Best Covered Call ETF in Canada?

- HTA: Harvest Tech Achievers Growth & Income ETF

- TLF: Brompton Tech Leaders Income ETF

- TXF.B: CI Tech Giants Covered Call ETF (Unhedged)

- ENCC: Global X Canadian Oil and Gas Equity Covered Call ETF

- TXF: CI Tech Giants Covered Call ETF

- LIFE.B: Evolve Global Healthcare Enhanced Yield Fund

- FHI.B: CI Health Care Giants Covered Call ETF

- USCC: Horizons US Large Cap Equity Covered Call ETF

- HHL: Harvest Healthcare Leaders Income ETF

- LIFE: Evolve Global Healthcare Enhanced Yield Fund Hedged Units

| Manager | Ticker | Name | MER | Dividend Yield | 5Y |

|---|---|---|---|---|---|

| Brompton | TLF | Brompton Tech Leaders Income ETF | 0.96% | 5.09% | 20.31% |

| CI | FHI.B | CI Health Care Giants Covered Call ETF Unhedged Units | 0.73% | 6.79% | 11.38% |

| CI | TXF | CI Tech Giants Covered Call ETF | 0.71% | 7.57% | 17.60% |

| CI | TXF.B | CI Tech Giants Covered Call ETF (Unhedged) | 0.69% | 7.53% | 19.91% |

| Evolve | LIFE | Evolve Global Healthcare Enhanced Yield Fund Hedged Units | 0.68% | 8.89% | 10.50% |

| Evolve | LIFE.B | Evolve Global Healthcare Enhanced Yield Fund UnHedged Units | 0.67% | 7.54% | 11.63% |

| Global X | ENCC | Global X Canadian Oil and Gas Equity Covered Call ETF | 0.80% | 14.03% | 18.39% |

| Global X | USCC | Global X S&P 500 Covered Call ETF | 0.60% | 10.50% | 11.37% |

| Harvest | HHL | Harvest Healthcare Leaders Income ETF | 0.99% | 8.42% | 11.13% |

| Harvest | HTA | Harvest Tech Achievers Growth & Income ETF | 0.99% | 7.36% | 20.99% |

10. Evolve Global Healthcare Enhanced Yield Fund Hedged Units

Evolve Global Healthcare Enhanced Yield Fund Hedged Units (LIFE) seeks to replicate, to the extent reasonably possible before fees and expenses, the performance of the Solactive Global Healthcare 20 Index Canadian Dollar Hedged, while mitigating downside risk. LIFE invests primarily in the equity constituents of the Solactive Global Healthcare 20 Index Canadian Dollar Hedged, while writing covered call options on up to 33% of the portfolio securities, at the discretion of the Manager. The level of covered call option writing may vary based on market volatility and other factors.

9. Harvest Healthcare Leaders Income ETF

Harvest Healthcare Leaders Income ETF (HHL) is an equally weighted portfolio of 20 large-cap global Healthcare companies, selected for their potential to provide attractive monthly income and long-term growth. In order to generate an enhanced monthly distribution yield, an active covered call strategy is engaged.

8. Global X S&P 500 Covered Call ETF

Global X S&P 500 Covered Call ETF (USCC) seeks to provide: (a) exposure to the performance of the large-cap market segment of the U.S. equity market and (b) monthly U.S. dollar distributions of dividend and call option income. To mitigate downside risk and generate income, USCC will employ a dynamic covered call option writing program.

7. CI Health Care Giants Covered Call ETF

CI Health Care Giants Covered Call ETF Unhedged Units (FHI.B) seeks to provide holders, through an actively managed portfolio, with (i) regular cash distributions, (ii) the opportunity for capital appreciation by investing on an equal weight basis in a portfolio of equity securities of at least the 20 largest health care companies measured by market capitalization listed on a North American stock exchange, and (iii) lower overall volatility of returns on the portfolio than would be experienced by owning a portfolio of securities of such issuers directly, by employing a covered call option writing program. The issuers included in the portfolio, which are based on their market capitalization, may be adjusted based on the Portfolio Manager’s view on the liquidity of the issuer’s equity securities and their related call options.

6. LIFE-B.TO: Evolve Global Healthcare Enhanced Yield Fund

Evolve Global Healthcare Enhanced Yield Fund UnHedged Units (LIFE.B) seeks to replicate, to the extent reasonably possible before fees and expenses, the performance of the Solactive Global Healthcare 20 Index Canadian Dollar Hedged, while mitigating downside risk. LIFE invests primarily in the equity constituents of the Solactive Global Healthcare 20 Index Canadian Dollar Hedged, while writing covered call options on up to 33% of the portfolio securities, at the discretion of the Manager. The level of covered call option writing may vary based on market volatility and other factors.

5. CI Tech Giants Covered Call ETF

CI Tech Giants Covered Call ETF (TXF) seeks to provide Unitholders, through an actively managed portfolio, with (i) quarterly cash distributions, (ii) the opportunity for capitalappreciation by investing on an equal weight basis in a portfolio of equity securities of at least the 25 largest technology companies measured by market capitalizationlisted on a North American stock exchange, and (iii) lower overall volatility of returns on the portfolio than would be experienced by owning a portfolio of securities of suchissuers directly, by employing a covered call option writing program. The issuers included in the portfolio, which are based on their market capitalization, may be adjustedbased on the Portfolio Manager’s view on the liquidity of the issuers’ equity securities and their related call options.

4. Global X Canadian Oil and Gas Equity Covered Call ETF

Global X Canadian Oil and Gas Equity Covered Call ETF (ENCC) seeks to provide, to the extent possible and net of expenses: (a) exposure to the performance of an index of Canadian companies that are involved in the crude oil and natural gas industry (currently, the Solactive Equal Weight Canada Oil & Gas Index); and (b) monthly distributions of dividend and call option income. To mitigate downside risk and generate income, ENCC will employ a dynamic covered call option writing program.

3. TXF-B.TO: CI Tech Giants Covered Call ETF

CI Tech Giants Covered Call ETF (Unhedged) (TXF.B) seeks to provide investors, through an actively managed portfolio, with (i) quarterly cash distributions, (ii) the opportunity for capital appreciation by investing on an equal weight basis in a portfolio of equity securities of at least the 25 largest technology companies measured by market capitalization listed on a North American stock exchange, and (iii) lower overall volatility of returns on the portfolio than would be experienced by owning a portfolio of securities of such issuers directly, by employing a covered call option writing program. The issuers included in the portfolio, which are based on their market capitalization, may be adjusted based on the Portfolio Manager’s view on the liquidity of the issuer’s equity securities and their related call options.

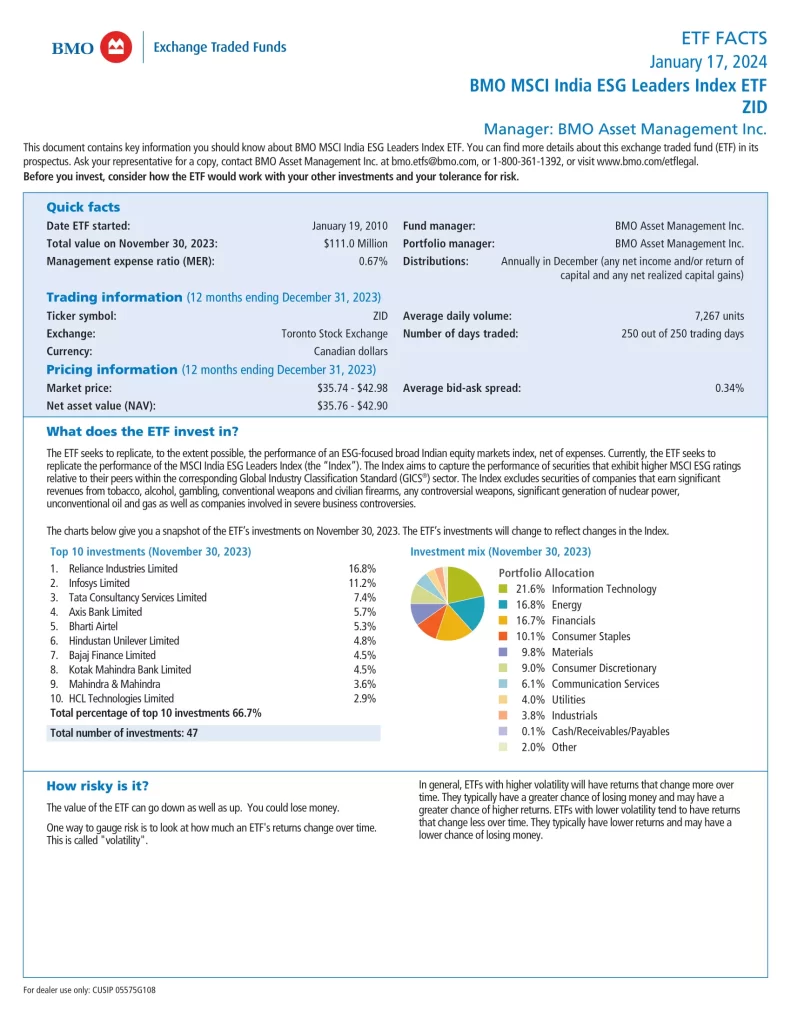

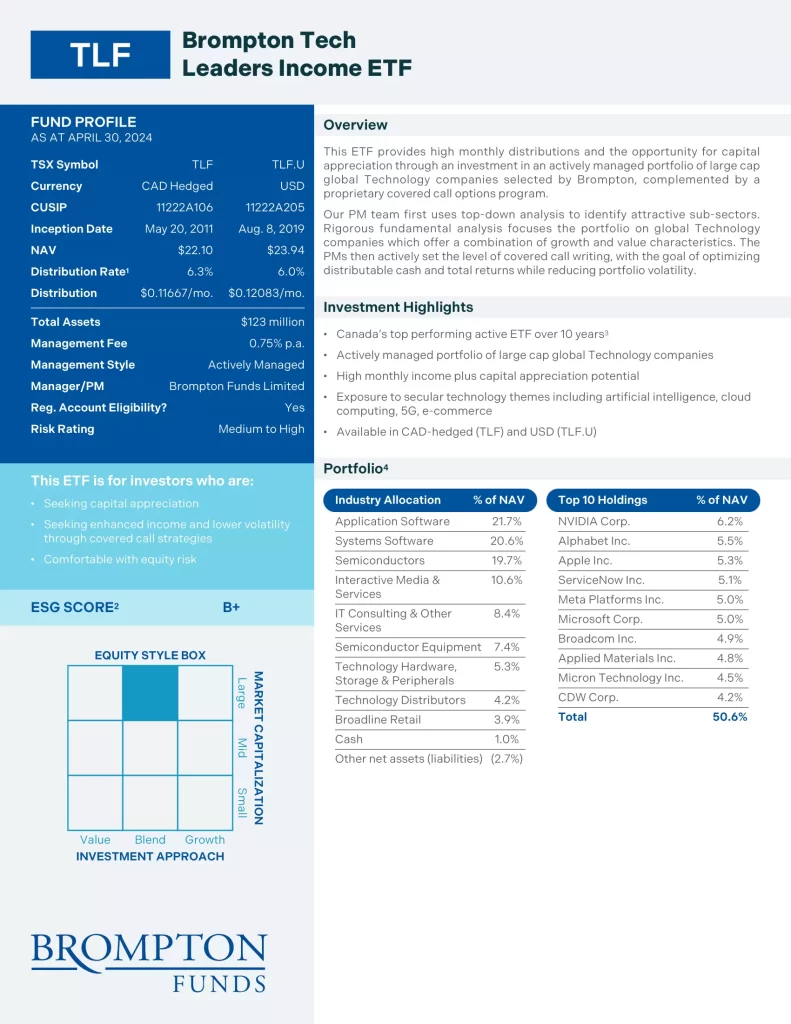

2. Brompton Tech Leaders Income ETF

Brompton Tech Leaders Income ETF (TLF) provides high monthly distributions and the opportunity for capital gains through an investment in an actively managed portfolio of large cap global Technology companies selected by Brompton, complemented by a proprietary covered call program. Top-down analysis is used to identify attractive sub-sectors. Rigorous fundamental analysis focuses the portfolio on global Technology companies which offer a combination of growth and value characteristics. The PMs then actively set the covered call writing level to optimize distributable cash and total returns.

1. Harvest Tech Achievers Growth & Income ETF

Harvest Tech Achievers Growth & Income ETF (HTA) is an equally weighted portfolio of 20 large-cap Technology companies that is diversified across the global technology sectors. The ETF is designed to provide a consistent and competitive monthly income with an opportunity for growth. In order to generate an enhanced monthly distribution yield, an active covered call strategy is engaged.

How Does a Covered Call ETF Strategy Work?

A call option gives the owner the right to buy the underlying stock at a predetermined price within a specific period. Covered call strategies involve holding a security and simultaneously selling a call option on it. By selling the option, the portfolio earns a premium, generating additional cash flow. This strategy also offers risk management, as the premium can help mitigate losses during market downturns. However, the trade-off is that it may limit the potential gains on the portion of the portfolio with a covered call.