Index funds are financial instruments crafted to mirror the performance of broad markets or specific industries, offering a convenient option over handpicking individual stocks. Tradable on stock exchanges like regular stocks, these funds provide exposure to a diverse array of underlying assets within benchmark indices. Operated passively, index funds avoid high commission fees. Incorporating index funds into an investment strategy can fortify the stability of a diversified portfolio, thanks to their broad market coverage and cost-efficient attributes.

What is the Best Index Fund in Canada?

- HBGD.TO: Horizons Big Data & Hardware Index ETF

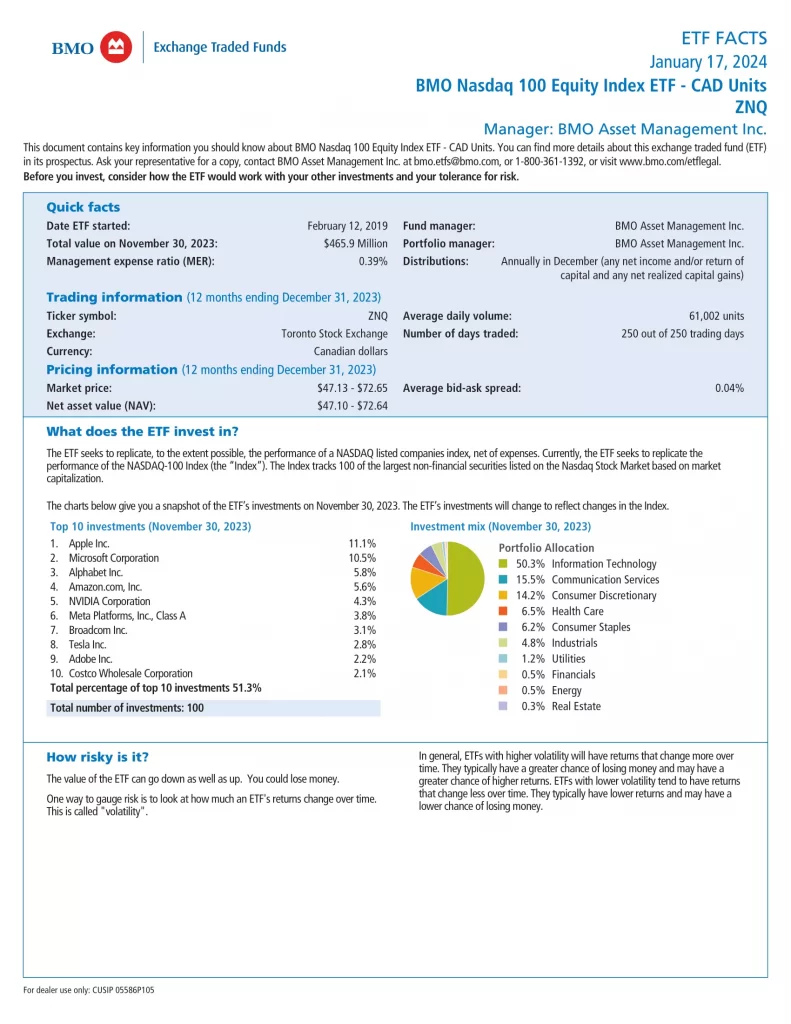

- ZNQ.TO: BMO NASDAQ 100 Equity Index ETF

- HXQ.TO: Horizons NASDAQ-100 Index ETF

- XIT.TO: iShares S&P/TSX Capped Information Technology Index ETF

- QQC-F.TO: Invesco NASDAQ 100 Index ETF

- JAPN.TO: CI WisdomTree Japan Equity Index ETF

- XQQ.TO: iShares NASDAQ 100 Index ETF (CAD-Hedged)

- ZQQ.TO: BMO Nasdaq 100 Equity Hedged to CAD Index ETF

- HXE.TO: Horizons S&P/TSX Capped Energy Index ETF

- XEG.TO: iShares S&P/TSX Capped Energy Index ETF

| Manager | ETF | Inception | MER | AUM | Holdings | Beta | P/E | Yield | Distributions | 5Y |

|---|---|---|---|---|---|---|---|---|---|---|

| BlackRock | XEG | 2001-03-19 | 0.60% | $1,844,025,891 | 31 | 0.96 | 7.70 | 3.20% | Quarterly | 17.14% |

| BlackRock | XIT | 2001-03-19 | 0.60% | $659,885,147 | 23 | 1.76 | 48.07 | N/A | Semi-Annually | 19.46% |

| BlackRock | XQQ | 2011-05-03 | 0.39% | $2,704,524,622 | 101 | 1.43 | 38.11 | 0.29% | Semi-Annually | 18.90% |

| BMO | ZNQ | 2019-02-15 | 0.39% | $804,910,000 | 102 | 1.24 | N/A | 0.31% | Annually | 20.59% |

| BMO | ZQQ | 2010-01-19 | 0.39% | $1,890,650,000 | 102 | 1.43 | N/A | 0.30% | Annually | 18.86% |

| CI | JAPN | 2018-08-01 | 0.53% | $12,160,000 | 398 | 0.54 | 12.80 | 1.14% | Quarterly | 18.93% |

| Horizons | HBGD | 2018-06-20 | 0.59% | $16,856,361 | 46 | 2.33 | 27.28 | 0.61% | Annually | 33.36% |

| Horizons | HXE | 2013-09-16 | 0.28% | $114,445,489 | N/A | 0.96 | 8.10 | N/A | N/A | 17.38% |

| Horizons | HXQ | 2016-04-19 | 0.28% | $623,858,090 | 102 | N/A | N/A | N/A | N/A | 20.37% |

| Invesco | QQC.F | 2021-05-27 | 0.20% | $745,309,826 | 103 | 1.43 | 38.17 | 0.55% | Quarterly | 19.14% |

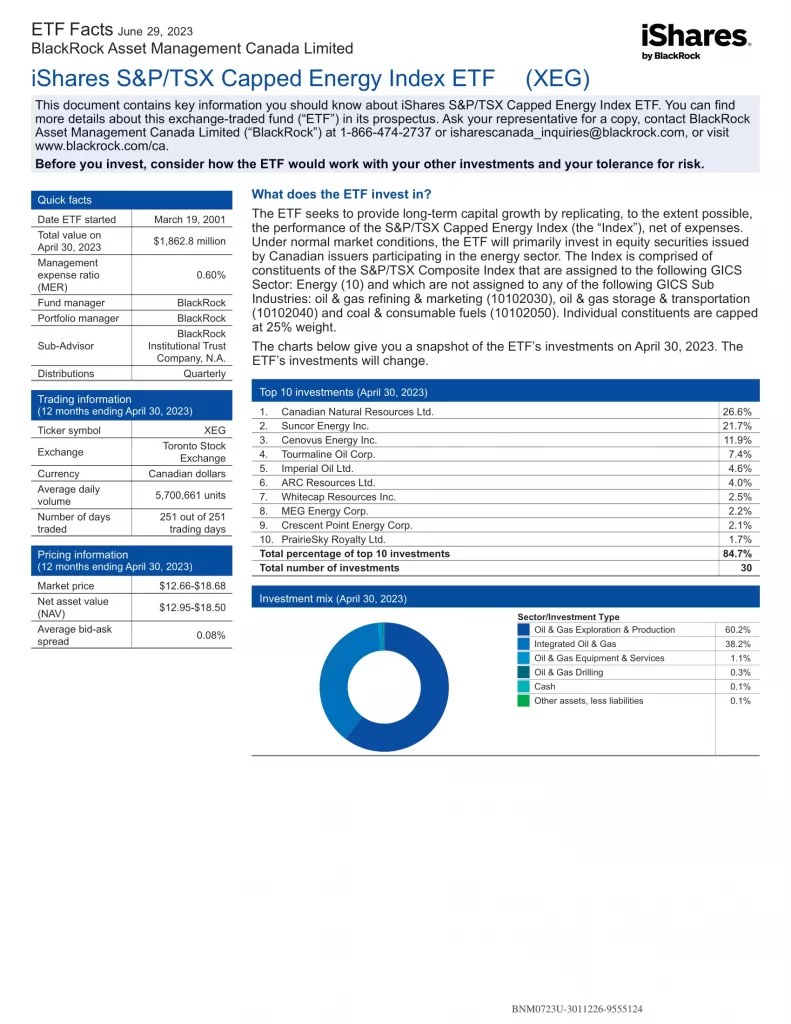

10. iShares S&P/TSX Capped Energy Index ETF

iShares S&P/TSX Capped Energy Index ETF (XEG) seeks long-term capital growth by replicating the performance of the S&P/TSX Capped Energy Index.

- Targeted exposure to companies in the Canadian energy sector

- Can be used to express a sector view

9. Horizons S&P/TSX Capped Energy Index ETF

Horizons S&P/TSX Capped Energy Index ETF (HXE) seeks to replicate, to the extent possible, the performance of the S&P/TSX Capped Energy Index (Total Return). The S&P/TSX Capped Energy Index (Total Return) is designed to measure the performance of Canadian energy sector equity securities included in the S&P/TSX Composite Index. The Relative Weight of any single index Constituent Security is capped.

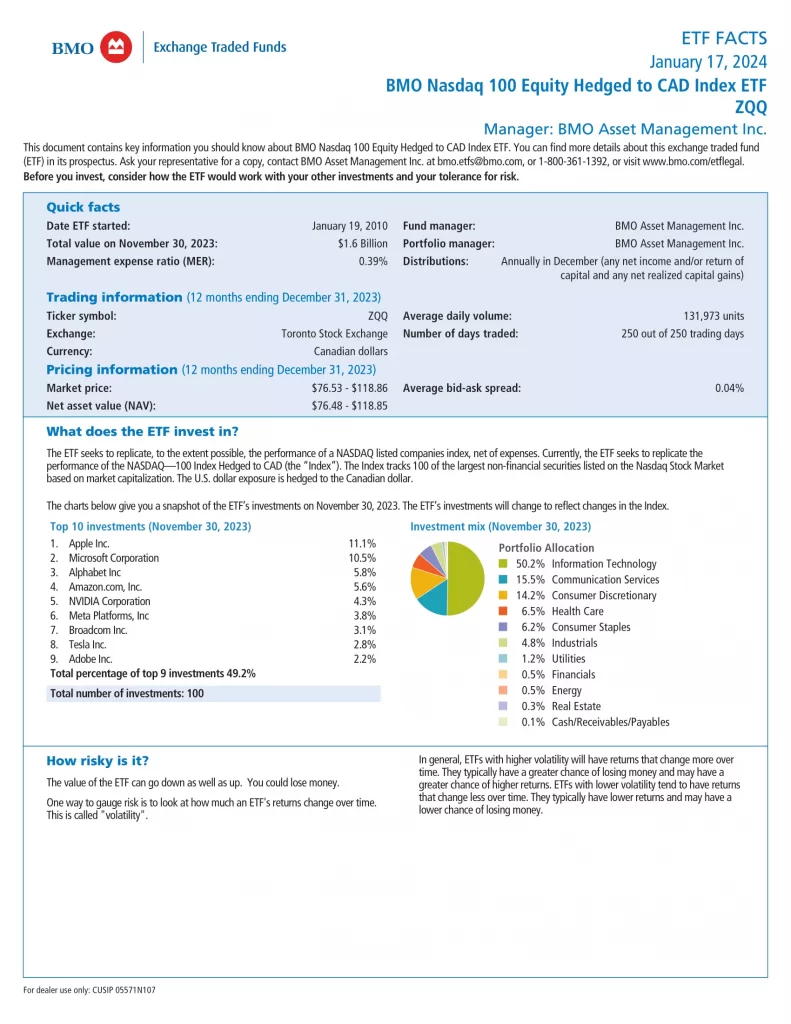

8. BMO Nasdaq 100 Equity Hedged to CAD Index ETF

BMO Nasdaq 100 Equity Hedged to CAD Index ETF (ZQQ) has been designed to replicate, to the extent possible, the performance of a NASDAQ listed companies index. The Fund invests in and holds the Constituent Securities of the Index in the same proportion as they are reflected in the Index. The U.S. dollar currency exposure is hedged back to the Canadian dollar.

7. iShares NASDAQ 100 Index ETF (CAD-Hedged)

iShares NASDAQ 100 Index ETF (CAD-Hedged) (XQQ) seeks to provide long-term capital growth by replicating the performance of the NASDAQ-100 Currency Hedged CAD Index.

- Exposure to 100 of the largest non-financial companies listed on The Nasdaq Stock Market based on market cap

- Can be used to diversify into large-cap U.S. companies while avoiding exposure to financial companies

6. CI WisdomTree Japan Equity Index ETF

CI WisdomTree Japan Equity Index ETF Hedged (JAPN) seeks to track, to the extent reasonably possible, the price and yield performance of the WisdomTree Japan Equity Index CAD. The investment strategy of the ETF is to invest in and hold the constituent securities of the index in the same proportion as they are reflected in the index or otherwise invest in a manner intended to track the price and yield performance of the Index. As an alternative to or in conjunction with investing in and holding the constituent securities, the ETF may invest in or use certain other securities to obtain exposure to the price and yield performance of the Index. The Index is a fundamentally weighted index designed to provide exposure to Japanese equity markets. The Index consists of dividend-paying companies incorporated in Japan and traded on the Tokyo Stock Exchange that derive less than 80% of their revenue from sources in Japan. By excluding companies that derive 80% or more of their revenue from Japan, the Index is tilted toward companies with a more significant global revenue base. The exposure that the portion of the portfolio of the ETF attributable to the hedged units has to foreign currencies will be hedged back to the Canadian dollar.

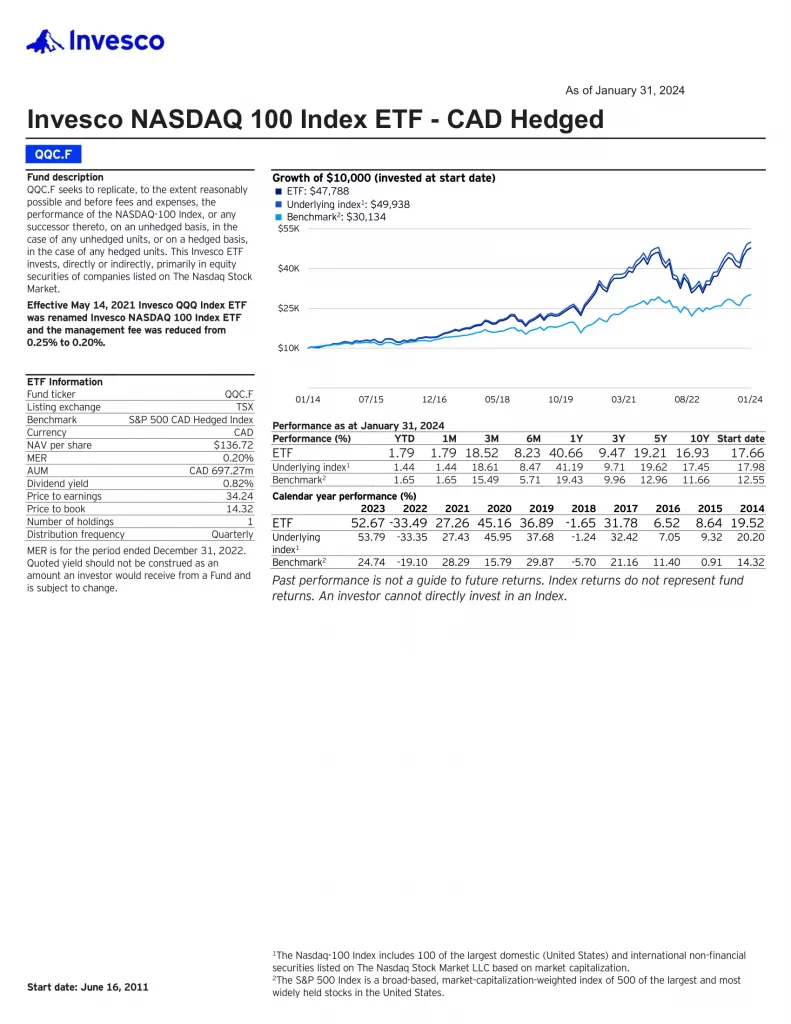

5. Invesco NASDAQ 100 Index ETF

Invesco NASDAQ 100 Index ETF CAD Hedged Units (QQC.F) seeks to replicate, to the extent reasonably possible, the performance of the NASDAQ-100 Index, or any successor thereto, on an unhedged basis, in the case of any unhedged units, or on a hedged basis, in the case of any hedged units. This Invesco ETF invests, directly or indirectly, primarily in equity securities of companies listed on The Nasdaq Stock Market.

4. iShares S&P/TSX Capped Information Technology Index ETF

iShares S&P/TSX Capped Information Technology Index ETF (XIT) seeks long-term capital growth by replicating the performance of the S&P/TSX Capped Information Technology Index, net of expenses.

- Targeted exposure to Canadian information technology companies

- Can be used to express a sector view

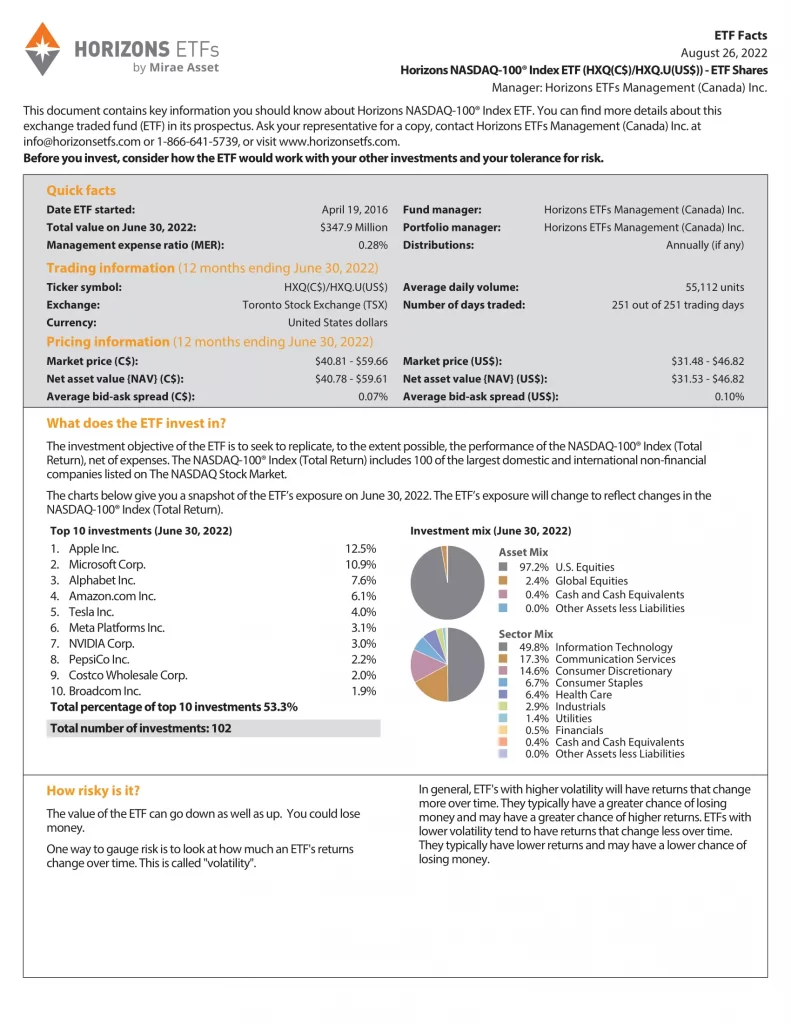

3. Horizons NASDAQ-100 Index ETF

Horizons NASDAQ-100 Index ETF (HXQ) seeks to replicate, to the extent possible, the performance of the NASDAQ-100 Index (Total Return). The NASDAQ-100 Index (Total Return) includes 100 of the largest domestic and international non-financial companies listed on The NASDAQ Stock Market.

2. BMO NASDAQ 100 Equity Index ETF

BMO NASDAQ 100 Equity Index ETF (ZNQ) has been designed to replicate, to the extent possible, the performance of a NASDAQ listed companies index, net of expenses. The Fund invests in and holds the Constituent Securities of the Index in the same proportion as they are reflected in the Index.

1. Horizons Big Data & Hardware Index ETF

Horizons Big Data & Hardware Index ETF (HBGD) seeks to replicate, to the extent possible, the performance of the Solactive Big Data & Hardware Index. The Solactive Big Data and Hardware Index tracks a portfolio of global companies focusing directly on data development, storage, and management-related services and solutions as well as hardware and hardware-related services used in data-intensive applications such as blockchain.

Should I Invest in Index Funds in Canada?

Index funds present an excellent passive investment opportunity, offering exposure to a broad array of high-performing Canadian companies at a minimal cost. Many index funds distribute dividends, making them particularly appealing to Canadian investors seeking income without the need to individually select dividend stocks. Additionally, index funds suit investors with a long-term perspective, as any periods of volatility are offset by extended periods of positive returns. They serve as an advantageous vehicle for retirement savings, allowing you to establish one within a TFSA or RRSP. Similar to the approach of selecting individual stocks, diversifying your portfolio by investing in multiple index funds enhances risk management and optimizes potential returns.

Is There an S&P 500 Index Fund in Canada?

There are plenty of index funds that track the S&P 500 index offered by BlackRock, BMO, Horizons and Vanguard. Some of these investments are Hedged to the Canadian dollar, others aren’t. Unhedged S&P 500 investments have historically outperformed making it the superior investment. Here is a list of S&P 500 index funds in Canada:

- HXS.TO: Horizons S&P 500 Index ETF

- VFV.TO: Vanguard S&P 500 Index ETF

- VSP.TO: Vanguard S&P 500 Index ETF (CAD-hedged)

- XSP.TO: iShares Core S&P 500 Index ETF (CAD-Hedged)

- XUS.TO: iShares Core S&P 500 Index ETF

- ZSP.TO: BMO S&P 500 Index ETF (USD)

- ZUE.TO: BMO S&P 500 Hedged to CAD Index ETF

What is the Average Return on Index Funds in Canada?

Index funds are simply investments that track a market index, such as the TSX in Canada. They typically contain every company in that index, aiming to duplicate the index’s performance. Active funds have a fund manager who handpicks stocks to fit a certain purpose or objective. For many individuals, it’s prudent to contemplate purchasing an index fund variant in Canada and engaging in long-term investment indexing.

Between 1960 and 2020, the S&P/TSX Composite Index (TSX) demonstrated a steady annual rate of return of 9.3%. Looking ahead, we anticipate average returns for Canadian equities to fall within the range of 6.0% to 7.5%, while long-term fixed-income investments are projected to yield average returns in the range of 3.0% to 3.5%.

|  |  |  |  |

|---|---|---|---|---|

| InvestCAN | InvestRESP | InvestUSA | RetireCAN | RetireMGN |

| $99.99 CAD | $12.99 CAD | $79.99 USD | $99.99 CAD | $9.99 USD |