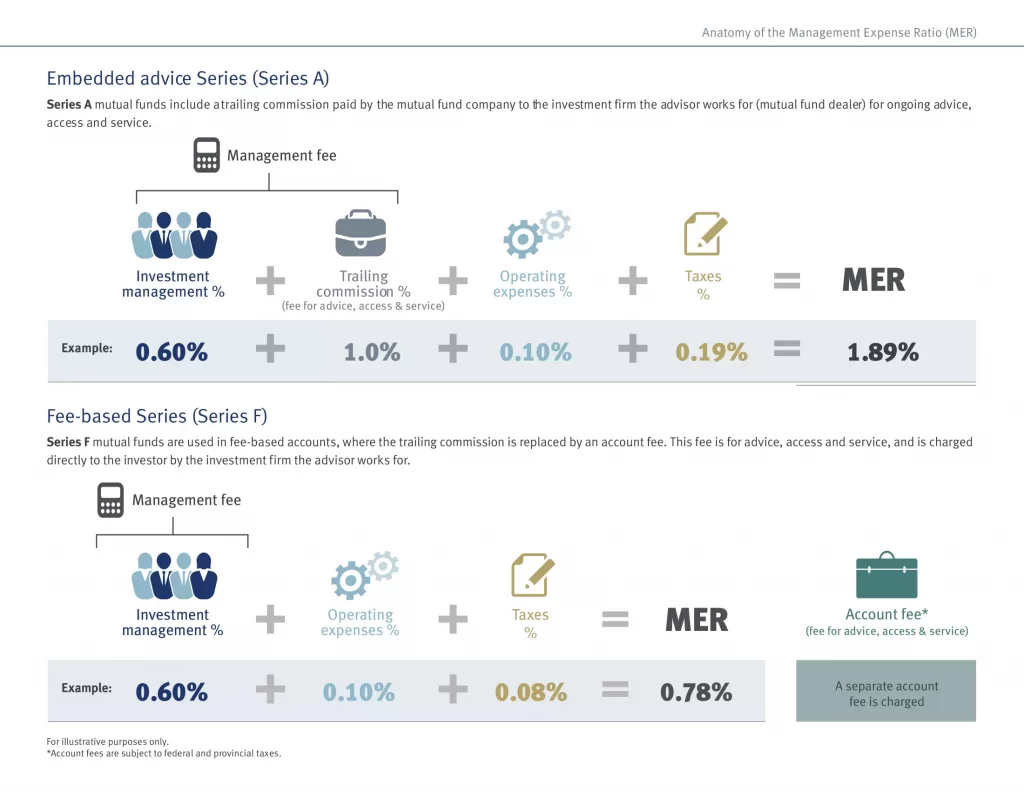

Management Expense Ratio (MER) is the total expenses of operating a mutual fund expressed as a percentage of the fund’s net asset value. It includes the management fees well as other expenses charged directly to the fund such as administrative, audit, legal fees etc., but excludes brokerage fees. Published rates of return are calculated after the management expense ration has been deducted.

What is Management Expense Ratio (MER)?

MER is the total annual operating cost of a mutual fund or exchange-traded fund (ETF), expressed as a percentage of the fund’s average net assets. MER includes all the costs associated with running the fund, such as management fees, distribution expenses, administrative expenses, and any other operating expenses incurred by the fund. It provides investors with a clear and simple measure of the cost of investing in a particular fund, allowing them to compare the costs of different funds and make more informed investment decisions.

MER is represented as a percentage of the average dollar amount invested in a fund. For instance, if an investor possesses assets totalling $10,000 and the fund experiences annual costs of $200, the MER would be 2.00%. You don’t pay the MER directly. It’s paid by the fund itself.

What is a Good Management Expense Ratio?

A number of factors determine whether an expense ratio is considered high or low. There are many index fund ETFs available for under 0.1%. A good expense ratio for an actively managed portfolio is around 0.50%. An expense ratio greater than 1.00% is considered high.

What are the Four Components of the Management Expense Ratio?

The expense ratio denotes the annual fee charged by mutual funds and ETFs for overseeing your investments. It represents the percentage of assets owed to the asset management company and encompasses operating costs, management fees, advertising expenses, and allocation charges.

Investment Administrative Costs

Each fund pays an administrative fee that is used to pay for day-to-day expenses including:

- Accounting and Fund Valuation Costs: encompassing the tracking of fund inflows and outflows, calculation of net asset values, and managing purchases, sales, and associated investment income, gains, losses, and operating expenses

- Audit and Legal Fees

- Custody Fees: incurred for securely holding an investor’s securities to mitigate the risk of theft or loss

- Fees for Record Keeping: covering the expenses of financial reports, tax slips, and statements

- Filing Fees: covering the expenses associated with filing reports and prospectuses with regulatory authorities

- Preparation Costs: for reports and prospectuses

MER and Investment Performance

MERs are paid indirectly as they are automatically subtracted from an investment. Consequently, the investment performance reported on your account statement is presented on an after-MER or “net of MER” basis. Meaning, the fees have been paid, when the investment total performance is displayed.