AGG ETF Review

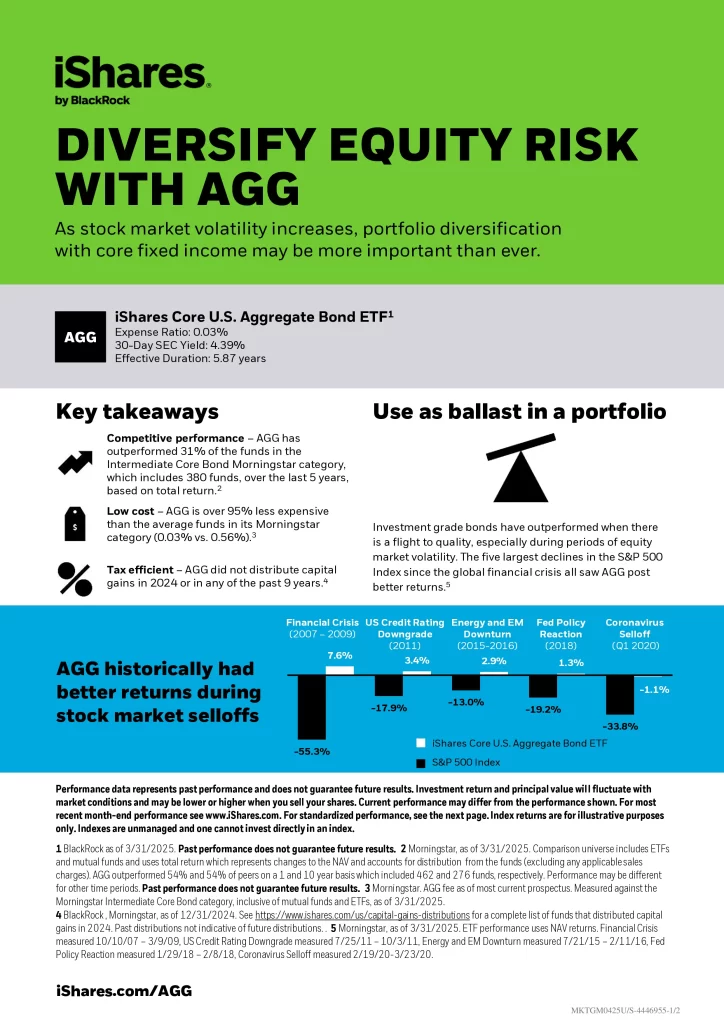

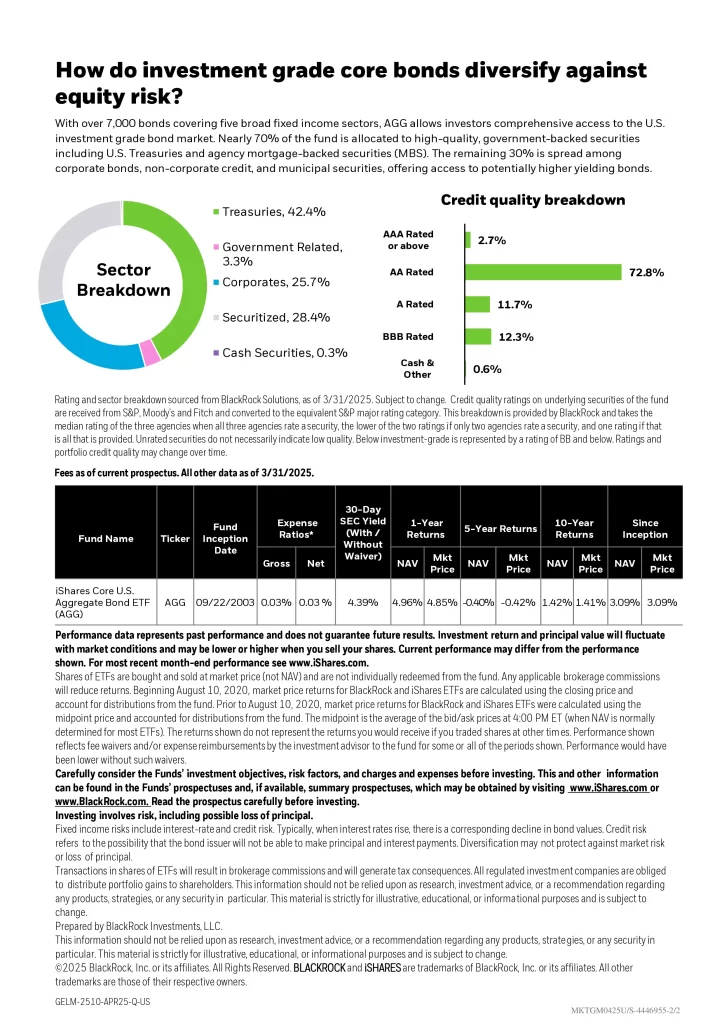

iShares Core U.S. Aggregate Bond ETF (AGG) seeks to track the investment results of an index composed of the total U.S. investment-grade bond market.

- Use at the core of your portfolio to seek stability and pursue income.

- A low-cost easy way to diversify a portfolio using fixed income.

- Broad exposure to U.S. investment-grade bonds.

| ETF | Inception | MER | AUM | Yield | Distributions | 1Y | 3Y | 5Y | 10Y | 15Y |

|---|---|---|---|---|---|---|---|---|---|---|

| AVIG | 2020-10-13 | 0.15% | $663,197,033 | 4.07% | Monthly | 2.61% | -3.39% | N/A | N/A | N/A |

| AGG | 2003-09-22 | 0.03% | $101,517,011,080 | 3.13% | Monthly | 2.09% | -3.16% | 0.81% | 1.58% | 2.53% |

| SCHZ | 2011-07-14 | 0.03% | $7,535,397,036 | 3.28% | Monthly | 1.98% | -3.21% | 0.78% | 1.55% | N/A |

| FBND | 2014-10-06 | 0.36% | $7,080,000,000 | 4.27% | Monthly | 2.44% | -2.25% | 1.85% | N/A | N/A |

| FLCB | 2019-09-17 | 0.15% | $1,750,000,000 | 3.40% | Monthly | 2.21% | -3.39% | N/A | N/A | N/A |

| SPAB | 2007-05-23 | 0.03% | $7,754,480,000 | 3.34% | Monthly | 1.91% | -3.24% | 0.76% | 1.57% | 2.47% |

| BND | 2007-04-03 | 0.03% | $105,800,000,000 | 3.08% | Monthly | 2.10% | -3.19% | 0.84% | 1.60% | 2.59% |