Bond ETFs are investment funds that are traded on stock exchanges and hold a portfolio of bonds. Here is a list of the best bond ETFs in Canada to allow investors to diversify their fixed-income investments by gaining exposure to a wide range of bonds. During times of market volatility, the natural tendency for investors is to shift their mindset from capital growth t capital preservation. GICs can be appealing because of their guaranteed nature. With GICs, you may be locking in a return that is lower than many other low-risk investments. A diversified portfolio of high quality bonds can preserve capital, provide income and outperform GICs. When markets are stressed, bonds have historically counterbalanced equity volatility in a portfolio

What is the Best Bond ETF in Canada?

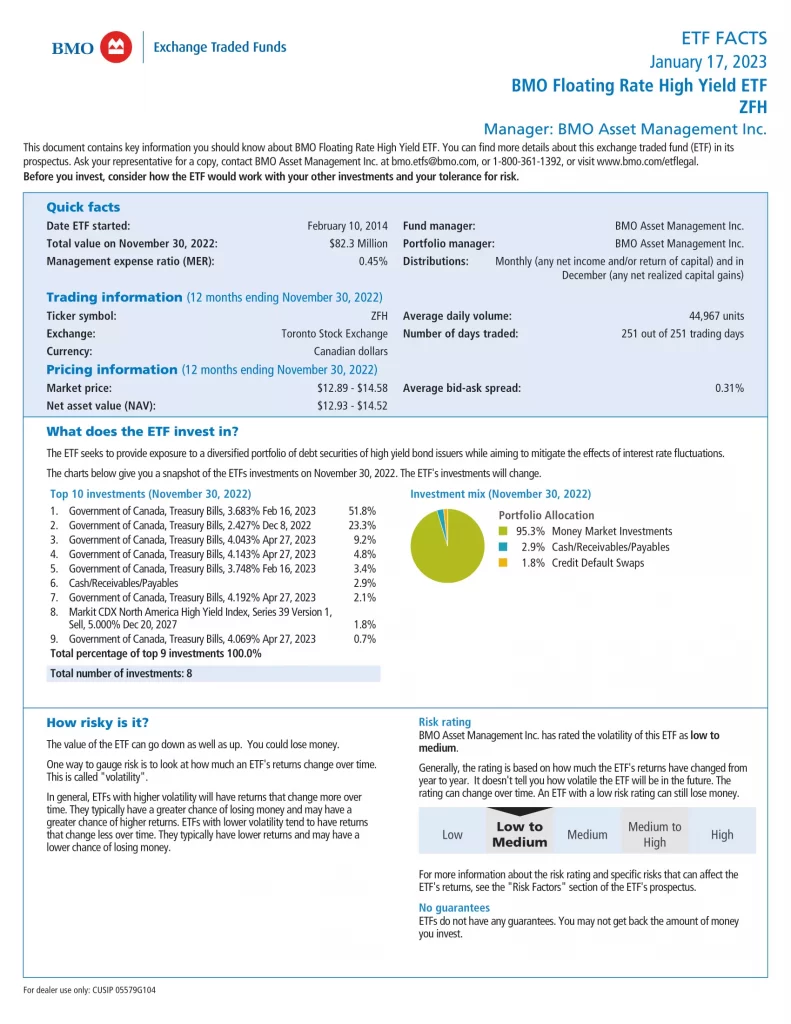

- ZFH: BMO Floating Rate High Yield ETF

- MFT: Mackenzie Floating Rate Income ETF

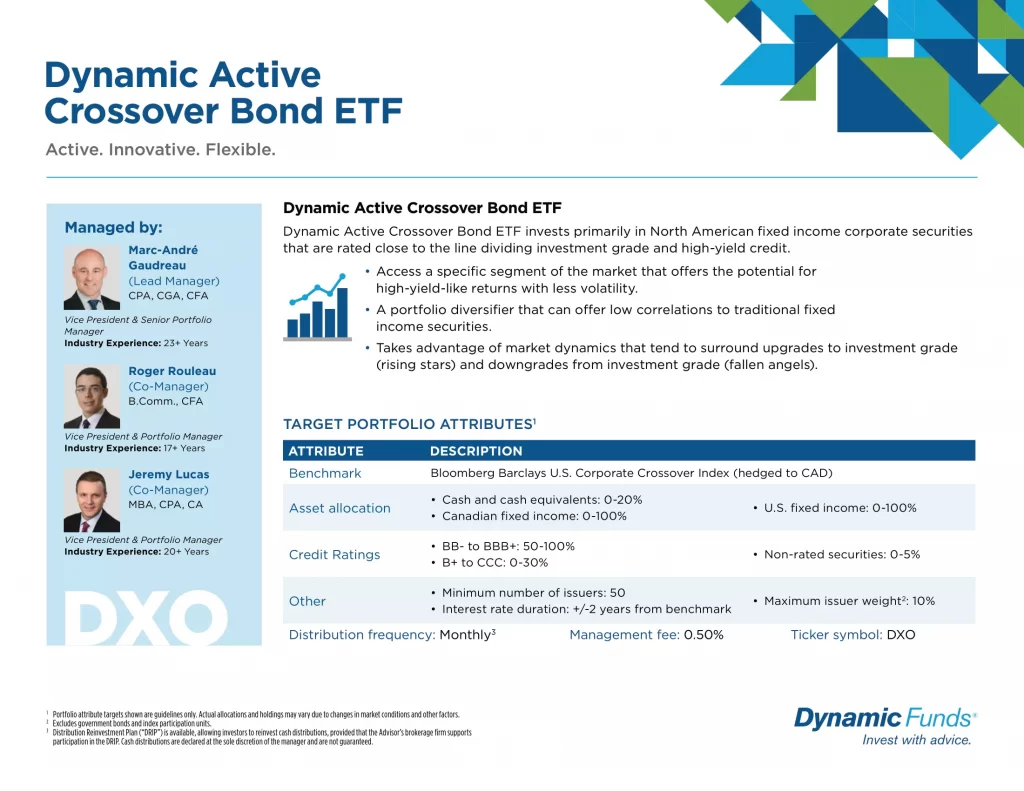

- DXO: Dynamic Active Crossover Bond ETF

- HFR: Horizons Active Ultra-Short Term Investment Grade Bond ETF

- DXV: Dynamic Active Investment Grade Floating Rate ETF

- PFH.F: Invesco Fundamental High Yield Corporate Bond Index ETF

- XHB: iShares Canadian HYBrid Corporate Bond Index ETF

- TCSB: TD Select Short Term Corporate Bond Ladder ETF

- XHY: iShares U.S. High Yield Bond Index ETF (CAD-Hedged)

- ZCM: BMO Mid Corporate Bond Index ETF

| Manager | ETF | Name | MER | Dividend Yield | Distributions | 5Y |

|---|---|---|---|---|---|---|

| Dynamic | DXO | Dynamic Active Crossover Bond ETF | 0.56% | 5.70% | Monthly | 3.72% |

| Dynamic | DXV | Dynamic Active Investment Grade Floating Rate ETF | 0.34% | 6.47% | Monthly | 3.02% |

| BMO | ZFH | BMO Floating Rate High Yield ETF | 0.45% | 8.47% | Monthly | 4.35% |

| Invesco | PFH.F | Invesco Fundamental High Yield Corporate Bond Index ETF | 0.55% | 4.76% | Monthly | 2.23% |

| BlackRock | XHY | iShares U.S. High Yield Bond Index ETF (CAD-Hedged) | 0.66% | 5.78% | Monthly | 2.13% |

| BlackRock | XHB | iShares Canadian HYBrid Corporate Bond Index ETF | 0.50% | 4.40% | Monthly | 2.19% |

| Mackenzie | MFT | Mackenzie Floating Rate Income ETF | 0.68% | 10.58% | Monthly | 3.93% |

| Global X | HFR | Global X Active Ultra-Short Term Investment Grade Bond ETF | 0.47% | 5.48% | Monthly | 3.15% |

| TD | TCSB | TD Select Short Term Corporate Bond Ladder ETF | 0.28% | 5.01% | Monthly | 2.18% |

| BMO | ZCM | BMO Mid Corporate Bond Index ETF | 0.33% | 4.06% | Monthly | 1.42% |

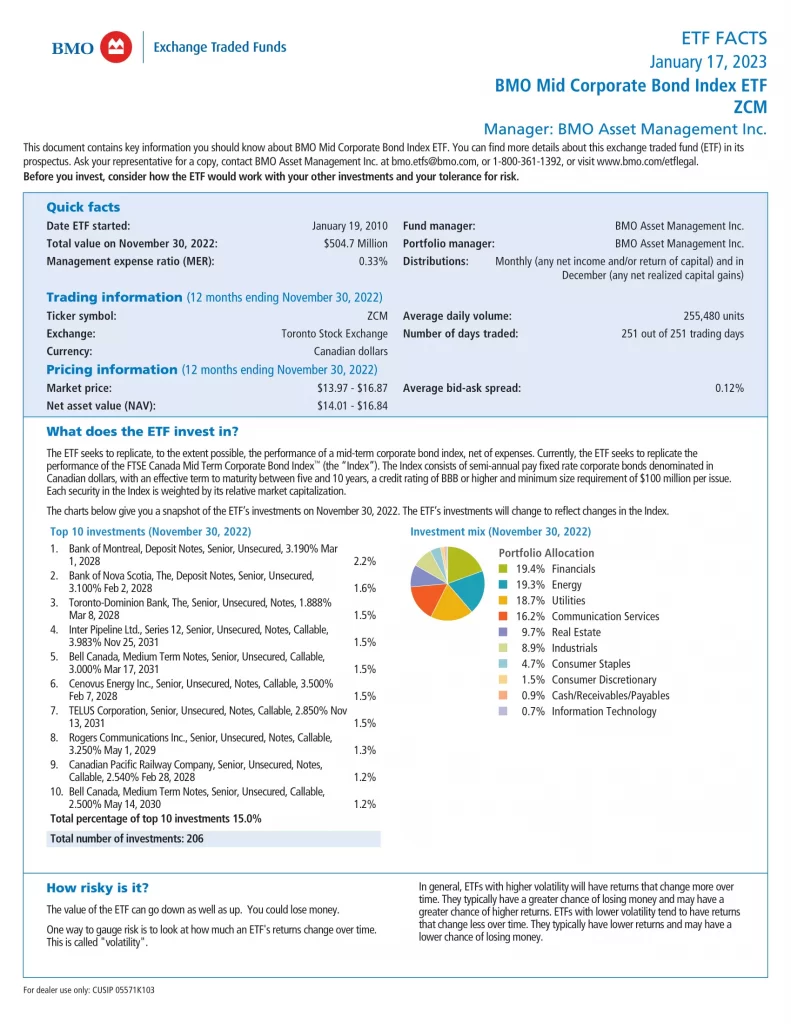

10. BMO Mid Corporate Bond Index ETF

BMO Mid Corporate Bond Index ETF (ZCM) has been designed to replicate, to the extent possible, the performance of the FTSE Canada Mid Term Corporate Bond Index, net of expenses. The Fund invests in a variety of debt securities primarily with a term to maturity between five and ten years. Securities held in the Index are generally corporate bonds issued domestically in Canada in Canadian dollars, with an investment grade rating.

9. iShares U.S. High Yield Bond Index ETF (CAD-Hedged)

Seeks to provide income by replicating the Markit iBoxx USD Liquid High Yield Total Return Index Hedged in CAD, net of expenses.

- Exposure to a broad range of U.S. high yield, non-investment grade corporate bonds, based on market-value weighting

- Access to approximately 900 U.S. corporate bonds in a single fund

- Can be used to seek higher yield and income

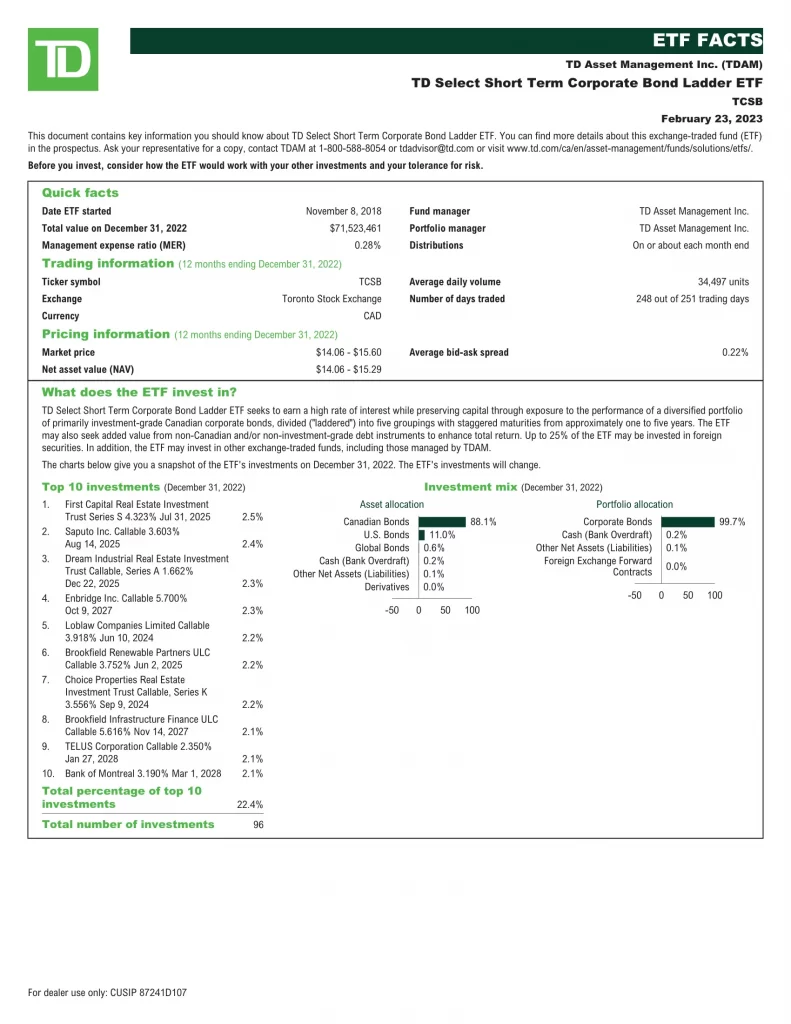

8. TD Select Short Term Corporate Bond Ladder ETF

TD Select Short Term Corporate Bond Ladder ETF seeks to earn a high rate of interest while preserving capital through exposure to the performance of a diversified portfolio of primarily investment-grade Canadian corporate bonds, divided (“laddered”) into five groupings with staggered maturities from approximately one to five years. The TD ETF may also seek added value from non-Canadian and/or non-investment-grade debt instruments to enhance total return.

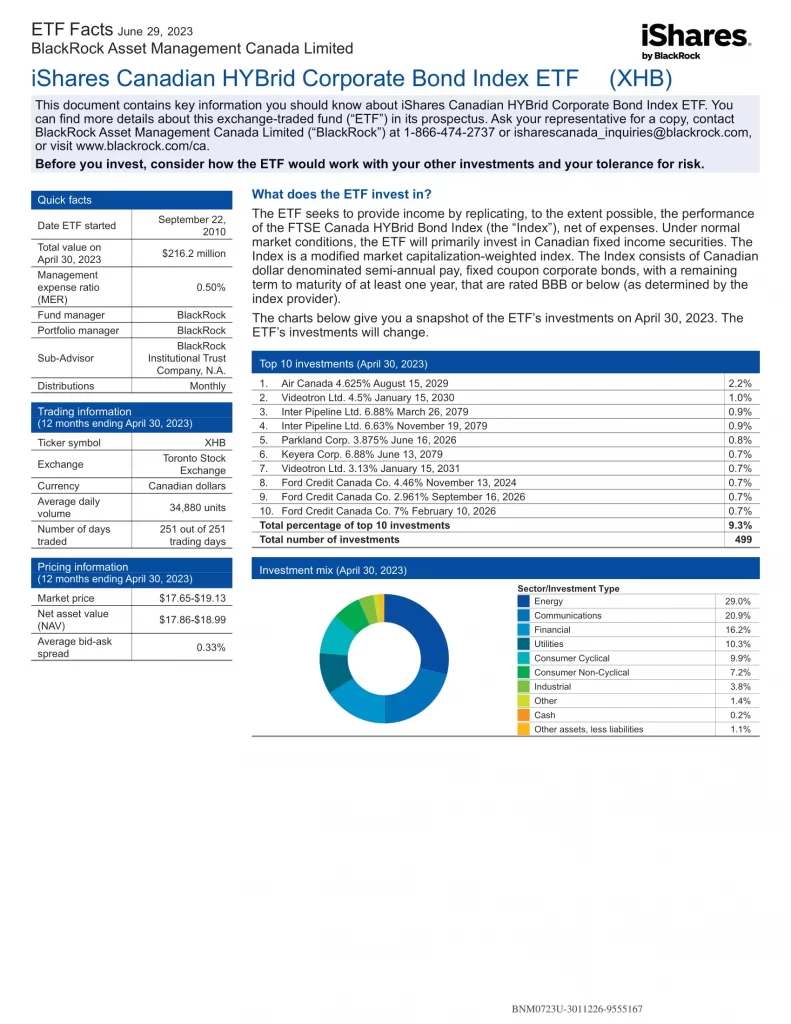

7. iShares Canadian HYBrid Corporate Bond Index ETF

Seeks to provide income by replicating the performance of the FTSE Canada HYBrid Bond Index, net of expenses.

- Exposure to Canadian corporate bonds, with a maturity of at least 1 year, that are rated BBB or below

- Access the investment and non-investment grade segment of the Canadian corporate bond market

- Can be used to customize your exposure to Canadian bonds

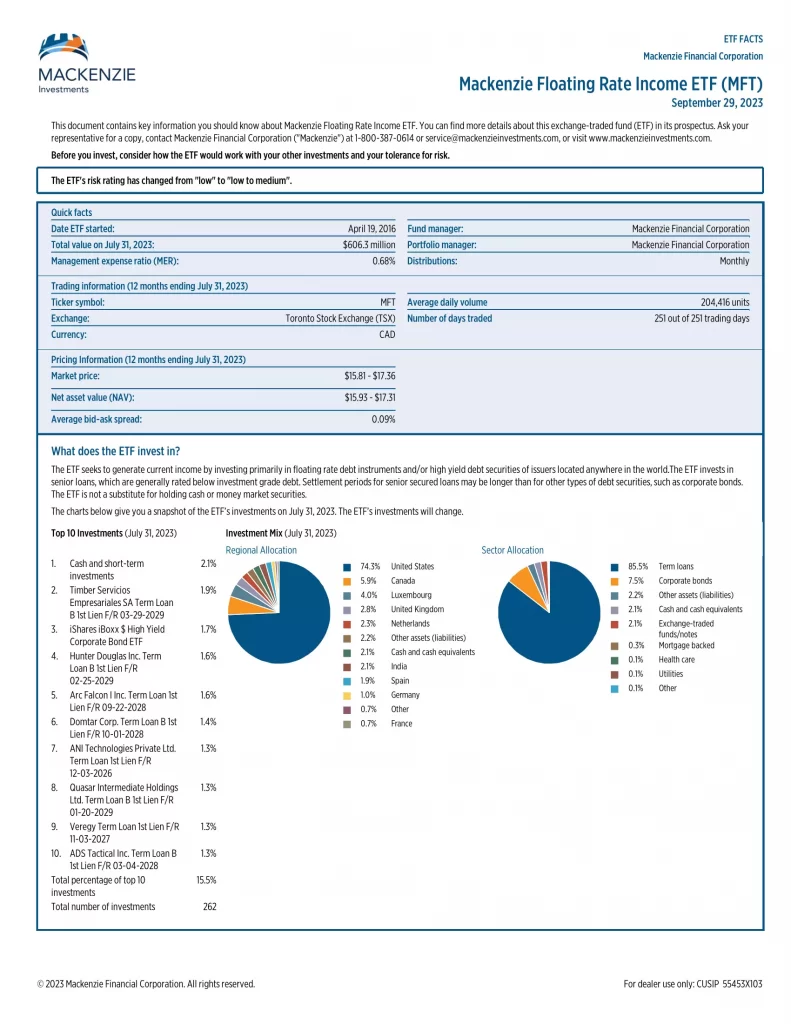

6. Mackenzie Floating Rate Income ETF

- Higher income potential as floating rate loans are generally below investment grade and yields often exceed conventional fixed income instruments

- Mitigates interest rate risk and tends to be less sensitive to interest rate fluctuations compared to fixed-rate bonds

- Improves diversification as floating rate loans generally have a lower correlation to conventional investment grade fixed income assets

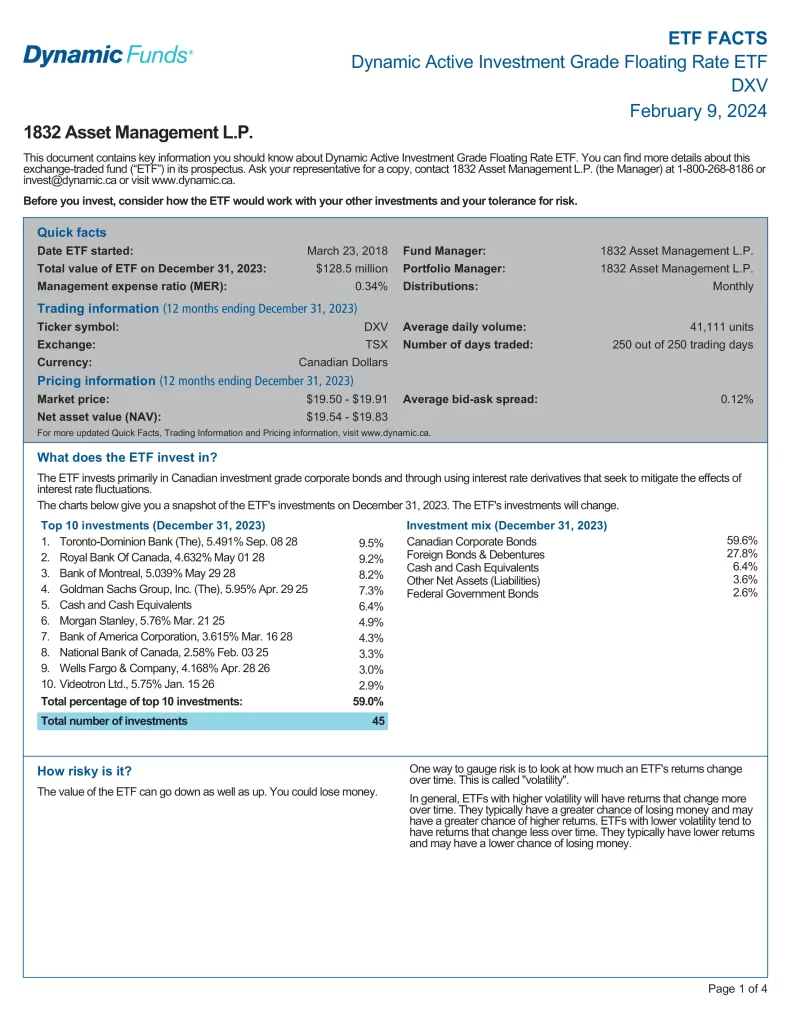

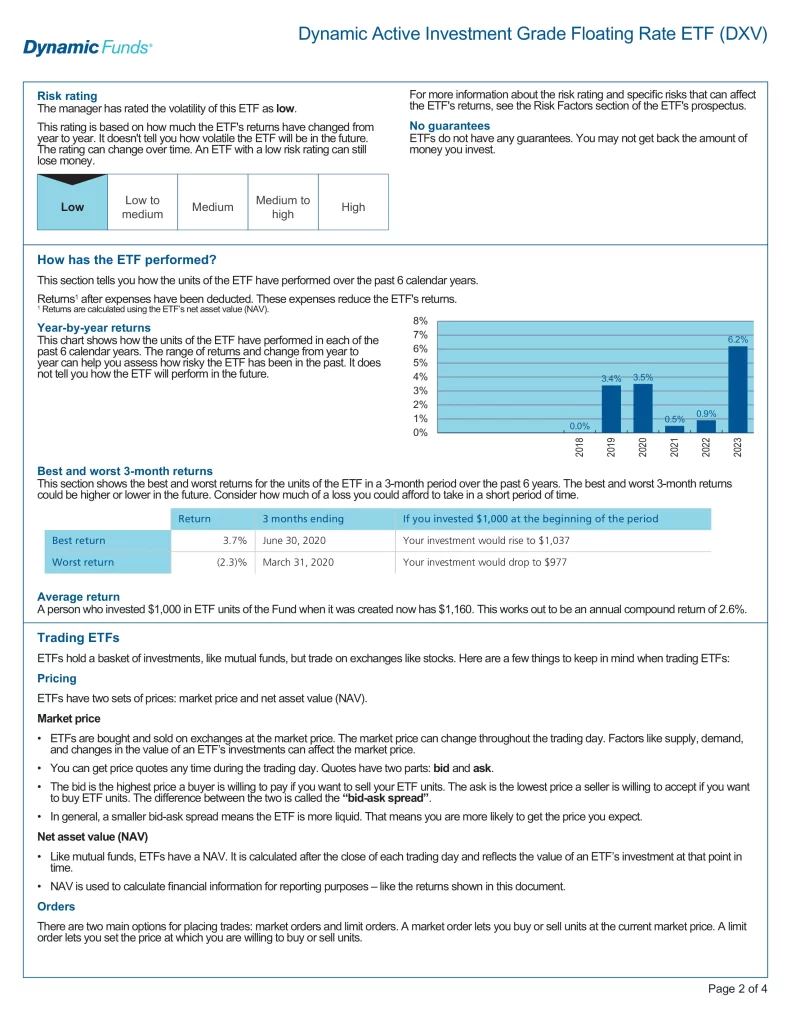

5. Dynamic Active Investment Grade Floating Rate ETF

Dynamic Active Investment Grade Floating Rate ETF (DXV) offers a floating rate of income linked to Canadian short-term interest rates

- Generates a competitive yield relative to other short-term interest products

- Helps diversify traditional fixed-income portfolios to lower overall interest rate sensitivity

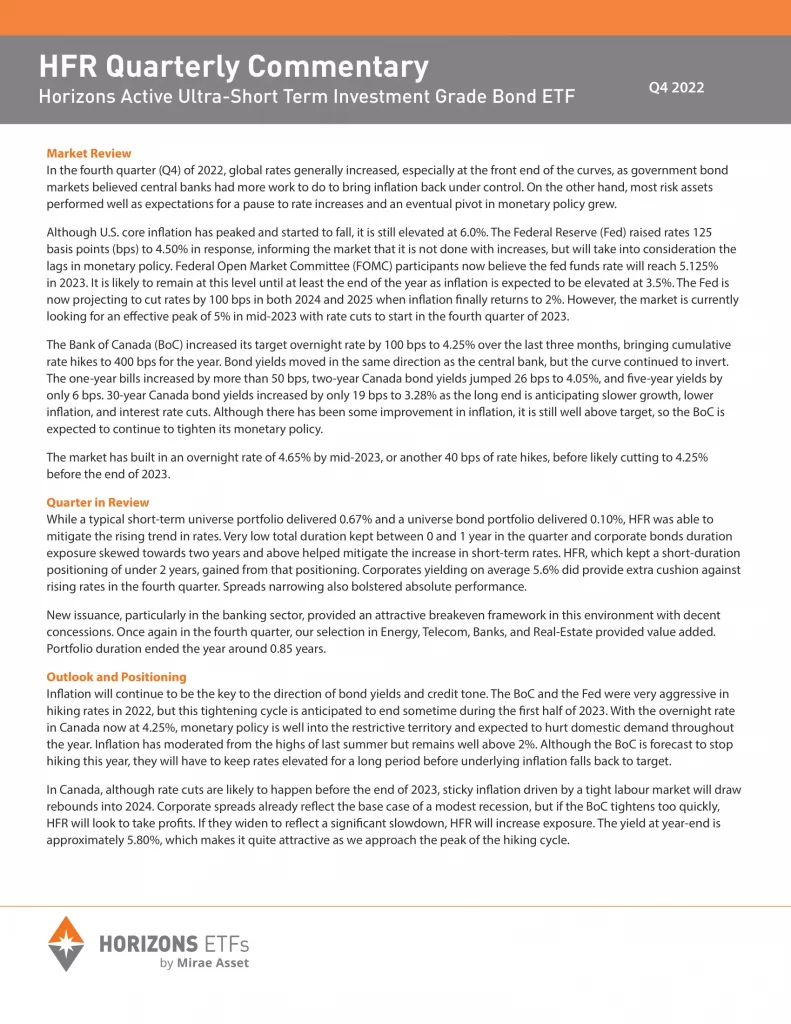

4. Horizons Active Ultra-Short Term Investment Grade Bond ETF

HFR seeks to generate income that is consistent with prevailing Canadian short term corporate bond yields while reducing the potential effects of Canadian interest rate fluctuations on HFR. HFR invests primarily in a portfolio of Canadian debt (including debt-like securities) directly, and hedges the portfolio’s interest rate risk by maintaining a portfolio duration that is not more than one year. HFR may also invest directly in debt of U.S. companies, as well as indirectly through investments in securities of Listed Funds. HFR uses derivatives, including interest rate swaps, to deliver a floating rate of income.

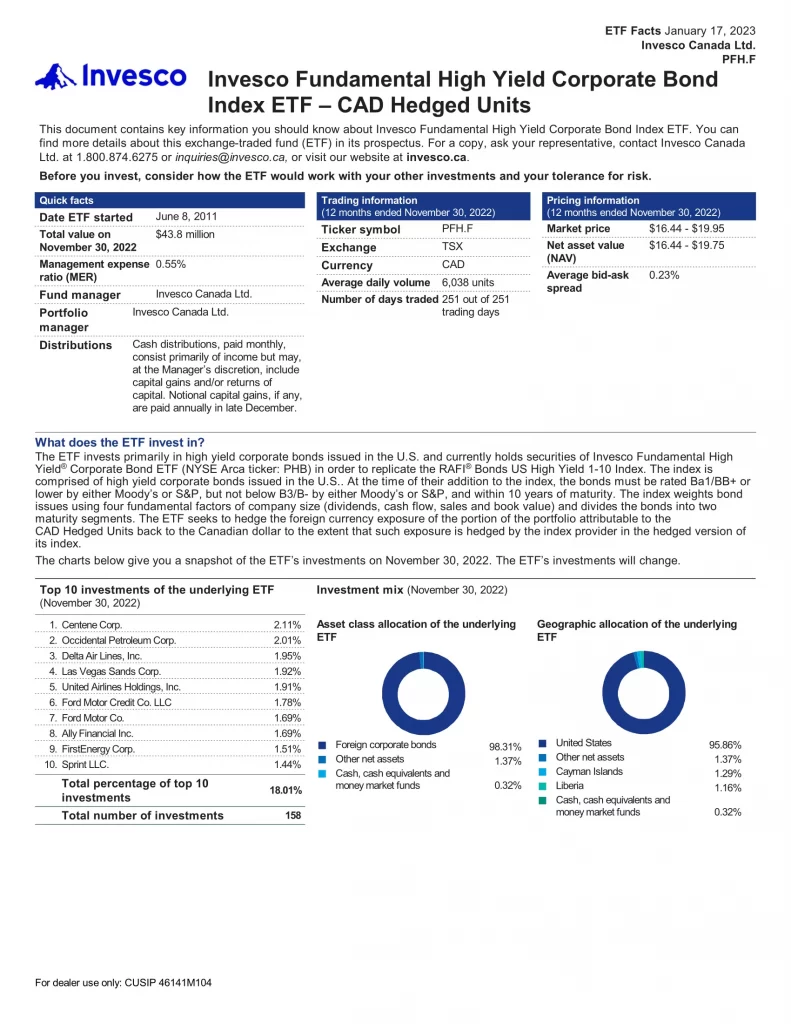

3. Invesco Fundamental High Yield Corporate Bond Index ETF

PFH.F invests either in securities of Invesco Fundamental High Yield Corporate Bond ETF (NYSE Arca ticker: PHB) or in securities of corporate fixed-income securities to replicate the RAFI Bonds US High Yield 1-10 Index. The index is comprised of high-yield corporate bonds issued in the United States. At the time of their addition to the index, the bonds must be rated Ba1/BB+ or lower by either Moody’s or S&P, but not below B3/B- by either Moody’s or S&P, and within 10 years of maturity. The index weights bond issues using four fundamental factors of company size (dividends, cash flow, sales and book value) and divides the bonds into two maturity segments. The ETF seeks to hedge the foreign currency exposure of the portion of the portfolio attributable to the CAD-Hedged Units back to the Canadian dollar to the extent that such exposure is hedged by the index provider in the hedged version of its index.

2. BMO Floating Rate High Yield ETF

BMO Floating Rate High Yield ETF provides exposure to high yield credit with minimal duration risks. The Fund invests in Canadian short term bonds to minimize interest rate risk and currency risk. To enhance the yield, the Fund gains exposure to a diversified basket of US high yield (non-investment grade) issuers through the use of credit default swaps (CDS). Exposure through CDS provides the fund with several benefits, including central clearing, liquidity, pricing transparency, counterparty assurance, and regulatory oversight.

1. Dynamic Active Crossover Bond ETF

Dynamic Active Crossover Bond ETF invests primarily in North American fixed income corporate securities that are rated close to the line dividing investment grade and high-yield credit.

- Access a specific segment of the market that offers the potential for high-yield-like returns with less volatility

- A portfolio diversifier that can offer low correlations to traditional fixed income securities

- Takes advantage of market dynamics that tend to surround upgrades to investment grade (rising stars) and downgrades from investment grade (fallen angels)

What is a Bond?

Bonds, also known as fixed income securities, represent a form of loan wherein the issuer is obligated to make regular fixed payments to the bondholder on a predetermined schedule. In addition to the fixed payment schedule, upon the bond’s maturity, the issuer is required to repay the principal amount. Essentially, holding bonds until maturity ensures that investors do not incur losses; instead, they receive the fixed interest payments along with the return of the principal. It is crucial to recognize that bonds are actively traded in an underlying market, much like commodities. Remarkably, the total value of bonds traded surpasses that of stocks.

What is a Bond ETF?

Buying individual bonds, especially corporate ones, can be complex. Investors often hold them until maturity due to lower liquidity compared to bond ETFs. Bond ETFs are investment vehicles holding a diverse bond portfolio, traded openly on stock exchanges. Acquiring ETF shares provides exposure to underlying bond price changes and periodic interest payments. Bond ETFs offer advantages over traditional bond investments, providing diversification without buying each bond separately. They ensure transparency with disclosed daily holdings. Their high liquidity, unlike less-traded individual bonds, enables easy entry or exit. Bond ETFs also offer flexibility in generating regular income through interest payments, which can be reinvested or received as cash. Customizable ETF options tracking specific indexes or sectors are available for passive investors or those targeting specific fixed-income segments.

Key Considerations When Investing in Bond ETFs

Opt for higher-rated bonds for lower yields and reduced default risk, while lower-rated bonds offer higher yields but come with increased risk. Align the duration of your Bond ETFs with your investment horizon and interest rate outlook. Enhance portfolio diversification by selecting Bond ETFs that offer exposure to various industries and geographic regions. Evaluate costs among different Bond ETF options for effective comparison.

- Issuer Types: Bond ETFs are classified by the types of issuers they hold, distinguishing between government and corporate issues. Examples of the former include Canadian provincial government bonds and U.S. Treasury bonds, while the latter may include bonds issued by Canadian banks or U.S. tech companies.

- Geographical Categories: Bond ETFs are organized based on the location of their issuers. Investors have the option to invest in Chinese government bonds or U.K. government gilts, for instance.

- Credit Quality: The credit quality of a bond ETF assesses the likelihood of the issuer defaulting on interest or principal payments. Generally, bonds with lower credit quality offer higher yields to compensate for increased risk.

- Maturity Durations: Bond ETFs vary in the lengths of time until their underlying bonds mature. Generally, ETFs with longer maturities offer higher yields but are more susceptible to fluctuations in interest rates.

- Yield-to-Maturity: This represents a theoretical assessment of the overall anticipated return of a bond ETF, assuming all underlying bonds are held until maturity. Investors can utilize this, coupled with a bond ETF’s 12-month trailing yield, to estimate the anticipated return they may earn.

Why are Bonds Tied to Interest Rates?

The interest a bond pays is typically determined by the prevailing interest rates at the time of issuance. Bonds often carry a slight premium over these rates to attract investors. Consider the latest bonds with a 2% yield when interest rates are at 1%. If interest rates rise from 1% to 2%, newly issued bonds may offer a higher yield, perhaps 3% or more. Consequently, the appeal of existing 2% yield bonds diminishes, as newer options provide a 1% or higher yield. To stay competitive, the price of the 2% yield bonds in the open market must decrease.

Government Bonds vs Corporate Bonds

The primary distinction between the two lies in their risk profiles. Government bonds are generally safer and carry higher credit ratings. Countries, provinces/states, and municipalities find it more challenging to go bankrupt and default on their issued bonds. In contrast, corporate bonds can be issued by a wide range of companies, from large, well-established institutions to smaller, highly leveraged corporations. As a result, corporate bonds typically entail more risk and exhibit greater volatility compared to government bonds. To attract investors, corporate bonds usually offer higher yields than government bonds.

|  |  |  |  |  |

|---|---|---|---|---|---|

| Advice | InvestCAN | InvestRESP | InvestUSA | RetireCAN | RetireMGN |

| $500.00 CAD $400.00 USD | $99.99 CAD | $79.99 USD | $99.99 CAD | $12.99 CAD $9.99 USD |