Emerging markets refer to countries that are in the process of rapid industrialization, experiencing higher economic growth rates compared to developed economies. Emerging markets ETFs provide investors with exposure to multiple countries across different regions, such as Asia, Latin America, Africa and Eastern Europe. Common countries found in these ETFs include China, India, Brazil, South Korea, South Africa, Mexico, Thailand, Turkey and others.

|  |  |  |  |  |

|---|---|---|---|---|---|

| Advice | InvestCAN | InvestRESP | InvestUSA | RetireCAN | RetireMGN |

| $500.00 CAD $400.00 USD | $99.99 CAD | $79.99 USD | $99.99 CAD | $17.99 CAD $12.99 USD |

Is an Emerging Markets ETF a Good Investment?

Investors should note that emerging markets come with higher risk compared to investing in developed markets. Emerging market investments offer high returns but correspondingly also high risks, given the instability in many emerging market countries.

What is the Best Emerging Markets Equity ETF?

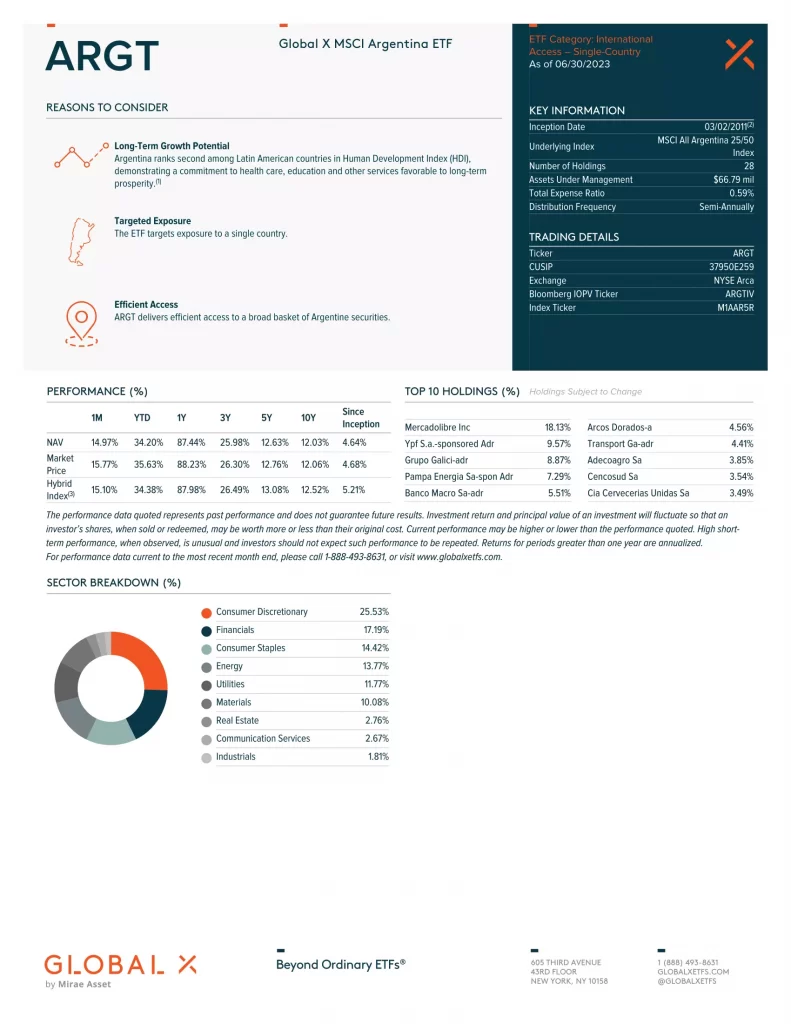

- ARGT: Global X MSCI Argentina ETF

- EPI: WisdomTree India Earnings Fund

- EWT: iShares MSCI Taiwan ETF

- FLTW: Franklin FTSE Taiwan ETF

- GREK: Global X MSCI Greece ETF

- SMIN: iShares MSCI India Small-Cap ETF

- EWW: iShares MSCI Mexico ETF

- PIN: Invesco India ETF

- NFTY: First Trust India NIFTY 50 Equal Weight ETF

- FLIN: Franklin FTSE India ETF

Here is a table comparing similar emerging markets equity ETFs as of November 30, 2023.

| Manager |  |  |  |  |  |  |  |  |  |  |

| ETF | EWT | EWW | SMIN | NFTY | FLIN | FLTW | ARGT | GREK | PIN | EPI |

| Inception | 2000-06-20 | 1996-03-12 | 2012-02-08 | 2012-02-14 | 2018-02-06 | 2017-11-02 | 2011-03-02 | 2011-12-07 | 2008-03-05 | 2008-02-22 |

| MER | 0.58% | 0.50% | 0.74% | 0.80% | 0.19% | 0.19% | 0.59% | 0.57% | 0.78% | 0.85% |

| AUM | $3,080,271,409 | $1,643,317,380 | $484,902,340 | $121,627,025 | $673,770,000 | $174,360,000 | $53,350,000 | $171,680,000 | $199,100,000 | $1,863,034.11 |

| P/E | 13.34 | 11.04 | 25.42 | N/A | 27.10 | 18.77 | 13.65 | 8.25 | 24.04 | 15.84 |

| P/B | 2.00 | 1.87 | 3.38 | 3.54 | 4.03 | 2.00 | 1.78 | 1.05 | 3.52 | 2.65 |

| Yield | 4.85% | 2.74% | 0.07% | N/A | N/A | N/A | 1.83% | 2.27% | N/A | 0.66% |

| Distributions | Annual | Semi-Annually | Semi-Annually | Quarterly | Semi-Annually | Semi-Annually | Semi-Annually | Semi-Annually | Quarterly | Quarterly |

| 1Y | 14.73% | 20.64% | 22.72% | 10.29% | 7.21 | 14.26% | 56.21% | 47.75% | 7.72% | 17.38% |

| 3Y | 6.99% | 18.73% | 19.51% | 15.05% | 12.83 | 7.78% | 22.55% | 19.34% | 11.99% | 19.49% |

| 5Y | 13.99% | 12.05% | 12.95% | 9.58% | 9.51% | 13.83% | 16.06% | 13.58% | 9.82% | 14.01% |

| 10Y | 9.69% | 1.55% | 14.15% | 7.22% | N/A | N/A | 10.34% | -3.88% | 9.14% | 12.19% |

1. ARGT: Global X MSCI Argentina ETF

The Global X MSCI Argentina ETF (ARGT) invests in among the largest and most liquid securities with exposure to Argentina. The Global X MSCI Argentina ETF (ARGT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI All Argentina 25/50 Index.

2. EPI: WisdomTree India Earnings Fund

WisdomTree India Earnings Fund seeks to track the investment results of profitable companies in the Indian equity market.

- Gain exposure to broad Indian all cap equity of profitable companies

- Use to access the Indian markets with a valuation centric approach

3. EWT: iShares MSCI Taiwan ETF

The iShares MSCI Taiwan ETF seeks to track the investment results of an index composed of Taiwanese equities.

- Exposure to large and mid-sized companies in Taiwan

- Targeted access to the Taiwanese stock market

- Use to express a single country view

4. FLTW: Franklin FTSE Taiwan ETF

Provides access to the Taiwanese stock market, allowing investors to precisely gain exposure to Taiwan at a low cost.

- Execute views on Taiwan within your Asia-Pac exposure

- Provides targeted exposure to large- and mid-sized companies in Taiwan

- Seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE Taiwan Capped Index

5. GREK: Global X MSCI Greece ETF

The Global X MSCI Greece ETF (GREK) invests in among the largest and most liquid companies in Greece. The Global X MSCI Greece ETF (GREK) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI All Greece Select 25/50 Index.

6. SMIN: iShares MSCI India Small-Cap ETF

The iShares MSCI India Small-Cap ETF seeks to track the investment results of an index composed of small-capitalization Indian equities.

- Exposure to small public companies in India

- Targeted access to small-cap Indian stocks

- Use to express a view on a single country market segment; pair with INDA for comprehensive India exposure

7. EWW: iShares MSCI Mexico ETF

The iShares MSCI Mexico ETF seeks to track the investment results of a broad-based index composed of Mexican equities.

- Exposure to a broad range of companies in Mexico

- Targeted access to Mexican stocks

- Use to express a single country view

8. PIN: Invesco India ETF

The Invesco India ETF (Fund) is based on the FTSE India Quality And Yield Select Index (Index). The Fund will normally invest at least 90% of its total assets in securities that comprise the Index as well as American depositary receipts and global depositary receipts based on the securities in the Index. The Index is constructed by evaluating all securities in the FTSE India Index and first excluding securities in the bottom 10% based on their 12-month trailing dividend yield. Of the remaining securities, those ranked in the bottom 10% by their quality scores are also then excluded. The Fund and the Index are rebalanced and reconstituted semi-annually.

9. NFTY: First Trust India NIFTY 50 Equal Weight ETF

The First Trust India NIFTY 50 Equal Weight ETF (the “Fund”), formerly First Trust Taiwan AlphaDEX® Fund, seeks investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of an equity index called the NIFTY 50 Equal Weight Index (the “Index”). The Fund will normally invest at least 90% of its net assets (including investment borrowings) in common stocks that comprise the Index.

- The NIFTY 50 Equal Weight Index is an equally weighted index that consists of the same companies as the NIFTY 50 Index, an index that tracks the performance of the 50 largest and most liquid Indian securities listed on the National Stock Exchange of India.

- The NIFTY 50 Equal Weight Index gives equal exposure to all 50 constituents. The same weight, or importance, is given to each stock in the index, allowing for the performance of smaller companies to contribute as much as the larger companies within the index.

- To maintain the equal weight focus, the index is rebalanced quarterly and reconstituted semi-annually.

10. FLIN: Franklin FTSE India ETF

Provides access to the Indian stock market, allowing investors to precisely gain exposure to India at a low cost.

- Execute views on India within your emerging markets exposure

- Provides targeted exposure to large- and mid-sized companies in India

- Seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE India Capped Index