Mid-cap ETFs are one-stop shops for this class of stocks. Mid-cap ETFs are a great way to own companies that are growing quickly and have good financial stability without having to analyze individual stocks and pick the winners. The mid-caps include plenty of companies that you haven’t heard of as well as quite a few that you may use in your daily life. The best of the mid-cap stocks will continue to grow larger, ultimately becoming large-caps and multiplying your initial investments many times over. Midcaps can be an excellent diversifier from other core and large-cap ETFs. It offers a portfolio of companies with higher growth potential and the opportunity to participate in strong price appreciation. Mid-cap companies may be more flexible to adapt to changing economic and competitive environments.

What is the Best Mid-Cap ETF?

- XMHQ: Invesco S&P MidCap Quality ETF

- IVOV: Vanguard S&P Mid-Cap 400 Value Index Fund

- VO: Vanguard Mid Cap Index Fund

- XMMO: Invesco S&P MidCap Momentum ETF

- IVOG: Vanguard S&P Mid-Cap 400 Growth Index Fund

- RWK: Invesco S&P MidCap 400 Revenue ETF

- RFV: Invesco S&P MidCap 400 Pure Value ETF

- IMCG: iShares Morningstar Mid-Cap Growth ETF

- VOE: Vanguard Mid-Cap Value Index Fund

- FLQM: Franklin U.S. Mid Cap Multifactor Index ETF

| ETF | IMCG | FLQM | XMMO | XMHQ | RWK | RFV | IVOG | IVOV | VO | VOE |

| Inception | 2004-06-28 | 2017-04-26 | 2005-03-03 | 2006-12-01 | 2005-03-03 | 2006-03-01 | 2010-09-07 | 2010-09-07 | 2004-01-26 | 2006-08-17 |

| MER | 0.06% | 0.30% | 0.34% | 0.33% | 0.39% | 0.35% | 0.15% | 0.15% | 0.04% | 0.07% |

| AUM | $1,663,626,733 | $290,730,000 | $1,013,900,000 | $1,750,300,000 | $197,700,000 | $333,800,000 | $767,300,000 | $789,300,000 | $55,300,000,000 | $15,500,000,000 |

| P/E | 27.45 | 15.81 | 16.04 | 13.50 | 10.92 | 9.68 | 16.1 | 13.4 | 19.3 | 16.0 |

| P/B | 4.57 | 3.55 | 3.66 | 3.33 | 1.83 | 1.20 | 2.9 | 1.7 | 2.8 | 2.0 |

| Yield | 1.00% | 2.10% | 1.03% | 1.00% | 1.05% | 1.28% | 1.27% | 1.87% | 1.66% | 2.42% |

| Distributions | Quarterly | Quarterly | Quarterly | Quarterly | Quarterly | Quarterly | Annually | Annually | Quarterly | Quarterly |

| 1Y | 5.75% | 4.43% | 3.58% | 12.39% | 6.54% | 7.69% | 17.40% | 15.42% | 16.04% | 9.83% |

| 3Y | 0.19% | 8.60% | 5.35% | 10.79% | 14.28% | 17.21% | 4.07% | 11.79% | 5.51% | 9.19% |

| 5Y | 11.53% | 10.63% | 11.93% | 13.23% | 11.69% | 11.59% | 11.77% | 12.79% | 12.73% | 11.31% |

| 10Y | 10.63% | N/A | 12.11% | 10.57% | 9.51% | 9.38% | 8.87% | 9.01% | 9.42% | 8.49% |

10. Invesco S&P MidCap 400 Revenue ETF

The Invesco S&P MidCap 400 Revenue ETF (Fund) is based on the S&P MidCap 400 Revenue-Weighted Index (Index). The Fund will invest at least 90% of its total assets in securities of mid-capitalization companies in the Index. The Index is constructed using a rules-based approach that re-weights securities of the S&P MidCap 400 Index according to the revenue earned by the companies, with a maximum 5% per company weighting. The Fund and Index are rebalanced quarterly.

9. Franklin U.S. Mid Cap Multifactor Index ETF

Franklin U.S. Mid Cap Multifactor Index ETF (FLQM) tracks a multi-factor index that aims to reduce market volatility and deliver a smoother investor experience over the long term.

- Seeks to provide investment results that closely correspond, before fees and expenses, to the performance of its corresponding underlying index, LibertyQ U.S. Mid Cap Equity Index

- Pursues low downside capture and strong risk-adjusted returns over the long term

- The index methodology employs a rules-based, custom multi-factor approach providing exposure to four well known factors: 50% Quality, 30% Value, 10% Momentum and 10% Low Volatility

8. Vanguard Mid-Cap Value Index Fund

Seeks to track the performance of the CRSP US Mid Cap Value Index, which measures the investment return of mid-capitalization value stocks.

- Provides a convenient way to match the performance of a diversified group of midsize value companies.

- Follows a passively managed, full-replication approach

7. iShares Morningstar Mid-Cap Growth ETF

iShares Morningstar Mid-Cap Growth ETF (IMCG) seeks to track the investment results of an index composed of mid-capitalization U.S. equities that exhibit growth characteristics.

- Exposure to mid-sized U.S. companies whose earnings are expected to grow at an above-average rate relative to the market

- Targeted access to a specific category of mid-cap domestic stocks

- Use to tilt your portfolio towards growth stocks

6. Invesco S&P MidCap 400 Pure Value ETF

The Invesco S&P MidCap 400 Pure Value ETF (Fund) is based on the S&P MidCap 400 Pure Value Index (Index). The Fund will invest at least 90% of its total assets in securities that comprise the Index. The Index measures the performance of securities that exhibit strong value characteristics in the S&P MidCap 400 Index. Value is measured by the following risk factors: book value-to-price ratio, earnings-to-price ratio and sales-to-price ratio. The Fund and the Index are rebalanced annually.

5. Vanguard S&P Mid-Cap 400 Growth Index Fund

Invests in stocks in the S&P MidCap 400 Growth Index, composed of the growth companies in the S&P 400.

- Focuses on closely tracking the index’s return, which is considered a gauge of overall U.S. mid-cap growth stock returns.

- Offers high potential for investment growth; share value rises and falls more sharply than that of funds holding bonds.

- More appropriate for long-term goals where your money’s growth is essential

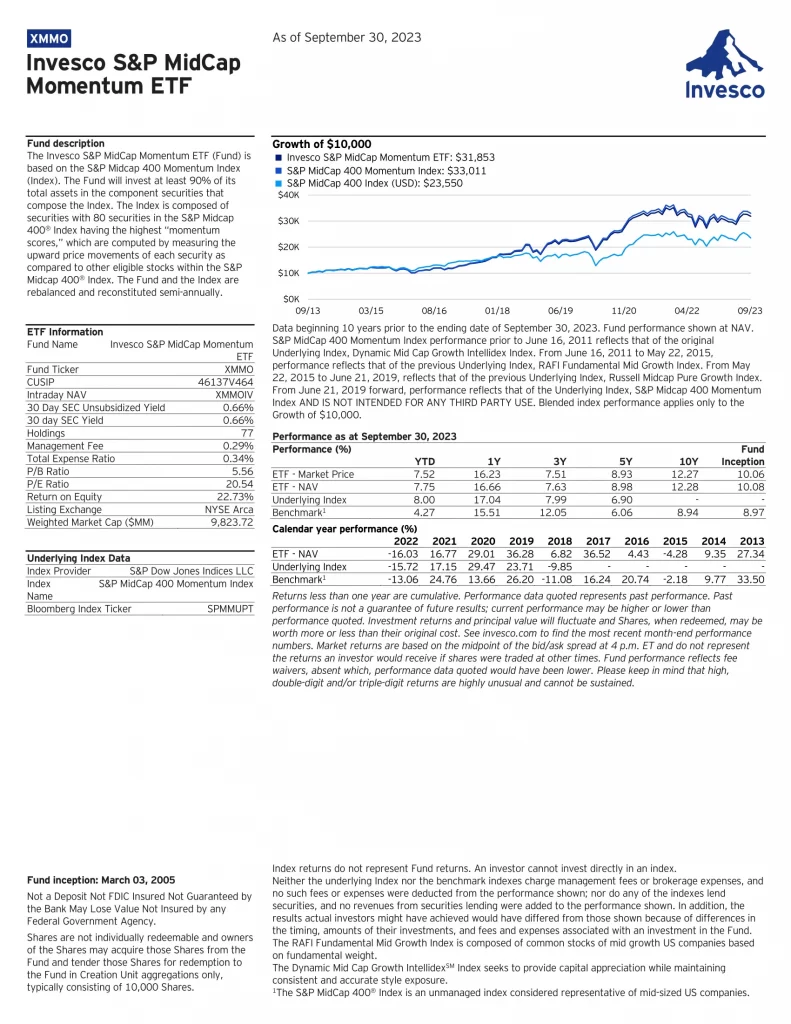

4. Invesco S&P MidCap Momentum ETF

Invesco S&P MidCap Momentum ETF (XMMO) is based on the S&P Midcap 400 Momentum Index (Index). The Fund will invest at least 90% of its total assets in the component securities that comprise the Index. The Index is composed of securities with 80 securities in the S&P Midcap 400 Index having the highest “momentum scores,” which are computed by measuring the upward price movements of each security as compared to other eligible stocks within the S&P Midcap 400 Index. The Fund and the Index are rebalanced and reconstituted semi-annually.

3. Vanguard Mid Cap Index Fund

Vanguard Mid-Cap Index Fund ETF Shares (VO) seeks to track the performance of the CRSP US Mid Cap Index, which measures the investment return of mid-capitalization stocks.

- Provides a convenient way to match the performance of a diversified group of medium-size companies.

- Follows a passively managed, full-replication approach

2. Vanguard S&P Mid-Cap 400 Value Index Fund

Invests in stocks in the S&P MidCap 400 Value Index, composed of the value companies in the S&P 400.

- Focuses on closely tracking the index’s return, which is considered a gauge of overall U.S. mid-cap value stock returns.

- Offers high potential for investment growth; share value rises and falls more sharply than that of funds holding bonds.

- More appropriate for long-term goals where your money’s growth is essential.

1. Invesco S&P MidCap Quality ETF

Invesco S&P MidCap Quality ETF (XMHQ) is based on the S&P MidCap 400 Quality Index. The Fund will invest at least 90% of its total assets in the component securities that comprise the Index. The Index is a modified market capitalization-weighted index that holds approximately 80 securities in the S&P Midcap 400 Index that have the highest quality scores, which are computed based on a composite of three proprietary factors. The Fund and the Index are rebalanced semi-annually.

Are Mid-Cap ETFs Worth It?

Mid-cap ETFs are an attractive way to invest in solid performers that have both growth and stability – and to do so without the risks of buying into individual stocks. While an ETF can help diversify the risk of buying a few individual stocks, it won’t eliminate all the risk of investing.