Healthcare funds offer a strong dose of defense, diversification and long-haul growth as the sector continues to produce new drugs, medical-device products and treatments on a reliable basis. Investors can choose a broad-based healthcare ETF comprising pharmaceutical, biotechnology, life sciences, sector services and medical-device companies. Or, they can opt for an industry-specific stock specializing in any healthcare field.

What is the Best Healthcare ETF?

- XLV: Health Care Select Sector SPDR Fund

- IYH: iShares U.S. Healthcare ETF

- VHT: Vanguard Health Care Index Fund

- FHLC: Fidelity MSCI Health Care Index ETF

- IXJ: iShares Global Healthcare ETF

- RSPH: Invesco S&P 500 Equal Weight Health Care ETF

- IHI: iShares U.S. Medical Devices ETF

- PPH: VanEck Pharmaceutical ETF

- IHF: iShares U.S. Healthcare Providers ETF

- FXH: First Trust Health Care AlphaDEX Fund

| Manager |  |  |  |  |  |  |  | |||

| ETF | IHF | IHI | IXJ | IYH | FHLC | FXH | RSPH | XLV | PPH | VHT |

| Inception | 2006-05-01 | 2006-05-01 | 2001-11-13 | 2000-06-12 | 2013-10-21 | 2007-05-08- | 2006-11-01 | 1998-12-16 | 2011-12-20 | 2004-01-26 |

| MER | 0.40% | 0.40% | 0.42% | 0.40% | 0.084% | 0.62% | 0.40% | 0.10% | 0.36% | 0.10% |

| AUM | $919,074,474 | $5,381,617,444 | $4,035,960,972 | $3,146,190,438 | $2,900,000,000 | $1,283,583,271 | $966,900,000 | $37,748,460,000 | $450,570,000 | $16,000,000,000 |

| P/E | 21.91 | 40.13 | 23.07 | 23.84 | 27.21 | 22.33 | 16.55 | 20.50 | 22.10 | 28.0 |

| P/B | 2.93 | 4.32 | 4.21 | 4.71 | 4.14 | 2.41 | 3.87 | 4.56 | 2.73 | 4.2 |

| Yield | 0.90% | 0.52% | 1.29% | 1.20% | 1.42% | 0.25% | 3.66% | 1.59% | 1.96 | 1.45% |

| Distributions | Quarterly | Quarterly | Semi-Annually | Quarterly | Quarterly | Quarterly | Quarterly | Quarterly | Quarterly | Quarterly |

| 1Y | -7.90% | -5.02% | -2.33% | -4.16% | -4.78% | -11.91% | -5.27% | -4.06% | 3.96% | -4.78% |

| 3Y | 4.91% | -0.89% | 5.35% | 6.08% | 4.81% | -1.96% | 3.80% | 7.81% | 8.44% | 4.83% |

| 5Y | 6.48% | 7.22% | 7.63% | 7.90% | 7.67% | 4.32% | 7.60% | 8.54% | 6.53% | 7.70% |

| 10Y | 11.49% | 13.22% | 8.65% | 10.47% | 10.48% | 7.34% | 10.35% | 10.82% | 6.18% | 10.53% |

10. FXH: First Trust Health Care AlphaDEX Fund

The First Trust Health Care AlphaDEX® Fund is an exchange-traded fund. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield, before fees and expenses, of an equity index called the StrataQuant® Health Care Index.

- The StrataQuant Health Care Index is an “enhanced” index developed, maintained and sponsored by ICE Data Indices, LLC or its affiliates (“IDI”) which employs the AlphaDEX stock selection methodology to select stocks from the Russell 1000 Index.

- IDI constructs the StrataQuant Health Care Index by ranking the stocks which are members of the Russell 1000 Index on growth factors including three, six and 12-month price appreciation, sales to price and one year sales growth, and, separately, on value factors including book value to price, cash flow to price and return on assets. All stocks are ranked on the sum of ranks for the growth factors and, separately, all stocks are ranked on the sum of ranks for the value factors.

- Each stock receives either its growth or value score rank as its selection score based on its style designation as determined by Russell. Stocks which Russell allocates between both growth and value receive the better of their growth or value score rank as their selection score.

- IDI then ranks those stocks contained in the health care sector according to their score. The greater of the top 75% of the eligible universe or 40 stocks is selected for the StrataQuant Health Care Index.

- If the total count of eligible stocks in the health care sector falls below 40, all eligible stocks will be included.

- The selected stocks are divided into quintiles based on their rankings and the top ranked quintiles receive a higher weight within the index. The stocks are equally-weighted within each quintile.

- The index is reconstituted and rebalanced quarterly.

9. IHF: iShares U.S. Healthcare Providers ETF

The iShares U.S. Healthcare Providers ETF seeks to track the investment results of an index composed of U.S. equities in the healthcare providers sector.

- Exposure to U.S. companies that provide health insurance, diagnostics, and specialized treatment

- Targeted access to domestic healthcare services stocks

- Use to express a sector view

8. PPH: VanEck Pharmaceutical ETF

VanEck Pharmaceutical ETF (PPH®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Pharmaceutical 25 Index (MVPPHTR), which is intended to track the overall performance of companies involved in pharmaceuticals, including pharmaceutical research and development as well a production, marketing and sales of pharmaceuticals.

- Highly Liquid Companies: Index seeks to track the most liquid companies in the industry based on market capitalization and trading volume

- Industry Leaders: Index methodology favours the largest companies in the industry

- Global Scope: Portfolio may include both domestic and U.S. listed foreign companies, allowing for enhanced industry representation

7. IHI: iShares U.S. Medical Devices ETF

The iShares U.S. Medical Devices ETF seeks to track the investment results of an index composed of U.S. equities in the medical devices sector.

- Exposure to U.S. companies that manufacture and distribute medical devices

- Targeted access to domestic medical device stocks

- Use to express a sector view

6. RSPH: Invesco S&P 500 Equal Weight Health Care ETF

The Invesco S&P 500® Equal Weight Health Care ETF (Fund) is based on the S&P 500® Equal Weight Health Care Index (Index). The Fund will invest at least 90% of its total assets in common stocks that comprise the Index. The Index equally weights stocks in the health care sector of the S&P 500® Index. The Fund and the Index are rebalanced quarterly.

5. IXJ: iShares Global Healthcare ETF

The iShares Global Healthcare ETF seeks to track the investment results of an index composed of global equities in the healthcare sector.

- Exposure to pharmaceutical, biotechnology, and medical device companies

- Targeted access to healthcare stocks from around the world

- Use to express a global sector view

4. FHLC: Fidelity MSCI Health Care Index ETF

Investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Health Care 25/50 Index. Invests at least 80% of assets in securities included in MSCI USA IMI Health Care 25/50 Index. Uses a representative sampling indexing strategy to manage the fund. The MSCI USA IMI Health Care 25/50 Index is a modified market capitalization-weighted index that captures the large-, mid-, and small-cap segments of the USA market.

3. VHT: Vanguard Health Care Index Fund

Vanguard Health Care Index Fund ETF Shares (VHT) seeks to track the performance of a benchmark index that measures the investment return of stocks in the health care sector.

- Passively managed, using a full-replication strategy when possible and a sampling strategy if regulatory constraints dictate.

- Includes stocks of companies involved in providing medical or health care products, services, technology, or equipment

2. IYH: iShares U.S. Healthcare ETF

The iShares U.S. Healthcare ETF seeks to track the investment results of an index composed of U.S. equities in the healthcare sector.

- Exposure to U.S. healthcare equipment and services, pharmaceuticals, and biotechnology companies

- Targeted access to domestic healthcare stocks

- Use to express a sector view

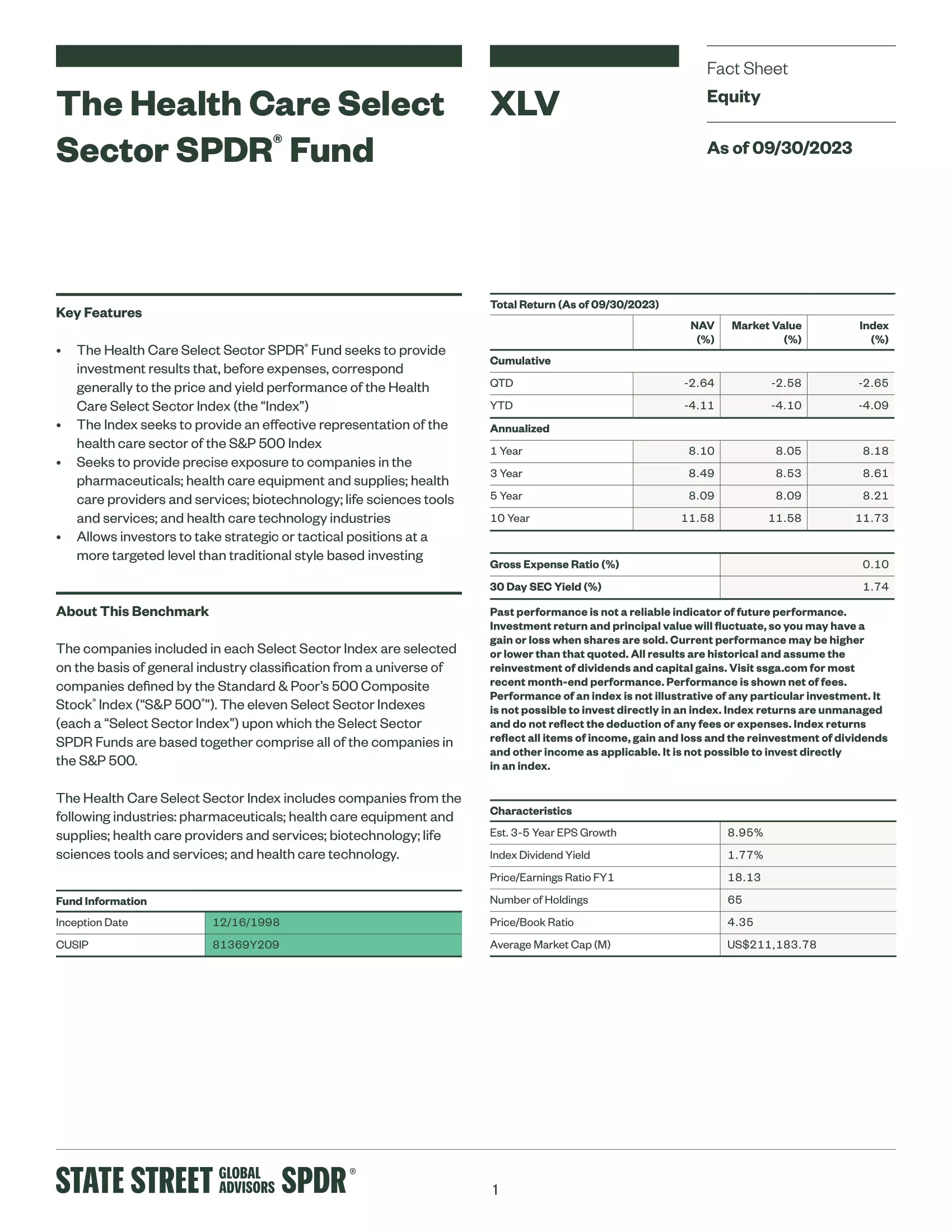

1. XLV: Health Care Select Sector SPDR Fund

Health Care Select Sector SPDR Fund (XLV) includes companies from the following industries: pharmaceuticals; health care equipment and supplies; health care providers and services; biotechnology; life sciences tools and services; and health care technology.

- The Health Care Select Sector SPDR Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Health Care Select Sector Index

- The Index seeks to provide an effective representation of the health care sector of the S&P 500 Index

- Seeks to provide precise exposure to companies in the pharmaceuticals; health care equipment and supplies; health care providers and services; biotechnology; life sciences tools and services; and health care technology industries

- Allows investors to take strategic or tactical positions at a more targeted level than traditional style based investing

|  |  |  |  |

|---|---|---|---|---|

| InvestCAN | InvestRESP | InvestUSA | RetireCAN | RetireMGN |

| $99.99 CAD | $12.99 CAD | $79.99 USD | $99.99 CAD | $9.99 USD |