These models are core solutions designed for investors seeking diversified portfolios that aim to outperform their benchmarks throughout a full market cycle. Each target risk model offers broad diversification across investment styles and asset classes, providing cost-efficient solutions for your retirement. Using the same portfolio construction techniques as those used for our most sophisticated institutional investors, these models cater to various risk profiles and return objectives, all within established target risk levels.

What is a Model ETF Portfolio?

Model exchange traded fund (ETF) portfolios typically set target allocations for different asset classes. The financial product landscape is undergoing a significant transformation, primarily driven by the growing adoption of model portfolios among financial advisors. Achieving success in self-directed investing can be distilled into a straightforward formula: diversify widely, minimize expenses, and steadfastly follow a long-term strategy. By holding just a few to a handful of ETFs, you can construct a sophisticated portfolio with exceptionally low fees and minimal upkeep.

The formula for successful do-it-yourself investing is simple: diversify broadly, keep your costs low, and stick to your plan over the long term. Asset allocation ETFs tick all of these boxes. With just one or two holdings, you can build a sophisticated portfolio with extremely low fees and minimal maintenance. Imagine a model portfolio as an investment blueprint or recipe. Combine a portion of stocks, bonds, cash and perhaps alternative investments, and you have a customized asset portfolio tailored to specific financial objectives.

How Do Model Portfolios Work?

In each distinct model portfolio, expert managers outline a precise asset allocation and routinely readjust it to maintain the portfolio’s intended structure. Model portfolios often employ widely recognized market indices, such as the S&P 500, as performance benchmarks. They aim to strike a balance between returns and risk by holding a collection of securities. Although model portfolio managers may set specific return targets for their portfolios, achieving or surpassing these objectives is not guaranteed. Many model portfolios, especially over the short or medium term, may fall short of their intended returns.

Investment Considerations

To determine the right asset allocation and investment strategy for you, it’s important to consider these three key factors:

- Your Objectives: What are you saving for? Whether it’s retirement, a down payment on your first home, or your child’s education, clearly defining your goals will guide your investment decisions. Shorter time horizons should have more money market products.

- Your Time Horizon: This is the timeframe in which you’ll need access to your funds. It’s essentially the target date for achieving your financial goals. Investing 20 years away from retirement allows for a larger equity position in a portfolio.

- Your Risk Tolerance: Assess how much market volatility and potential unrealized losses (losses on investments that haven’t been sold yet) you are comfortable with. This will influence the level of risk you’re willing to take on in your portfolio. Bonds usually help smooth out returns to help avoid a sequence of returns risk.

Where are You on the Risk Spectrum?

Here’s an overview of popular risk tolerances that most asset allocation mutual funds and ETFs benchmark to:

- All-Equity Portfolio (100/0): Focuses on achieving high returns, accepting higher risk in the process. This portfolio is heavily weighted toward stocks, including aggressive growth stocks and emerging markets.

- Growth Portfolio (80/20): Strikes a balance between growth and stability, with a higher proportion of stocks than bonds. It aims for reasonable growth while still managing risk.

- Balanced Portfolio (60/40): Targets a balanced approach, offering moderate risk and return. This portfolio maintains a mix of 60% stocks and 40%bonds.

- Conservative Portfolio (40/60): Prioritizes capital preservation while still allowing for some growth. It has a larger allocation to bonds and a smaller allocation to stocks, focusing on stability.

- Income Portfolio (20/80): Aims to preserve capital with minimal risk. This portfolio is bond-heavy, offering lower potential returns but also the lowest level of risk.

Asset Allocation

Model portfolios hinge on two fundamental investment principles: diversification and asset allocation. These principles work in tandem to mitigate investment risks. Diversification involves incorporating a variety of investments into a single portfolio, spanning different asset classes and even within those classes. It can be a mix of stocks, bonds, cash or alternatives.

Model ETF portfolios typically set target allocations for different asset classes. Asset allocation pertains to the proportion of the portfolio allocated to each asset type. For instance, a common example is the 70/30 portfolio, where 70% comprises stocks and 30% fixed income. Portfolio managers strive to maintain consistent asset allocations over time by regularly rebalancing the portfolio. They sell assets that have performed well and buy assets that have underperformed to realign the portfolio with its intended allocation. This ensures that the portfolio remains in line with its designated blueprint.

Model ETF Portfolio Examples

Popular Canadian mutual funds have been constructed using benchmarks. If you think an all-ETF portfolio might suit you, here are three ways to build one, ranging from ultra-simple to very fine-tuned. For instance, if you’re an investor seeking moderate risk and decide that you want 60% of your portfolio in stocks and 40% in bonds, you could consider purchasing an all-country stock index ETF and then combine it with a bond ETF. With that in mind, here’s a list of model portfolios that incorporate equities and fixed income.

Money Guy Now ETF Portfolio

An unbiased ETF portfolio is constructed by diversifying across a range of asset classes to balance risk and return while avoiding over-concentration in any single category. Typically, a well-rounded ETF portfolio includes asset classes, such as large-cap stocks, small-cap stocks, international equities, emerging market stocks, bonds (government and corporate), real estate investment trusts (REITs), commodities (like gold or oil), Treasury inflation-protected securities (TIPS), cash equivalents, and alternative investments like private equity or hedge funds. Each asset class serves a distinct purpose: equities offer growth potential, bonds provide stability, and alternatives can hedge against inflation or market downturns. By mixing these asset classes, the portfolio is designed to reduce volatility and smooth out performance fluctuations, ensuring that it remains aligned with an investor’s risk tolerance, time horizon, and objectives. The goal is to create a comprehensive, diversified strategy that is not skewed toward any single market or sector, fostering long-term financial growth with minimized exposure to risk.

InvestCAN: Canadian Portfolio Construction

Most registered financial advisors will have inferior returns to a simple combination of a global equity and aggregate bond ETF. However, a global bond is preferred.

| Asset Class | ETF | Weight |

|---|---|---|

| Global Equity | XWD | ? |

| Aggregate Bond | XBB | ? |

Here is a list of the asset classes in InvestCAN to build a portfolio with a popular ETF in Canada. Allocations are customized and unique for each investor.

InvestUSA: American Portfolio Construction

Most registered financial advisors will have inferior returns to a simple combination of a global equity and aggregate bond ETF. However, a global bond is preferred.

| Asset Class | ETF | Weight |

|---|---|---|

| Global Equity | VT | ? |

| Global Bond | BNDW | ? |

Here is a list of the asset classes in InvestUSA to build a portfolio with a popular ETF in America. Allocations are customized and unique for each investor.

| Asset Class | ETF | Weight |

|---|---|---|

| Emerging Markets Equity | EEM | ? |

| International Equity | EFA | ? |

| US Sector Equity | XLK | ? |

| US Small & Mid-Cap Equity | IJR | ? |

| American Equity | SPY | ? |

| Foreign Bond | BWX | ? |

| Corporate Bond | LQD | ? |

| Government Bond | IEF | ? |

| Commodity | GLD | ? |

| Money Market | BIL | ? |

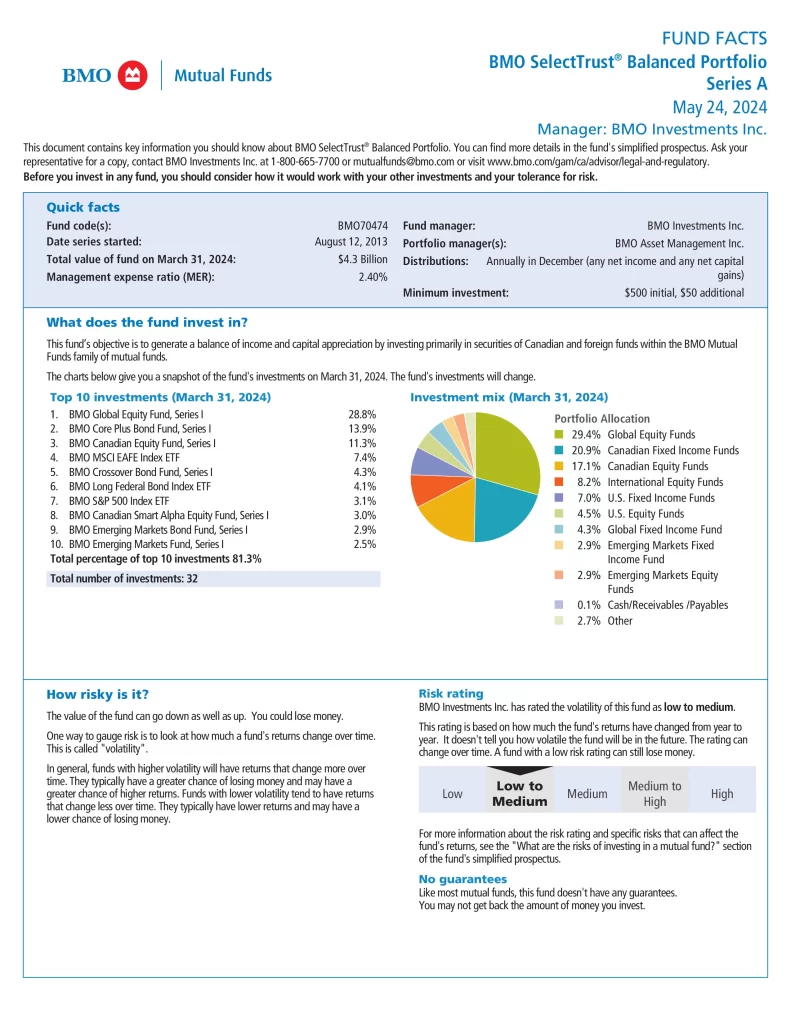

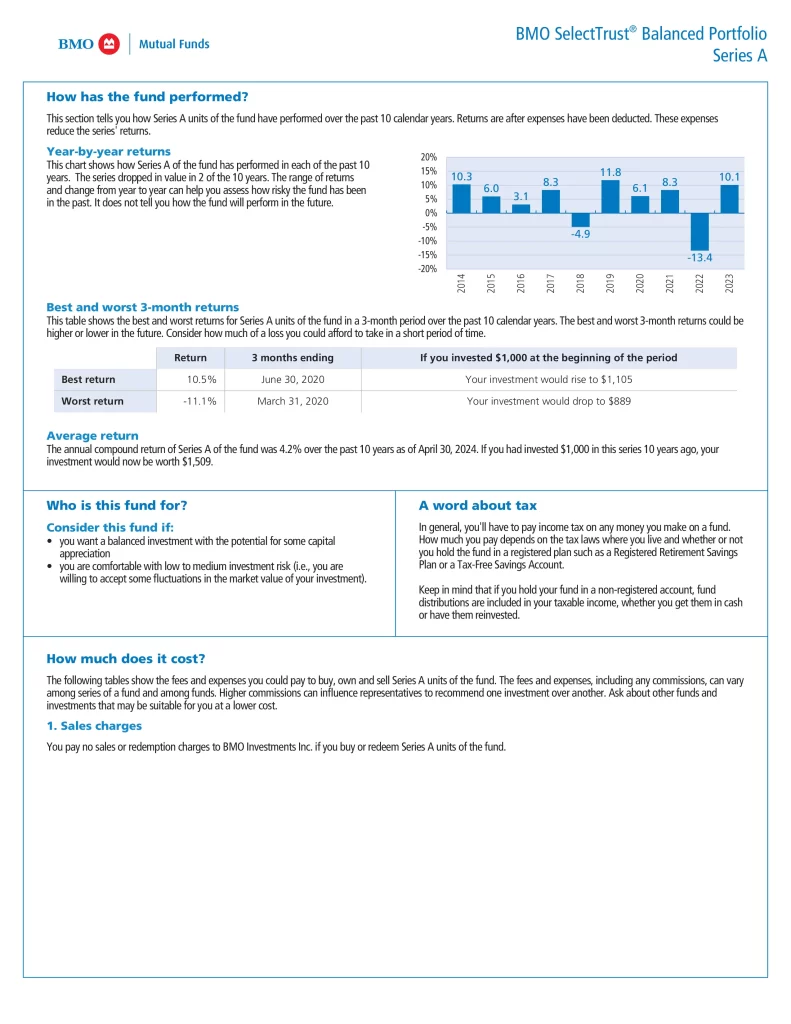

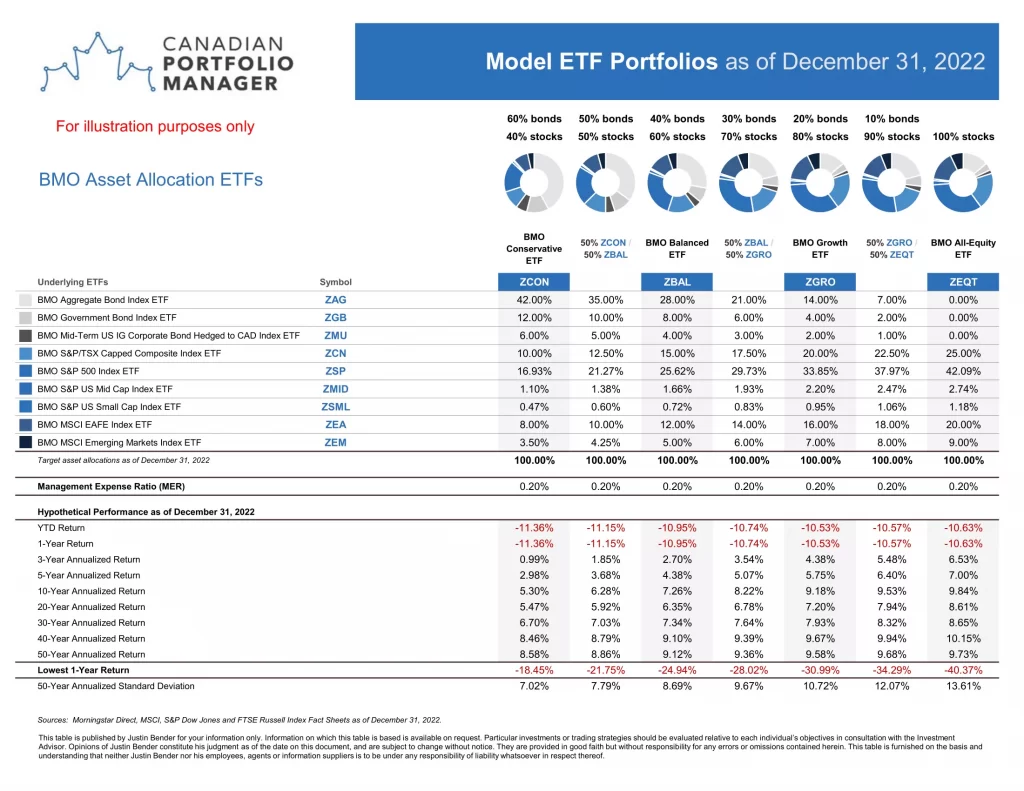

BMO Model ETF Portfolios

The Bank of Montreal (BMO) is a Canadian multinational investment bank and financial services company. This financial institution uses a simple index strategy that can be built using Canadian bonds, Canadian equities and global equities. Here is a list of portfolios for various risk tolerances to replace your current mutual fund with a comparable ETF portfolio.

| Mutual Fund | Fund Code | MER | ETF | Ticker | MER |

|---|---|---|---|---|---|

| BMO SelectTrust Conservative Portfolio | BMO473 | 2.29% | BMO Conservative ETF | ZCON | 0.20% |

| BMO SelectTrust Balanced Portfolio | BMO474 | 2.40% | BMO Balanced ETF | ZBAL | 0.20% |

| BMO SelectTrust Growth Portfolio | BMO484 | 2.50% | BMO Growth ETF | ZGRO | 0.20% |

| BMO SelectTrust Equity Growth Portfolio | BMO485 | 2.61% | BMO All-Equity ETF | ZEQT | 0.20% |

Warren Buffet ETF Portfolio

The Warren Buffett Portfolio can be implemented with 2 ETFs. This portfolio has a very high risk, meaning it can experience significant fluctuations in value. It is suitable for investors with a high-risk tolerance who are seeking substantial returns and can withstand large drawdowns. The asset allocation is the following: 90% on the Stock Market and 10% on Fixed Income. In general, bonds are useful for mitigating overall portfolio risk, especially if they are issued by national entities or highly reliable companies. This portfolio has a 10% allocation to bonds, leading to its classification as very high risk.

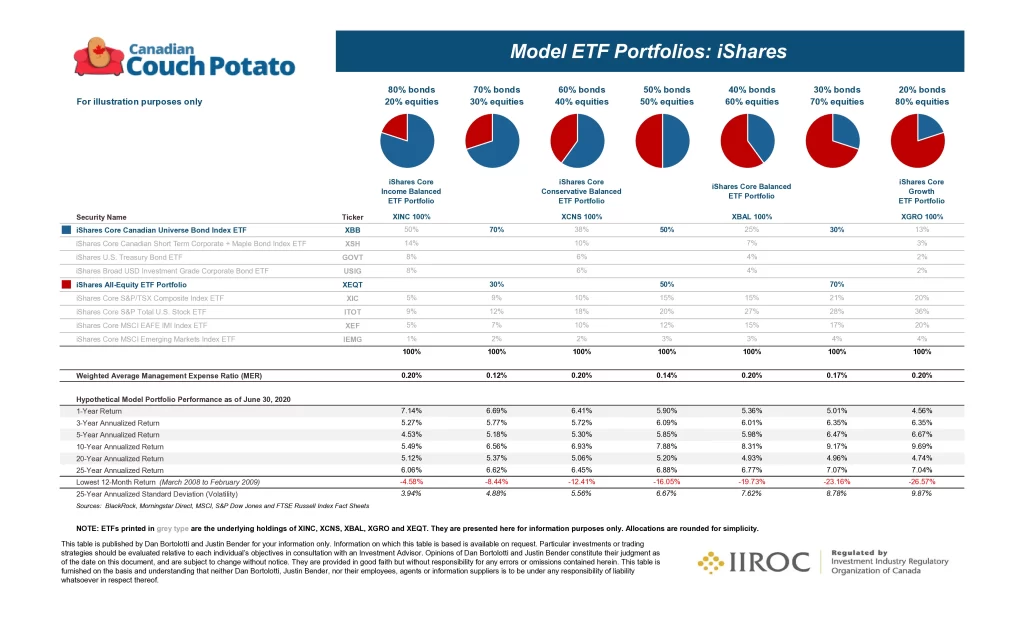

Canadian Couch Potato Model ETF Portfolios

Canadian Couch Potato is a basic guide to index investing. The formula for successful do-it-yourself investing is simple: diversify broadly, keep your costs low, and stick to your plan over the long term. Asset allocation ETFs tick all of these boxes. If your chosen asset mix is 100%, 80%, 60%, 40% or 20% stocks, then you can build your portfolio with a single asset allocation ETF. With this one-fund solution, you’ll never need to rebalance your portfolio. Here is a list of model portfolios for various risk tolerances to help you build an ETF portfolio.

| Risk Tolerance | Stocks | Bonds | BlackRock | BMO | Vanguard |

|---|---|---|---|---|---|

| Income | 20% | 80% | XINC | N/A | VCIP |

| Conservative | 40% | 60% | XCNS | ZCON | VCNS |

| Balanced | 60% | 40% | XBAL | ZBAL | VBAL |

| Growth | 80% | 20% | XGRO | ZGRO | VGRO |

| All-Equity | 100% | 0% | XEQT | ZEQT | VEQT |

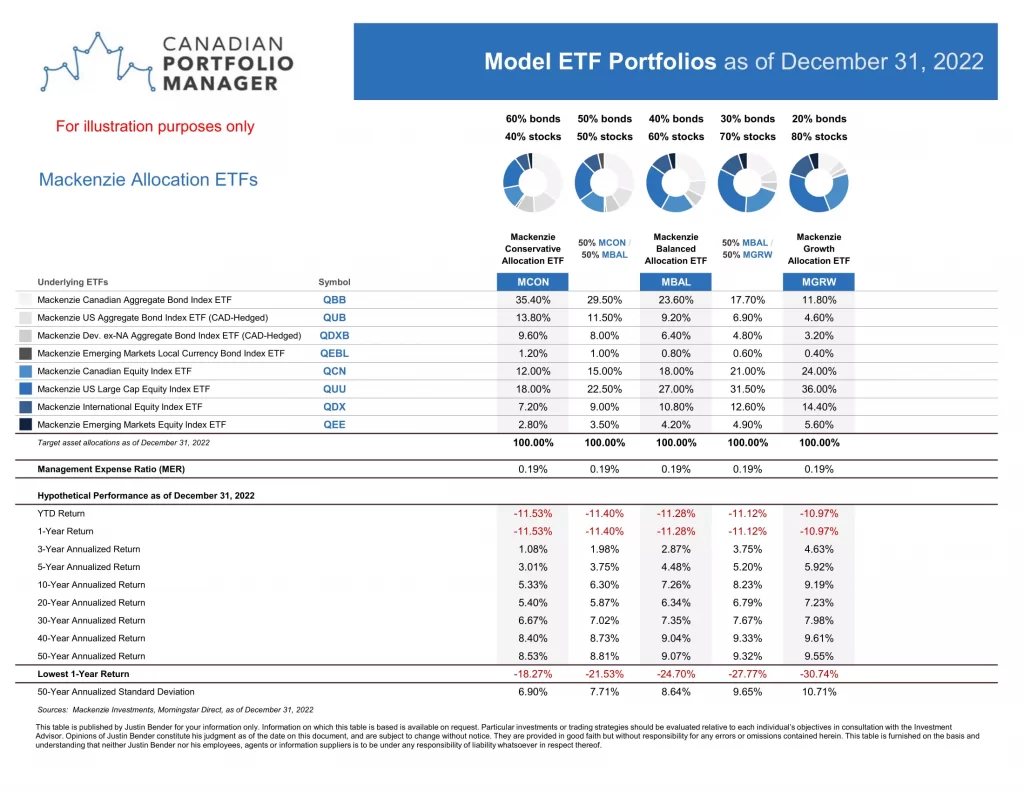

Canadian Portfolio Manager Model ETF Portfolios

The Canadian Portfolio Manager blog helps new and seasoned DIY investors implement and manage their own ETF portfolio. Here is a list of model portfolios for various risk tolerances to help you build an ETF portfolio.

| Risk Tolerance | Stocks | Bonds | BlackRock | BMO | Mackenzie | Vanguard |

|---|---|---|---|---|---|---|

| Income | 20% | 80% | XINC | N/A | N/A | VCIP |

| Conservative | 40% | 60% | XCNS | ZCON | MCON | VCNS |

| Balanced | 60% | 40% | XBAL | ZBAL | MBAL | VBAL |

| Growth | 80% | 20% | XGRO | ZGRO | MGRW | VGRO |

| All-Equity | 100% | 0% | XEQT | ZEQT | N/A | VEQT |

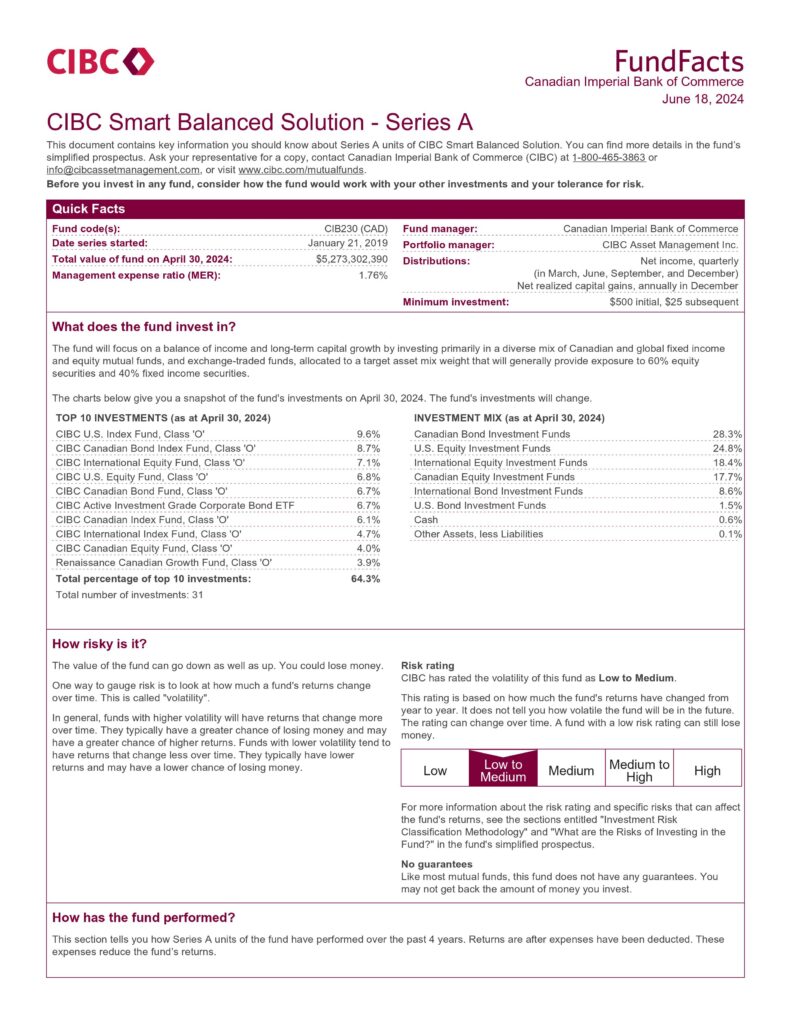

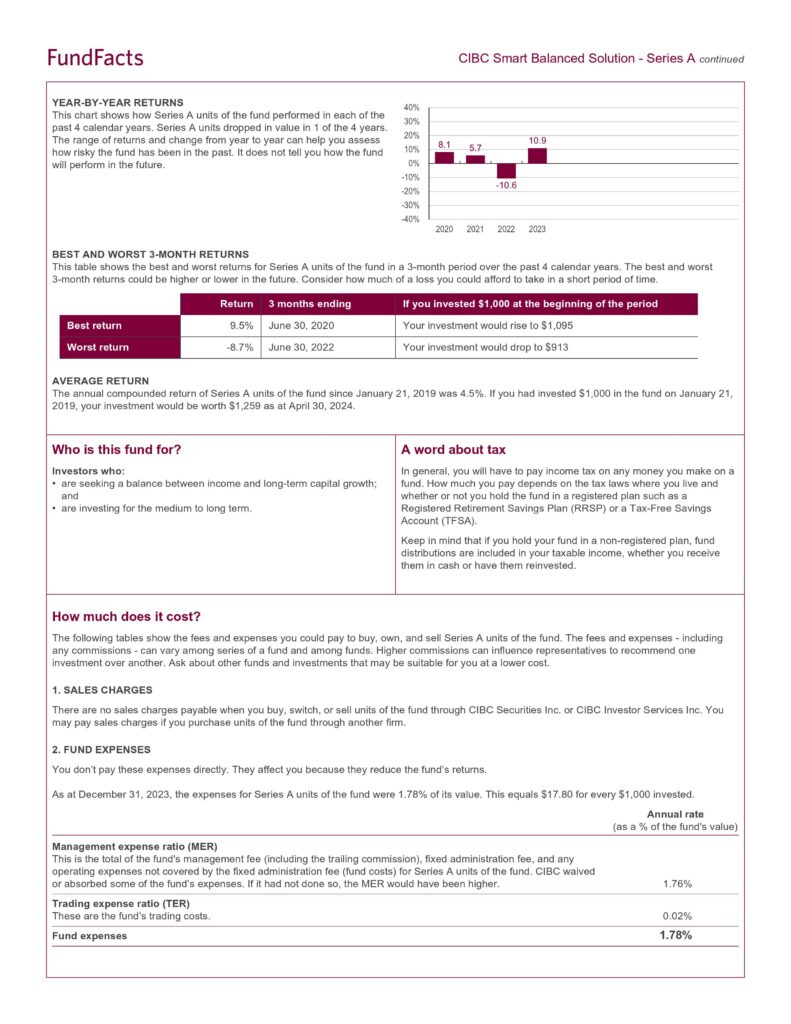

CIBC Model ETF Portfolios

Canadian Imperial Bank of Commerce is a Canadian multinational banking and financial services corporation headquartered at CIBC Square in the Financial District of Toronto, Ontario. This financial institution uses a simple index strategy that can be built using Canadian bonds and global equities. Here is a list of portfolios for various risk tolerances to replace your current mutual fund with a comparable ETF portfolio.

| Mutual Fund | Fund Code | MER | VAB | XWD |

|---|---|---|---|---|

| CIBC Smart Income Solution | CIB210 | 1.62% | 75% | 25% |

| CIBC Smart Balanced Income Solution | CIB220 | 1.67% | 60% | 40% |

| CIBC Smart Balanced Solution | CIB230 | 1.77% | 40% | 60% |

| CIBC Smart Balanced Growth Solution | CIB240 | 1.82% | 25% | 75% |

| CIBC Smart Growth Solution | CIB250 | 1.93% | 10% | 90% |

Ray Dalio All Weather Portfolio

The Ray Dalio All Weather Portfolio can be implemented with 5 ETFs. It is suitable for investors with a balanced approach to risk and return, seeking steady growth while tolerating some level of volatility. The asset allocation is 30% on the Stock Market, 55% on Fixed Income, and 15% on Commodities.

| ETF | Name | Weight |

|---|---|---|

| VTI | Vanguard Total Stock Market Index Fund ETF | 30% |

| TLT | iShares 20+ Year Treasury Bond ETF | 40% |

| IEI | iShares 3-7 Year Treasury Bond ETF | 15% |

| GLD | SPDR Gold Shares | 7.5% |

| PDBC | Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF | 7.5% |

Golden Butterfly Portfolio

The golden butterfly portfolio asset allocation is the following: 40% on the Stock Market, 40% on Fixed Income, 20% on Commodities. In general, bonds are useful for mitigating overall portfolio risk, especially if they are issued by national entities or highly reliable companies. This portfolio has a 40% allocation to bonds, leading to its classification as high risk.

| ETF | Name | Weight |

|---|---|---|

| VTI | Vanguard Total Stock Market Index Fund ETF | 20% |

| AVUV | Avantis US Small Cap Value ETF | 20% |

| TLT | iShares 20+ Year Treasury Bond ETF | 20% |

| SHY | iShares 1-3 Year Treasury Bond ETF | 20% |

| GLD | SPDR Gold Shares | 20% |

Good Investing Model ETF Portfolios

Sustainable investing aims to make intentional decisions about where they’re investing their money. Here is a list of Good Investing model portfolios for various risk tolerances to help you build an ETF portfolio.

| Strategy | AGSG | CESG.B | DRCU | DRFG | ETHI | GBAL | HGGB | QCLN | ZCLN | ZESG | ZGB | N/A |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| The Organic Couch Potato Pie | 15% | 0% | 0% | 0% | 0% | 75% | 0% | 0% | 0% | 0% | 0% | 10% |

| De La Crème Pie | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 15% | 75% | 0% | 10% |

| Round the World Pie | 0% | 0% | 30% | 45% | 0% | 0% | 0% | 15% | 0% | 0% | 0% | 0% |

| Crunchy Granola Pie | 0% | 20% | 0% | 0% | 40% | 0% | 0% | 0% | 0% | 0% | 30% | 10% |

Libro Model ETF Portfolios

Libro Credit Union, Libro, or Libro Credit Union Limited, is a credit union based in London, Ontario, Canada. Libro is owned by its customers, who direct the institution’s decisions. Libro offers many financial services, including chequing and savings accounts, loans, mortgages, investments, financial coaching and advice for consumers and farm and business owners. This financial institution uses a simple index strategy that can be built using Canadian bonds, Canadian equities and global equities. Here is a list of portfolios for various risk tolerances to replace your current mutual fund with a comparable ETF portfolio.

| Mutual Fund | Fund Code | MER | VAB | ZLB | XWD |

|---|---|---|---|---|---|

| NEI Select Income RS Portfolio | NWT024 | 1.80% | 75% | 7% | 18% |

| NEI Select Income & Growth RS Portfolio | NWT014 | 2.03% | 60% | 12% | 28% |

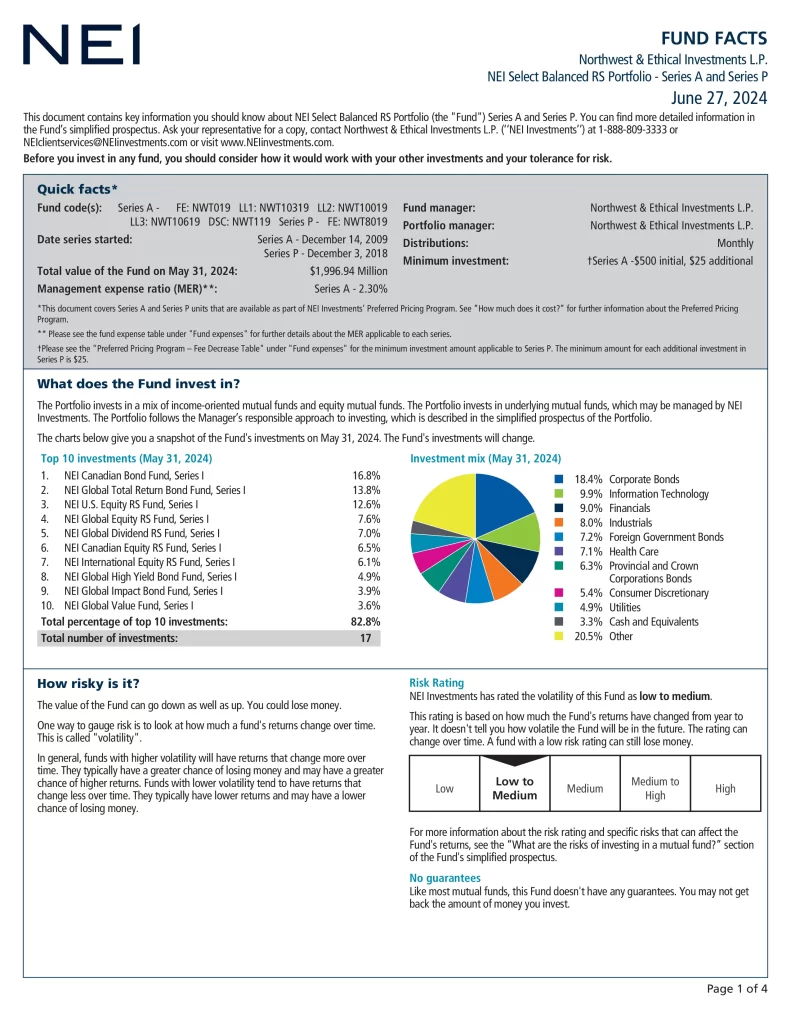

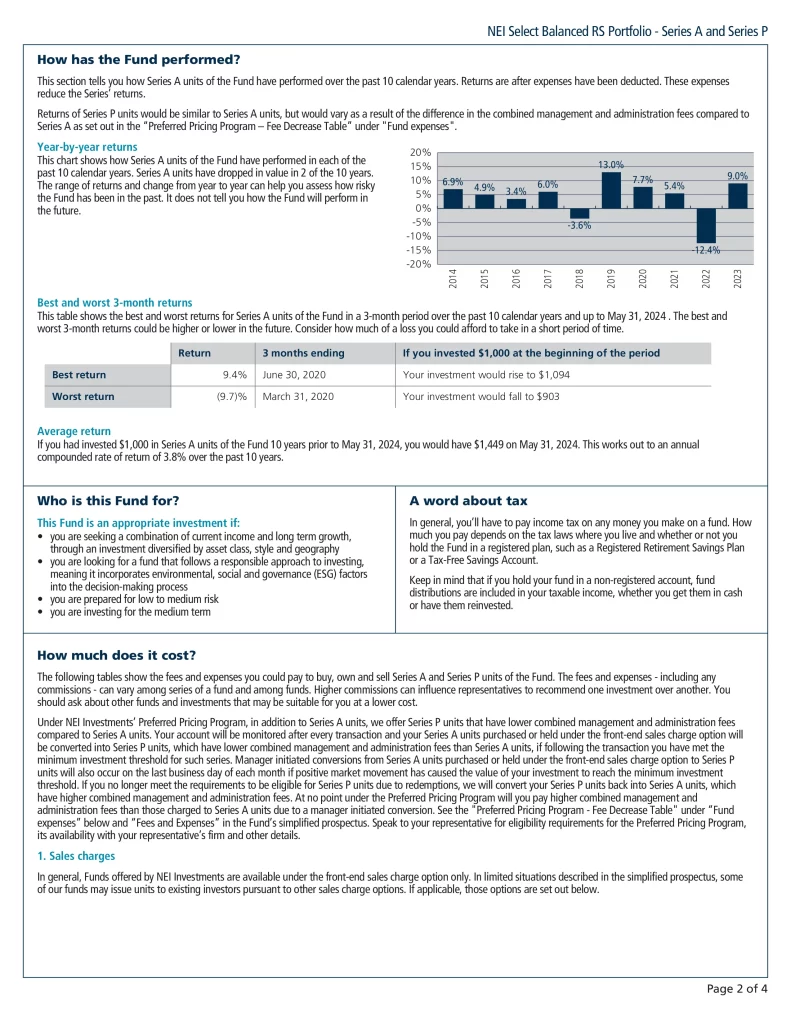

| NEI Select Balanced RS Portfolio | NWT019 | 2.44% | 40% | 15% | 45% |

| NEI Select Growth & Income RS Portfolio | NWT008 | 2.36% | 30% | 15% | 55% |

| NEI Select Growth RS Portfolio | NWT020 | 2.54% | 15% | 17% | 68% |

| NEI Select Maximum Growth RS Portfolio | NWT90012 | 2.45% | 0% | 20% | 80% |

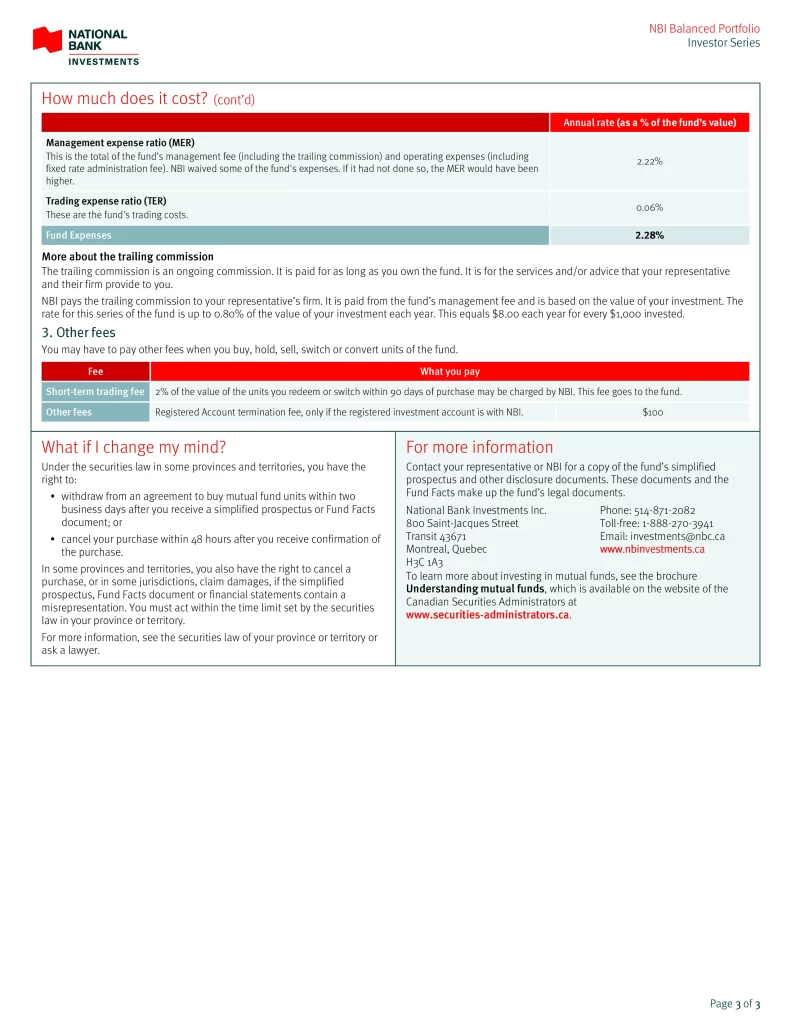

National Bank Model ETF Portfolios

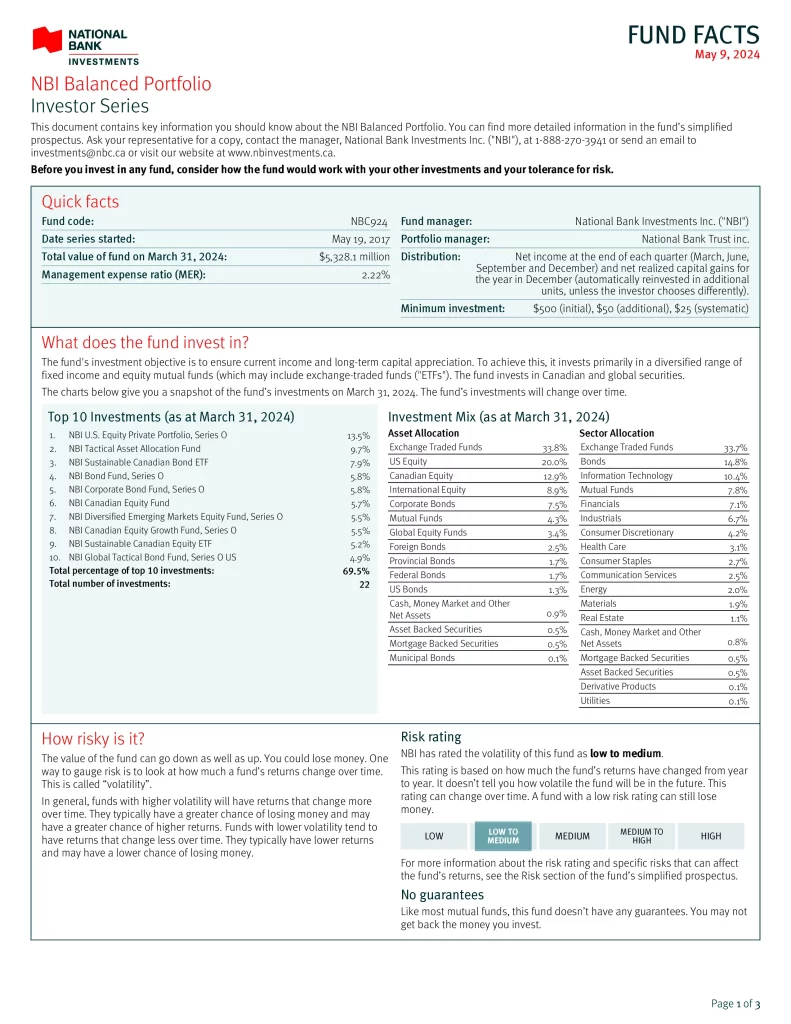

The National Bank of Canada is the sixth largest commercial bank in Canada. It is headquartered in Montreal, and has branches in most Canadian provinces and 2.4 million personal clients. National Bank is the largest bank in Quebec, and the second largest financial institution in the province, after Desjardins credit union. This financial institution uses a simple index strategy that can be built using Canadian bonds, Canadian equities, American equities, European equities and emerging markets equities. Here is a list of portfolios for various risk tolerances to replace your current mutual fund with a comparable ETF portfolio.

| Mutual Fund | Fund Code | MER | VAB | ZLB | HXX | CWO | XUS |

|---|---|---|---|---|---|---|---|

| NBI Secure Portfolio | NBC921 | 1.88% | 80% | 7% | 4% | 2% | 7% |

| NBI Conservative Portfolio | NBC922 | 1.93% | 70% | 10.5% | 6% | 3% | 10.5% |

| NBI Moderate Portfolio | NBC923 | 2.05% | 55% | 15.75% | 9% | 4.5% | 15.75% |

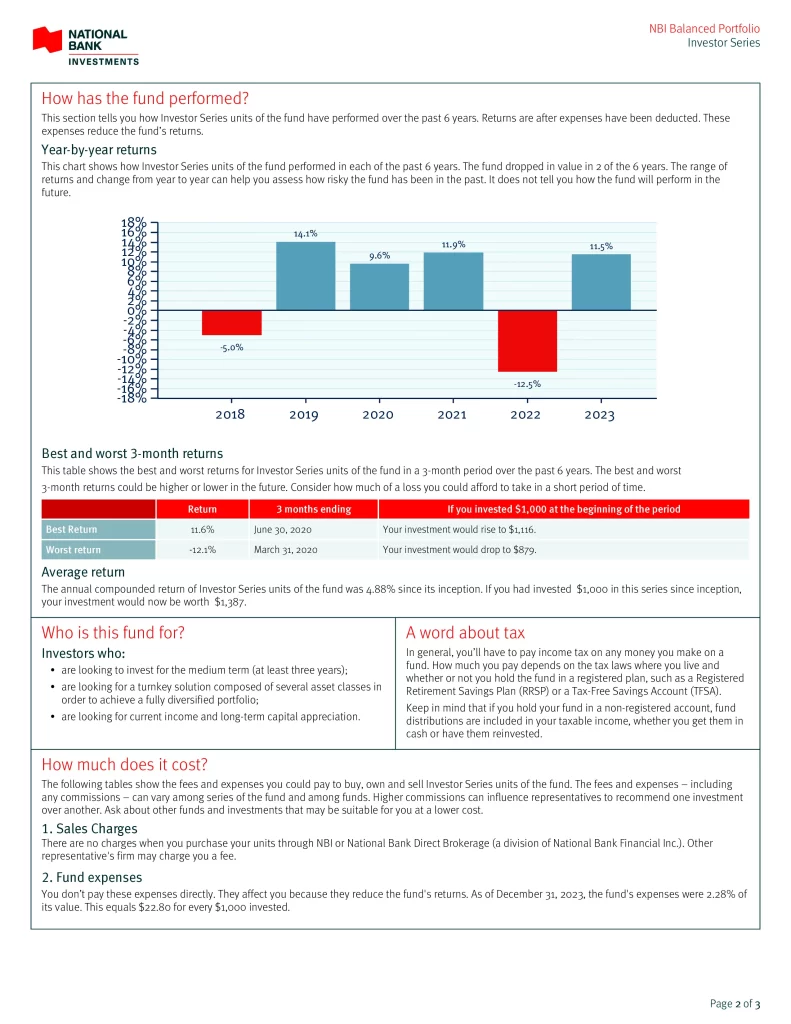

| NBI Balanced Portfolio | NBC924 | 2.23% | 40% | 21% | 12% | 6% | 21% |

| NBI Growth Portfolio | NBC925 | 2.41% | 20% | 28% | 16% | 8% | 28% |

| NBI Equity Portfolio | NBC926 | 2.51% | 0% | 35% | 20% | 10% | 35% |

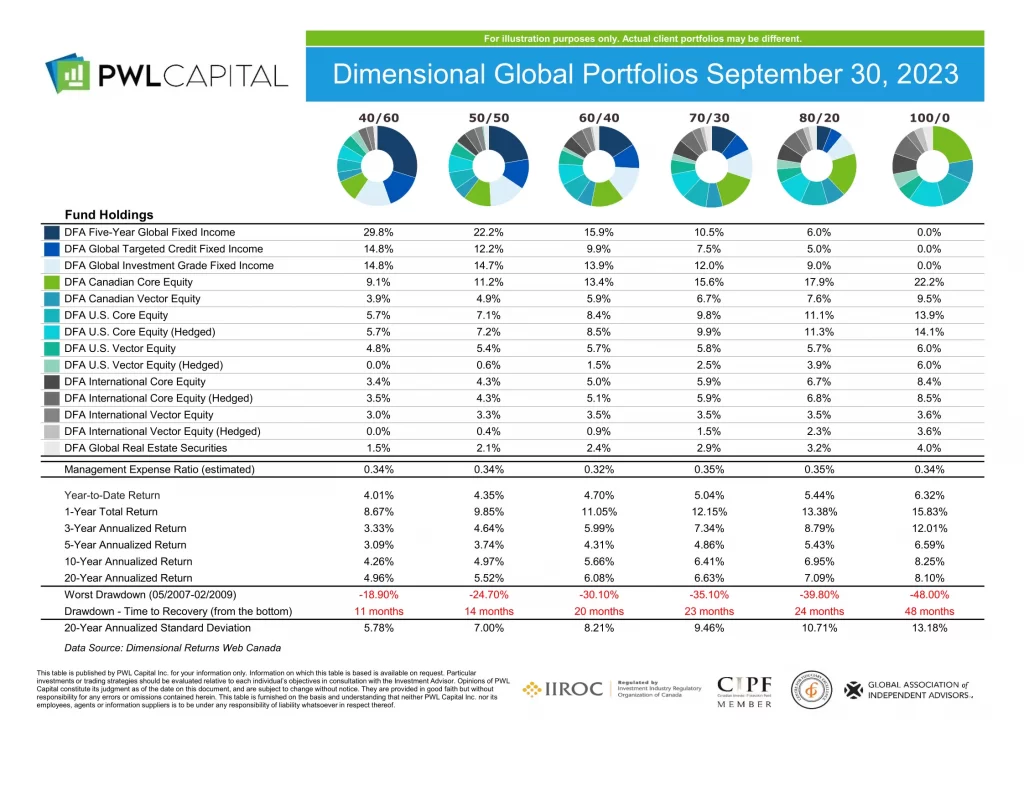

PWL Capital Model ETF Portfolios (Dimensional)

PWL Capital offers wealth management services, simplifying wealth for Canadians. Helping you frame financial decisions through the lens of living a good life. PWL offers a personalized approach to wealth management that lets their clients define their financial and family goals based on their lifestyles. They integrate financial planning and investment management so our advisors can develop targeted strategies and provide each customer with a unique experience. Their teams specialize in serving high net worth (HNW) clients, with the expertise and experience to oversee every aspect of your financial life. Here is a list of model portfolios for various risk tolerances to help you build an ETF portfolio.

Rational Reminder Model ETF Portfolios (Ben Felix)

Ben Felix is a portfolio manager at PWL Capital in Canada. He is perhaps better known for his YouTube channel and Rational Reminder podcast alongside Cameron Passmore. Felix is a proponent of research-based advice looking at the evidence and data to inform and optimize investing decisions. Here is a list of model portfolios for various risk tolerances to help you build an ETF portfolio.

| Risk Tolerance | ZAG | XIC | VUN | AVUV | XEF | AVDV | XEC |

|---|---|---|---|---|---|---|---|

| 40/60 | 60.0% | 12.0% | 12.0% | 4.0% | 6.4% | 2.4% | 3.2% |

| 50/50 | 50.0% | 15.0% | 15.0% | 5.0% | 8.0% | 3.0% | 4.0% |

| 60/40 | 40.0% | 18.0% | 18.0% | 6.0% | 9.6% | 3.6% | 4.8% |

| 70/30 | 30.0% | 21.0% | 21.0% | 7.0% | 11.2% | 4.2% | 5.6% |

| 80/20 | 20.0% | 24.0% | 24.0% | 8.0% | 12.8% | 4.8% | 6.4% |

| 100/0 | 0.0% | 30.0% | 30.0% | 10.0% | 16.0% | 6.0 | 8.0% |

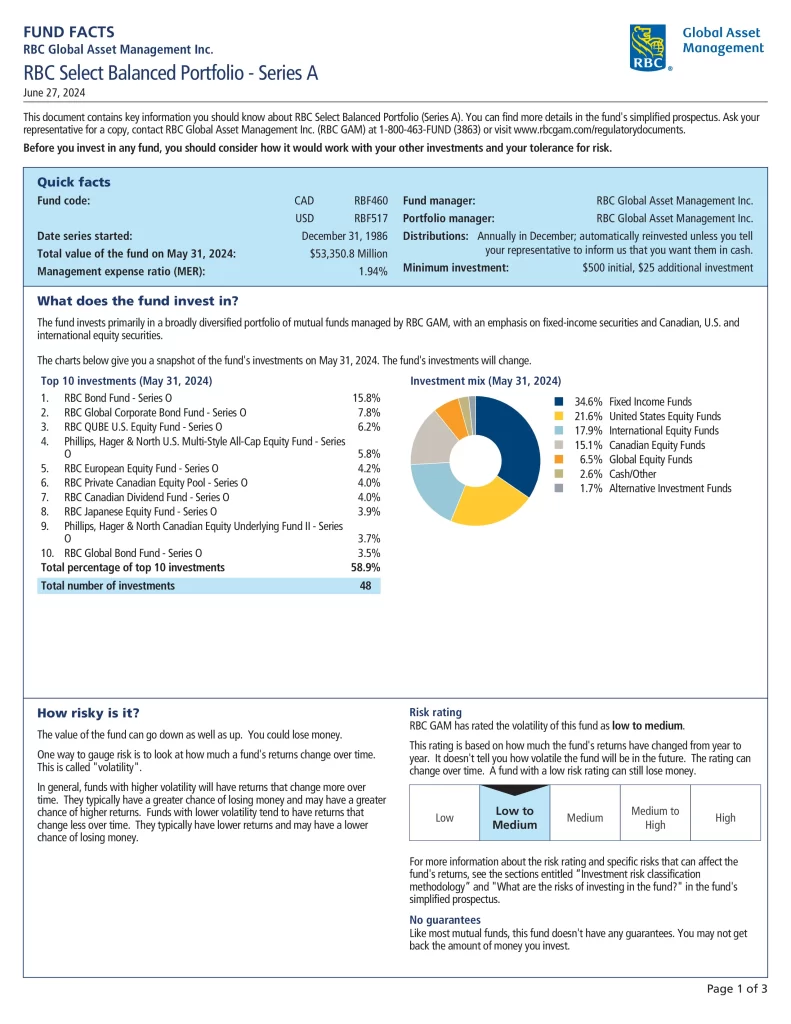

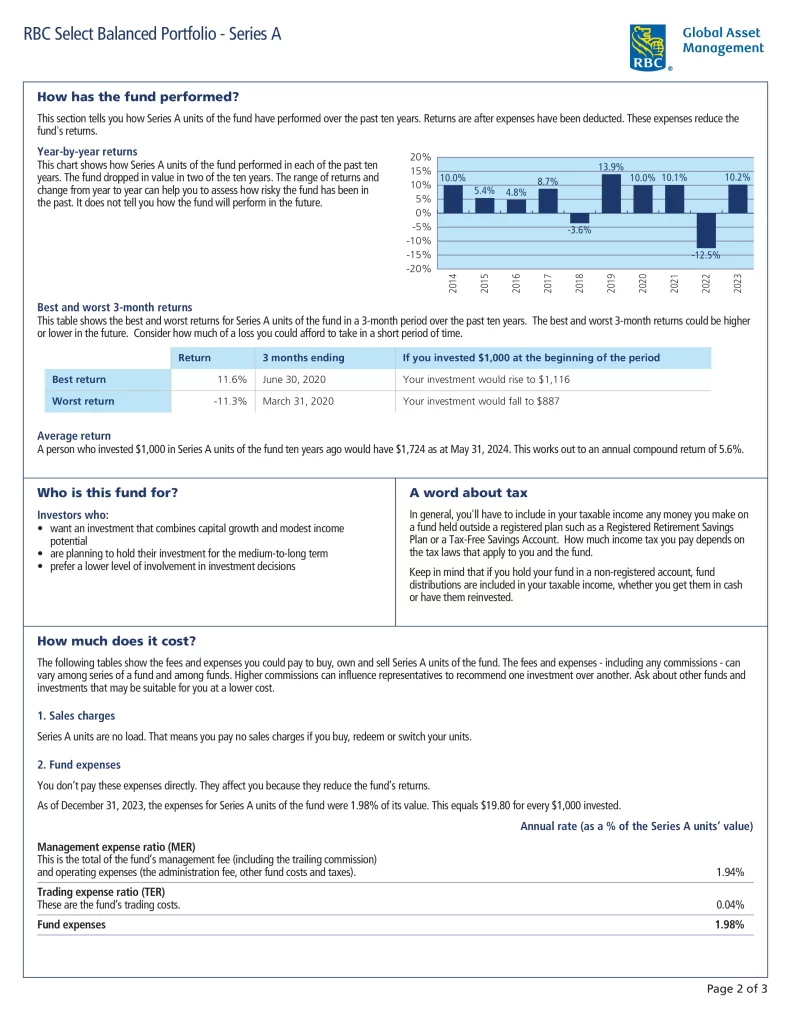

RBC Model ETF Portfolios

Royal Bank of Canada is a Canadian multinational financial services company and the largest bank in Canada by market capitalization. The bank serves over 17 million clients and has more than 89,000 employees worldwide. Founded in 1864 in Halifax, Nova Scotia, it maintains its corporate headquarters in Toronto and its head office in Montreal. This financial institution uses a simple index strategy that can be built using a diversified mix of cash, bonds and equities equities. Here is a list of portfolios for various risk tolerances to replace your current mutual fund with a comparable ETF portfolio.

| Mutual Fund | Fund Code | MER | VAB | ZLB | XUS | HXX | PSA | CJP | ZID | CWO |

|---|---|---|---|---|---|---|---|---|---|---|

| RBC Select Very Conservative Portfolio | RBF209 | 1.69% | 73% | 10% | 8% | 3.5% | 2% | 1.9% | 1.6% | 0% |

| RBC Select Conservative Portfolio | RBF461 | 1.84% | 58% | 13% | 15% | 6% | 2% | 3.25% | 2.75% | 0% |

| RBC Select Balanced Portfolio | RBF460 | 1.94% | 38% | 15% | 25% | 7.5% | 2% | 4% | 3.5% | 5% |

| RBC Select Growth Portfolio | RBF459 | 2.04% | 23% | 18% | 30% | 9.5% | 2% | 5.1% | 4.4% | 8% |

| RBC Select Aggressive Growth Portfolio | RBF592 | 2.14% | 0% | 29% | 38% | 10% | 2% | 5.4% | 4.6% | 11% |

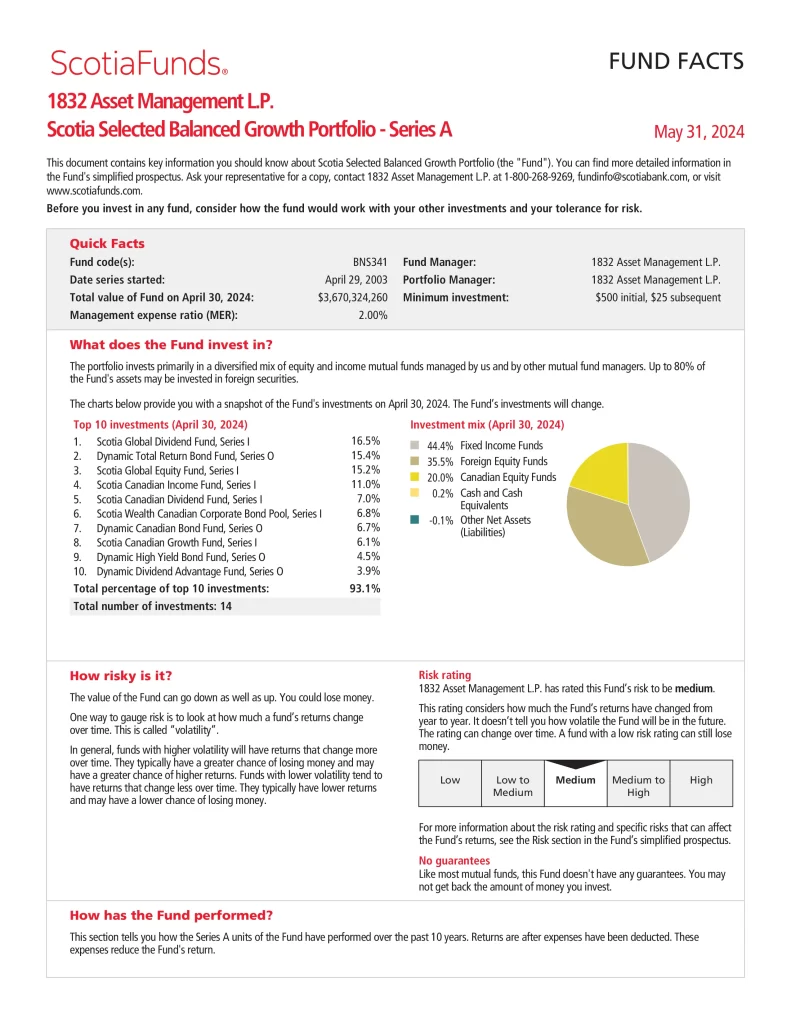

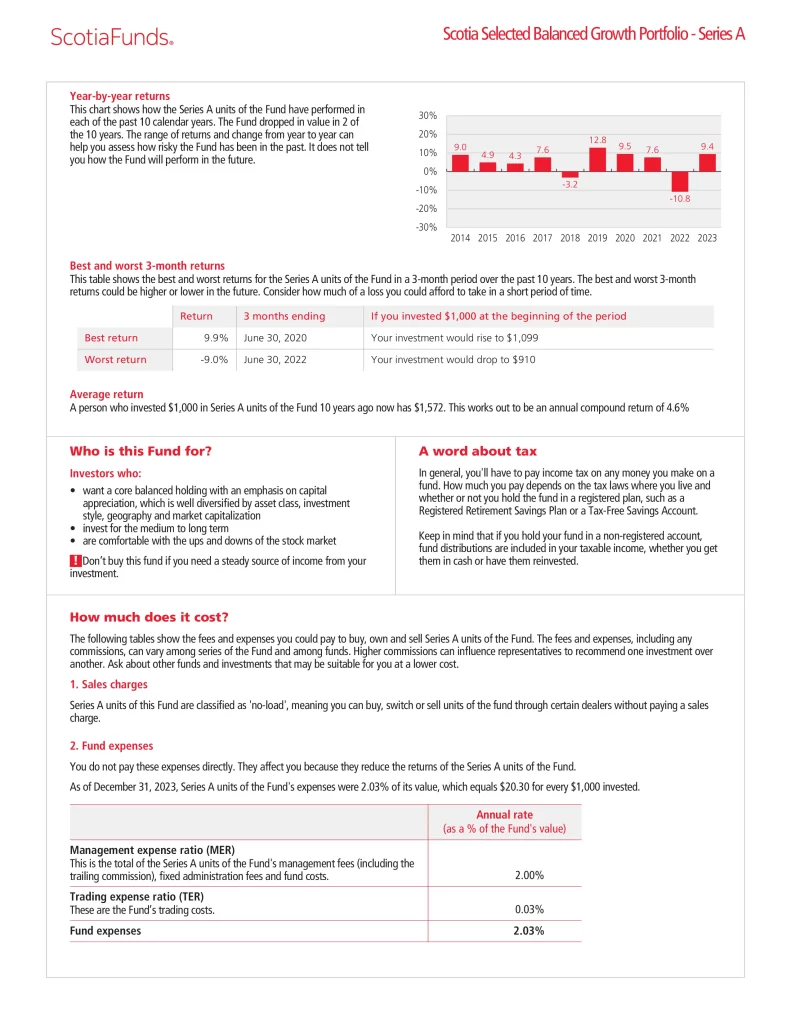

Scotiabank Model ETF Portfolios

This financial institution uses a simple index strategy that can be built using Canadian bonds, Canadian equities and global equities. Here is a list of portfolios for various risk tolerances to replace your current mutual fund with a comparable ETF portfolio.

| Mutual Fund | Fund Code | MER | VAB | ZLB | XWD |

|---|---|---|---|---|---|

| Scotia Selected Income Portfolio | BNS338 | 1.72% | 75% | 10% | 15% |

| Scotia Selected Balanced Income Portfolio | BNS340 | 1.83% | 65% | 15% | 20% |

| Scotia Selected Balanced Growth Portfolio | BNS341 | 1.94% | 45% | 22% | 33% |

| Scotia Selected Growth Portfolio | BNS342 | 2.04% | 25% | 30% | 45% |

| Scotia Selected Maximum Growth Portfolio | BNS344 | 2.16% | 10% | 27% | 63% |

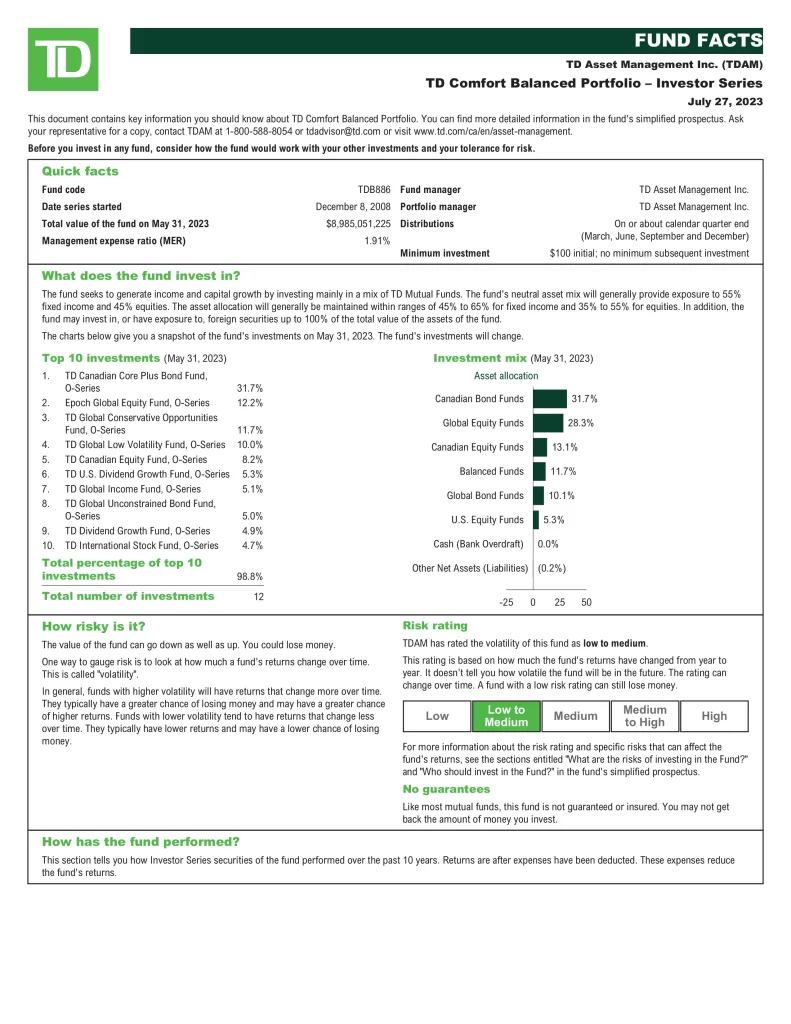

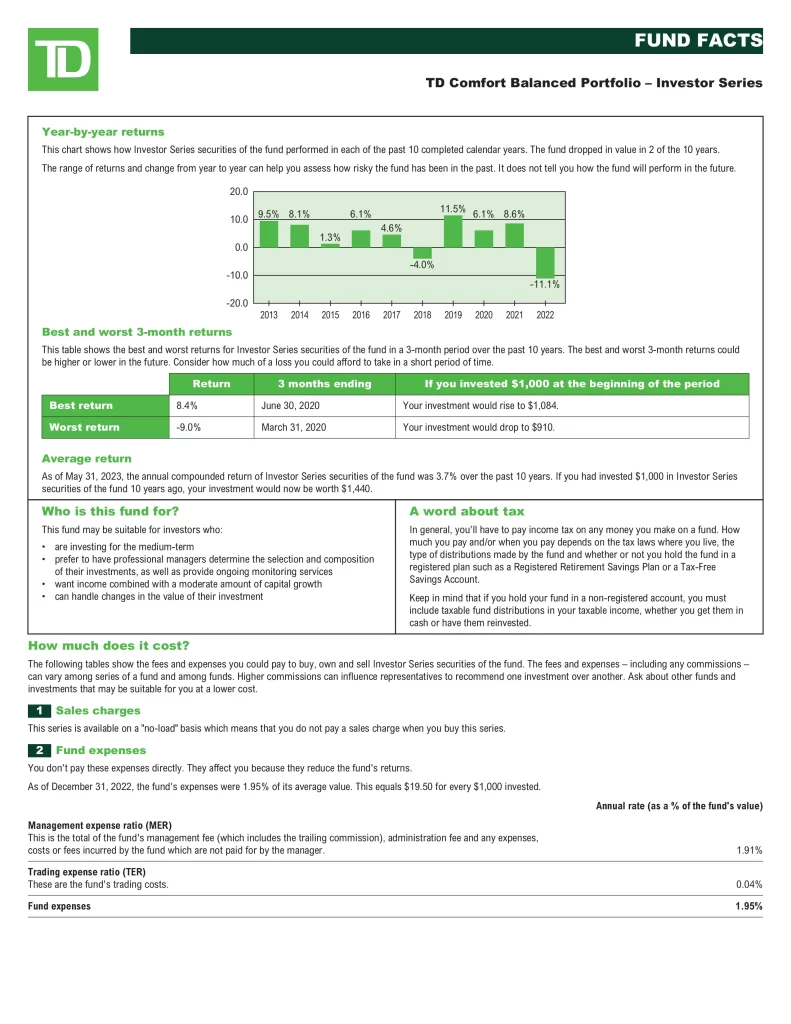

TD Model ETF Portfolios

This financial institution uses a simple index strategy that can be built using Canadian bonds, Canadian equities and global equities. Here is a list of portfolios for various risk tolerances to replace your current mutual fund with a comparable ETF portfolio.

| Mutual Fund | Fund Code | MER | VAB | ZLB | XWD |

|---|---|---|---|---|---|

| TD Comfort Conservative Income Portfolio | TDB2440 | 1.53% | 80% | 5% | 15% |

| TD Comfort Balanced Income Portfolio | TDB885 | 1.75% | 70% | 8% | 22% |

| TD Comfort Balanced Portfolio | TDB886 | 1.91% | 55% | 13% | 32% |

| TD Comfort Balanced Growth Portfolio | TDB887 | 2.02% | 40% | 16.5% | 43.5% |

| TD Comfort Growth Portfolio | TDB888 | 2.13% | 20% | 22.5% | 57.5% |

| TD Comfort Aggressive Growth Portfolio | TDB889 | 2.23% | 0% | 30% | 70% |

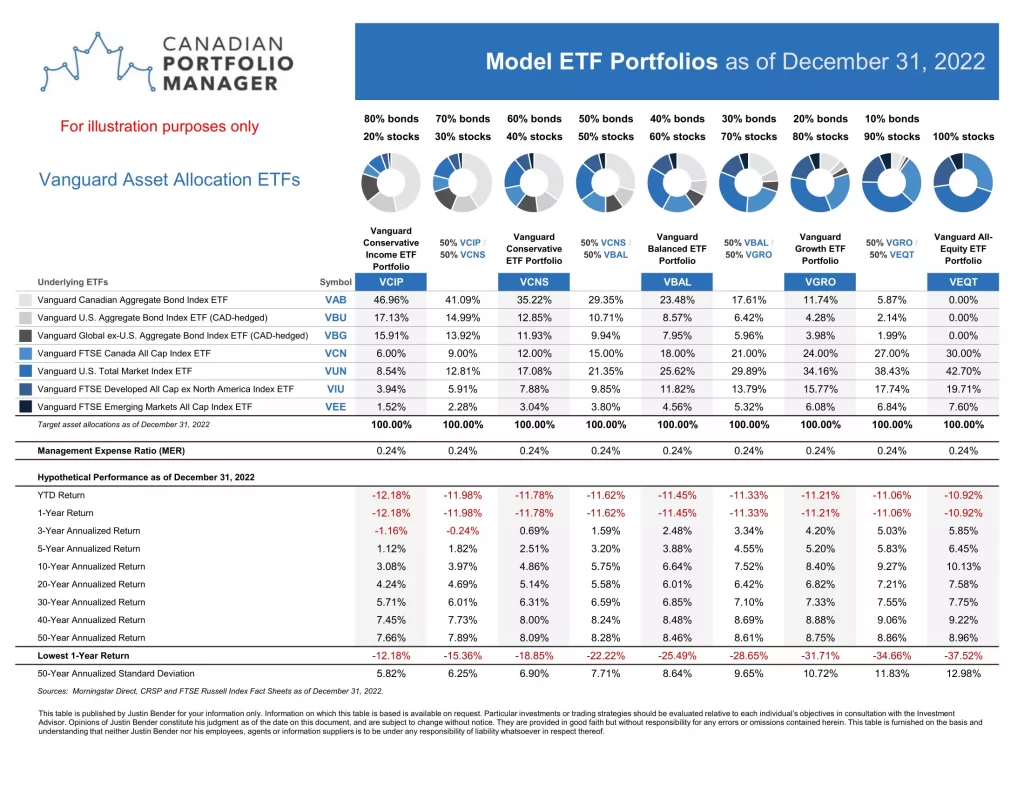

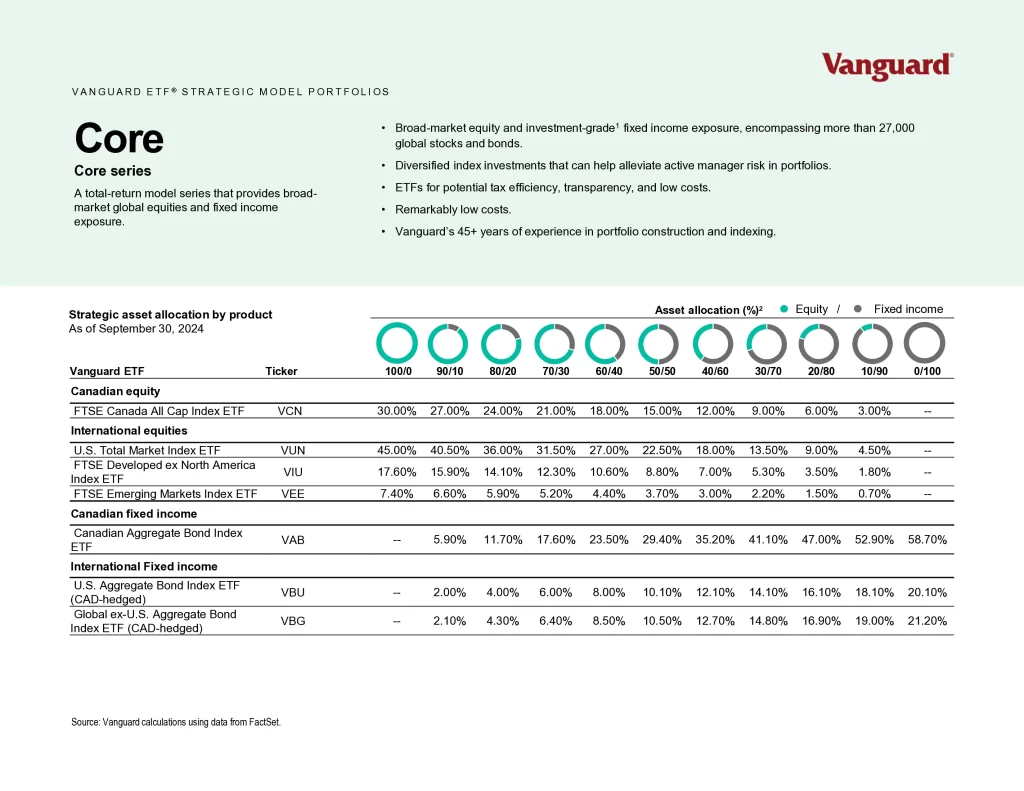

Vanguard ETF Strategic Model Porfolios

- Broad-market equity and investment-grade1 fixed income exposure, encompassing more than 27,000 global stocks and bonds.

- Diversified index investments that can help alleviate active manager risk in portfolios.

- Vanguard’s 45+ years of experience in portfolio construction and indexing.

- ETFs for potential tax efficiency, transparency, and low costs.

- Remarkably low costs.

Conclusion

Model portfolios can be great options for beginner investors looking for an ETF solution with their current mutual fund product. But before you invest your hard-earned money into a model portfolio, it’s important to understand how the portfolio works. You will also want to compare fees. The more knowledgeable you are, the better investment decisions you will make. Remember, ETF model portfolios are general descriptions and suggestions, and the specific allocations within each model portfolio can vary among investors with unique investment goals, risk tolerance and investing preferences.