Dividend exchange-traded funds (ETFs) focus on stocks with elevated yields, typically comprising established firms that distribute profits to shareholders rather than plowing them back into operations. These companies are often well-established blue-chip entities with a track record of dividend disbursements. Opting for monthly dividends can simplify cash flow management and aid in financial planning by furnishing a predictable income stream. Moreover, reinvesting these dividends can potentially amplify overall returns.

The widespread adoption of ETFs has democratized investing, offering a cost-effective avenue for entry-level investors. Yet, individuals seeking reliable income frequently gravitate toward dividend ETFs, which emphasize stocks with robust dividend yields. These ETFs furnish a steady income flow and are viewed as enduring investments, occasionally dispensing monthly dividend payouts. Nevertheless, it’s imperative to scrutinize the associated fees as they can impact the net returns.

What is the Best Monthly Dividend ETF in 2024?

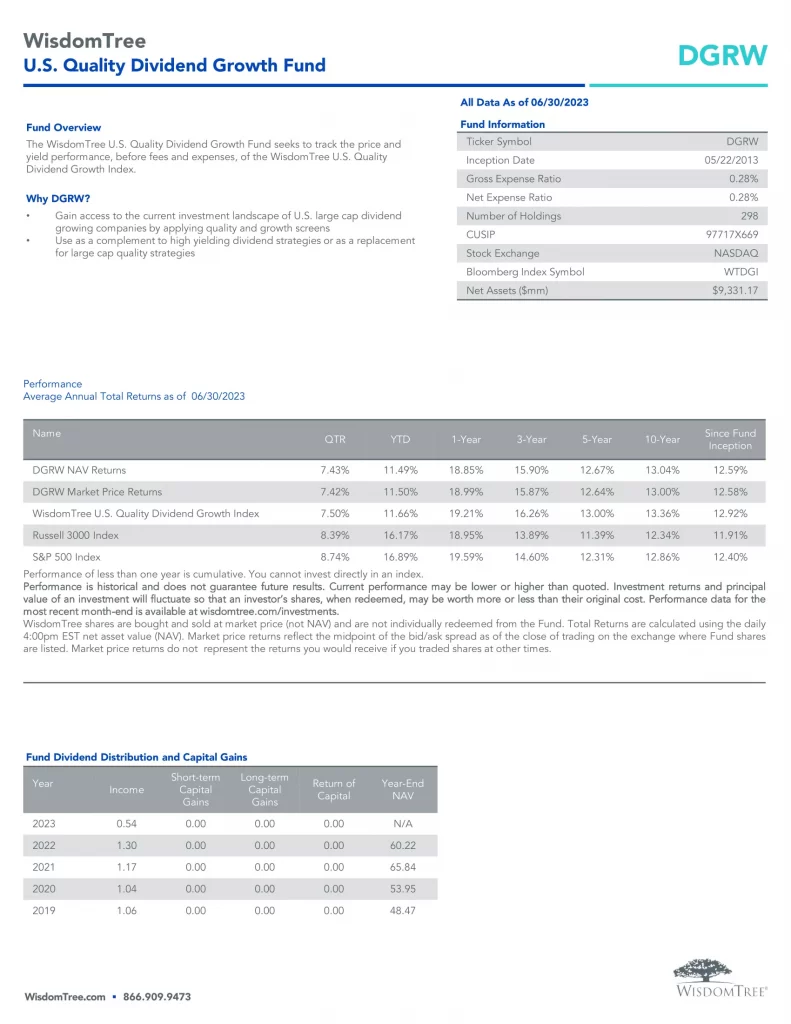

- DGRW: WisdomTree U.S. Quality Dividend Growth Fund

- DIVO: Amplify CWP Enhanced Dividend Income ETF

- DIA: SPDR Dow Jones Industrial Average ETF Trust

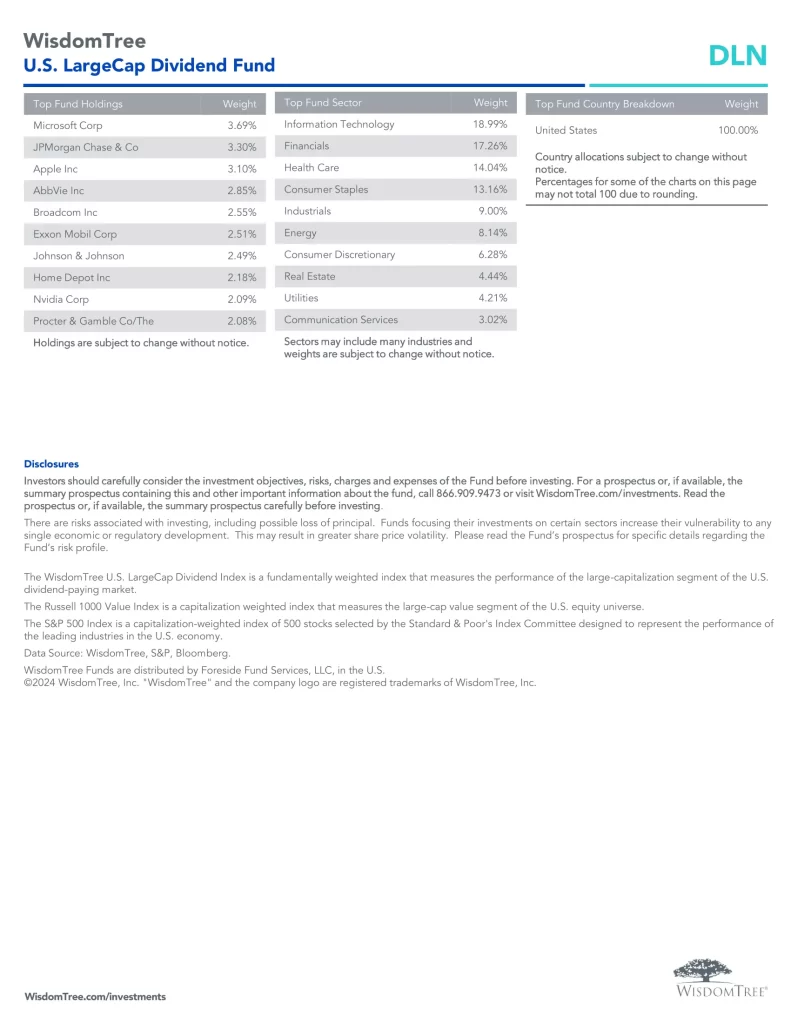

- DLN: WisdomTree U.S. LargeCap Dividend Fund

- DTD WisdomTree U.S. Total Dividend Fund

- QDIV: Global X S&P 500 Quality Dividend ETF

- PEY: Invesco High Yield Equity Dividend Achievers ETF

- DON: WisdomTree U.S. MidCap Dividend Fund

- DHS: WisdomTree U.S. High Dividend Fund

- SPHD: Invesco S&P 500 High Dividend Low Volatility ETF

| Ticker | Name | MER | 5Y | Yield |

|---|---|---|---|---|

| DGRW | WisdomTree U.S. Quality Dividend Growth Fund | 0.28% | 12.65% | 1.78% |

| DIVO | Amplify CWP Enhanced Dividend Income ETF | 0.55% | 12.10% | 4.57% |

| DIA | SPDR Dow Jones Industrial Average ETF Trust | 0.16% | 10.70% | 1.74% |

| DLN | WisdomTree U.S. LargeCap Dividend Fund | 0.28% | 9.37% | 2.25% |

| DTD | WisdomTree U.S. Total Dividend Fund | 0.28% | 8.91% | 2.39% |

| QDIV | Global X S&P 500 Quality Dividend ETF | 0.20% | 7.99% | 3.40% |

| PEY | Invesco High Yield Equity Dividend Achievers ETF | 0.52% | 6.95% | 4.83% |

| DON | WisdomTree U.S. MidCap Dividend Fund | 0.38% | 6.69% | 3.05% |

| DHS | WisdomTree U.S. High Dividend Fund | 0.38% | 5.91% | 4.39% |

| SPHD | Invesco S&P 500 High Dividend Low Volatility ETF | 0.30% | 4.06% | 4.56% |

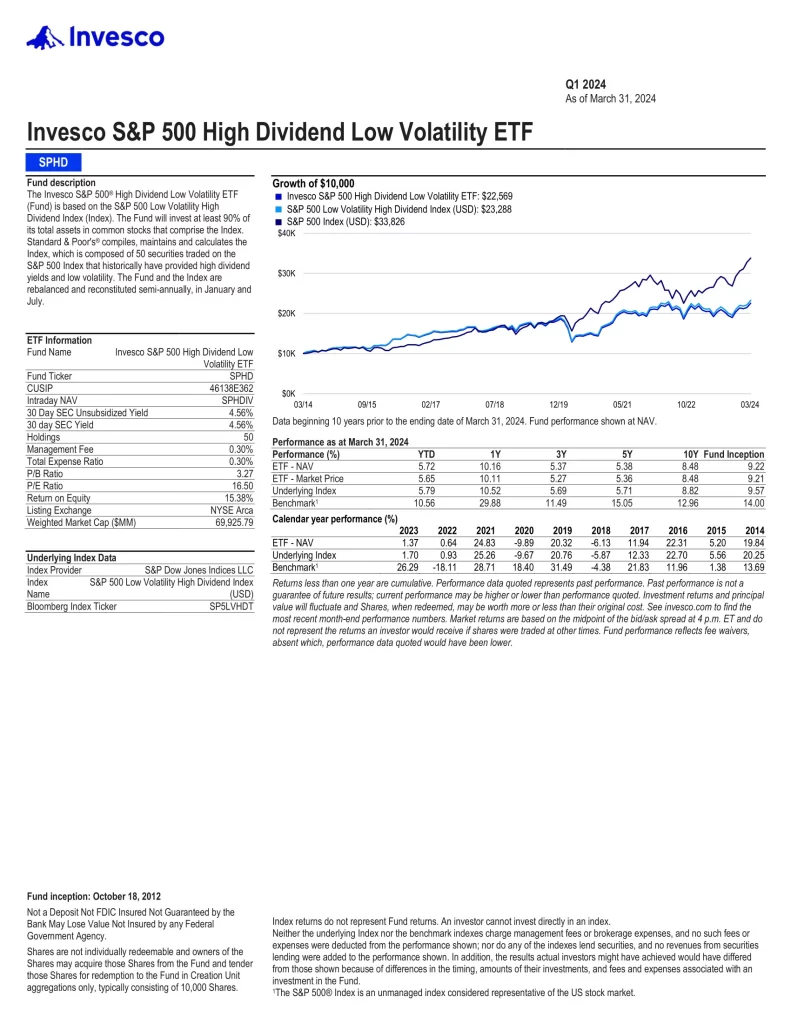

10. Invesco S&P 500 High Dividend Low Volatility ETF

The Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) is based on the S&P 500 Low Volatility High Dividend Index. The Fund will invest at least 90% of its total assets in common stocks that comprise the Index. Standard & Poor’s compiles, maintains and calculates the Index, which is composed of 50 securities traded on the S&P 500 Index that historically have provided high dividend yields and low volatility. The Fund and the Index are rebalanced and reconstituted semi-annually, in January and July.

Top 10 SPHD Holdings

| Ticker | Name | Weight |

|---|---|---|

| MO | Altria Group Inc | 3.15% |

| KMI | Kinder Morgan Inc | 2.89% |

| D | Dominion Energy Inc | 2.74% |

| T | AT&T Inc | 2.73% |

| VZ | Verizon Communications Inc | 2.73% |

| OKE | ONEOK Inc | 2.54% |

| PM | Philip Morris International Inc | 2.40% |

| WMB | Williams Cos Inc/The | 2.40% |

| MMM | 3M Co | 2.34% |

| DOW | Dow Inc | 2.29% |

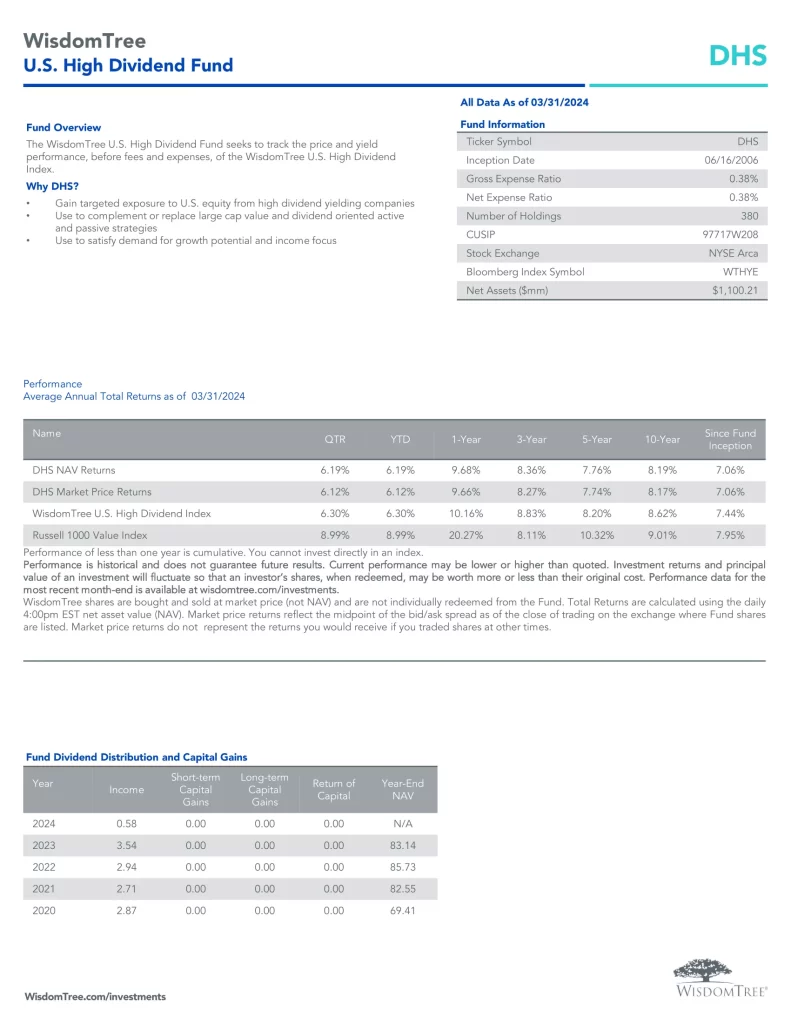

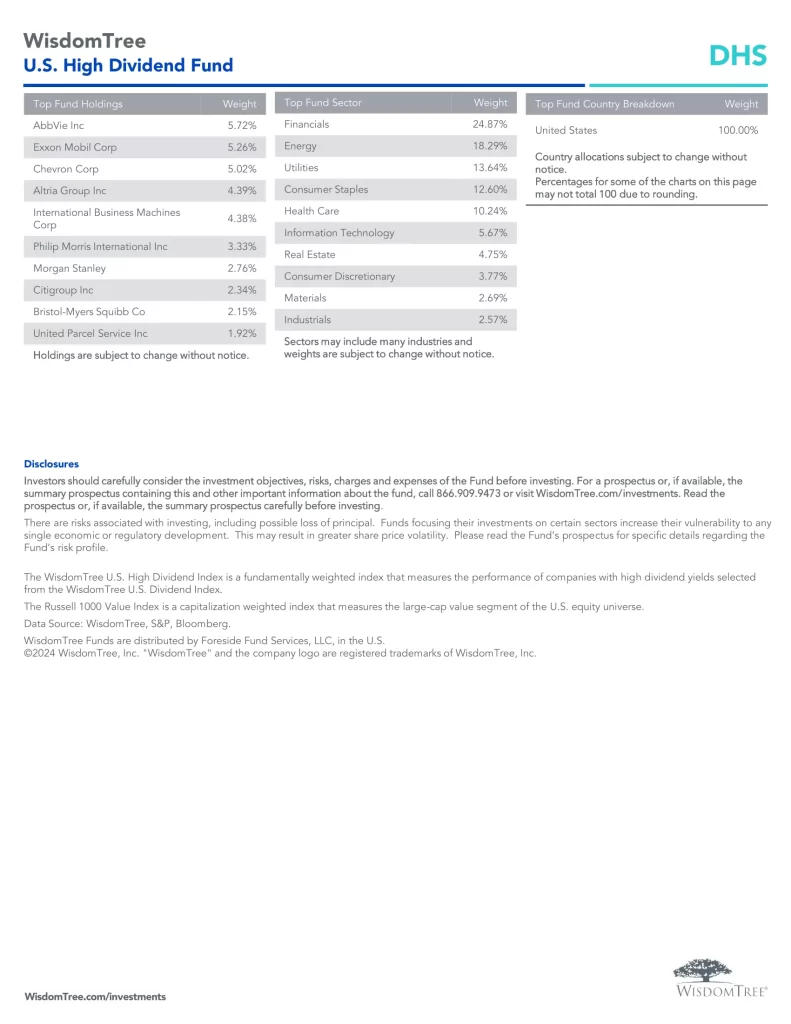

9. WisdomTree U.S. High Dividend Fund

WisdomTree U.S. High Dividend Fund seeks to track the investment results of high-dividend-yielding companies in the U.S. equity market.

- Gain targeted exposure to U.S. equity from high dividend yielding companies

- Use to complement or replace large cap value and dividend oriented active and passive strategies

- Use to satisfy demand for growth potential and income focus

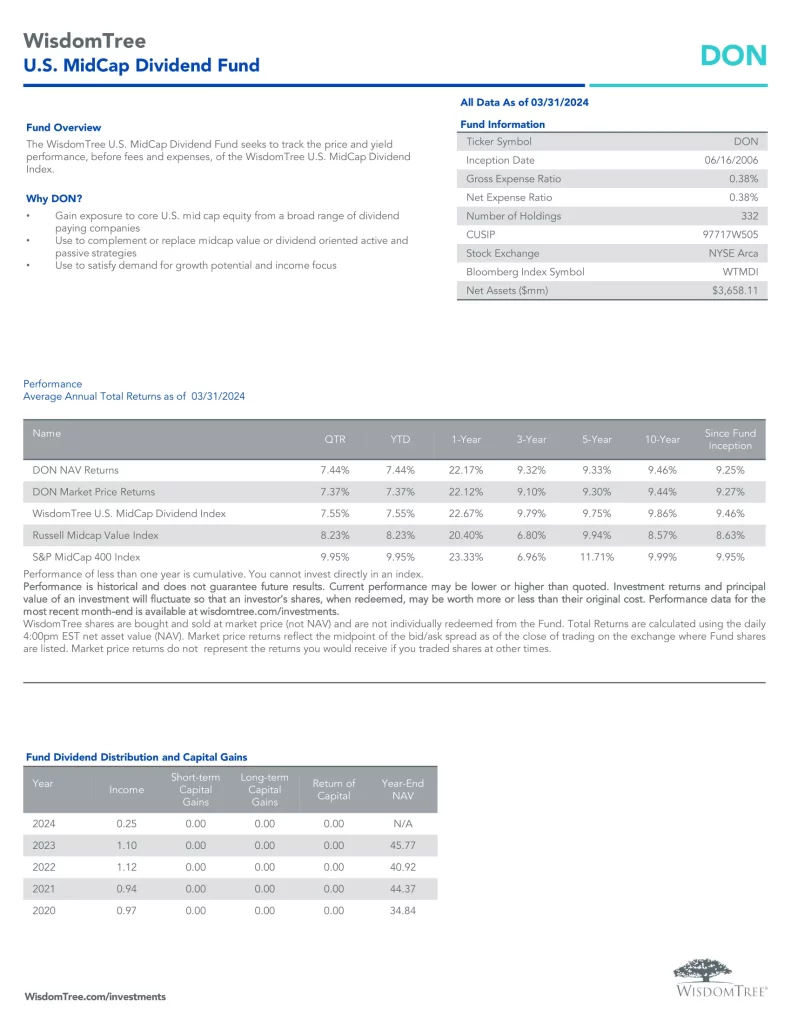

8. WisdomTree U.S. MidCap Dividend Fund

WisdomTree U.S. MidCap Dividend Fund (DON) seeks to track the investment results of dividend-paying mid-cap companies in the U.S. equity market.

- Gain exposure to core U.S. mid cap equity from a broad range of dividend paying companies

- Use to complement or replace midcap value or dividend oriented active and passive strategies

- Use to satisfy demand for growth potential and income focus

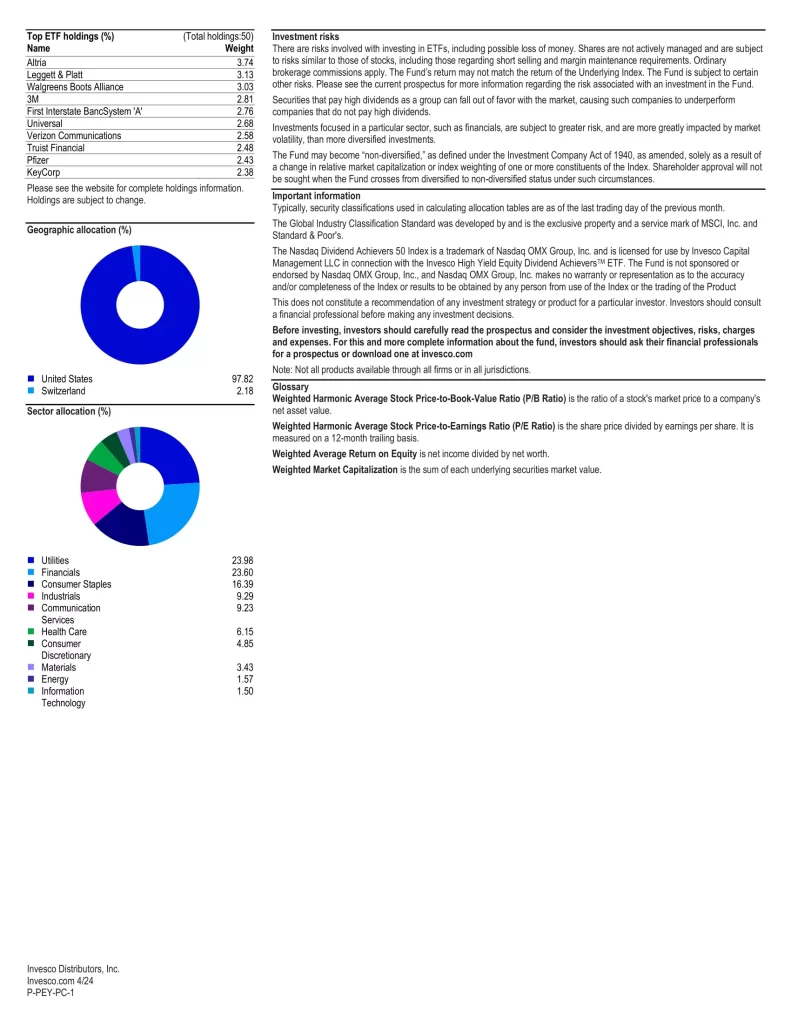

7. Invesco High Yield Equity Dividend Achievers ETF

The Invesco High Yield Equity Dividend Achievers ETF is based on the NASDAQ US Dividend Achievers 50 Index (Index). The Fund will normally invest at least 90% of its total assets in dividend-paying common stocks that comprise the Index. The Index is comprised of 50 stocks selected principally based on dividend yield and consistent growth in dividends. The Fund and the Index are reconstituted annually in March and rebalanced quarterly in March, June, September and December.

Top 10 PEY Holdings

| Ticker | Name | Weight |

|---|---|---|

| WBA | Walgreens Boots Alliance Inc | 2.44% |

| VZ | Verizon Communications Inc | 2.52% |

| UVV | Universal Corp/VA | 2.83% |

| TFC | Truist Financial Corp | 2.54% |

| TDS | Telephone and Data Systems Inc | 2.41% |

| PFE | Pfizer Inc | 2.48% |

| MO | Altria Group Inc | 3.89% |

| MMM | 3M Co | 2.65% |

| FIBK | First Interstate BancSystem Inc | 2.85% |

| AVA | Avista Corp | 2.44% |

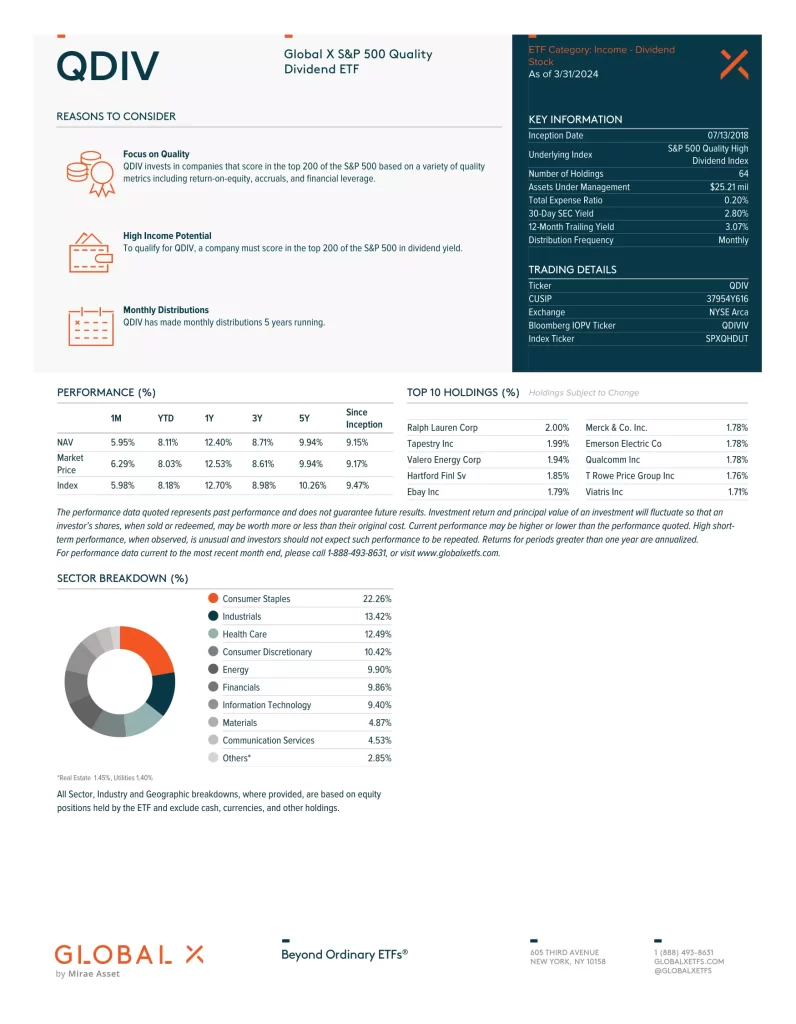

6. Global X S&P 500 Quality Dividend ETF

QDIV invests in companies that score in the top 200 of the S&P 500 based on a variety of quality metrics including return-on-equity, accruals, and financial leverage. QDIV has made monthly distributions 5 years running.

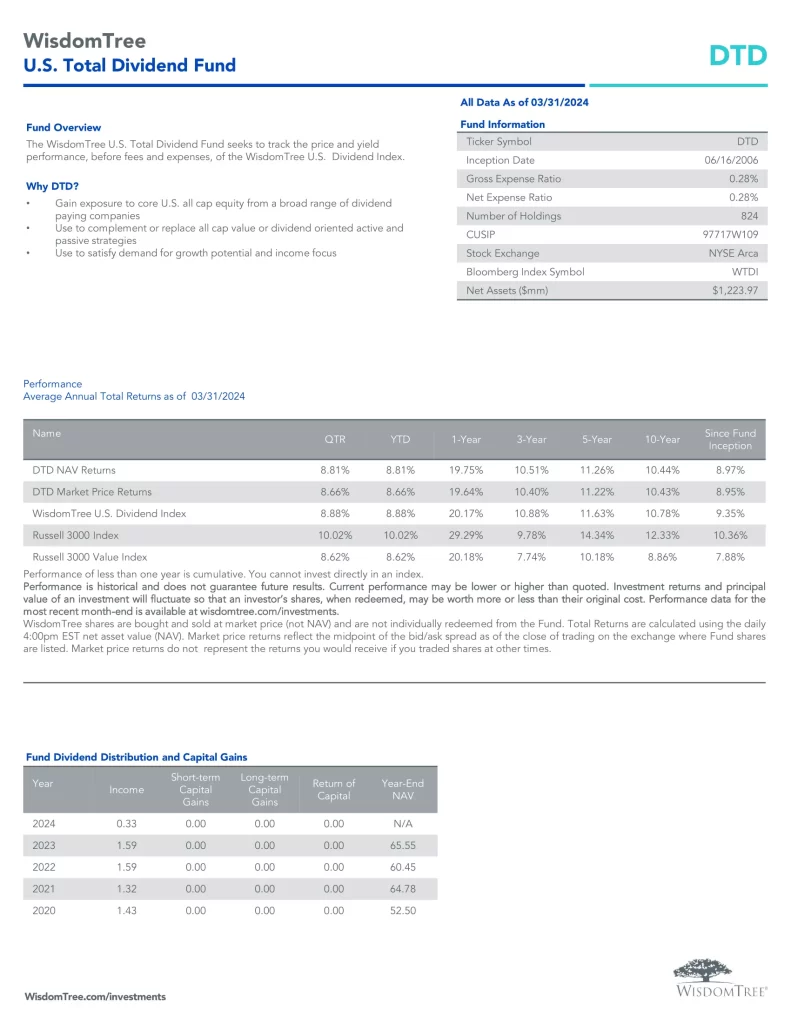

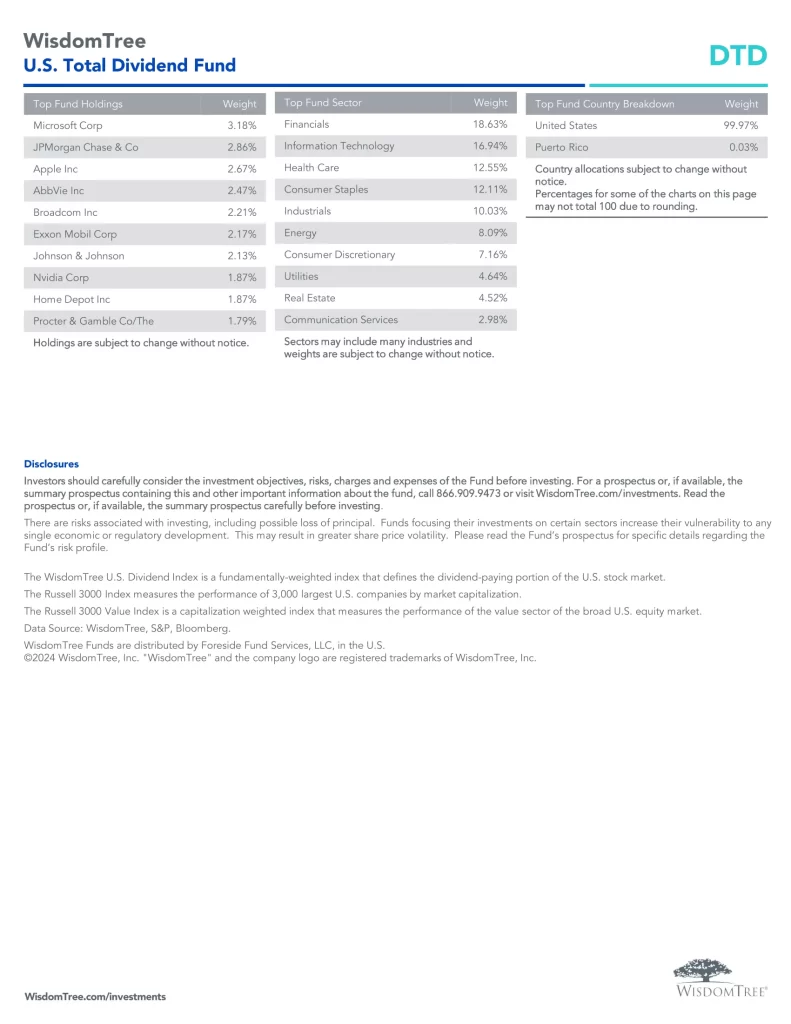

5. WisdomTree U.S. Total Dividend Fund

WisdomTree Total U.S. Dividend Fund seeks to track the investment results of broad dividend-paying companies in the U.S. equity market.

- Gain exposure to core U.S. all cap equity from a broad range of dividend paying companies

- Use to complement or replace all cap value or dividend oriented active and passive strategies

- Use to satisfy demand for growth potential and income focus

4. WisdomTree U.S. LargeCap Dividend Fund

WisdomTree U.S. LargeCap Dividend Fund seeks to track the investment results of dividend-paying large-cap companies in the U.S. equity market.

- Gain exposure to core U.S. large cap equity from dividend paying companies

- Use to complement or replace large cap value or dividend oriented active and passive strategies

- Use to satisfy demand for growth potential and income focus

3. SPDR Dow Jones Industrial Average ETF Trust

SPDR Dow Jones Industrial Average ETF Trust (DIA) is composed of thirty (30) “blue-chip” U.S. stocks. At 100-plus years, it is the oldest continuing U.S. market index. The DJIA has evolved into the most recognizable stock indicator in the world, and the only index composed of companies that have sustained earnings performance over a significant period.

2. Amplify CWP Enhanced Dividend Income ETF

DIVO is an actively managed ETF of high-quality large-cap companies with a history of dividend growth and a tactical covered call strategy on individual stocks. DIVO is strategically designed to offer high levels of total return on a risk-adjusted basis. DIVO seeks investment results that correspond generally to an existing strategy called the Enhanced Dividend Income Portfolio (EDIP). DIVO’s sub-adviser, Capital Wealth Planning (CWP), manages the strategy.

1. WisdomTree U.S. Quality Dividend Growth Fund

WisdomTree U.S. Quality Dividend Growth Fund (DGRW) seeks to track the investment results of dividend-paying large-cap companies with growth characteristics in the U.S. equity market.

- Gain access to the current investment landscape of U.S. large cap dividend growing companies by applying quality and growth screens

- Use as a complement to high yielding dividend strategies or as a replacement for large cap quality strategies

Do Any ETFs Pay Dividends Monthly?

Every ETF in this list pays dividends monthly. Individuals nearing retirement frequently opt for dividend ETFs due to their reliable income, diversification advantages, risk management, and protection against inflation. With the proliferation of dividend ETF options, it’s crucial to tailor your selection to align with your precise objectives, taking into account variables such as investment approach, historical performance, sectoral variety, and associated expenses.

Beginners employing ETFs to access dividend stocks offer a pragmatic approach, blending exposure to dividend investment with the advantages of diversification. These dividend ETFs follow indexes comprising dividend-yielding stocks, utilizing diverse dividend strategies depending on factors such as yield, market capitalization, or geographical location.

Are Monthly Dividends Worth It?

Dividend ETFs bring together a proven investment strategy with the benefits of ETF investing: low costs, tax efficiency and transparency that includes daily disclosure of holdings. Most dividend-oriented ETFs distribute income to investors quarterly, a frequency that can help investors meet their current spending needs, but a new fascination with monthly dividend paying ETFs to provide retirement income is a popular DIY investor approach. This might be due to the lack of retirement planning software.

Fixed bond payments are also regular but tend to be more exposed to inflation than equities. Because stocks may grow their dividends and realize capital appreciation, they can be better positioned to keep pace with or exceed inflation over the long term. In recent years, dividends have come to represent a greater proportion of income than bonds in a typical blended portfolio.