What is the S&P 500?

The S&P 500, the Standard & Poor’s 500 Index, is a popular stock market index for investors following the largest U.S. corporations. This stock market index is considered a universal benchmark to compete against. Even Warren Buffet is investing his legacy in the index after his passing. An S&P 500 ETF can be a great way for Canadians to diversify their portfolios to help avoid a home country bias.

What is the Best S&P 500 ETF?

- SPHB: Invesco S&P 500 High Beta ETF

- SPYG: SPDR Portfolio S&P 500 Growth ETF

- VOOG: Vanguard S&P 500 Growth Index Fund

- IVW: iShares S&P 500 Growth ETF

- SPHQ: Invesco S&P 500 Quality ETF

- SPGP: Invesco S&P 500 GARP ETF

- SPLG: SPDR Portfolio S&P 500 ETF

- VOO: Vanguard 500 Index Fund

- IVV: iShares Core S&P 500 ETF

- SPY: SPDR S&P 500 ETF Trust

| ETF | Name | MER | 5Y |

|---|---|---|---|

| IVV | iShares Core S&P 500 ETF | 0.03% | 15.74% |

| IVW | iShares S&P 500 Growth ETF | 0.18% | 16.48% |

| SPGP | Invesco S&P 500 GARP ETF | 0.34% | 16.32% |

| SPHB | Invesco S&P 500 High Beta ETF | 0.25% | 18.04% |

| SPHQ | Invesco S&P 500 Quality ETF | 0.15% | 16.47% |

| SPLG | SPDR Portfolio S&P 500 ETF | 0.02% | 15.77% |

| SPY | SPDR S&P 500 ETF Trust | 0.0945% | 15.71% |

| SPYG | SPDR Portfolio S&P 500 Growth ETF | 0.04% | 16.64% |

| VOO | Vanguard 500 Index Fund | 0.03% | 15.76% |

| VOOG | Vanguard S&P 500 Growth Index Fund | 0.04% | 16.58% |

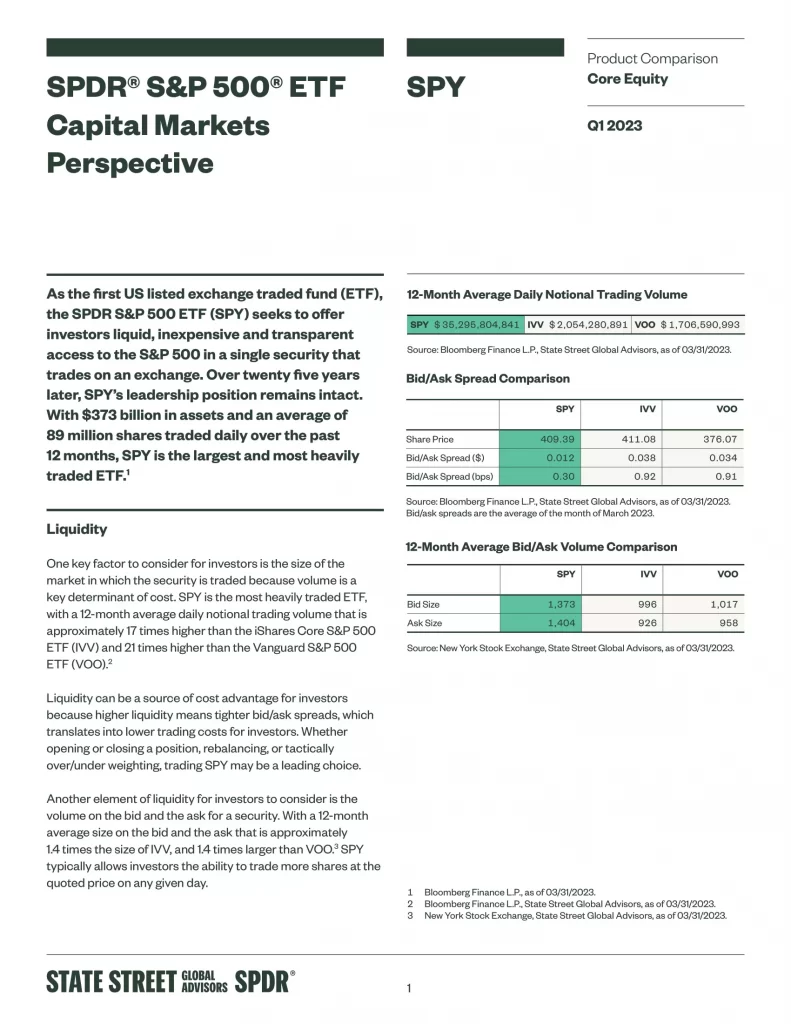

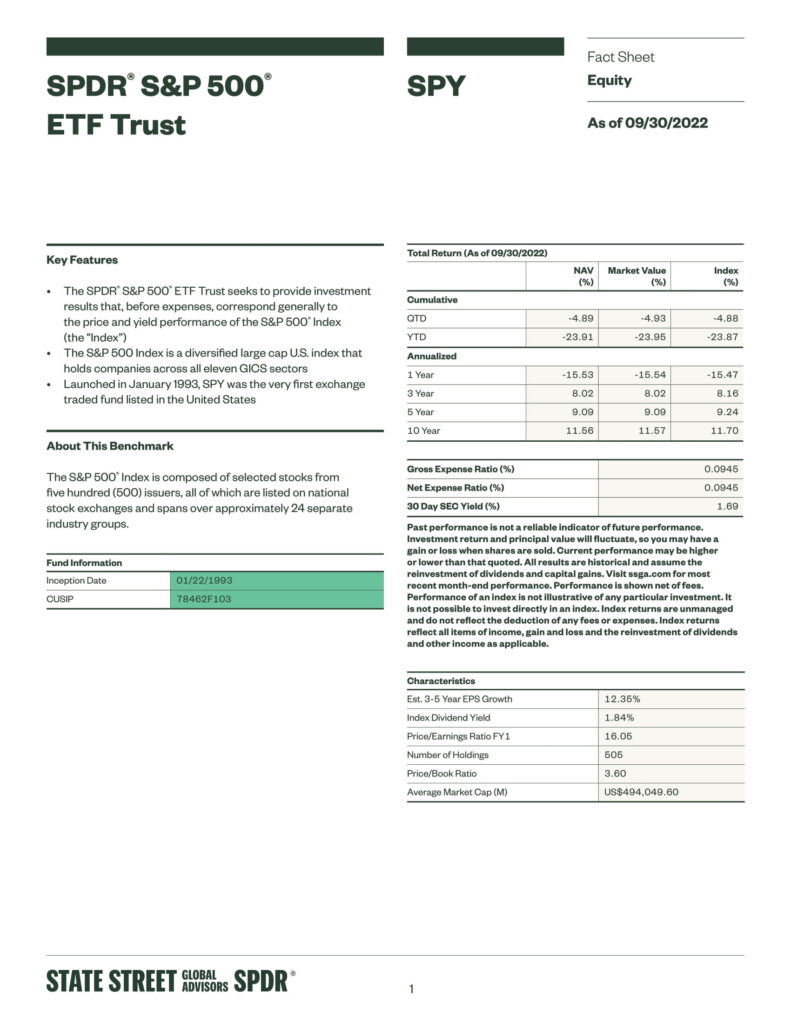

10. SPDR S&P 500 ETF Trust

The SPDR S&P 500 ETF Trust (SPY) is designed to measure the performance of the large-cap segment of the US equity market. It is float-adjusted market capitalization weighted.

- The SPDR S&P 500 ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500 Index

- The S&P 500 Index is a diversified large cap U.S. index that holds companies across all eleven GICS sectors

- Launched in January 1993, SPY was the very first exchange traded fund listed in the United States

Top 10 SPY Holdings

| Name | Weight |

|---|---|

| MICROSOFT CORP | 7.12% |

| APPLE INC | 6.24% |

| NVIDIA CORP | 5.26% |

| AMAZON.COM INC | 3.74% |

| ALPHABET INC CL A | 2.34% |

| META PLATFORMS INC CLASS A | 2.28% |

| ALPHABET INC CL C | 1.98% |

| BERKSHIRE HATHAWAY INC CL B | 1.68% |

| ELI LILLY + CO | 1.43% |

| BROADCOM INC | 1.38% |

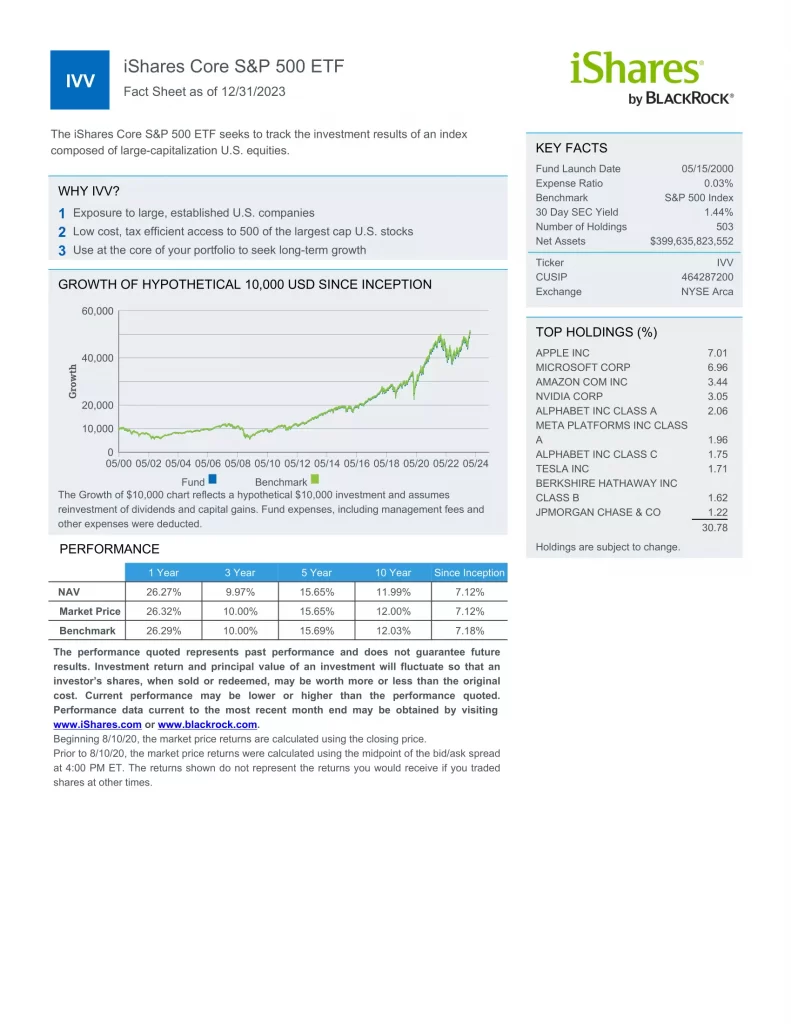

9. IVV: iShares Core S&P 500 ETF

The iShares Core S&P 500 ETF (IVV) seeks to track the investment results of an index composed of large-capitalization U.S. equities.

- Exposure to large, established U.S. companies

- Low cost, tax efficient access to 500 of the largest cap U.S. stocks

- Use at the core of your portfolio to seek long-term growth

Top 10 IVV Holdings

| Ticker | Name | Weight |

|---|---|---|

| MSFT | MICROSOFT CORP | 7.12% |

| AAPL | APPLE INC | 6.24% |

| NVDA | NVIDIA CORP | 5.26% |

| AMZN | AMAZON COM INC | 3.74% |

| GOOGL | ALPHABET INC CLASS A | 2.34% |

| META | META PLATFORMS INC CLASS A | 2.28% |

| GOOG | ALPHABET INC CLASS C | 1.98% |

| BRKB | BERKSHIRE HATHAWAY INC CLASS B | 1.68% |

| LLY | ELI LILLY | 1.43% |

| AVGO | BROADCOM INC | 1.38% |

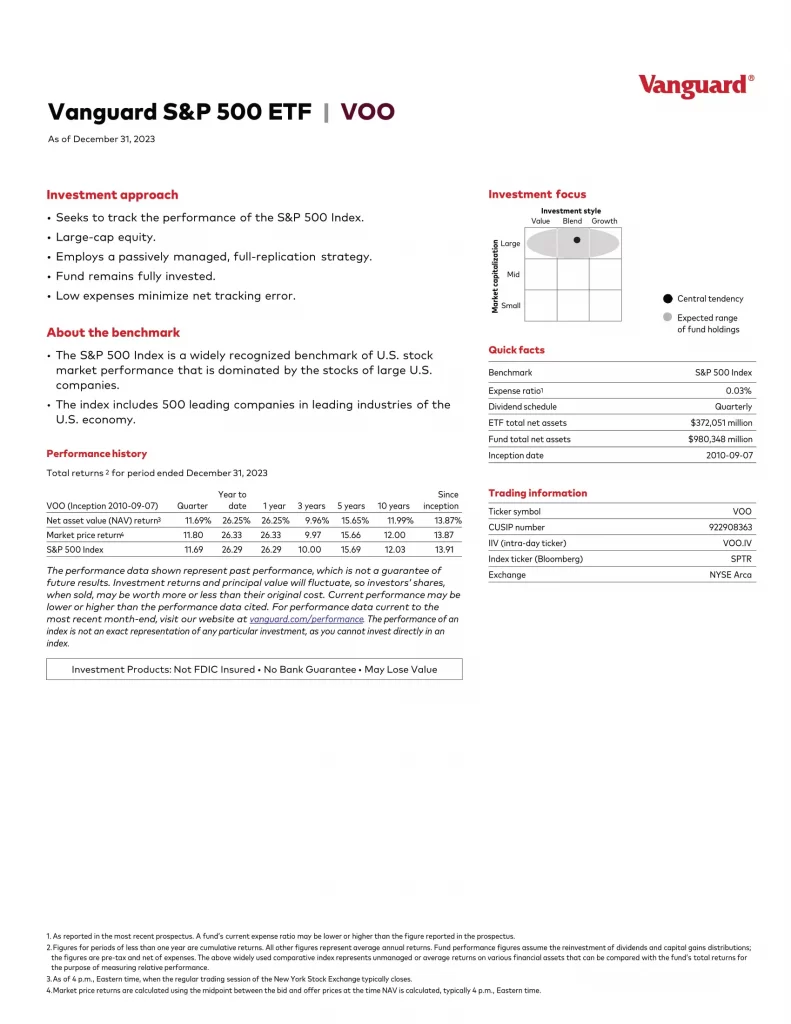

8. Vanguard 500 Index Fund

Vanguard S&P 500 ETF (VOO) Invests in stocks in the S&P 500 Index, representing 500 of the largest U.S. companies.

- Goal is to closely track the index’s return, which is considered a gauge of overall U.S. stock returns

- Offers high potential for investment growth; share value rises and falls more sharply than that of funds holding bonds

- More appropriate for long-term goals where your money’s growth is essential

Top 10 VOO Holdings

| Ticker | Name | Weight |

|---|---|---|

| MSFT | Microsoft Corp. | 6.83% |

| AAPL | Apple Inc. | 5.83% |

| NVDA | NVIDIA Corp. | 5.04% |

| AMZN | Amazon.com Inc. | 3.77% |

| GOOGL | Alphabet Inc. Class A | 2.26% |

| META | Facebook Inc. Class A | 2.23% |

| GOOG | Alphabet Inc. Class C | 1.92% |

| BRK.B | Berkshire Hathaway Inc. Class B | 1.70% |

| LLY | Eli Lilly & Co. | 1.47% |

| AVGO | Broadcom Inc. | 1.35% |

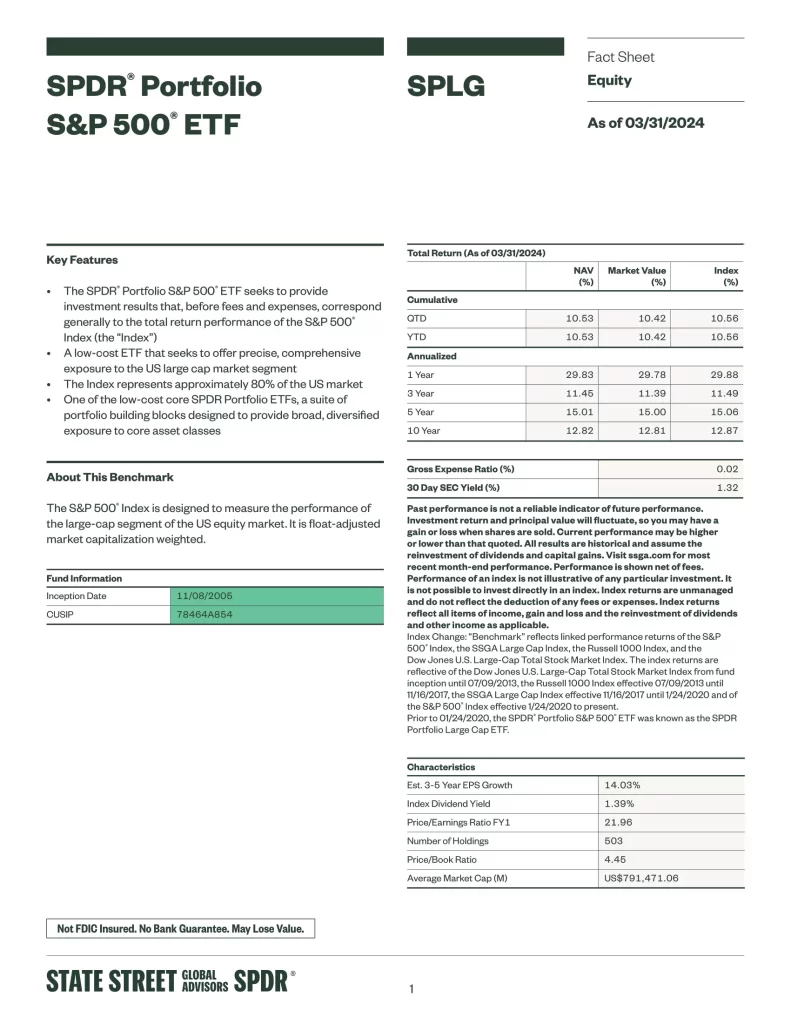

7. SPLG: SPDR Portfolio S&P 500 ETF

The SPDR Portfolio S&P 500 ETF (SPLG) seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P 500 Index.

- A low-cost ETF that seeks to offer precise, comprehensive exposure to the US large cap market segment

- The Index represents approximately 80% of the US market

- One of the low-cost core SPDR Portfolio ETFs, a suite of portfolio building blocks designed to provide broad, diversified exposure to core asset classes

Top 10 SPLG Holdings

| Name | Weight |

|---|---|

| MICROSOFT CORP | 7.10% |

| APPLE INC | 6.22% |

| NVIDIA CORP | 5.25% |

| AMAZON.COM INC | 3.73% |

| ALPHABET INC CL A | 2.34% |

| META PLATFORMS INC CLASS A | 2.28% |

| ALPHABET INC CL C | 1.97% |

| BERKSHIRE HATHAWAY INC CL B | 1.68% |

| ELI LILLY + CO | 1.43% |

| BROADCOM INC | 1.37% |

6. Invesco S&P 500 GARP ETF

Invesco S&P 500 GARP ETF (SPGP) is based on the S&P 500 Growth at a Reasonable Price Index. The Fund will invest at least 90% of its total assets in the component securities that comprise the Index. The Index is composed of approximately 75 securities in the S&P 500 Index that have been identified as having the highest “growth scores” and “quality and value composite scores,” calculated pursuant to the index methodology. The Index constituents are weighted based on their growth scores. The Fund and the Index are rebalanced and reconstituted semi-annually.

Top 10 SPGP Holdings

| Ticker | Name | Weight |

|---|---|---|

| FANG | Diamondback Energy Inc | 2.53% |

| STLD | Steel Dynamics Inc | 2.20% |

| KLAC | KLA Corp | 2.09% |

| MPC | Marathon Petroleum Corp | 2.06% |

| CF | CF Industries Holdings Inc | 1.99% |

| NXPI | NXP Semiconductors NV | 1.95% |

| VRTX | Vertex Pharmaceuticals Inc | 1.88% |

| CTRA | Coterra Energy Inc | 1.86% |

| NUE | Nucor Corp | 1.83% |

| DVN | Devon Energy Corp | 1.82% |

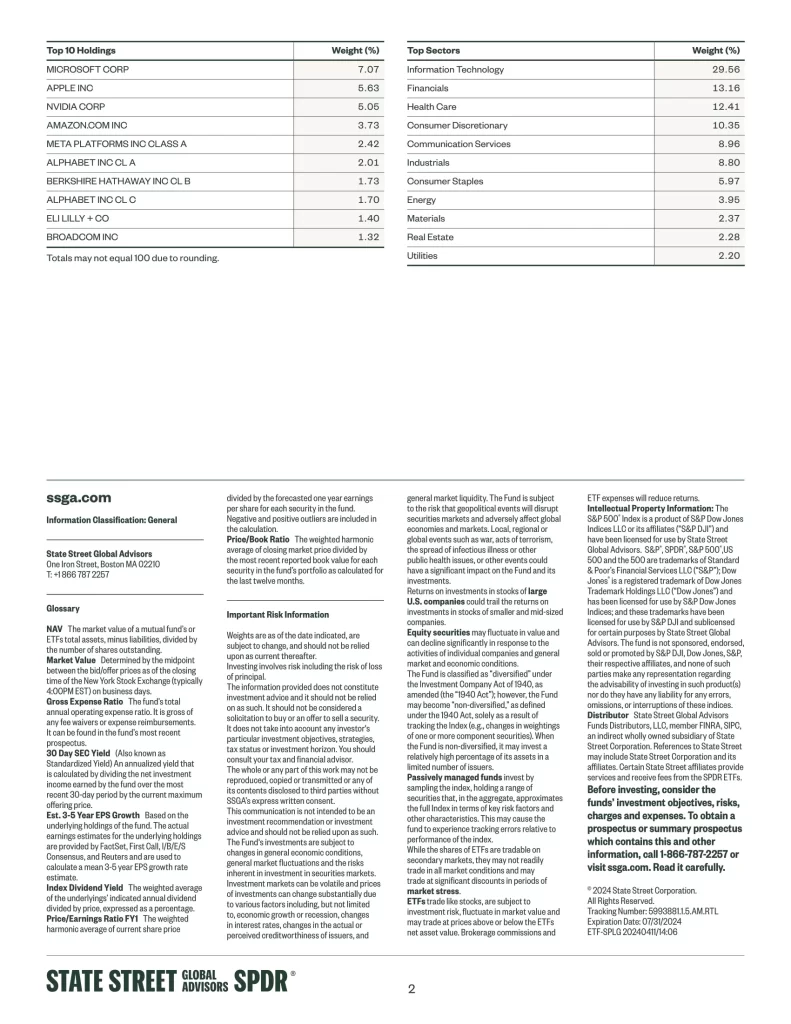

5. Invesco S&P 500 Quality ETF

The Invesco S&P 500 Quality ETF (SPHQ) is based on the S&P 500 Quality Index. The Fund will normally invest at least 90% of its total assets in common stocks that comprise the Index. The Index tracks the performance of stocks in the S&P 500 Index that have the highest quality score, which is calculated based on three fundamental measures, return on equity, accruals ratio and financial leverage ratio. The Fund and the Index are rebalanced and reconstituted semi-annually on the third Friday of June and December.

Top 10 SPHQ Holdings

| Ticker | Name | Weight |

|---|---|---|

| NVDA | NVIDIA Corp | 8.85% |

| AVGO | Broadcom Inc | 6.19% |

| GOOG | Alphabet Inc | 5.77% |

| MSFT | Microsoft Corp | 4.91% |

| MA | Mastercard Inc | 4.72% |

| AAPL | Apple Inc | 4.22% |

| V | Visa Inc | 4.16% |

| XOM | Exxon Mobil Corp | 3.81% |

| PG | Procter & Gamble Co/The | 3.04% |

| JNJ | Johnson & Johnson | 2.89% |

4. iShares S&P 500 Growth ETF

The iShares S&P 500 Growth ETF (IVW) seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit growth characteristics.

- Exposure to large U.S. companies whose earnings are expected to grow at an above-average rate relative to the market

- Low cost and tax efficient

- Use as a complement to a portfolio’s core holdings

Top 10 IVW Holdings

| Ticker | Name | Weight |

|---|---|---|

| MSFT | MICROSOFT CORP | 12.85% |

| AAPL | APPLE INC | 11.25% |

| NVDA | NVIDIA CORP | 9.50% |

| AMZN | AMAZON COM INC | 6.75% |

| GOOGL | ALPHABET INC CLASS A | 4.22% |

| META | META PLATFORMS INC CLASS A | 4.12% |

| GOOG | ALPHABET INC CLASS C | 3.57% |

| LLY | ELI LILLY | 2.58% |

| AVGO | BROADCOM INC | 2.48% |

| TSLA | TESLA INC | 2.08% |

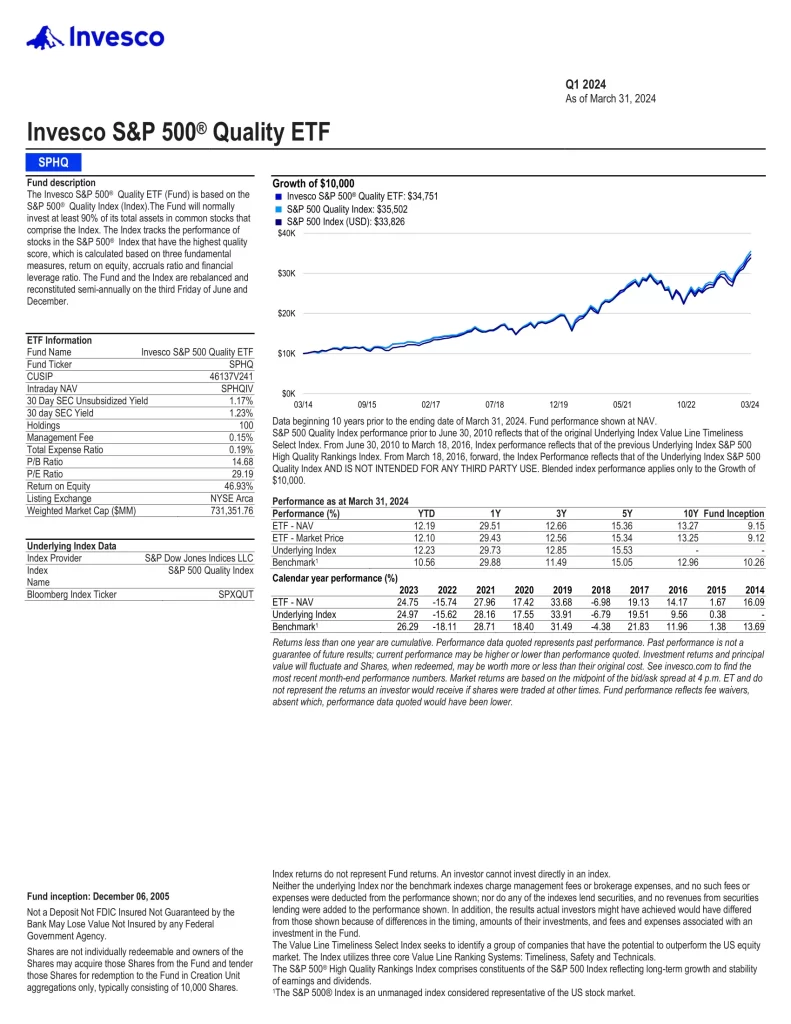

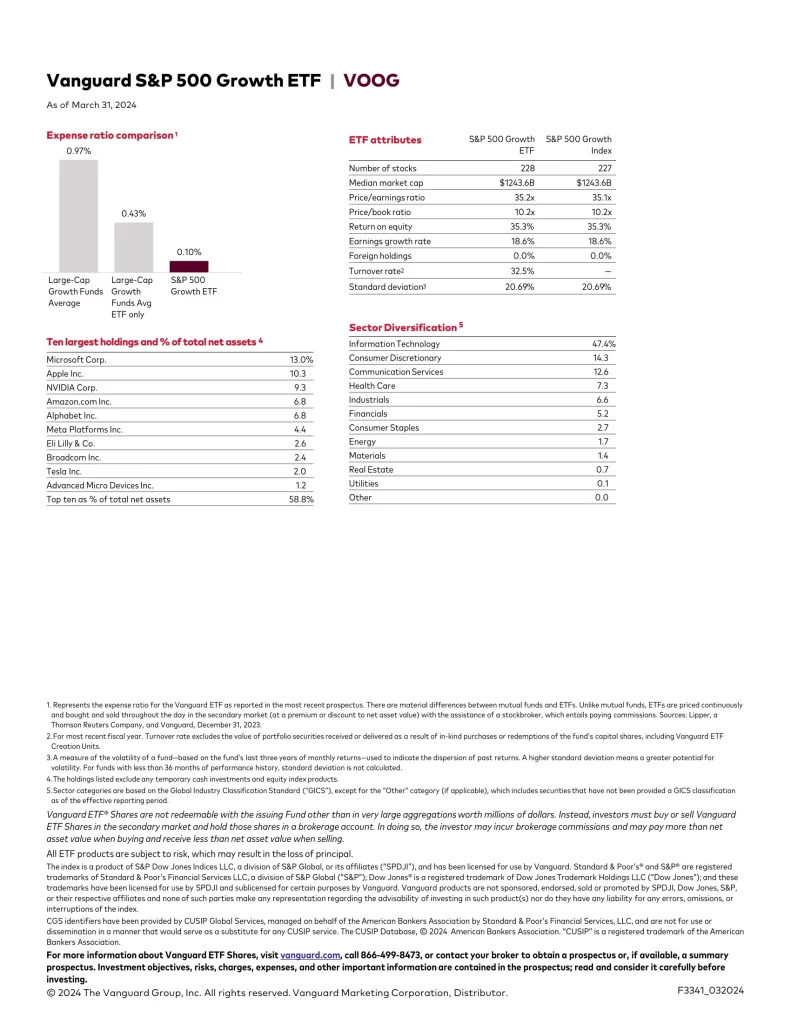

3. Vanguard S&P 500 Growth Index Fund

Vanguard S&P 500 Growth Index Fund ETF Shares (VOOG) invests in stocks in the Standard & Poor’s 500 Growth Index, composed of the growth companies in the S&P 500.

- Focuses on closely tracking the index’s return, which is considered a gauge of overall U.S. growth stock returns

- Offers high potential for investment growth; share value rises and falls more sharply than that of funds holding bonds

- More appropriate for long-term goals where your money’s growth is essential

Top 10 VOOG Holdings

| Ticker | Name | Weight |

|---|---|---|

| MSFT | Microsoft Corp. | 12.48 % |

| AAPL | Apple Inc. | 10.67 % |

| NVDA | NVIDIA Corp. | 9.21 % |

| AMZN | Amazon.com Inc. | 6.90 % |

| GOOGL | Alphabet Inc. Class A | 4.14 % |

| META | Facebook Inc. Class A | 4.08 % |

| GOOG | Alphabet Inc. Class C | 3.50 % |

| LLY | Eli Lilly & Co. | 2.69 % |

| AVGO | Broadcom Inc. | 2.47 % |

| TSLA | Tesla Inc. | 2.19 % |

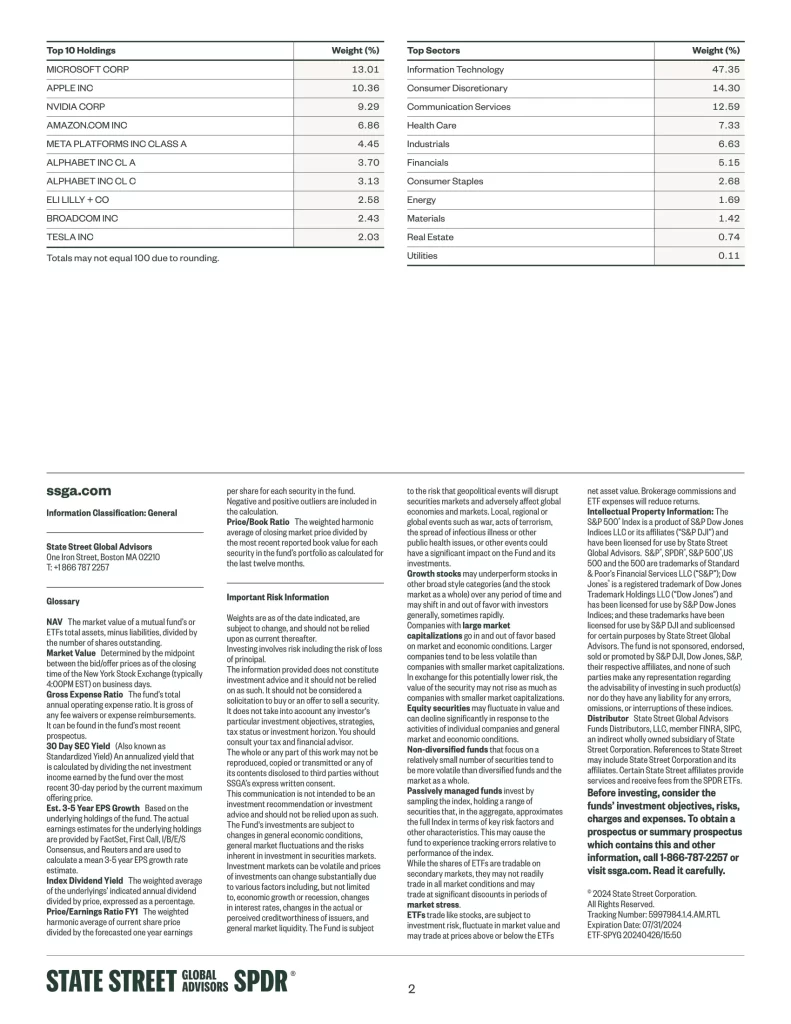

2. SPDR Portfolio S&P 500 Growth ETF

The SPDR Portfolio S&P 500 Growth ETF (SPYG) seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P 500 Growth Index.

- A low cost ETF that seeks to offer exposure to S&P 500 companies that display the strongest growth characteristics

- The Index contains stocks that exhibit the strongest growth characteristics based on: sales growth, earnings change to price ratio, and momentum

- One of the low cost core SPDR Portfolio ETFs, a suite of portfolio building blocks designed to provide broad, diversified exposure to core asset classes

Top 10 SPYG Holdings

| Name | Weight |

|---|---|

| MICROSOFT CORP | 12.85% |

| APPLE INC | 11.26% |

| NVIDIA CORP | 9.50% |

| AMAZON.COM INC | 6.75% |

| ALPHABET INC CL A | 4.23% |

| META PLATFORMS INC CLASS A | 4.12% |

| ALPHABET INC CL C | 3.57% |

| ELI LILLY + CO | 2.58% |

| BROADCOM INC | 2.48% |

| TESLA INC | 2.08% |

1. Invesco S&P 500 High Beta ETF

The Invesco S&P 500 High Beta ETF (SPHB) is based on the S&P 500 High Beta Index. The Fund will invest at least 90% of its total assets in the securities that comprise the Index. The Index is compiled, maintained and calculated by Standard & Poor’s and consists of the 100 stocks from the S&P 500 Index with the highest sensitivity to market movements, or beta, over the past 12 months. Beta is a measure of relative risk and is the rate of change of a security’s price. The Fund and the Index are rebalanced and reconstituted quarterly in February, May, August and November.

Top 10 SPHB Holdings

| Ticker | Name | Weight |

|---|---|---|

| SMCI | Super Micro Computer Inc | 2.29% |

| NVDA | NVIDIA Corp | 1.58% |

| AMD | Advanced Micro Devices Inc | 1.53% |

| MPWR | Monolithic Power Systems Inc | 1.49% |

| TER | Teradyne Inc | 1.44% |

| CCL | Carnival Corp | 1.41% |

| ENPH | Enphase Energy Inc | 1.35% |

| TSLA | Tesla Inc | 1.29% |

| AVGO | Broadcom Inc | 1.29% |

| CZR | Caesars Entertainment Inc | 1.28% |

What is an S&P 500 ETF?

The S&P 500 index represents 500 of the largest US companies. This index is often taken as the benchmark for the performance of risk assets. With the explosion of assets under passive management, S&P 500 index ETFs replicate the returns of large-cap US equities in the most cost-effective manner. Investors can utilize these ETFs to seek exposure to the underlying performance of the US economy. Asset managers like BlackRock, Invesco, State Street and Vanguard with low fees. These index ETFs have become a cornerstone of long-term diversified portfolios and offer spectacular returns given the simplicity of owning these assets.