Billions of dollars are invested in Exchange Traded Funds (ETFs) designed to track the performance of the S&P 500, one of the most widely followed stock market indices. The S&P 500, short for the Standard & Poor’s 500 Index, represents the 500 largest publicly traded companies in the U.S. and serves as a universal benchmark for investors. Even Warren Buffett has entrusted his legacy to this index after his passing.

For Canadians looking to diversify their portfolios and reduce home country bias, investing in the S&P 500 can be a smart strategy. To help streamline your choices, here are the top ten Canadian S&P 500 ETFs to consider right now.

What is an S&P 500 ETF?

With the surge in assets under passive management, S&P 500 ETFs have become a cost-effective way to replicate the performance of large-cap U.S. equities. The index was first introduced in 1957. Since direct investment in an index is impossible, investors turn to ETFs designed to track the S&P 500’s performance. These ETFs provide a straightforward way to gain exposure to the broader U.S. economy and have become a foundational component of long-term diversified portfolios. Their simplicity and potential for strong returns make them attractive to investors seeking broad market exposure.

What is the Best S&P 500 ETF in Canada?

If you’re looking for ETFs with the best historical performance based on their five-year annualized returns, here are a few top performers:

- HSU: BetaPro S&P 500 2x Daily Bull ETF

- VFV: Vanguard S&P 500 Index ETF

- ZSP: BMO S&P 500 Index ETF

- XUS: iShares Core S&P 500 Index ETF

- HXS: Global X S&P 500 Corporate Class ETF

- HSH: Global X S&P 500 CAD Hedged Index Corporate Class ETF

- VSP: Vanguard S&P 500 Index ETF (CAD-hedged)

- XSP: iShares Core S&P 500 Index ETF (CAD-Hedged)

- ZUE: BMO S&P 500 Hedged to CAD Index ETF

- ULV.C: Invesco S&P 500 Low Volatility Index ETF

- ULV.F: Invesco S&P 500 Low Volatility Index ETF CAD Hedged

- EQL: Invesco S&P 500 Equal Weight Index ETF

- EQL.F: Invesco S&P 500 Equal Weight Index ETF CAD Hedged Units

- ESG: Invesco S&P 500 ESG Index ETF

- ESG.F: Invesco S&P 500 ESG Index ETF (CAD Hedged)

- ISTE: Invesco S&P 500 ESG Tilt Index ETF

- ISTE.F: Invesco S&P 500 ESG Tilt Index ETF (CAD Hedged)

- EQLI: Invesco S&P 500 Equal Weight Income Advantage ETF

- XUSC: iShares S&P 500 3% Capped Index ETF

- XSPC: iShares S&P 500 3% Capped Index ETF (CAD-Hedged)

- ESPX: Evolve S&P 500 Enhanced Yield Fund

- HSD: BetaPro S&P 500 -2x Daily Bear ETF

- HIU: BetaPro S&P 500 Daily Inverse ETF

- USSX: Global X S&P 500 Index ETF

- USCC: Global X S&P 500 Covered Call ETF

- USSL: Global X Enhanced S&P 500 Index ETF

- USCL: Global X Enhanced S&P 500 Covered Call ETF

S&P 500 ETF Comparison

Quickly compare S&P 500 ETFs in Canada by fees, performance, yield, and other metrics to decide which ETF fits in your portfolio.

| Manager | ETF | Name | Inception | AUM | MER | Holdings | Yield | 5Y |

|---|---|---|---|---|---|---|---|---|

| BetaPro | HIU | BetaPro S&P 500 Daily Inverse ETF | 2010-02-03 | $22,957,994 | 1.56% | 5 | N/A | -13.39% |

| BetaPro | HSD | BetaPro S&P 500 -2x Daily Bear ETF | 2008-06-17 | $48,187,280 | 1.48% | 4 | N/A | -28.98% |

| BetaPro | HSU | BetaPro S&P 500 2x Daily Bull ETF | 2008-06-17 | $157,152,861 | 1.54% | 4 | N/A | 17.20% |

| BlackRock | XSP | iShares Core S&P 500 Index ETF (CAD-Hedged) | 2001-05-24 | $11,286,674,729 | 0.09% | 500 | 1.41% | 12.77% |

| BlackRock | XSPC | iShares S&P 500 3% Capped Index ETF (CAD-Hedged) | 2024-07-09 | $97,869,132 | N/A | 503 | N/A | N/A |

| BlackRock | XUS | iShares Core S&P 500 Index ETF | 2013-04-10 | $8,072,930,223 | 0.09% | 500 | 1.41% | 16.54% |

| BlackRock | XUSC | iShares S&P 500 3% Capped Index ETF | 2024-07-09 | $75,097,345 | N/A | 503 | N/A | N/A |

| BMO | ZSP | BMO S&P 500 Index ETF | 2012-11-14 | $17,611,200,000 | 0.09% | 501 | 1.42% | 16.50% |

| BMO | ZUE | BMO S&P 500 Hedged to CAD Index ETF | 2009-05-29 | $2,906,380,000 | 0.09% | 500 | 1.43% | 12.73% |

| Evolve | ESPX | Evolve S&P 500 Enhanced Yield Fund | 2023-01-09 | $224,034,000 | 0.69% | 504 | 7.49% | N/A |

| Evolve | ESPX.B | Evolve S&P 500® Enhanced Yield Fund – Unhedged ETF | 2023-01-09 | $119,859,984 | 0.69% | 504 | 6.82% | N/A |

| Global X | HSH | Global X S&P 500 CAD Hedged Index Corporate Class ETF | 2016-09-19 | $303,906,734 | 0.11% | 10 | N/A | 13.12% |

| Global X | HXS | Global X S&P 500 Corporate Class ETF | 2010-11-30 | $4,434,559,529 | 0.11% | 56 | N/A | 16.39% |

| Global X | USCC | Global X S&P 500 Covered Call ETF | 2011-09-13 | $259,412,489 | 0.49% | 2 | 9.86% | 11.60% |

| Global X | USCL | Global X Enhanced S&P 500 Covered Call ETF | 2023-07-05 | $164,431,428 | N/A | 2 | 11.57% | N/A |

| Global X | USSL | Global X Enhanced S&P 500 Index ETF | 2024-05-21 | $7,316,892 | N/A | 2 | N/A | N/A |

| Global X | USSX | Global X S&P 500 Index ETF | 2024-05-14 | $407,705,477 | N/A | N/A | N/A | N/A |

| Invesco | EQL | Invesco S&P 500 Equal Weight Index ETF | 2018-05-16 | $1,354,662,831 | 0.25% | 503 | 1.93% | 12.52% |

| Invesco | EQL.F | Invesco S&P 500 Equal Weight Index ETF CAD Hedged Units | 2018-05-29 | $729,686,610 | 0.25% | 507 | 1.37% | 8.64% |

| Invesco | EQLI | Invesco S&P 500 Equal Weight Income Advantage ETF | 2024-08-15 | $81,352,498 | 0.34% | 23 | N/A | N/A |

| Invesco | ESG | Invesco S&P 500 ESG Index ETF | 2020-03-05 | $394,711,193 | 0.17% | 314 | 0.92% | N/A |

| Invesco | ESG.F | Invesco S&P 500 ESG Index ETF (CAD Hedged) | 2020-03-05 | $87,337,406 | 0.17% | 314 | 0.97% | N/A |

| Invesco | ISTE | Invesco S&P 500 ESG Tilt Index ETF | 2022-01-20 | $1,206,071 | 0.17% | 442 | N/A | N/A |

| Invesco | ISTE.F | Invesco S&P 500 ESG Tilt Index ETF (CAD Hedged) | 2022-01-20 | $1,024,047 | 0.17% | 442 | N/A | N/A |

| Invesco | ULV.C | Invesco S&P 500 Low Volatility Index ETF | 2017-01-31 | $20,301,560 | 0.31% | 102 | 1.51% | 7.65% |

| Invesco | ULV.F | Invesco S&P 500 Low Volatility Index ETF CAD Hedged | 2012-01-24 | $92,788,737 | 0.31% | 102 | 1.60% | 7.30% |

| Vanguard | VFV | Vanguard S&P 500 Index ETF | 2012-11-02 | $18,270,000,000 | 0.09% | 504 | 1.45% | 16.51% |

| Vanguard | VSP | Vanguard S&P 500 Index ETF (CAD-hedged) | 2012-11-02 | $3,540,000,000 | 0.09% | 504 | 1.45% | 12.81% |

10. Invesco S&P 500 Equal Weight Index ETF

Invesco S&P 500 Equal Weight Index ETF (EQL) invests in either securities of Invesco S&P 500 Equal Weight ETF (NYSE Arca ticker: RSP) or in securities of U.S.-listed companies in order to replicate the S&P 500 Equal Weight Index which has the same constituents as the capitalization-weighted S&P 500; however, each company represented in the index is allocated a fixed weight of 0.20% at each quarterly rebalancing of the index.

- Want capital growth over the long term

- Want a well-diversified core US equity investment

- Own, or plan to own, other types of investments to diversify their holdings

- Are comfortable with medium risk

9. BMO S&P 500 Hedged to CAD Index ETF

The BMO S&P 500 Hedged to CAD Index ETF (ZUE) has been designed to replicate, to the extent possible, the performance of the S&P 500 Hedged to Canadian Dollars Index (Index), net of expenses. The ETF invests in and holds the Constituent Securities of the Index in the same proportion as they are reflected in the Index. The U.S. dollar currency exposure is hedged back to the Canadian dollar. In addition, as ZUE is a fund of fund, the management fees charged are reduced by those accrued in the underlying funds.

8. iShares Core S&P 500 Index ETF (CAD-Hedged)

iShares Core S&P 500 Index ETF (CAD-Hedged) (XSP) seeks long-term capital growth by replicating the performance of the S&P 500 Hedged to Canadian Dollars Index, net of expenses. This exposure is also available unhedged in XUS.

- Own a diverse portfolio of 500 US large cap companies while hedging currency risk

- Designed to be a long-term core holding

- Low cost

7. Vanguard S&P 500 Index ETF (CAD-hedged)

Vanguard S&P 500 Index ETF (CAD-hedged) (VSP) seeks to track, to the extent reasonably possible and before fees and expenses, the performance of a broad U.S. equity index that measures the investment return of large-capitalization U.S. stocks, which Index is hedged to the Canadian dollar. Currently, this Vanguard ETF seeks to track the S&P 500 Index (CAD-hedged) (or any successor thereto). It invests directly or indirectly primarily in stocks of U.S. companies and uses derivative instruments to seek to hedge the U.S. dollar exposure of the securities included in the S&P 500 Index back to the Canadian dollar.

- Invests primarily in the U.S.-domiciled Vanguard S&P 500 ETF. U.S. dollar exposure is hedged back to the Canadian dollar

- Employs a passively managed, full-replicated index strategy to provide exposure of large U.S. companies

- Uses efficient, cost effective index management techniques

6. Global X S&P 500 CAD Hedged Index Corporate Class ETF

Global X S&P 500 CAD Hedged Index Corporate Class ETF (HSH) seek to replicate, to the extent possible, the performance of the S&P 500 CAD Hedged Index (Total Return), net of expenses. The S&P 500 CAD Hedged Index (Total Return) is designed to measure the performance of the large-cap market segment of the U.S. equity market, hedged to the Canadian dollar. The ETF uses derivatives, such as a swap agreement or multiple swap agreements, to obtain exposure to its underlying index without investing directly in the securities that make up its underlying index.

5. Global X S&P 500 Corporate Class ETF

Global X S&P 500 Corporate Class ETF (HXS) seeks to replicate, to the extent possible, the performance of the S&P 500 Index (Total Return), net of expenses. The S&P 500 Index (Total Return) is designed to measure the performance of the large-cap market segment of the U.S. equity market. This ETF is suitable for an investor looking for total return exposure to the large-cap U.S. equity market, who can handle the ups and downs of the stock market, but is not looking for regular distributions.

4. iShares Core S&P 500 Index ETF

iShares Core S&P 500 Index ETF (XUS) seeks long-term capital growth by replicating the performance of the S&P 500 Index, net of expenses. This exposure is also available hedged to the Canadian dollar in XSP.

- Own a diversified portfolio of 500 US large cap companies

- Designed to be a long-term core holding

- Low cost

3. BMO S&P 500 Index ETF

The BMO S&P 500 Index ETF (ZSP) has been designed to replicate, to the extent possible, the performance of the S&P 500 Index, net of expenses. The ETF invests in and holds the Constituent Securities of the Index in the same proportion as they are reflected in the Index.

The S&P 500 Index is a world-renowned float-adjusted market capitalization weighted Index that tracks the securities of the largest and most liquid public companies in the United States. Constituent securities must pass minimum float-adjusted and liquidity screens to qualify and maintain membership in the Index. Index weights are reviewed quarterly.

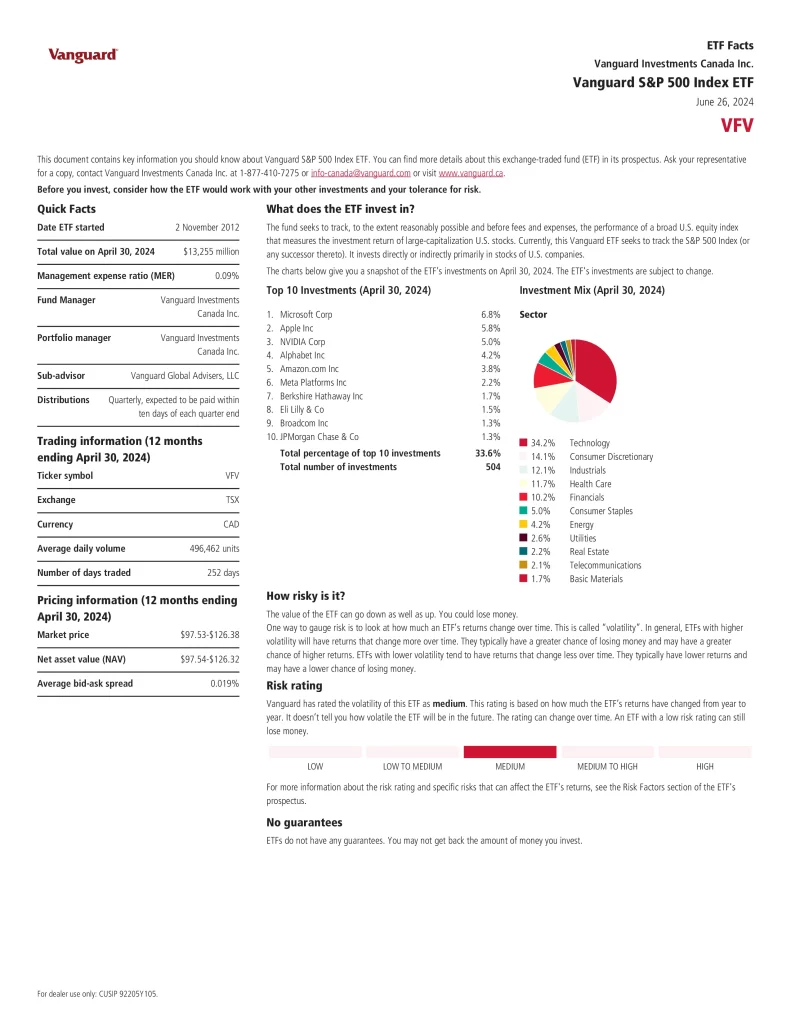

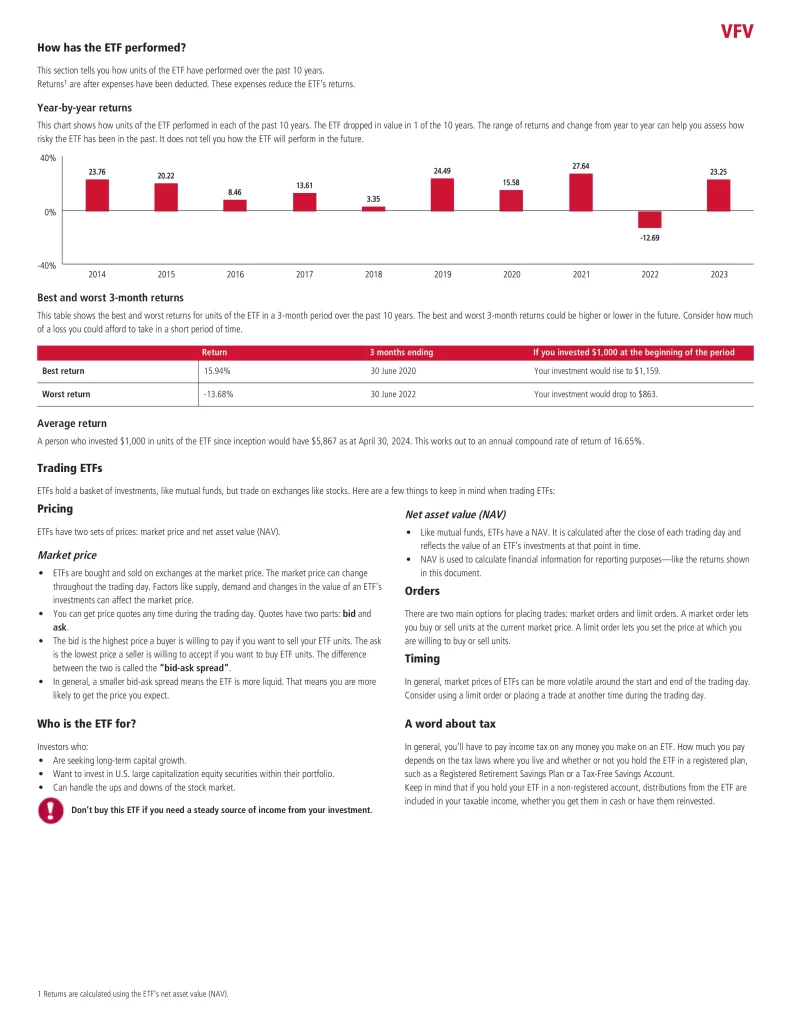

2. Vanguard S&P 500 Index ETF

Vanguard S&P 500 Index ETF (VFV) seeks to track, to the extent reasonably possible and before fees and expenses, the performance of a broad U.S. equity index that measures the investment return of large-capitalization U.S. stocks. Currently, this Vanguard ETF seeks to track the S&P 500 Index (or any successor thereto). It invests directly or indirectly primarily in stocks of U.S. companies.

- Seeks to track the performance of the S&P 500 Index to the extent possible and before fees and expenses

- Invests primarily in the U.S.-domiciled Vanguard S&P 500 ETF

- Employs a passively managed, full-replicated index strategy to provide exposure of large U.S. companies

- Uses efficient, cost effective index management techniques

1. BetaPro S&P 500 2x Daily Bull ETF

BetaPro S&P 500 2x Daily Bull ETF (HSU) seeks daily investment results, before fees, expenses, distributions, brokerage commissions and other transaction costs, that endeavour to correspond to two times (200%) the daily performance of the S&P 500. HSU is denominated in Canadian dollars. Any U.S. dollar gains or losses as a result of the ETF’s investment will be hedged back to the Canadian dollar to the best of the ETF’s ability.

What Companies are in the S&P 500?

The S&P 500 is a market capitalization-weighted index representing 500 leading U.S. companies across key industries. Traded on the New York Stock Exchange (NYSE) and NASDAQ, it accounts for approximately 80% of the total U.S. market capitalization. Widely regarded as the premier benchmark for U.S. stock market performance, the S&P 500 includes many of the world’s most recognizable and influential companies. Its top ten constituents collectively comprise about 35% of the index’s total value.

| Ticker | Name | Weight |

|---|---|---|

| AAPL | Apple Inc | 7.11056% |

| NVDA | NVIDIA Corp | 6.76096% |

| MSFT | Microsoft Corp | 6.25276% |

| AMZN | Amazon.com Inc | 3.60453% |

| META | Meta Platforms Inc | 2.56703% |

| GOOGL | Alphabet Inc | 2.07541% |

| GOOG | Alphabet Inc | 1.71710% |

| BRK.B | Berkshire Hathaway Inc | 1.70994% |

| AVGO | Broadcom Inc | 1.63596% |

| TSLA | Tesla Inc | 1.43512% |

To Hedge or Not to Hedge?

Why can choosing an S&P 500 ETF be so confusing? For Canadians, the main complication is currency conversion. To help mitigate the effects of currency fluctuations, many ETF providers offer a Canadian dollar-hedged version of the standard S&P 500 ETF. Historically, unhedged American-focused funds have outperformed over the long term, though they tend to be more volatile since their returns are also influenced by changes in the USD-CAD exchange rate.

Can You Buy an S&P 500 Index in a TFSA in Canada?

You can in invest in the S&P 500 index in Canada through low-fee ETFs from many asset managers like BlackRock, BMO, Horizons, Invesco and Vanguard. Opting for a Canadian-listed ETF that mirrors the S&P 500 for your TFSA benefits you by avoiding currency conversion expenses. As these ETFs are denominated in Canadian dollars, there’s no need to convert your funds into U.S. dollars when making investments or selling your holdings.

How to Buy S&P 500 ETF in Canada

- Select a Trading Platform: Ensure the broker you choose supports the investment options you’re interested in and evaluate potential fees

- Open and Finance Your Account: Complete an application providing your personal information and link a bank account for funding purposes or transfer existing assets

- Conduct Research on Investment Opportunities: Explore ETFs options and thoroughly analyze each option to determine its suitability for your investment goals

- Execute the Investment: Purchase the desired number of shares using a market order or opt for a limit order to buy at a specified price

- Keep Track of Your Investment: Regularly monitor your investment and adjust your strategy as needed

Conclusion

The only significant difference between these ETFs is whether or not the investment is hedged to the Canadian dollar or not. Vanguard S&P 500 Index ETF (VFV) is currently the oldest and least expensive making it my preferred ETF in this category without leverage.