Optimal choices for long-term goals, some of the finest TSX ETFs are suitable for a diverse range of investors. By combining a few of these ETFs, investors can construct a well-rounded equity ETF portfolio, enjoying lower fees compared to mutual funds. A significant number of Canadian investors have transitioned from mutual funds to exchange-traded funds (ETFs), finding affordability and flexibility in managing their DIY portfolios.

The growth in the Canadian population has garnered global attention. Some economists suggest that the Canadian economy may be entering a period of recession, prompting the central bank to potentially halt further interest rate hikes. Factors contributing to the economic contraction include a decrease in housing investment, reduced exports, and a decline in domestic household spending.

In general, top-notch ETFs encompass a diverse selection of securities, yield substantial returns, and impose reasonable management fees. Depending on individual investment preferences, some may lean towards sustainable or green energy ETFs, while others may favour precious metals.

What are the Best TSX ETFs in Canada?

- DXC.TO: Dynamic Active Canadian Dividend ETF

- FXM.TO: CI Morningstar Canada Value Index ETF

- VDY.TO: Vanguard FTSE Canadian High Dividend Yield Index ETF

- VCE.TO: Vanguard FTSE Canada Index ETF

- PXC.TO: Invesco FTSE RAFI Canadian Index ETF

Here is a table comparing to similar TSX ETFs in Canada as of December 31, 2023.

| Manager |  |  |  |  |  |

| ETF | FXM | DXC | PXC | VCE | VDY |

| Inception | 2012-02-13 | 2017-01-20 | 2012-01-10 | 2011-11-30 | 2012-11-01 |

| MER | 0.66% | 0.84% | 0.49% | 0.06% | 0.22% |

| AUM | $328,020,000 | $162,720,000 | $171,183,792 | $1,460,000,000 | $2,250,000,000 |

| P/E | N/A | N/A | N/A | 14.8 | 12.2 |

| P/B | N/A | N/A | N/A | 1.8 | 1.5 |

| Yield | 2.74% | 2.5% | N/A | 3.59% | 4.81% |

| Distributions | Quarterly | Monthly | Quarterly | Quarterly | Monthly |

| 1Y | 5.81% | 10.41% | 9.82% | 12.33% | 8.30% |

| 3Y | 11.18% | 11.33% | 14.24% | 11.11% | 13.92% |

| 5Y | 12.59% | 12.75% | 11.92% | 11.95% | 12.12% |

| 10Y | 6.42% | N/A | 7.68% | 8.11% | 7.78% |

| 15Y | N/A | N/A | N/A | N/A | N/A |

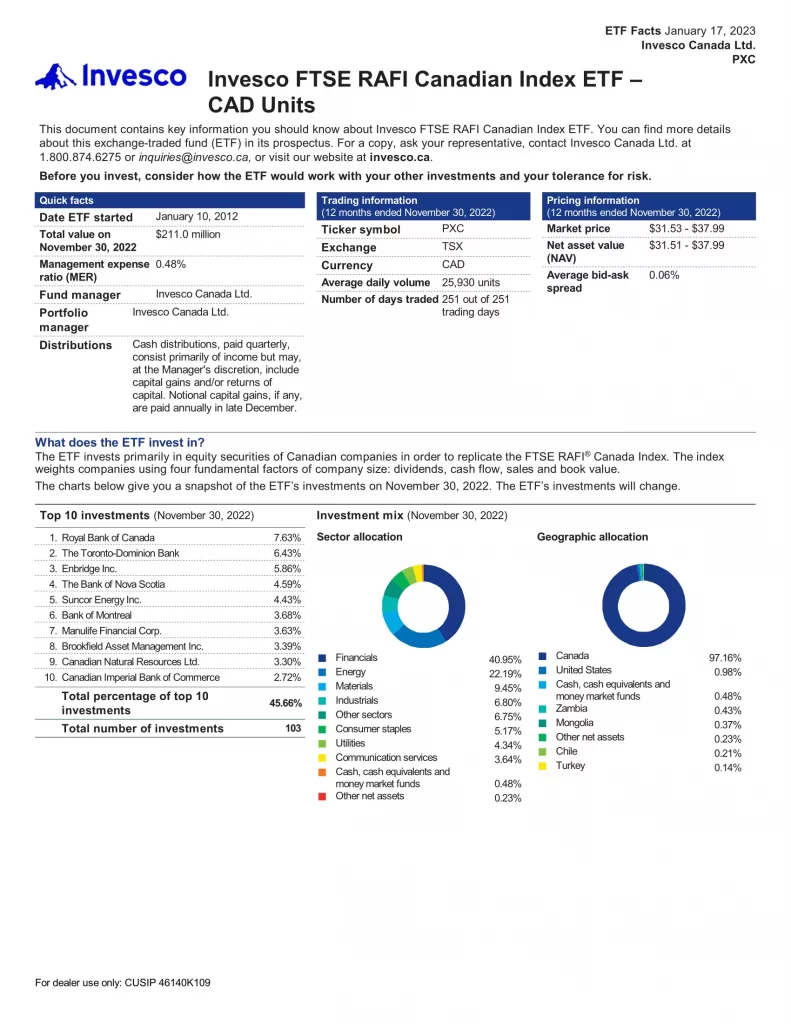

5. Invesco FTSE RAFI Canadian Index ETF

PXC invests in equity securities of Canadian companies in order to replicate the FTSE RAFI® Canada Index. The index weights companies using four fundamental factors of company size: dividends, cash flow, sales and book value.

- Want capital growth over the long term

- Want a well-diversified core Canadian equity investment

- Own, or plan to own, other types of investments to diversify their holdings

- Are comfortable with medium risk

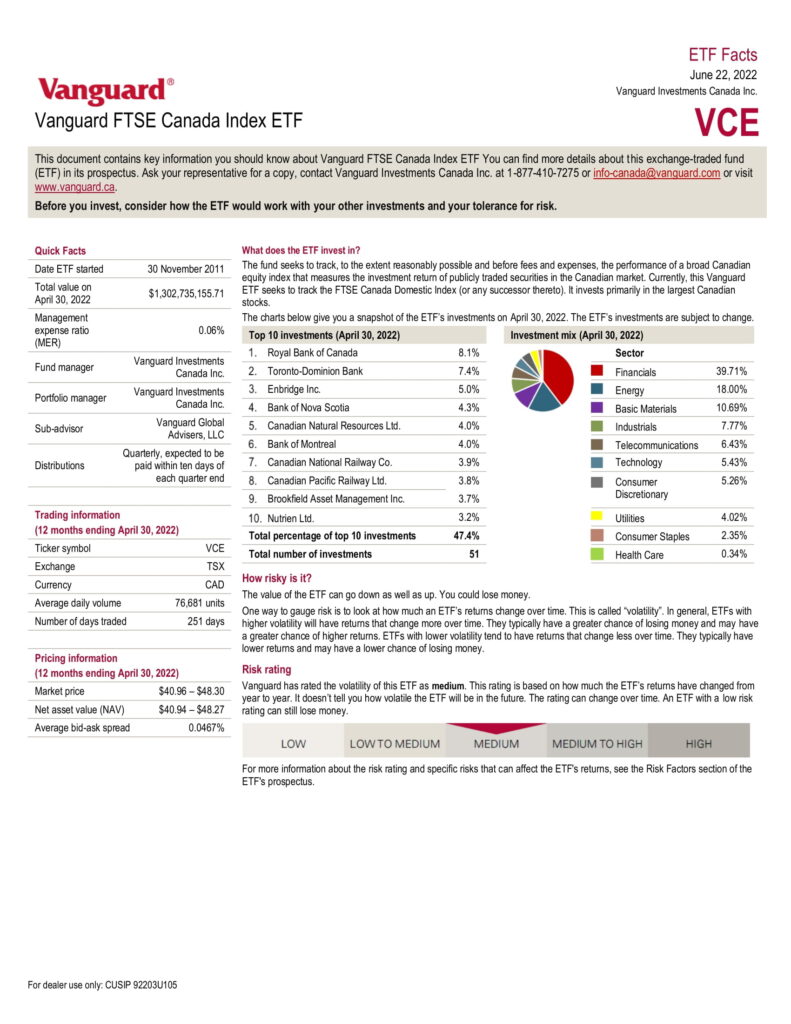

4. Vanguard FTSE Canada Index ETF

Vanguard FTSE Canada Index ETF seeks to track, to the extent reasonably possible and before fees and expenses, the performance of a broad Canadian equity index that measures the investment return of publicly traded securities in the Canadian market. Currently, this Vanguard ETF seeks to track the FTSE Canada Domestic Index (or any successor thereto). It invests primarily in the largest Canadian stocks.

- Seeks to track the performance of the FTSE Canada Domestic Index to the extent possible and before fees and expenses

- Employs a passively managed, full-replicated index strategy to provide broad exposure to predominantly large- and mid-cap companies in Canada, diversified across growth and value styles

- Uses efficient, cost effective index management techniques

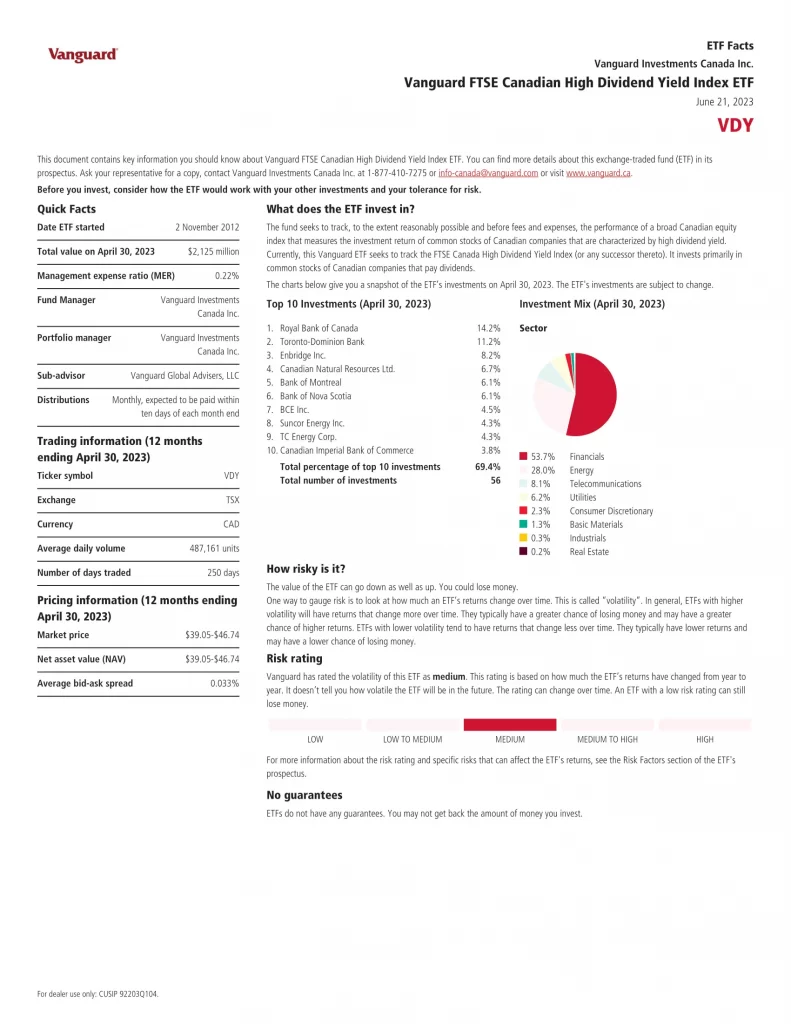

3. Vanguard FTSE Canadian High Dividend Yield Index ETF

Vanguard FTSE Canadian High Dividend Yield Index ETF seeks to track, to the extent reasonably possible and before fees and expenses, the performance of a broad Canadian equity index that measures the investment return of common stocks of Canadian companies that are characterized by high dividend yield. Currently, this Vanguard ETF seeks to track the FTSE Canada High Dividend Yield Index (or any successor thereto). It invests primarily in common stocks of Canadian companies that pay dividends.

- Seeks to track the performance of the FTSE Canada High Dividend Yield Index to the extent possible and before fees and expenses.

- Employs a passively managed, full-replicated index strategy to provide exposure of Canadian large-, mid-, and small-cap stocks, diversified across all industries.

- Uses efficient, cost effective index management techniques.

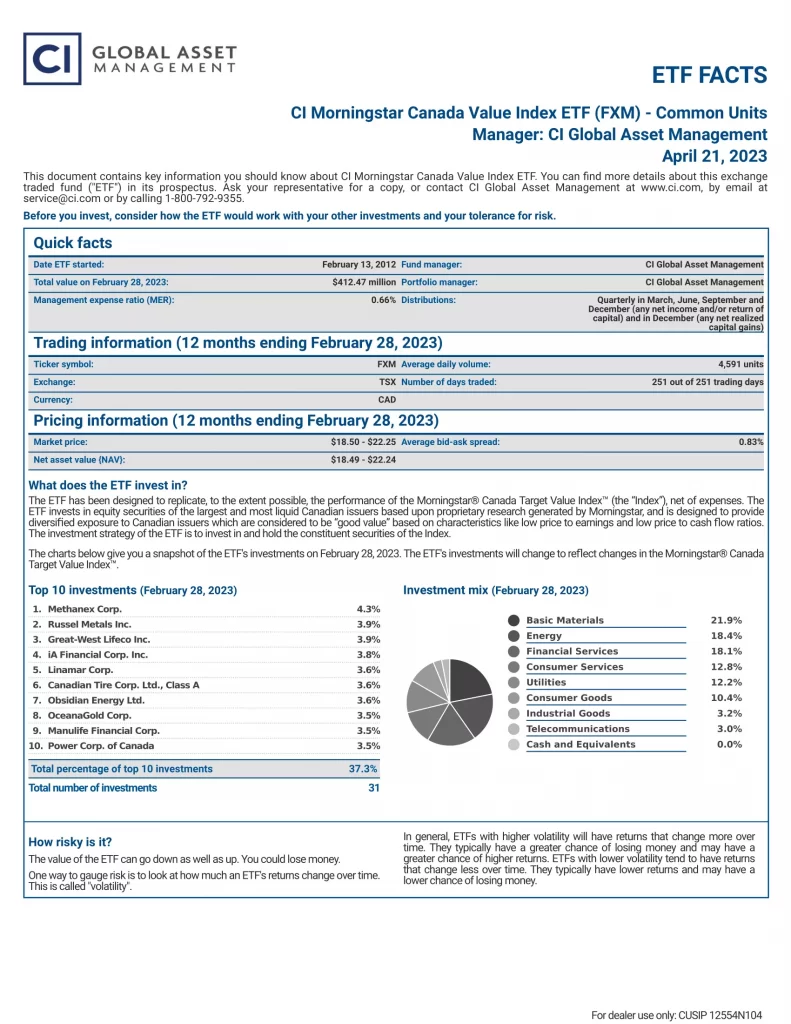

2. CI Morningstar Canada Value Index ETF

The Fund has been designed to replicate, to the extent possible, the performance of the Morningstar® Canada Target Value IndexTM (the “Index”), net of expenses. The Fund invests in equity securities of the largest and most liquid Canadian public issuers based upon proprietary research generated by Morningstar, and is designed to provide diversified exposure to Canadian issuers which are considered to be “good value” based on characteristics like low price to earnings and low price to cash flow ratios. The investment strategy of the Fund is to invest in and hold the constituent securities of the Index.

1. Dynamic Active Canadian Dividend ETF

Dynamic Active Canadian Dividend ETF invests primarily in a diversified portfolio of equity securities of Canadian-based businesses that pay or are expected to pay a dividend or distribution.

- Utilizes a bottom-up approach and fundamental analysis to assess growth and value potential

- Targets companies that are attractively valued, have high margins, market share, and are run by quality management teams

- Has the flexibility to access businesses located outside Canada