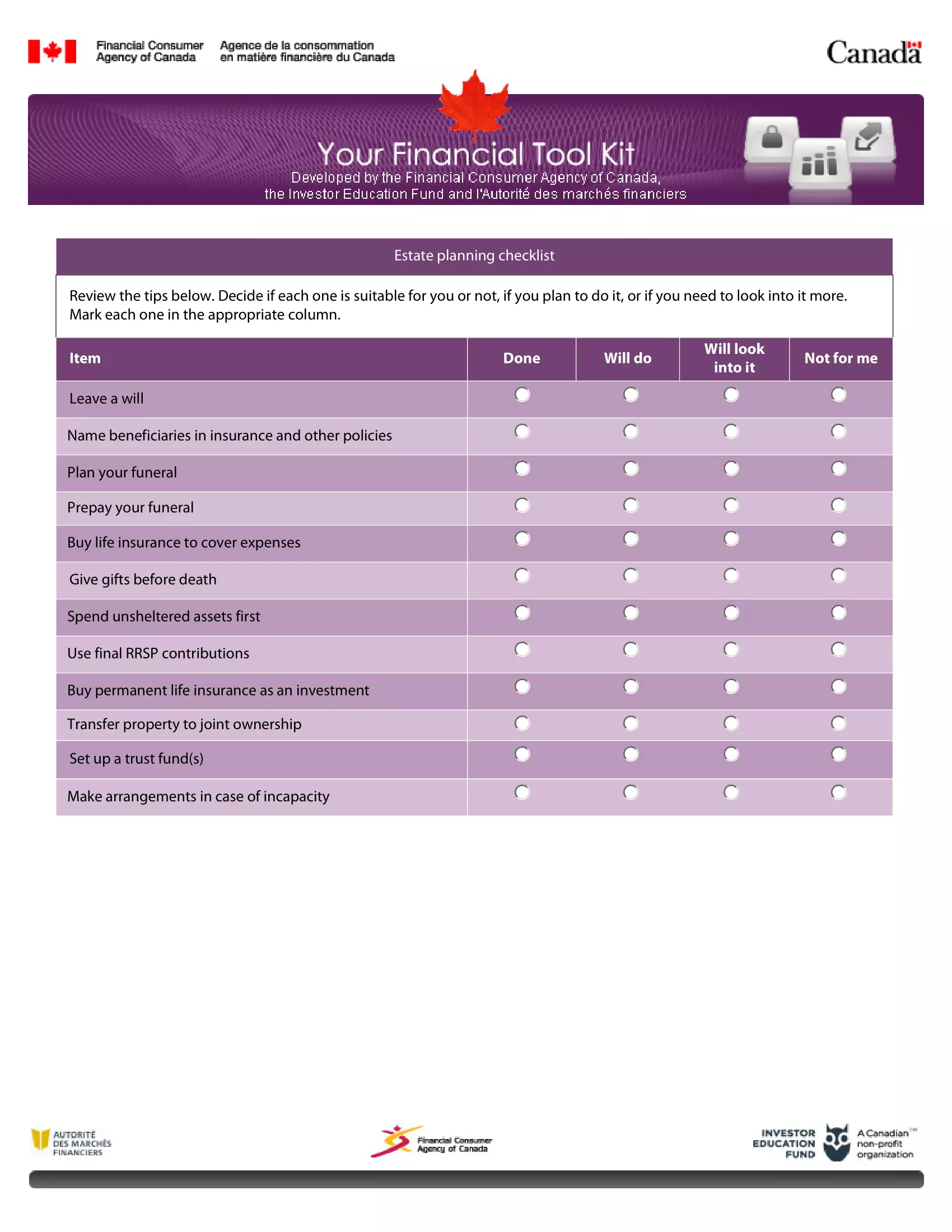

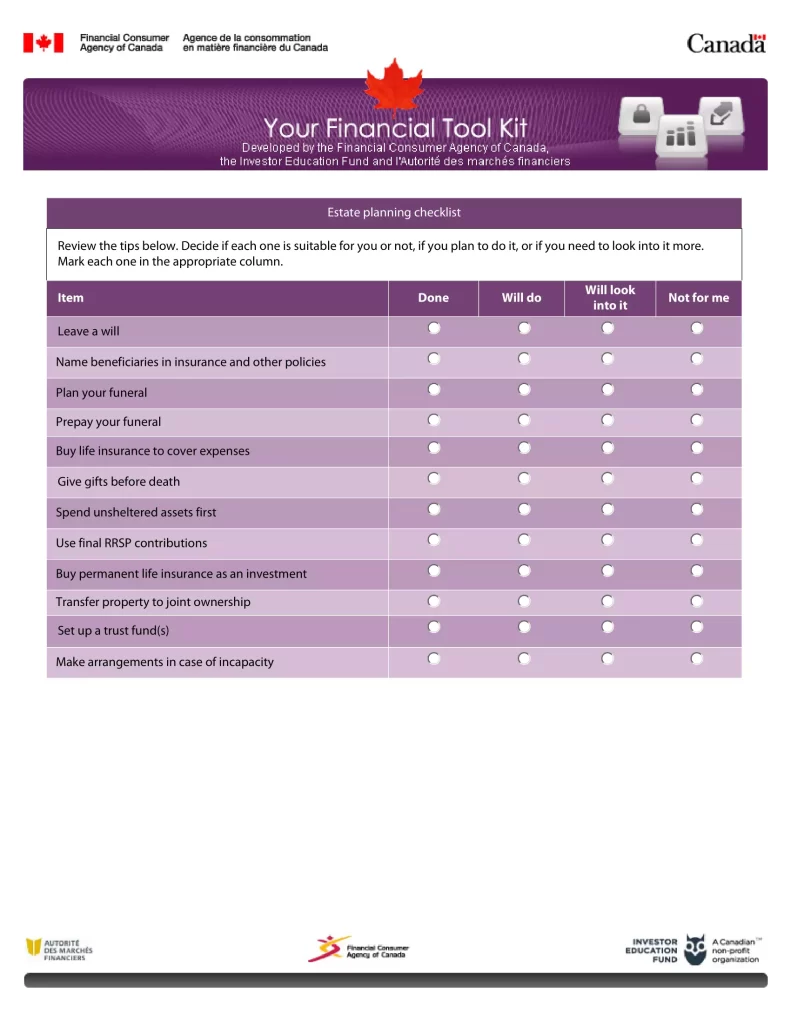

By going through this estate planning checklist once a year, you can help keep your estate plan up to date. This can help you be confident your property will be preserved and distributed the way you want. It means planning for health issues, tax planning, and supporting those needing support. Update your inventory of assets as necessary and let the affected people know. Whether you are creating an estate plan for the first time or updating the one you already have in place, here’s a checklist to make sure you’ve got what you need.

Estate Planning Questions to Ask Yourself

- Have you moved?

- Have you changed any bill-paying arrangements?

- Have you been married, divorced, separated or widowed?

- Have you had a new child, stepchild, grandchild?

- Have you lost a family member?

- Have you changed or lost a job?

- Have you changed your investments?

- Have you bought an insurance policy?

- Have your income or expenses changed?

- Have your financial needs changed?

- Have you opened or closed a bank account?

- Have you obtained or closed a credit card?

- Have you changed passwords to emails and online accounts?

- Has your financial advisor, lawyer or accountant changed?

- Have you changed your will?

- Have you updated any beneficiaries?

- Have you spoken to your prospective guardians?

- Have you changed your executor?

- Have you changed power of attorney for health care or finances?

- Have your funeral arrangements changed?

- Have you choose to leave a legacy behind to charity or the church?

- Have you specified how you want your social media accounts handled?

Conclusion

If you don’t have a will or your intentions or unclear for any other reasons, your estate will wind up in probate court. While none of us likes to think about dying, improper or no planning can lead to family disputes, assets getting into the wrong hands, long court litigation, and excess money paid in estate taxes.