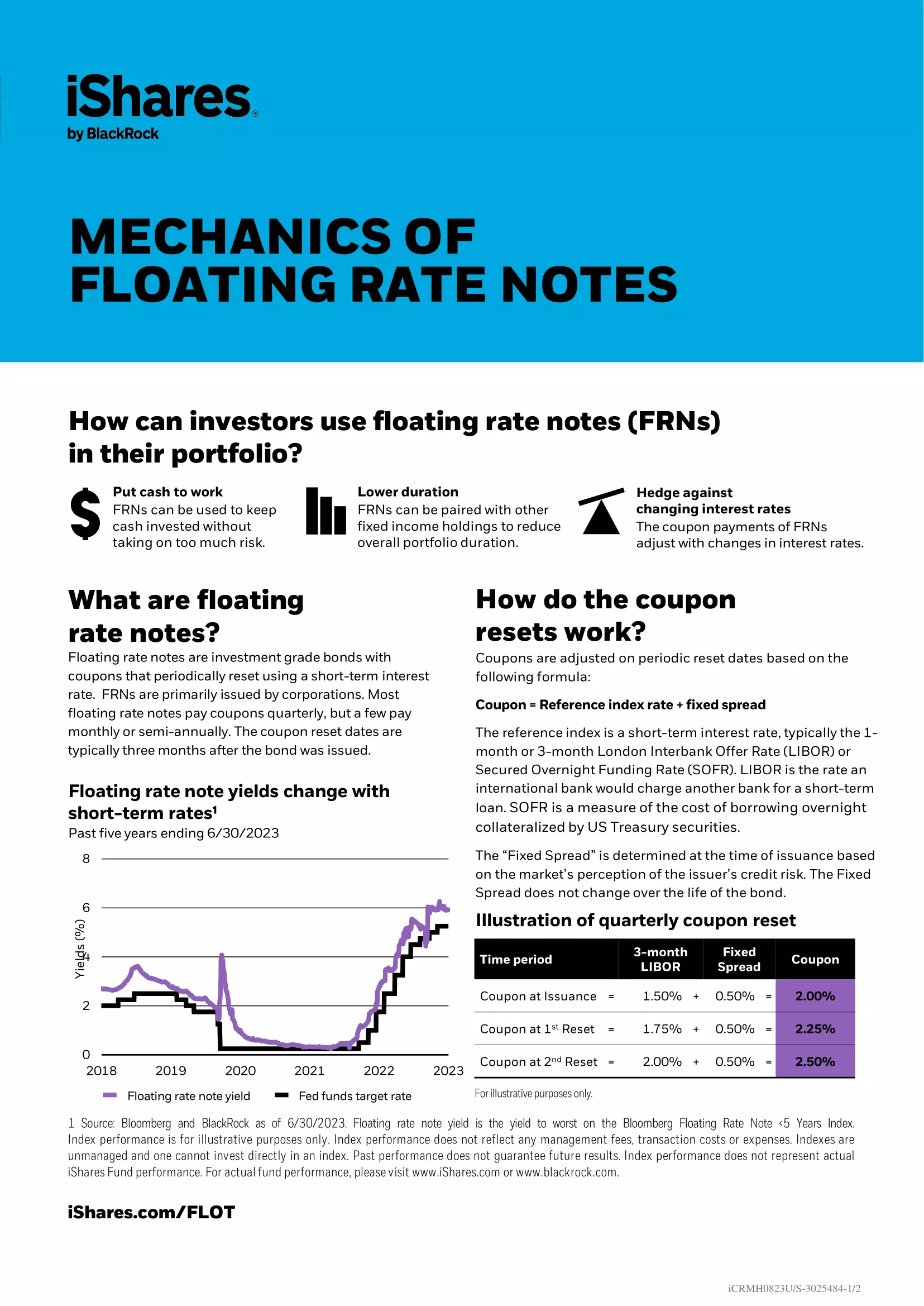

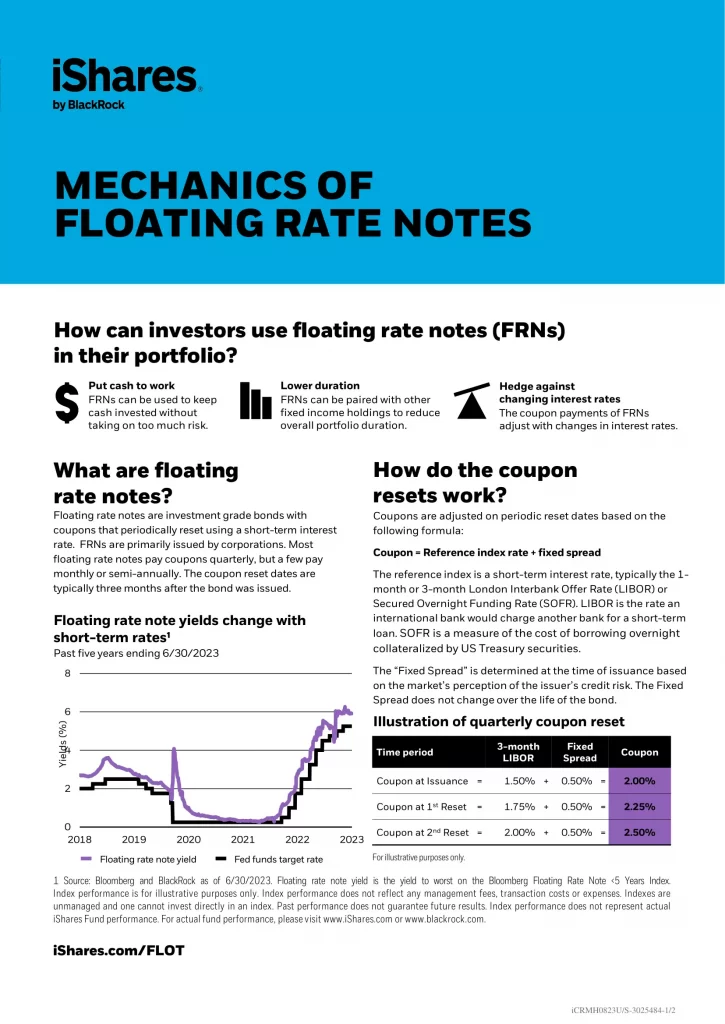

Floating rate notes are investment-grade bonds with coupons that periodically reset using a short-term interest rate. FRNs are primarily issued by corporations. Most floating rate notes pay coupons quarterly, but a few pay monthly or semi-annually. The coupon reset dates are typically three months after the bond was issued.

FLOT ETF Review

- Put Cash to Work: FRNs can be used to keep cash invested without taking on too much risk

- Lower Duration: FRNs can be paired with other fixed-income holdings to reduce overall portfolio duration

- Hedge Against Changing Interest Rates: The coupon payments of FRNs adjust with changes in interest rates

What is the Best Floating Rate ETF?

- BKUI: BNY Mellon Ultra Short Income ETF

- FLOT: iShares Floating Rate Bond ETF

- FLRN: SPDR Bloomberg Investment Grade Floating Rate ETF

- FLRT: Pacer Pacific Asset Floating Rate High Income ETF

- FLTR: VanEck IG Floating Rate ETF

- FLUD: Franklin Ultra Short Bond ETF

- GSY: Invesco Ultra Short Duration ETF

- ICSH: iShares Ultra Short-Term Bond ETF

- JPST: JPMorgan Ultra-Short Income ETF

- MINT: PIMCO Enhanced Short Maturity Active Exchange-Traded Fund

- PULS: PGIM Ultra Short Bond ETF

- RAVI: FlexShares Ultra-Short Income Fund

- SPSB: SPDR Portfolio Short Term Corporate Bond ETF

- TBUX: T. Rowe Price Ultra Short-Term Bond ETF

- ULST: SPDR SSgA Ultra Short Term Bond ETF

- ULTR: IQ Ultra Short Duration ETF

- VRIG: Invesco Variable Rate Investment Grade ETF

- VUSB: Vanguard Ultra-Short Bond ETF

Here is a table comparing similar floating rate ETFs as of August 31, 2023.

| Manager |  |  |  |  |  |  |

| ETF | FLOT | VRIG | JPST | PULS | FLRN | FLTR |

| Inception | 2011-06-14 | 2016-09-22 | 2017-05-17 | 2018-04-05 | 2011-11-30 | 2011-04-25 |

| MER | 0.15% | 0.30% | 0.18% | 0.15% | 0.15% | 0.14% |

| AUM | $7,257,345,624 | $661,900,000 | $22,790,000,000 | $5,279,880,402 | $2,373,090,000 | $1,150,000,000 |

| 1Y | 5.84% | 6.07% | 4.08% | 5.34% | 5.74% | 6.62% |

| 3Y | 2.07% | 2.55% | 1.49% | 2.15% | 2.07% | 2.33% |

| 5Y | 2.12% | 2.47% | 2.07% | 2.24% | 2.11% | 2.43% |

| 10Y | 1.63% | N/A | N/A | N/A | 1.67% | 1.97% |