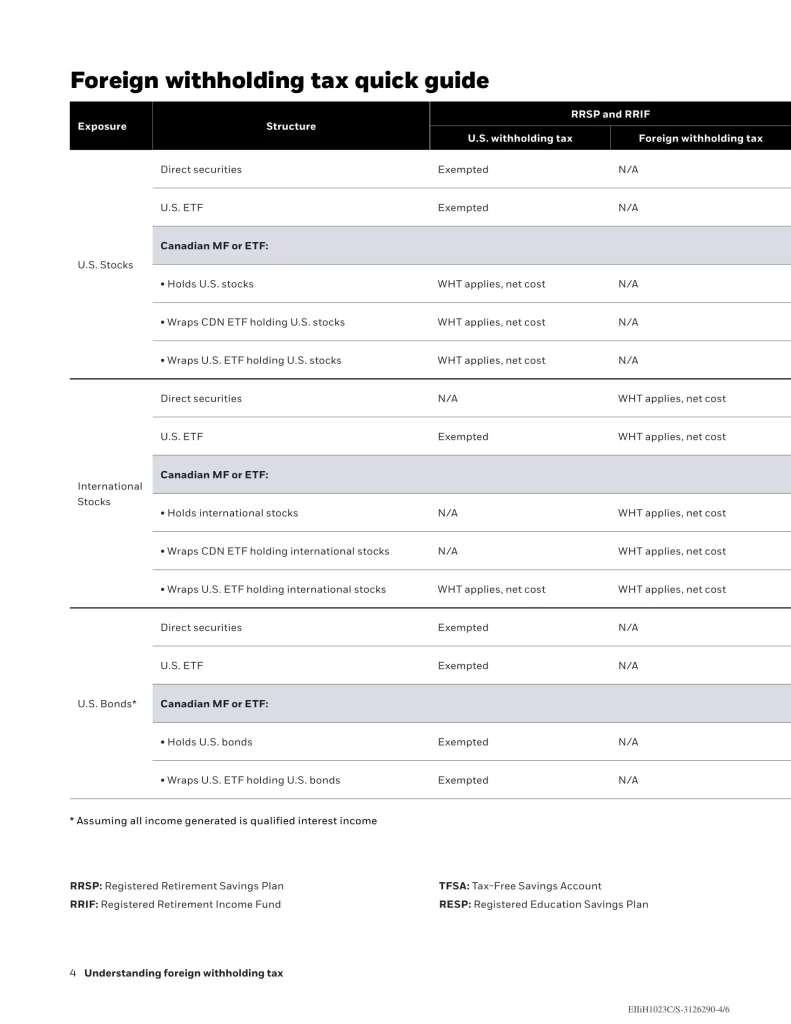

Depending on how investors hold foreign securities, they may encounter foreign withholding taxes. For Canadians, when US assets distribute dividends, taxes are levied on those dividends if the assets are held in TFSA, RESP, or non-registered accounts. However, if the US assets are held in an RRSP, a tax treaty between Canada and the US exempts them from non-resident withholding taxes. These taxes are deducted before the dividend reaches your investment account.

It’s crucial for investors to understand that most countries impose withholding taxes on dividends paid to foreign investors, whether individuals or funds. The key considerations in assessing the costs of foreign withholding tax include the underlying holdings and structure of the ETF, as well as the type of investment account in which the ETF is held. Depending on the ETF structure and underlying holdings, investors may face two levels of withholding tax. ETFs listed on Canadian stock exchanges will encounter withholding taxes when dividends are distributed from the underlying securities to the fund, governed by negotiated treaties between the country of origin of the company issuing the dividend and Canada.

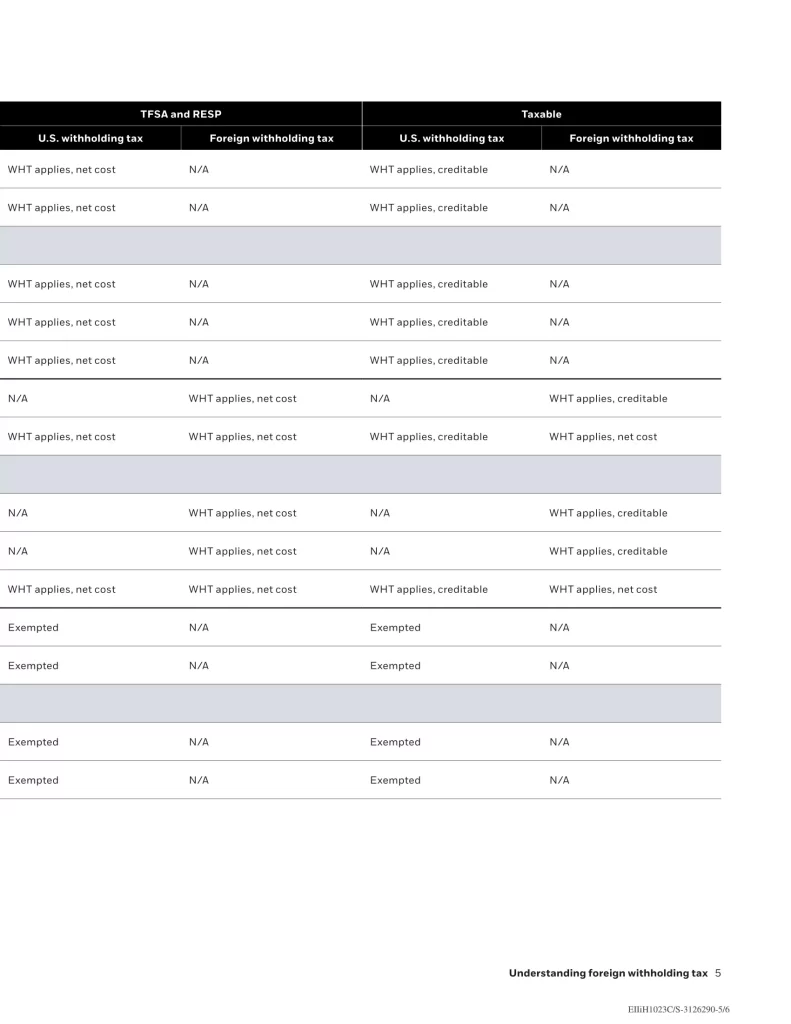

ETF Structures

The amount of withholding tax incurred by the ETF investment is dependent on the structure of the ETF and how that structure gains exposure to U.S. and international fixed income. The three most common structures available to Canadian fixed-income investors include:

- U.S.-listed ETF that invests in U.S. or international fixed income

- Canadian-listed ETF that holds U.S.-listed ETFs which invest in U.S. or international fixed income

- Canadian-listed ETF that invests directly in U.S. or international fixed income

Two Levels of Tax Consideration

- First Level: Tax assessed on dividends, interest or capital gains that are distributed from the underlying securities (including shares of other funds or ETFs) to the U.S.-listed (underlying) fund

- Second Level: Tax assessed on dividends, interest or capital gains that are distributed from the U.S.-listed fund to the Canada-listed fund

In taxable accounts, investors may be able to recover some of their incurred withholding taxes by using tax credits allotted to them. In RRSP accounts, the use of a U.S.-listed ETF may be beneficial as RRSPs are exempt from certain withholding taxes if the underlying securities are held directly.

Withholding Taxes by Investment Account

- Retirement Accounts: The US government exempts US security dividends from withholding taxes if they’re held in an RRSP, RRIF, or LIRA, thanks to the current Canada-US tax treaty. Consequently, a US-listed ETF of US stocks won’t undergo any tax withholding on dividends paid to an RRSP. However, this exemption doesn’t extend to TFSAs and RESPs. Additionally, other countries lack similar agreements, resulting in foreign withholding taxes being applicable to dividends from non-US international stocks, regardless of the account type.

- Taxable Accounts: In taxable accounts, withheld foreign taxes are reported on your T3 or T5 and can typically offset your Canadian taxes. Thus, while foreign taxes are remitted, they are reclaimable. Conversely, in registered accounts, no T slips are issued, rendering any foreign tax paid unrecoverable for offsetting Canadian tax liabilities.

Conclusion

If considering investing in foreign equities it’s crucial to understand the potential implications of foreign withholding tax. The actual rate of withholding tax applied to your received dividends might exceed your initial expectations, impacting your after-tax return. Nevertheless, the influence of higher foreign withholding taxes on your entire portfolio typically remains moderate. Other factors may hold greater significance for your investment strategy. Consult your advisor for guidance in constructing your portfolio. For further insights into the taxation of your investments, seek advice from your qualified tax advisor.