Hamilton ETFs is a Canadian investment manager claiming to be a financial sector specialist that launched their first fund in 2009 and ETF in 2016. Many of their investment products have leverage and attempt to implement covered call strategies for income investors. They were a very small asset manager in December 2019 having only $240,000,000 assets under management.

The majority of Hamilton’s products return capital which is a portion of the original investment. This lowers the adjusted cost base (ACB) and will increase any future capital gains, if any. Covered calls have been popular with retail investors for years because they offer substantial yields, but are paired with lower market returns.

What are the Top 10 Hamilton ETFs?

- HYLD.TO: Hamilton Enhanced U.S. Covered Call ETF

- HDIV.TO: Hamilton Enhanced Multi-Sector Covered Call ETF

- HMAX.TO: Hamilton Canadian Financials Yield Maximizer ETF

- UMAX.TO: Hamilton Utilities Yield Maximizer ETF

- HCAL.TO: Hamilton Enhanced Canadian Bank ETF

- HUTS.TO: Hamilton Enhanced Utilities ETF

- HFG.TO: Hamilton Global Financials ETF

- HCA.TO: Hamilton Canadian Bank Mean Reversion Index ETF

- HBA.TO: Hamilton Australian Bank Equal-Weight Index ETF

- HFIN.TO: Hamilton Enhanced Canadian Financials ETF

| Ticker | ETF | MER | AUM |

|---|---|---|---|

| HBA | Hamilton Australian Bank Equal-Weight Index ETF | 0.70% | $136,400,000 |

| HCA | Hamilton Canadian Bank Mean Reversion Index ETF | 0.55% | $74,600,000 |

| HCAL | Hamilton Enhanced Canadian Bank ETF | 1.46% | $531,700,000 |

| HDIV | Hamilton Enhanced Multi-Sector Covered Call ETF | 2.39% | $401,600,000 |

| HFG | Hamilton Global Financials ETF | 0.91% | $47,800,000 |

| HFIN | Hamilton Enhanced Canadian Financials ETF | 1.18% | $125,400,000 |

| HMAX | Hamilton Canadian Financials Yield Maximizer ETF | 0.71% | $687,600,000 |

| HUTS | Hamilton Enhanced Utilities ETF | 1.87% | $79,800,000 |

| HYLD | Hamilton Enhanced U.S. Covered Call ETF | 2.08% | $507,600,000 |

| UMAX | Hamilton Utilities Yield Maximizer ETF | N/A | $240,500,000 |

10. Hamilton Enhanced Canadian Financials ETF

Hamilton Enhanced Canadian Financials ETF (HFIN.TO) seeks to replicate a 1.25 times multiple of the Solactive Canadian Financials Equal-Weight Index TR (SOLCAFNT), comprised of equal-weightings of the top 12 largest Canadian financial services companies, while adding modest 25% cash leverage to enhance growth potential and yield.

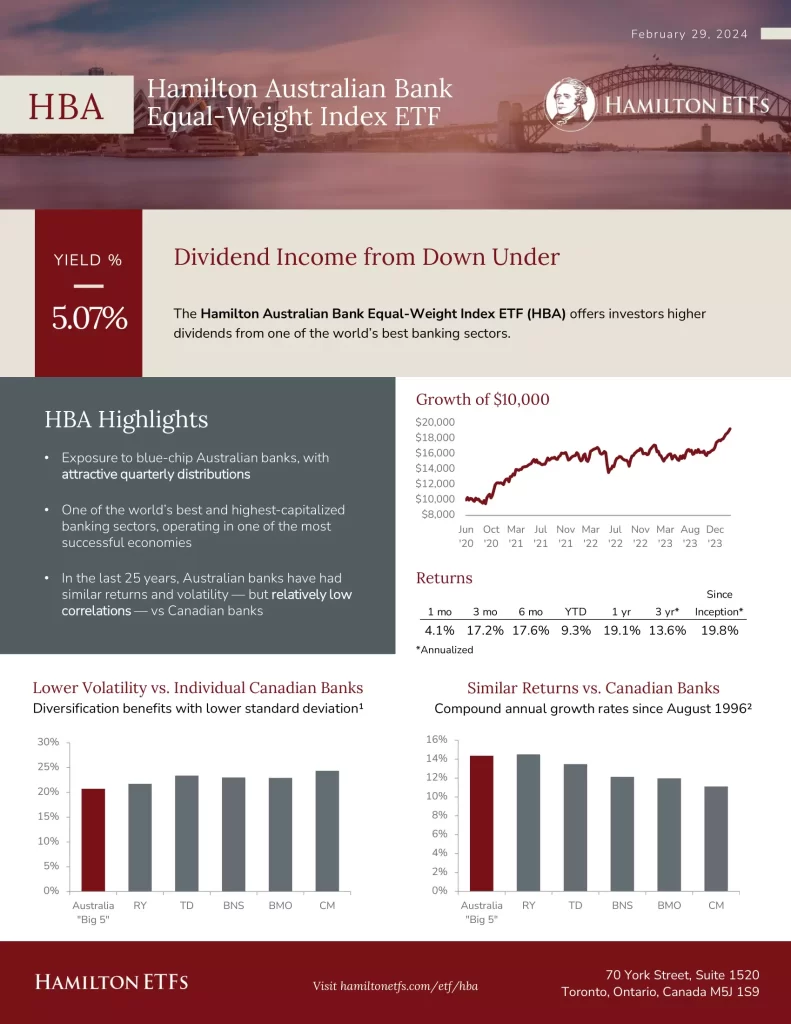

9. Hamilton Australian Bank Equal-Weight Index ETF

The investment objective of Hamilton Australian Bank Equal-Weight Index ETF (HBA.TO) is to replicate, to the extent reasonably possible and before the deduction of fees and expenses, the performance of an equal-weight Australian bank index. The ETF currently seeks to replicate the Solactive Australian Bank Equal-Weight Index (or any successor thereto).

8. Hamilton Canadian Bank Mean Reversion Index ETF

The fund is designed to closely track the returns of the Solactive Canadian Bank Mean Reversion Index TR, which applies a variable-weight, mean reversion trading strategy to Canada’s “Big Six” banks, with quarterly rebalancing. The Solactive Canadian Bank Mean Reversion Index TR has outperformed an equal-weight portfolio of Canada’s banks.

7. Hamilton Global Financials ETF

Hamilton Global Financials ETF (HFG.TO) is designed to seek long-term returns from an actively managed equity portfolio consisting of long-term capital growth and dividend income by investing in financial services companies located around the globe. Currency hedging at discretion of the manager.

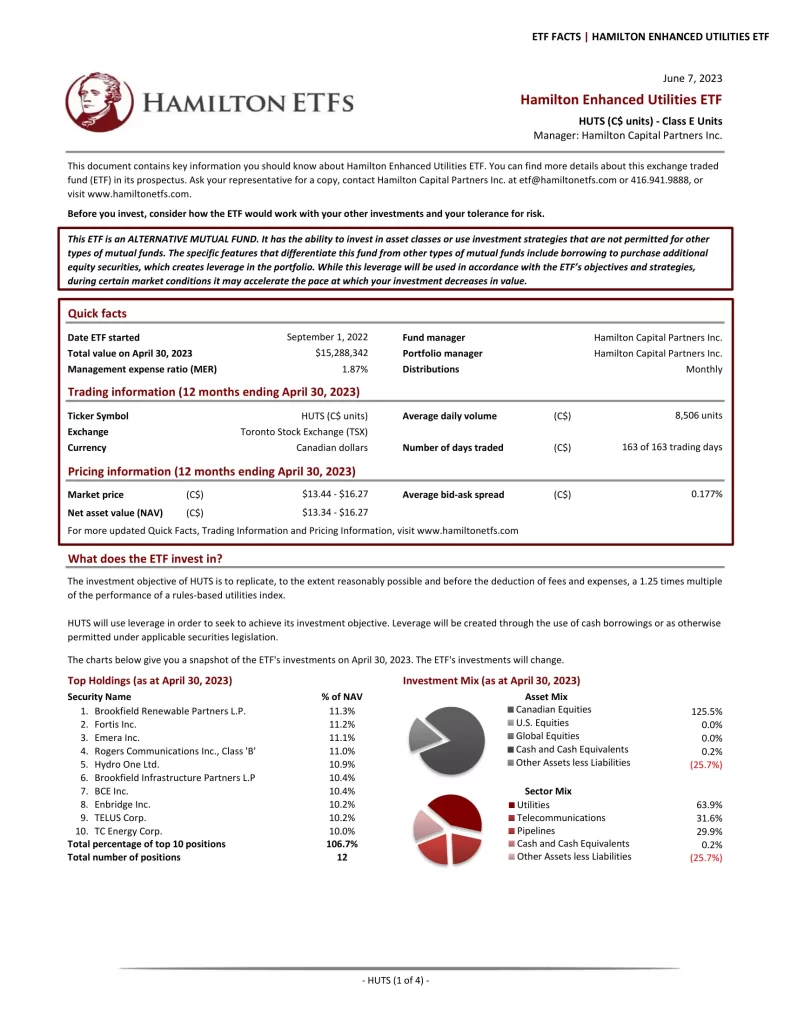

6. Hamilton Enhanced Utilities ETF

The investment objective of Hamilton Enhanced Utilities ETF (HUTS.TO) is to replicate, to the extent reasonably possible and before the deduction of fees and expenses, a 1.25 times multiple of a rules-based utilities index, currently the Solactive Canadian Utility Services High Dividend Index TR (SOLCUHDT).

5. HCAL.TO: Hamilton Enhanced Canadian Bank ETF

HCAL is designed to track 1.25x the returns of the Solactive Equal Weight Canada Banks Index, investing in Canadian banks — using modest 25% cash leverage. HCAL does not use derivatives.

4. UMAX: Hamilton Utilities Yield Maximizer ETF

Hamilton Utils Yield Maximizer ETF (UMAX.TO) is designed for attractive monthly income, while providing exposure to a portfolio of utility services equity securities, primarily domiciled/listed in Canada and the U.S. To reduce volatility and augment dividend income, UMAX will employ an active covered call strategy. UMAX does not use leverage.

3. Hamilton Canadian Financials Yield Maximizer ETF

Hamilton Canadian Financials Yield Maximizer ETF (HMAX.TO) is designed for attractive monthly income while providing exposure to a market cap-weighted portfolio of Canadian financial services stocks. To reduce volatility and augment dividend income, HMAX will employ an active covered call strategy. HMAX does not use leverage.

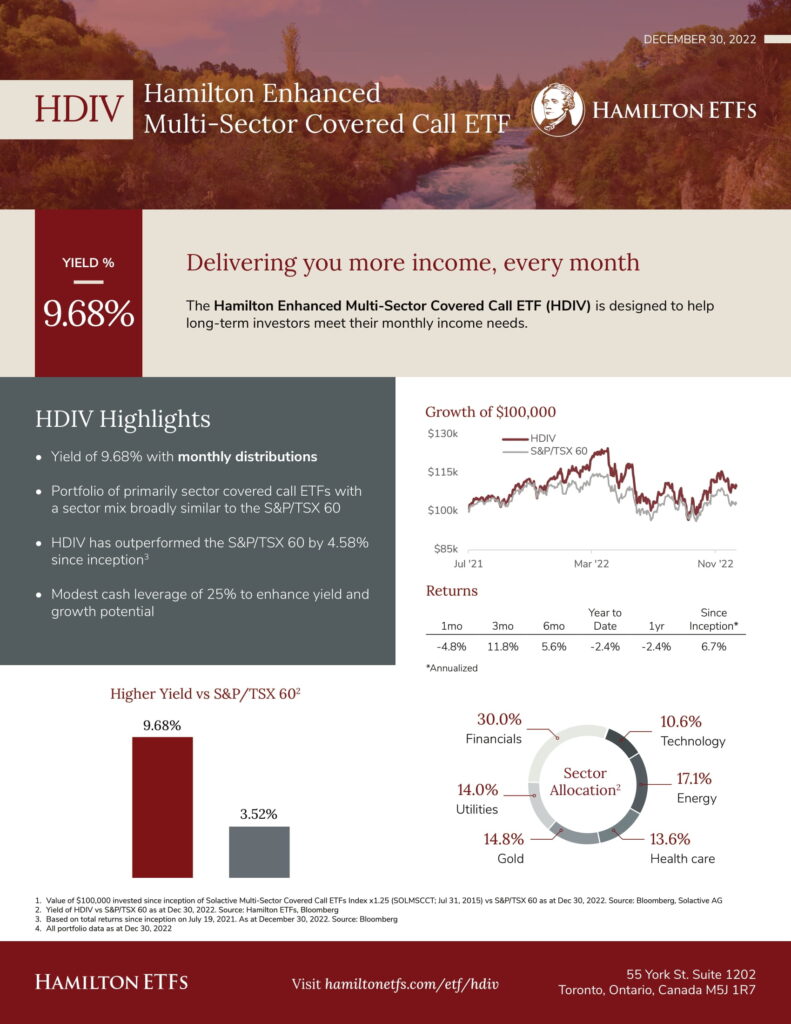

2. HDIV.TO: Hamilton Enhanced Multi-Sector Covered Call ETF

Hamilton Enhanced Multi-Sector Covered Call ETF (HDIV.TO) seeks to provide attractive monthly income and long-term capital appreciation from a diversified, multi-sector portfolio of primarily covered call ETFs focused on Canada.

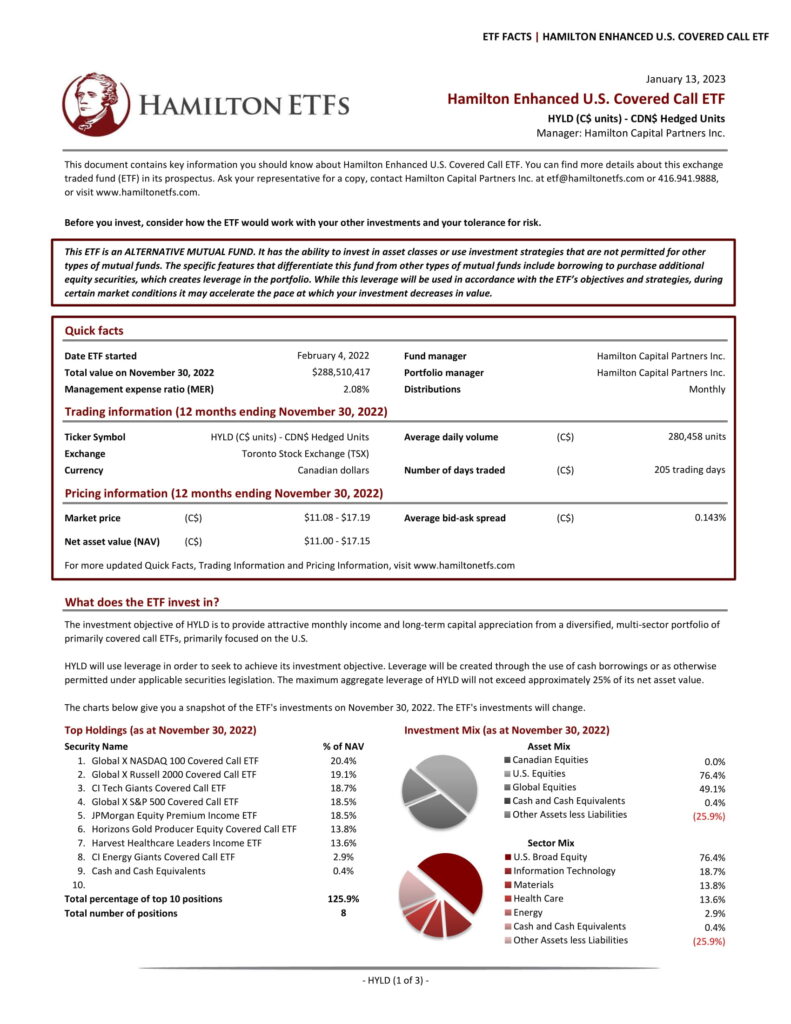

1. Hamilton Enhanced U.S. Covered Call ETF

Hamilton Enhanced U.S. Covered Call ETF (HYLD.TO) seeks to provide attractive monthly income and long-term capital appreciation from a diversified, multi-sector portfolio of primarily covered call ETFs, primarily focused on the U.S.

Who Owns Hamilton ETFs?

Rob Wessel is the owner of Hamilton ETFs and has a Bachelor of Business Administration from Wilfrid Laurier University.

What is the Yield of Hamilton HDIV?

Hamilton Enhanced Multi-Sector Covered Call ETF (HDIV) has a yield of 10.62%.

What is the Management Fee for Hamilton ETF?

Hamilton ETFs is known to have management fees far higher than other financial institutions. Some other Hamilton’s ETF products have MERs over 2% which is alarming.

What is the Dividend on Hamilton Enhanced Multi-Sector Covered Call ETF?

Hamilton Enhanced Multi-Sector Covered Call ETF (HDIV) paid a recent dividend distribution of $0.1350.

Conclusion

Hamilton has some of the highest fees in the industry and should be avoided by most investors.