What is a 60/40 Portfolio?

The 60/40 portfolio, where 60% is invested in equities (stocks) and 40% in fixed income (bonds). This asset allocation is often considered a “balanced” portfolio. Exchange Traded Funds (ETFs) are a straightforward and low-cost way for investors to implement the 60/40 strategy. Performance is usually based on an index most ETFs are passively managed investments. It allows investors to benefit from the stock market’s long-term capital appreciation, while smoothing out some of the volatile market fluctuations and with low-risk bonds. Some investors may also want to tilt the fixed-income portion of the portfolio towards inflation-protected securities or floating-rate debt instruments to hedge against inflation.

- Stocks: Represent ownership in a company, offering a share of its profits. While potentially yielding higher returns, they generally carry more risk than bonds.

- Bonds: Essentially loans to a company or government. You receive the principal back plus interest. Bonds are typically less risky than stocks but tend to have lower returns.

- Commodities: Raw materials like oil, gold, silver and wheat used in production. They can be a volatile asset class but can provide diversification to a portfolio and act as a hedge for inflation.

- Cash: Includes readily accessible and stable assets like savings accounts, money market funds, and CDs. This is the lowest-risk and most liquid asset class, designed to preserve capital and be a liquidity buffer.

Popular ETFs & Asset Classes

Simple portfolios can be constructed using the popular Vanguard Total World Stock ETF (VT) or iShares MSCI ACWI ETF (ACWI) for the equities and Vanguard Total World Bond ETF (BNDW) can be purchased for fixed income.

| Asset Class | Role | Description | Examples |

|---|---|---|---|

| Emerging Markets Equity | Growth | High-growth potential, higher risk | EEM & VWO |

| International Equity | Diversification | Developed markets outside North America | EFA & VEU |

| Global & US Sector Equity | Targeted growth | Thematic or sector-specific exposure (e.g., tech, health) | VGT, XLF & IXJ |

| US Small & Mid-Cap Equity | Growth & agility | Smaller U.S. companies with room to grow | IWM & VO |

| US Large Cap Equity | Stability & growth | Blue-chip U.S. companies | SPY & VTI |

| Foreign Bond | Diversification & yield | International sovereign and corporate debt | IGOV |

| Corporate Bond | Income | Investment-grade & high-yield U.S. corporate debt | LQD |

| Government Bond | Safety | U.S. or domestic government debt | IEF |

| Commodity | Inflation hedge & diversification | Gold, oil, agriculture, etc. | DBC |

| Money Market | Liquidity & stability | Cash-equivalents, short-term T-bills | TFLO |

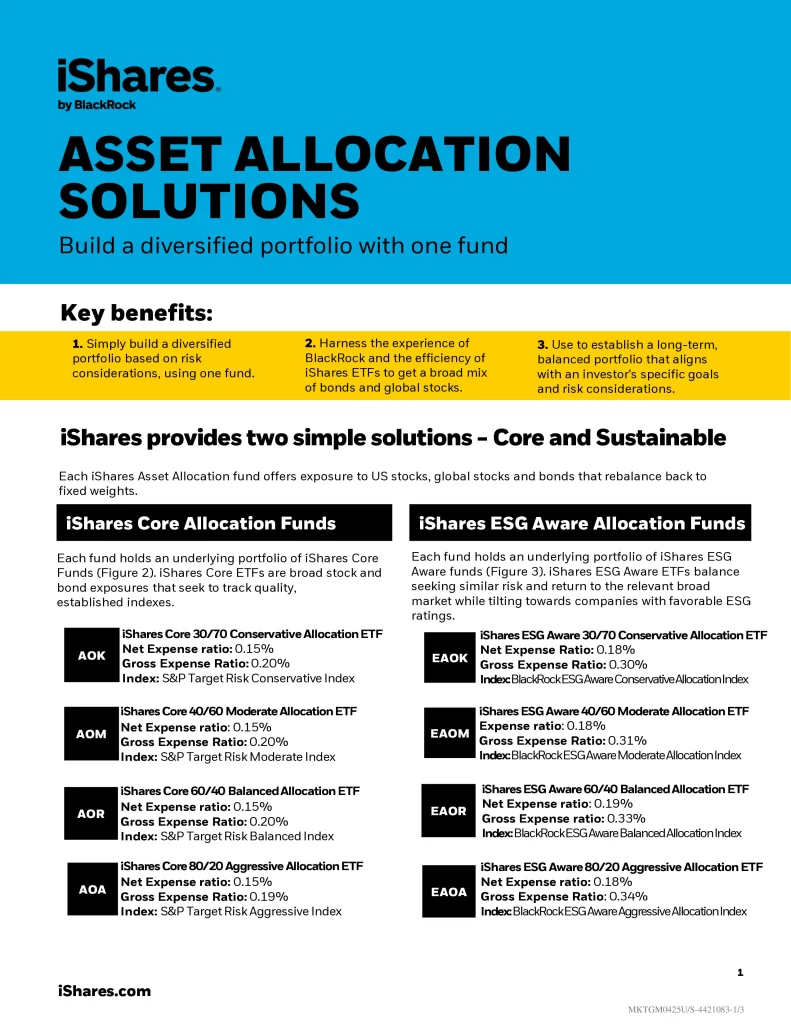

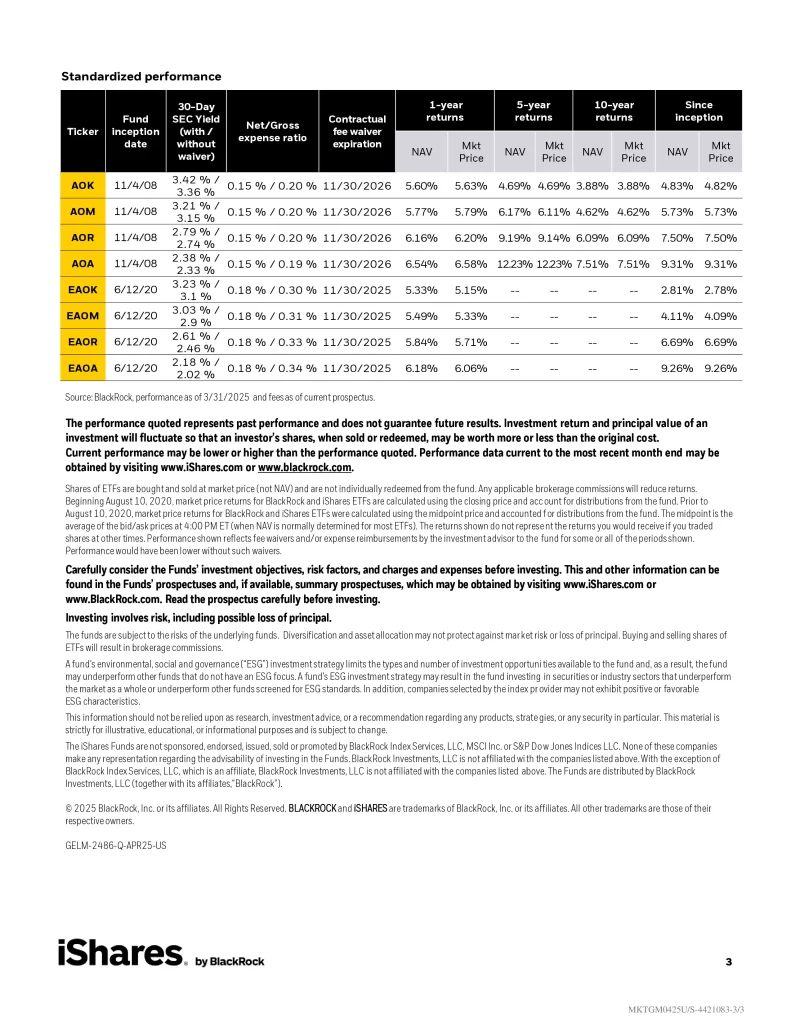

All-in-One Portfolio

The iShares Core 60/40 Balanced Allocation ETF (AOR) seeks to track the investment results of an index composed of a portfolio of underlying equity and fixed income funds intended to represent a growth allocation target risk strategy.

- Harness the experience of BlackRock and the efficiency of iShares ETFs to get a broad mix of bonds and global stocks.

- Use to establish a long-term, balanced portfolio and combine with other funds for particular needs like income.

- A simple way to build a diversified core portfolio focused on growth using one low-cost fund.

| Ticker | Name | Percentage |

|---|---|---|

| AOR | iShares Core 60/40 Balanced Allocation ETF | 100% |

2 Fund Portfolio

A 2-fund portfolio using global equity and fixed income is a simple yet effective diversified investment strategy.

- Global Equity

- Global/Aggregate Fixed Income

3 Fund Portfolio

A 3-fund portfolio with international equity, American equity, and a fixed income ETF can build a well-balanced, globally diversified strategy that offers both growth and income potential.

- International Equity

- American Equity

- Global/Aggregate Fixed Income

| Ticker | Name | Percentage |

|---|---|---|

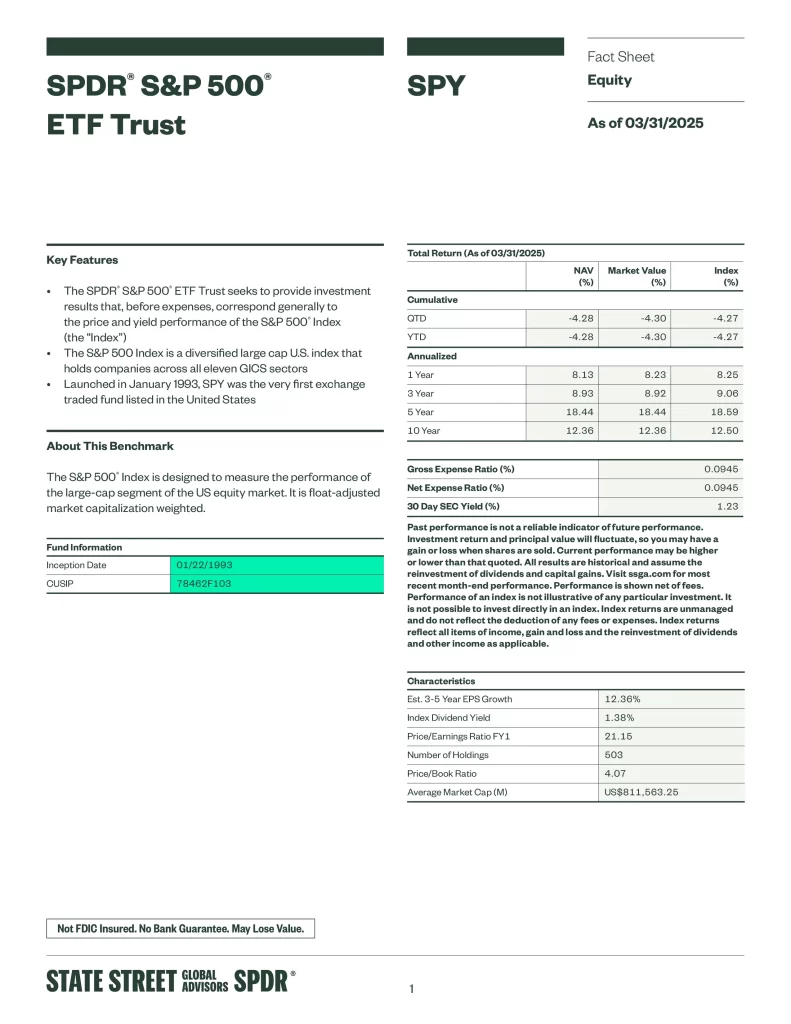

| SPY | SPDR S&P 500 ETF | 40% |

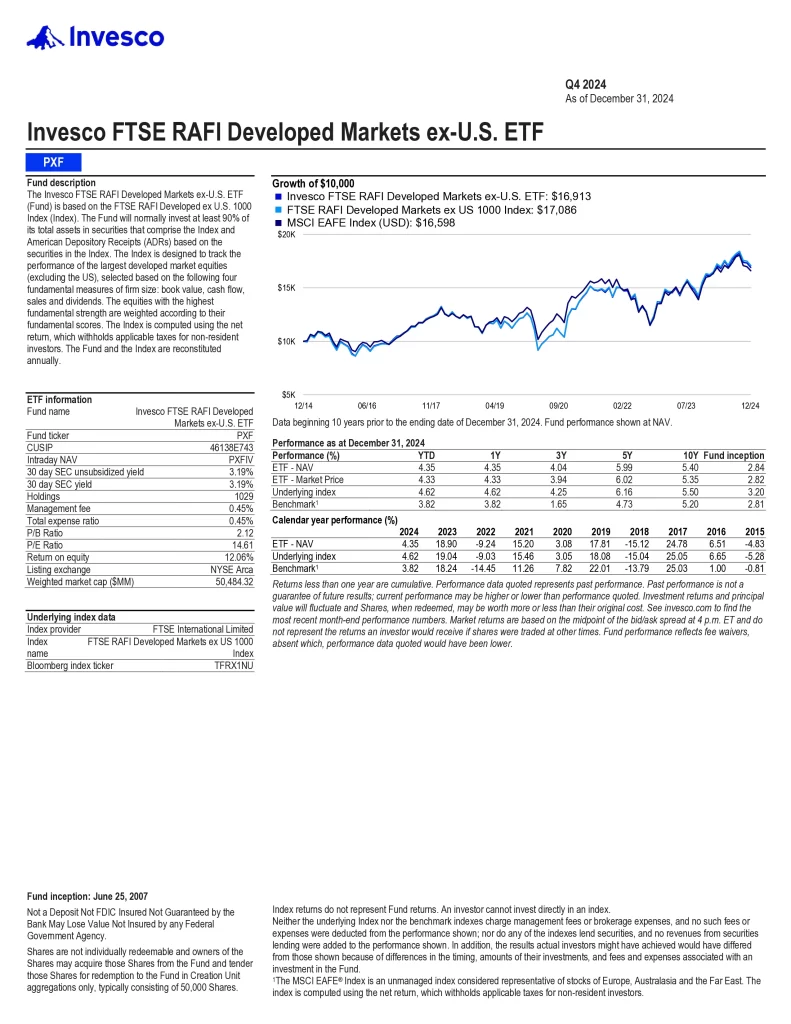

| PXF | Invesco RAFI Developed Markets ex-U.S. ETF | 20% |

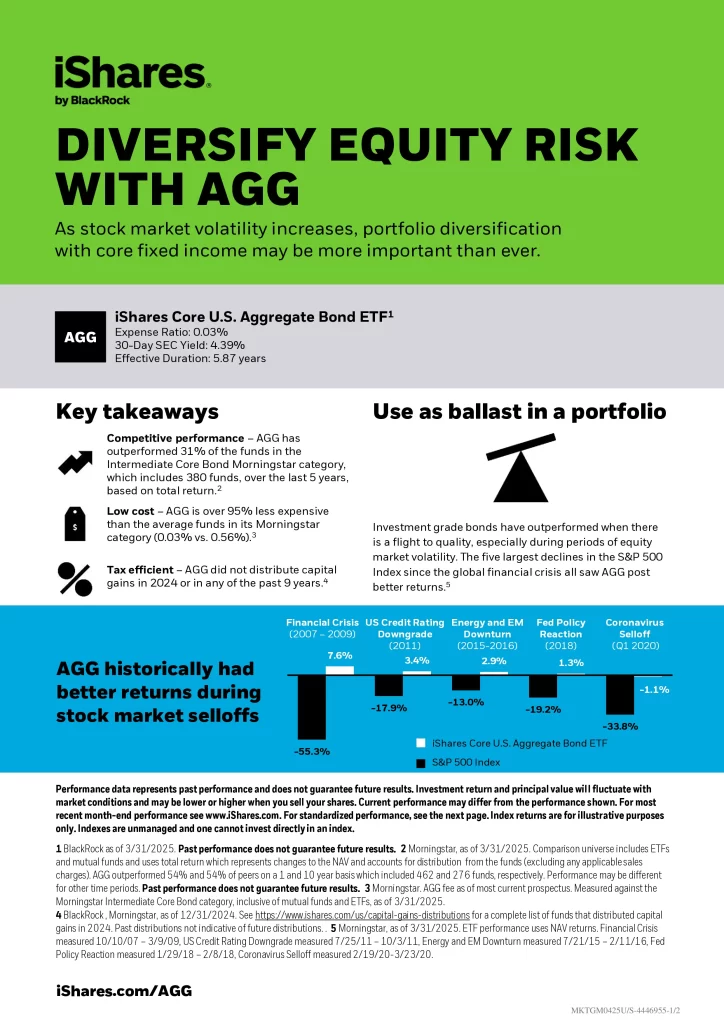

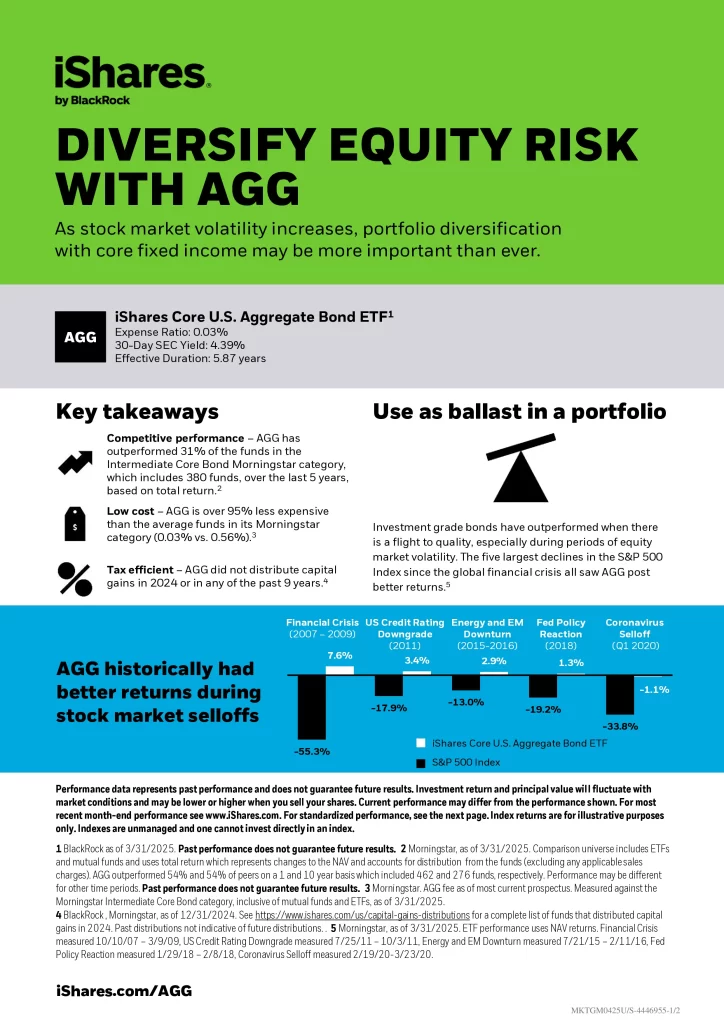

| AGG | iShares Core U.S. Aggregate Bond ETF | 40% |

3 Bucket Portfolio

A 3-bucket portfolio is a classic retirement or long-term investing strategy designed to manage risk, liquidity, and income over time. It separates your investments by time horizon and purpose.

- Global Equity

- Global/Aggregate Fixed Income

- Money Market & T-Bills

| Ticker | Name | Percentage |

|---|---|---|

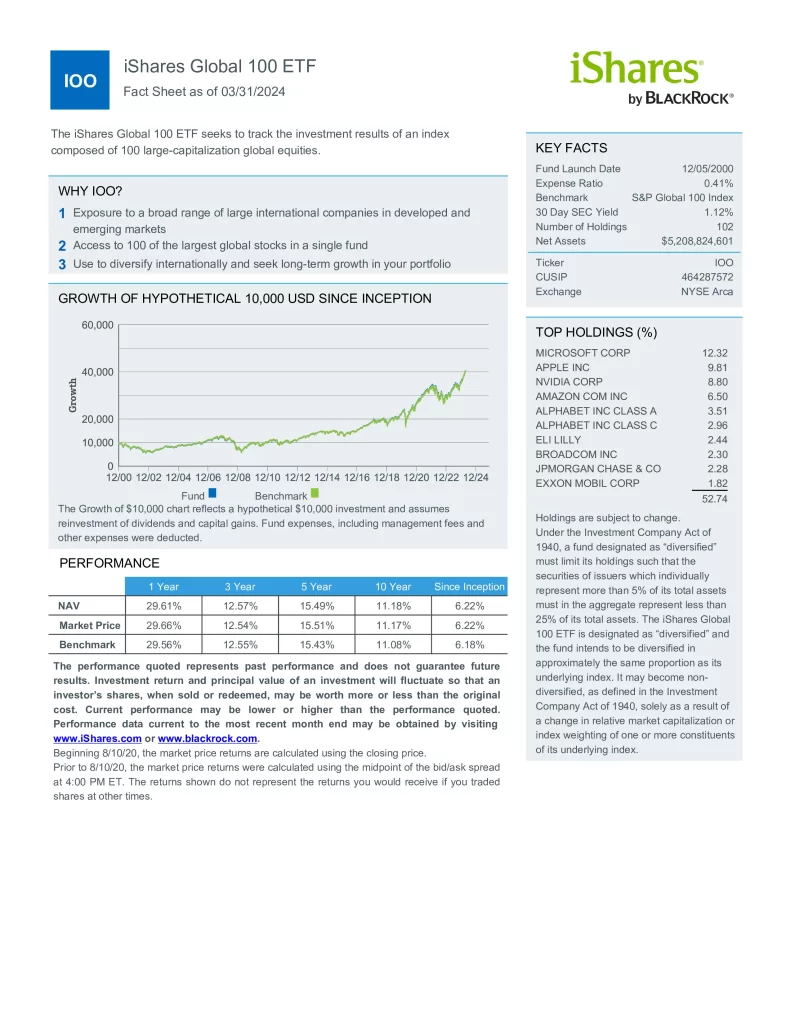

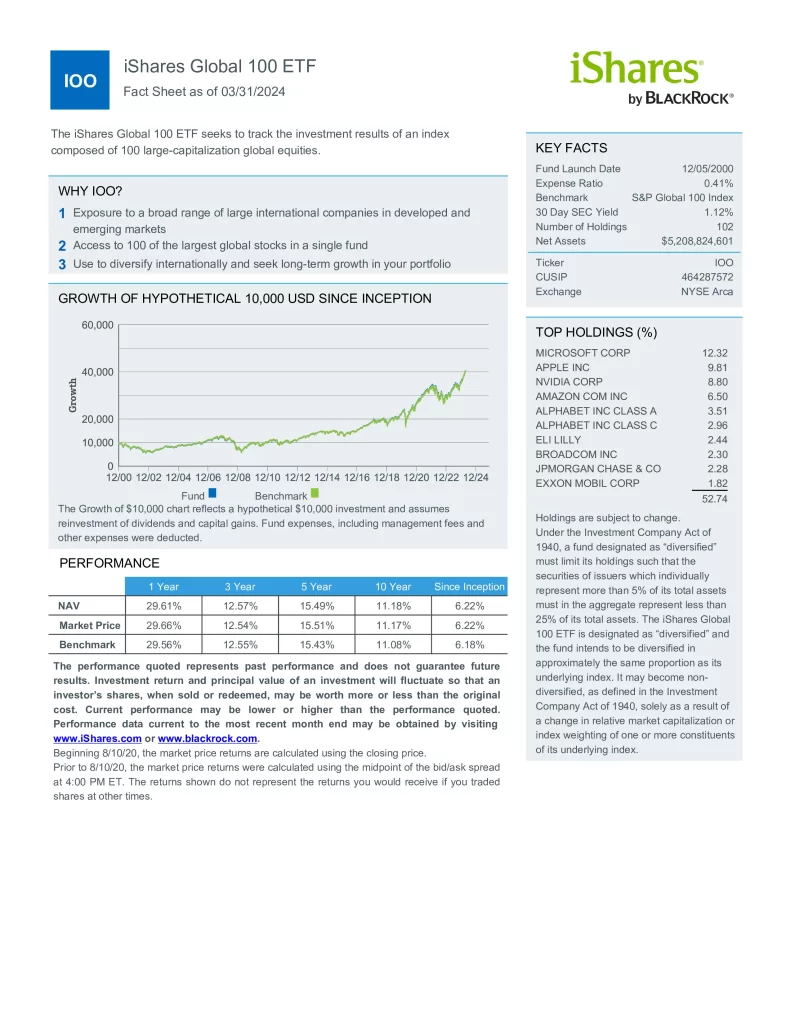

| IOO | iShares Global 100 ETF | 60% |

| AGG | iShares Core U.S. Aggregate Bond ETF | 30% |

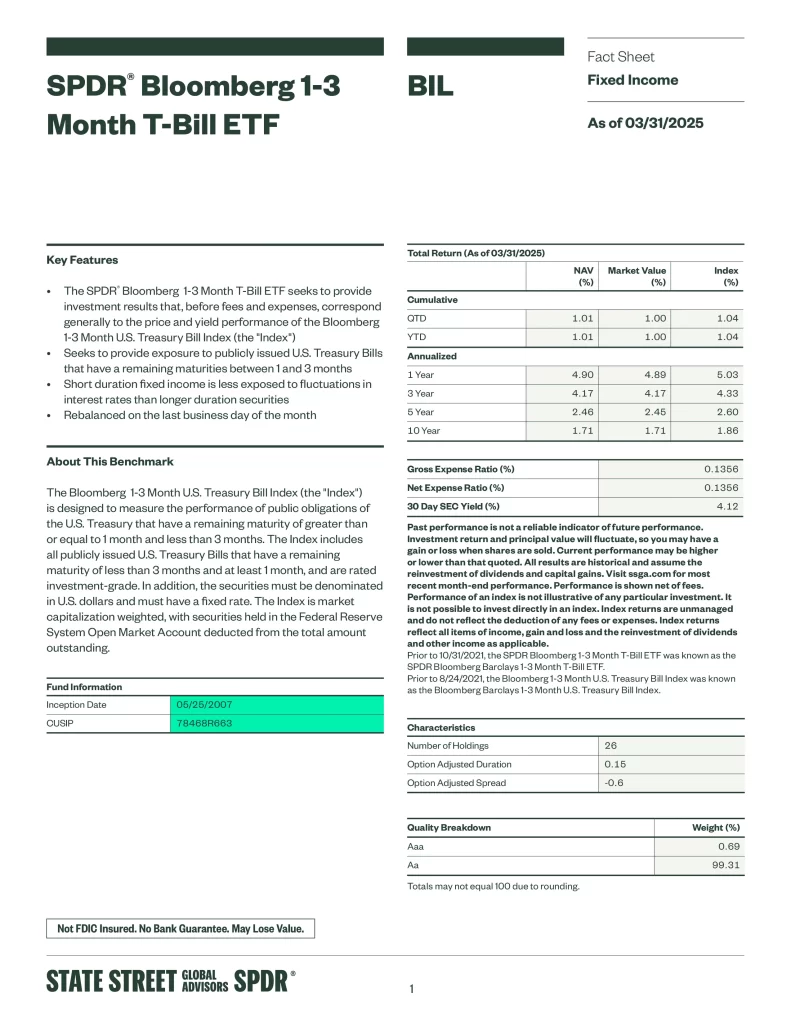

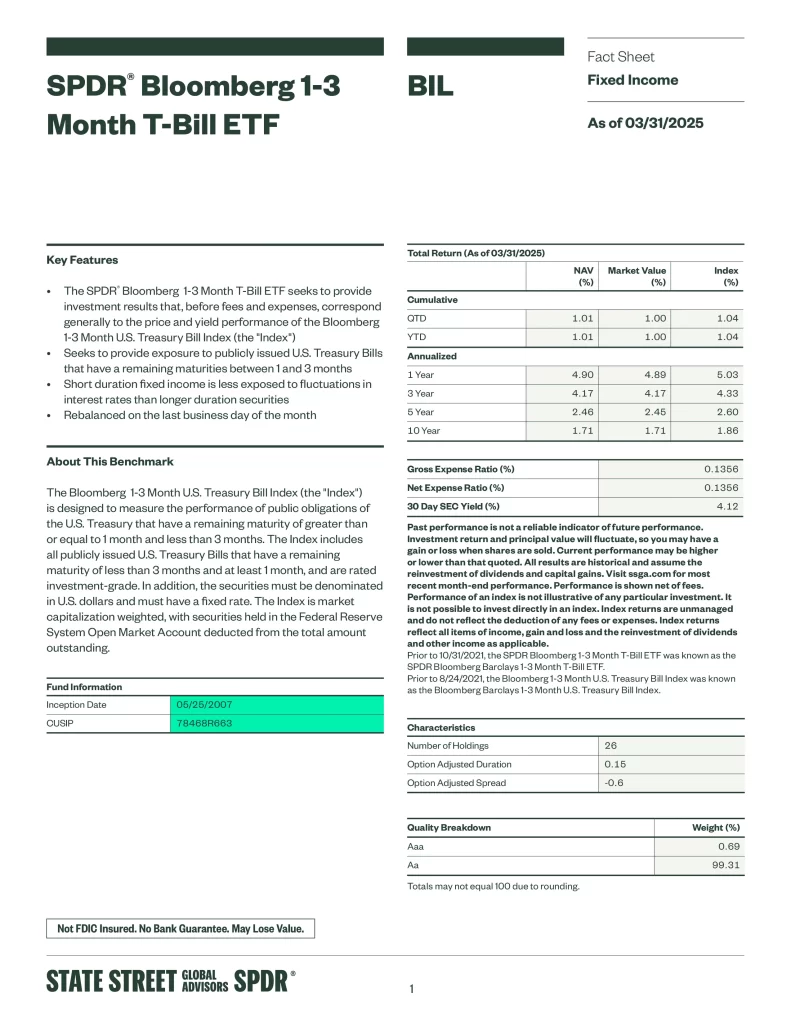

| BIL | SPDR Bloomberg 1-3 Month T-Bill ETF | 10% |

Top 10 Portfolio

This is a comprehensive, multi-asset class portfolio suited for an investor who wants broad exposure across geographies, market caps, and asset types.

- Emerging Markets Equity

- International Equity

- Global & US Sector Equity

- US Small & Mid-Cap Equity

- US Large Cap Equity

- Foreign Bond

- Corporate Bond

- Government Bond

- Commodity

- Money Market

| Ticker | Name | Percentage |

|---|---|---|

| SPEM | SPDR Portfolio Emerging Markets ETF | 12% |

| PXF | Invesco RAFI Developed Markets ex-U.S. ETF | 12% |

| XLK | The Technology Select Sector SPDR Fund | 12% |

| IJS | The Technology Select Sector SPDR Fund | 12% |

| SPY | SPDR S&P 500 ETF | 12% |

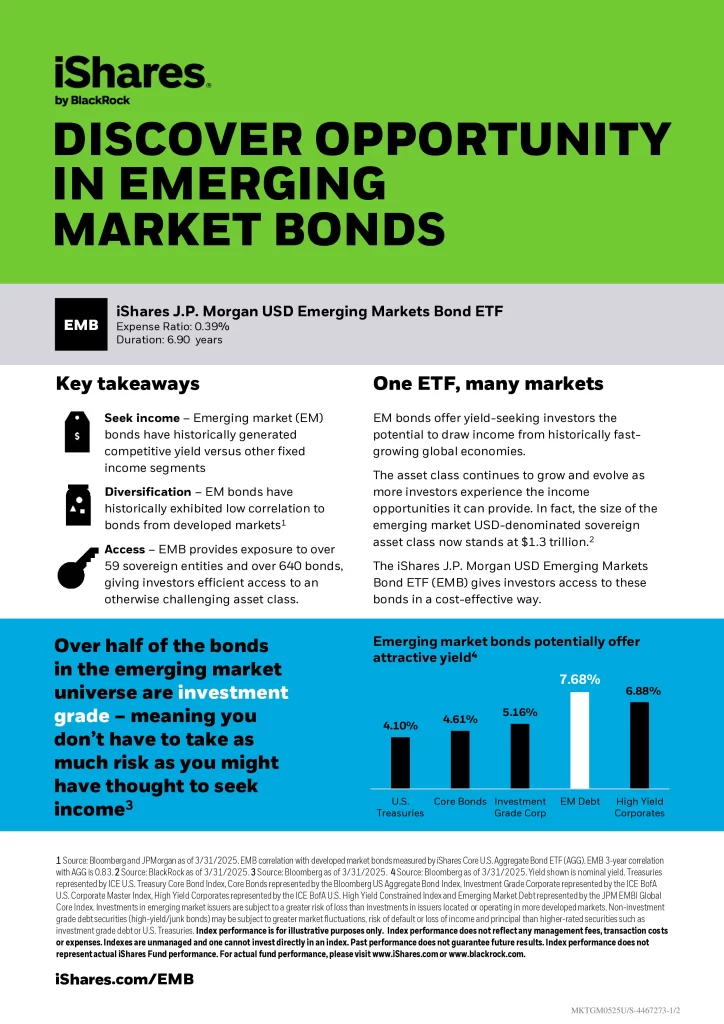

| EMB | iShares J.P. Morgan USD Emerging Markets Bond ETF | 8% |

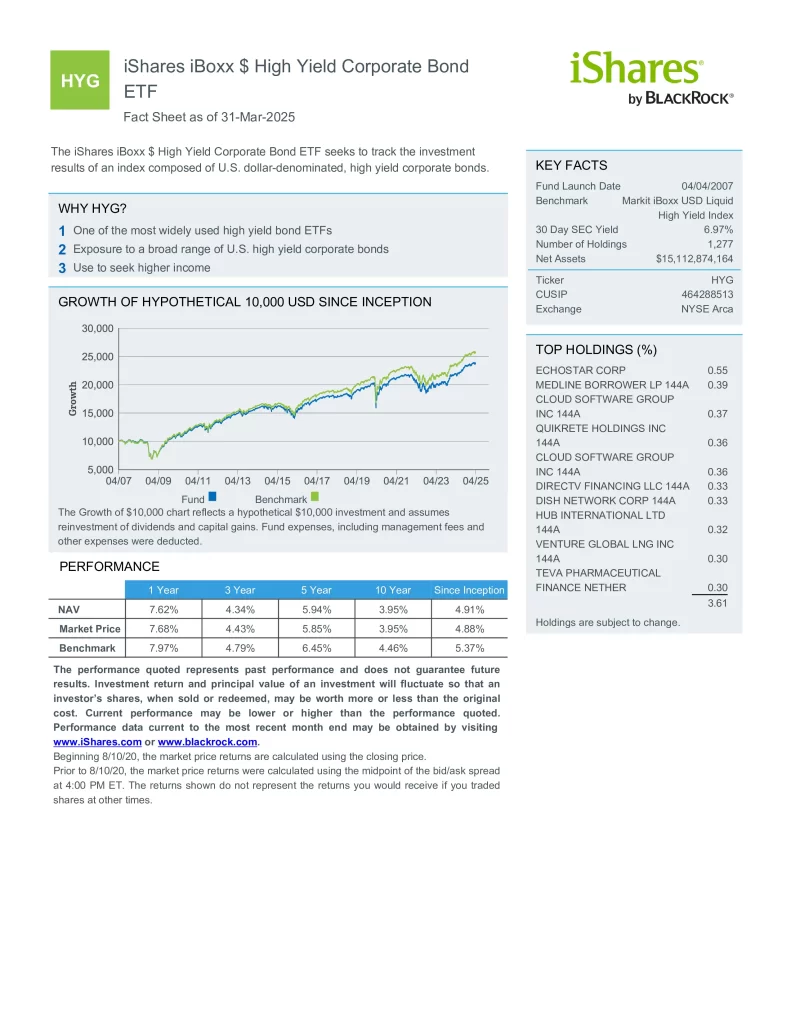

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF | 8% |

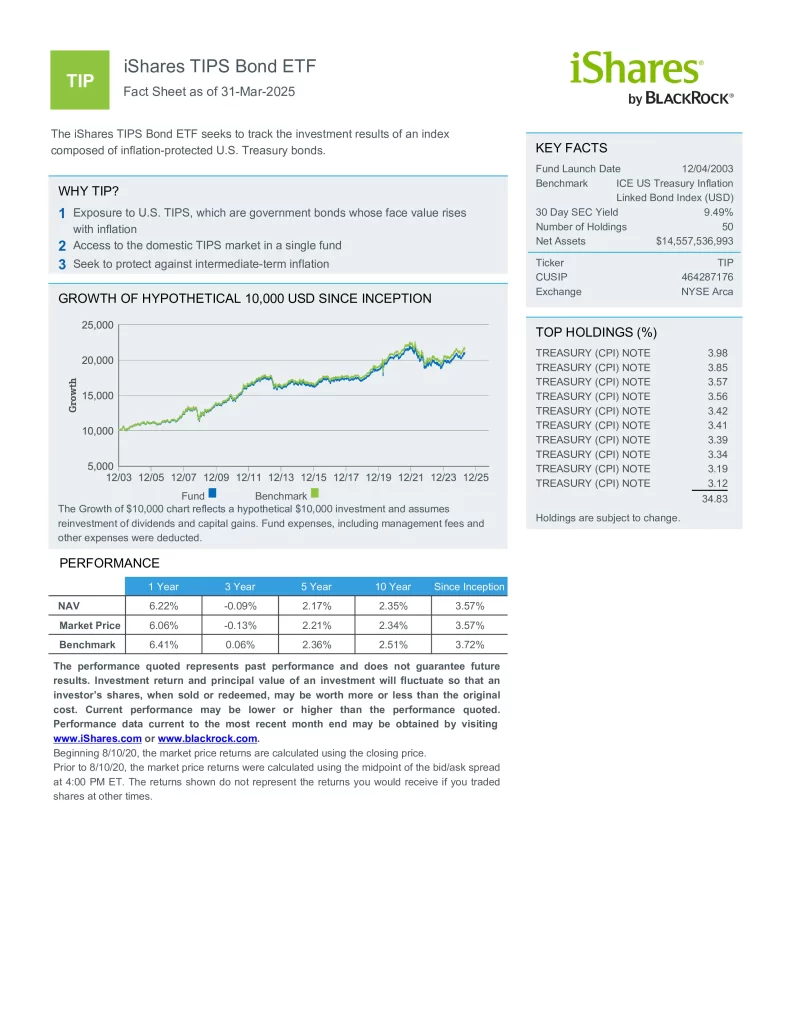

| TIP | iShares TIPS Bond ETF | 8% |

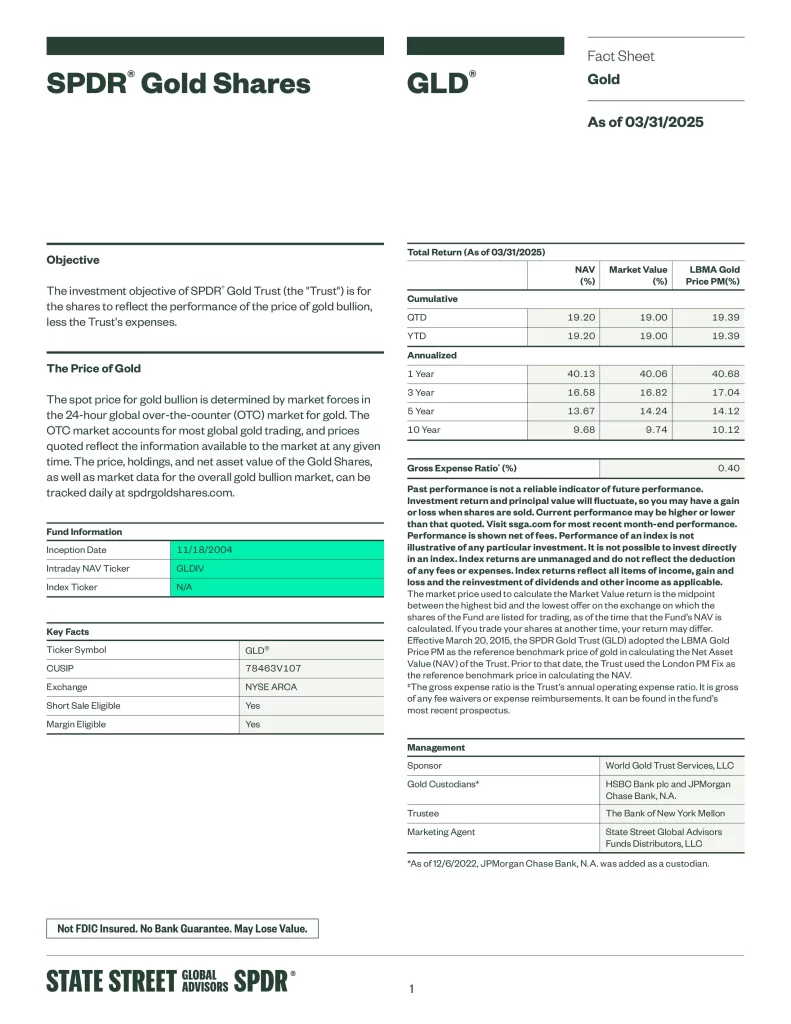

| GLD | SPDR Gold Shares | 8% |

| BIL | SPDR Bloomberg 1-3 Month T-Bill ETF | 8% |