Learn how to invest in stocks, including selecting a brokerage account and researching stock market investments. When you invest in a stock, you’re hoping the company grows and performs well over time. That’s how you end up making money. One of the best ways for beginners to learn how to invest in stocks is to put money in an online investment account and purchase stocks from there.

- Investing in stocks means buying shares of ownership in a public company

- If a stock you own becomes more valuable, you could earn a profit by selling it to another investor.

- Most people invest in stocks online, through a brokerage account

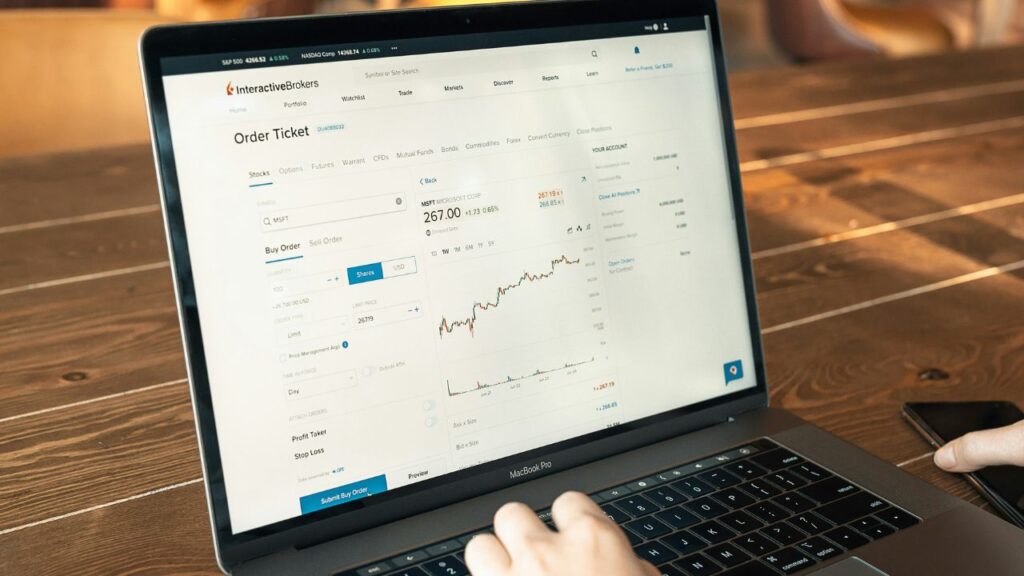

Select an Online Brokerage

To invest in stocks, open an online brokerage account, add money to the account, and purchase stocks or stock-based funds from there. You don’t have to have a lot of money to start investing. Many brokerages allow you to open an investing account with $0, and then you just have to purchase stock. Some brokers also offer paper trading, which lets you learn how to buy and sell with stock market simulators before you invest any real money.

Choose an Investment Account

Once you know how you want to invest, you’re ready to shop for an investment account, also known as a brokerage account. There are several types of investment accounts, and it’s a good idea to figure out which account is right for you. For example, a Roth IRA or TFSA comes with significant tax benefits while a standard brokerage account does not.

An online investment account likely offers your quickest and least expensive path to buying stocks, funds, and a variety of other investments. With a broker, you can open an individual retirement account (IRA) or a taxable brokerage account if you’re already saving adequately for retirement in an employer plan.

Your Stock Market Investment

If you’re after a specific company, you can buy a single share or a few shares as a way to dip your toe into the stock-trading waters. The amount of money you need to buy an individual stock depends on how expensive the shares are. Some brokerages allow you to invest with fractional shares, meaning you can choose a dollar amount and invest that despite the share price being greater than what you have. You can allocate a fairly large portion of your portfolio toward stocks, especially if you have a long time horizon.

Focus on Investing for the Long-Term

Stock market investments have proven to be one of the best ways to grow long-term wealth. Over several decades, the average stock market return is about 10% per year. However, remember that’s just an average across the entire market — some years will be up, some down, and individual stocks will vary in their returns.For long-term investors, the stock market is a good investment no matter what’s happening day-to-day or year-to-year; it’s that long-term average they’re looking for.

Manage Your Stock Portfolio

While fretting over daily fluctuations won’t do much for your portfolio’s health, there will be times when you’ll need to check in on your stocks or other investments. If you follow the steps above to buy individual stocks, over time, you’ll want to revisit your portfolio a few times a year to make sure it’s still in line with your investment goals.

Best Stocks for Beginners

The process of picking stocks can be overwhelming, especially for beginners. After all, there are thousands of stocks listed on the major U.S. exchanges. Stock investing is filled with intricate strategies and approaches, yet some of the most successful investors have done little more than stick with stock market basics.

Conclusion

Learning how to invest in stocks can be daunting for beginners, but it’s really just a matter of figuring out which investment approach you want to use, what kind of account makes sense for you, and how much money you should put into stocks.