Dividend investing offers a simple solution to the problem of separating your income from your time, a key requirement for retirement. But can you really live off dividends?

For most investors, a secure and comfortable retirement is the top priority. Many people allocate the bulk of their assets to accounts dedicated to this goal. However, living off your investments once you retire can be as challenging as saving for retirement. Let’s explore what it takes to retire on dividends.

Most withdrawal methods involve spending interest income from bonds and selling shares to cover the rest. The well-known four-percent rule operates on this principle, aiming to provide a steady income stream while preserving an account balance to last many years. But what if you could get four percent or more from your portfolio each year without selling shares and reducing the principal? With some planning, it’s possible to live off dividends.

Many Canadians dream of quitting work and living off investment income and dividends. While enticing, it’s a challenging goal that requires intense frugality, a smart savings plan, and a thoughtful investment strategy. Not many are willing to sacrifice their short-term lifestyle for long-term freedom.

Is Living Off Dividends in Retirement Possible?

The short answer is yes – it’s entirely possible to live off dividends in retirement. Many people do it every day. The key is to start early, invest wisely, and reinvest your dividends to let your portfolio grow. Of course, there’s no guarantee you’ll be able to retire on dividends alone. But by reading this guide, you’re on the right track. Here’s how you can get started today.

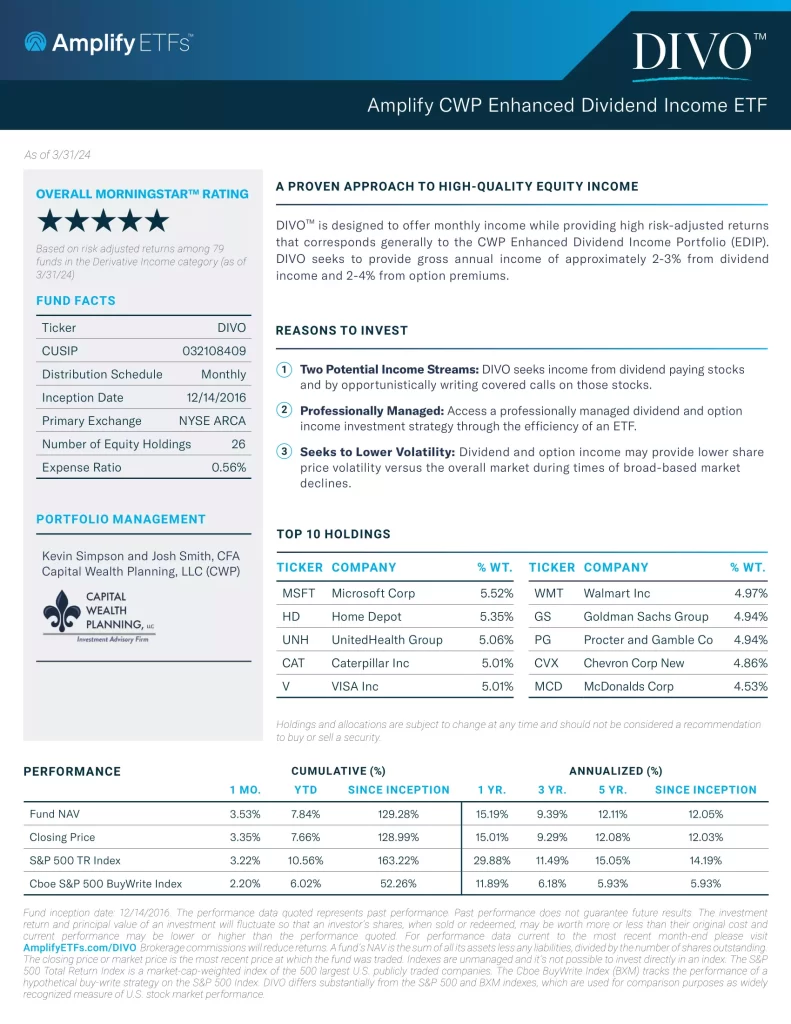

To match the median single-person salary of $59,384, based on Q4 2023 data from the Bureau of Labor Statistics, the required investment portfolio size varies with different dividend yields:

- For a 2% yield, you need approximately $2,969,200

- For a 3% yield, about $1,979,467

- For a 4% yield, around $1,484,600

- For a 5% yield, about $1,187,680

- For a 6% yield, around $989,733

The rising cost of living in Canada means you might need significantly more cash for retirement than just a few years ago. Yet, it’s still achievable with sacrifice.Living off dividends depends on factors such as salary, lifestyle, debt, location, savings capacity, and investment acumen. As a result, there is no one-size-fits-all answer to how much cash you need to live off dividend income. It really depends.Depending on your investments’ size, growth, and how much you reinvest your dividends, you could generate enough money to live on each year without another retirement plan.

The Process of Living Off Dividends

While simple in concept, living off dividends takes complete dedication from an early age. We’re laying out this information for those just starting retirement planning and wanting a comfortable, stress-free retirement. We assume you have time to build a nest egg before retiring.

Much of the advice is also relevant for those approaching retirement and wanting to move cash from traditional savings accounts, 401Ks, or IRAs into dividend-paying stocks.

It’s All About Dividend Growth

Stock dividends tend to grow over time, unlike bond interest. This makes stocks essential for any portfolio, as dividend growth has historically outpaced inflation. For long-term investors, this creates a portfolio aimed at living off dividend income. A smart strategy for those saving for retirement is to reinvest dividends to buy more stock, increasing future dividends and shares.

For example, if you buy 1,000 shares at $100 each, totaling $100,000, with a 3% dividend yield, you earn $3,000 in dividends annually. Reinvesting these dividends increases your investment, and if the dividend grows by 6% annually, your dividends grow accordingly. This compounding effect significantly increases your dividends over time.

How Much Cash Will You Need?

The amount you need to invest depends on living costs, lifestyle, and risk tolerance. The average Canadian family of four needs between $75,000 and $90,000 annually for a comfortable life.

The Wall Street Journal provided an example of retiring with $1 million, desiring $40,000 in annual income, with a mix of Treasury bonds and stocks. After 21 years, the bond portfolio might deplete, but dividend income could grow to sustain you. A conservative dividend portfolio yielding 3% or higher with 3.5% annual growth is attainable.

The Average Canadian Needs Around $6,500/Month

The median family income in Canada is $98,400, or $6,500 per month after tax. To generate this from dividends, you need a portfolio yielding 3.5% to 4.5%, translating to $1.4 to $1.8 million. Other income sources like Social Security can reduce the required amount.

Like clockwork and with no effort on your part, the dividend stocks and funds you hold will deposit recurring dividend payments into your brokerage account throughout the year. These cash payments can then be transferred to your bank account and used for housing, food, healthcare, travel, and other living expenses, all without selling a single share of stock.

Use the Index to Earn Passive Income

The S&P/TSX Composite Index has an average dividend yield of 3.15%. To generate $75,000 to $90,000 annually, you need $2.4 to $2.9 million invested. Dividend-focused ETFs may yield more, offering a good passive investment option.

Generate Dividend Income with a Portfolio of Stocks

Investing in a diversified portfolio of quality dividend stocks can yield around 5%, needing $1.5 to $1.8 million to live off your dividend income. Dividends provide consistent income, making them valuable in retirement. While building a dividend portfolio requires effort, it offers control and predictability over your income stream.