More information about Global X Canadian High Dividend Index Corporate Class ETF (HXH) is in its prospectus. Before investing in an Exchange Traded Fund (ETF), it’s important to assess how it fits within your portfolio and aligns with your risk tolerance. ETF prices can also experience higher volatility during market openings and closings and there is always the possibility of losing money. It’s also worth noting that a narrower bid-ask spread generally indicates higher liquidity, meaning you’re more likely to execute trades at expected prices. Always consider these factors carefully when making investment decisions, as even ETFs considered low-risk can experience losses under certain market conditions.

HXH ETF Review

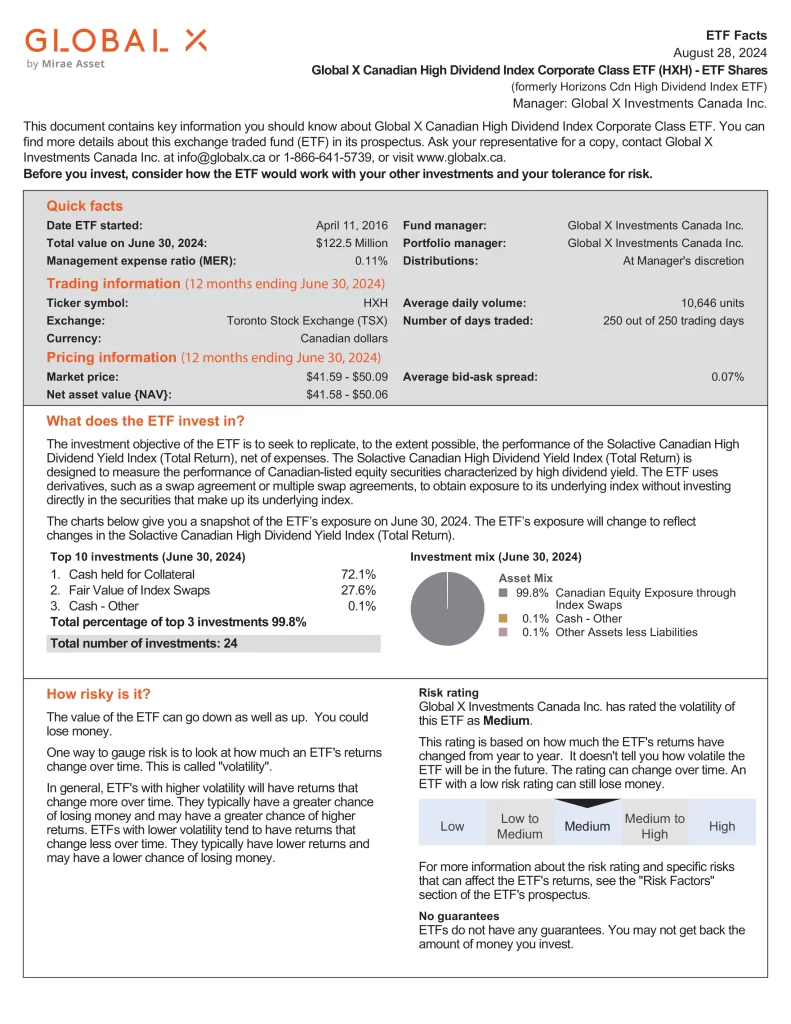

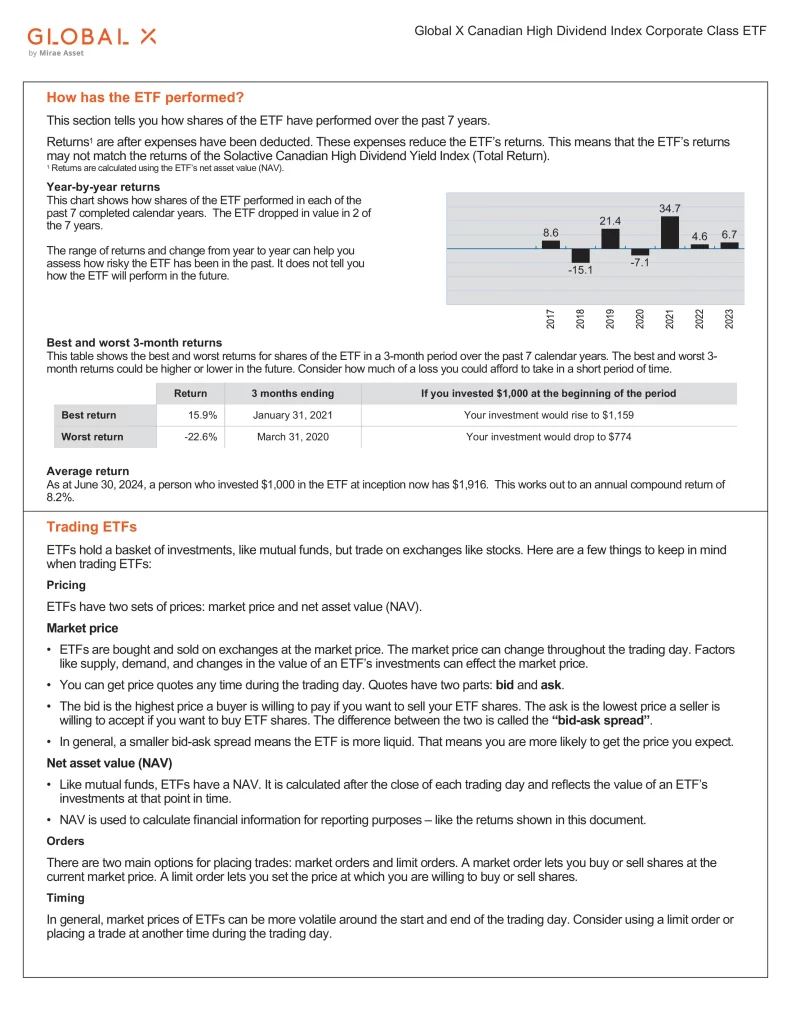

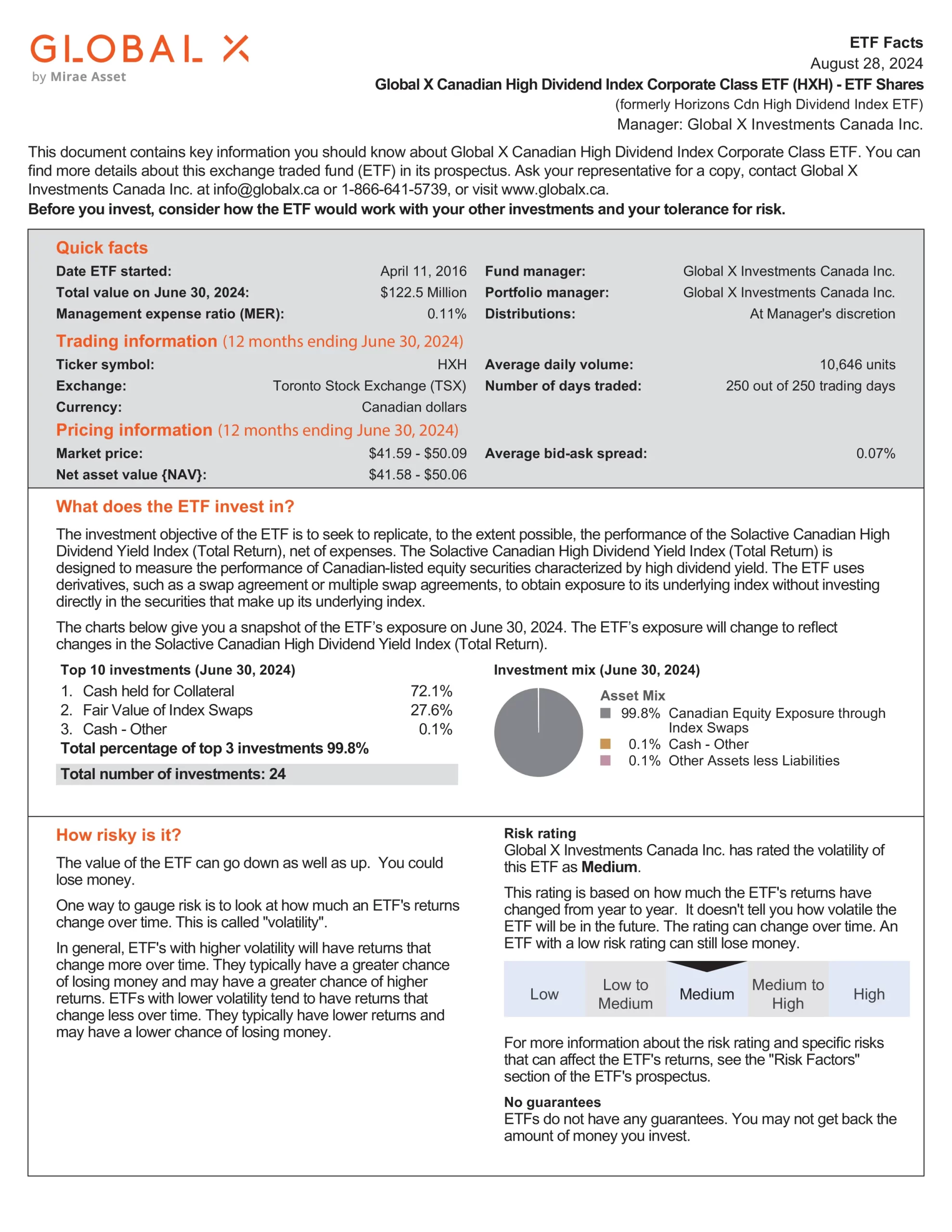

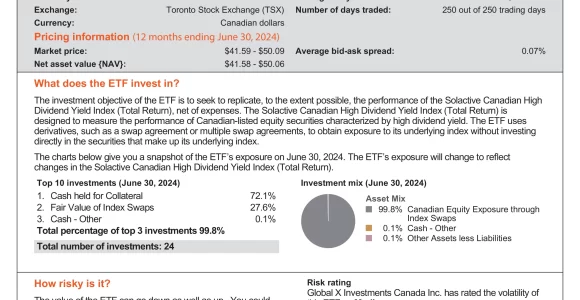

Global X Canadian High Dividend Index Corporate Class ETF (HXH) seeks to replicate the performance of the Solactive Canadian High Dividend Yield Index (Total Return). The Solactive Canadian High Dividend Yield Index (Total Return) is designed to measure the performance of Canadian-listed equity securities characterized by high dividend yield.