What is a Mutual Fund?

A mutual fund is an arrangement under which shares or units are sold to raise capital. Investors purchase units if the mutual fund is a trust or shares if the fund is a corporation. When you invest in a mutual fund, your money is pooled with other investors’ money and invested on your behalf by the fund manager. Money collected from various investors is pooled together to invest in different assets including bonds, stocks, and/or money market investments.

What are the Benefits of Mutual Funds?

Mutual funds typically require a small initial minimum investment amount and are traded once per day at their closing Net Asset Value (NAV), allowing them to be relatively accessible for most investors. Mutual funds can be held on their own or in an RRSP, TFSA, RESP, RDSP or RRIF.

Are Mutual Funds a Good Investment in Canada?

This largely depends on the individual investor’s risk tolerance and financial goals. There are many mutual funds in Canada to suit almost any investment objectives, but this must be coupled with superior advice. A financial plan and coaching during downturns can be worth the fees, but financial planning software is the only competitive advantage an advisor has compared to the DIY investor. You can be confident your money is being properly with a handful of Exchange Traded Funds (ETFs).

Types of Mutual Funds

Investment objectives, risk tolerance and time horizon may differ for each of your investment accounts. The most popular types of mutual funds include all-in-one portfolio solutions, equity, fixed-income, balanced and index funds.

- Money Market: Short-term fixed income securities, for example, treasury bills

- Fixed Income: Global, government and corporate bonds

- Dividend: High-yielding, dividend-paying preferred and common shares

- Growth or Equity: Stocks or Exchange Traded Funds (ETFs)

- Balanced: A combination of equities, bonds and short-term money-market instruments

- Specialty – Equities or fixed income securities in a specific region (Asia) or sector (technology, environmental, etc.)

How Can Your Investments Make Money?

You’ll make money on a mutual funds if the value of its investments goes up and you sell fund units for more than you paid for it. Depending on the fund, you may also receive distributions of dividends, interest, capital gains or other income the fund earns on its investments. These reinvested distributions will earn income going forward, like compounding interest. Investment returns are not guaranteed.

How a fund has performed in the past can’t predict how it will perform in the future. However, it can give you an idea of how the fund has performed in different market conditions. When a mutual fund sells an investment that’s increased in price, this is a capital gain. Most funds deliver capital gains or losses to investors annually. Mutual funds frequently fail to outperform their benchmarks.

Know Your Risk

Every investment comes with a risk. You may not make any money, or you may even lose money. If you are willing to risk losing your money for the potential of a higher payback, you have a high tolerance for risk. You must also set your investment objectives and determine when you will need access to the money. Make sure to understand your risk tolerance, your investment goals, and your timeline. Market volatility can be unsettling, but there are strategies available to manage and potentially benefit from market turbulence.

Know Your Investment

Is it right for you? Will it help you meet your goals? What fees apply? If you’re not saving yet, start soon. Save regularly and watch your money grow. What amount of your paycheque needs to be invested? Knowing your goals can help you determine what type of investments you should be considering. Remember to choose different types of investments and choose investment options that fit within your risk level to help you reach your life goals.

Management Expense Ratio (MER)

The management expense ratio (MER) is the total of the management fee and operating expenses. You don’t pay management fees or operating expenses directly. Each mutual fund pays an annual fee to a management company for managing the fund and its investments. MERs may vary depending on the type of fund and how actively managed it is. The MER is expressed as a percentage of the fund’s assets. For example, if a $100 million fund has $2 million in expenses for the year, its MER is 2%. These expenses reduce the overall value of the fund, and mutual funds report their value after the MER is deducted.

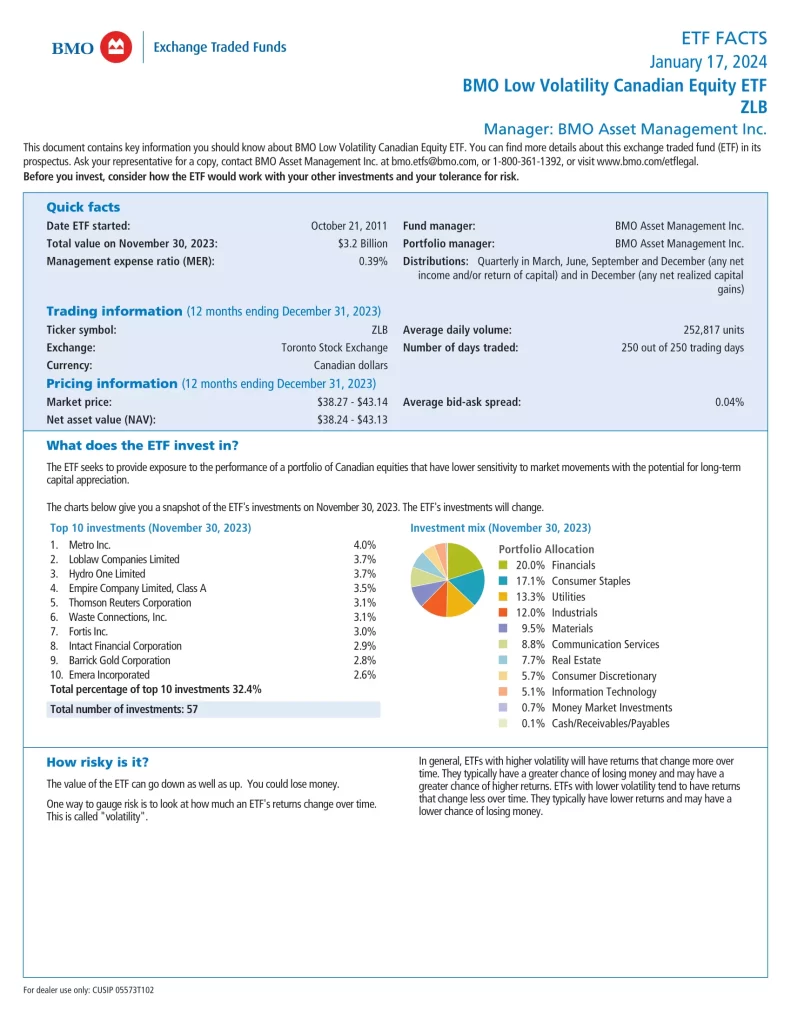

Fund Facts Document

It is important to review the Fund Facts document with your investment representative, before investing in a fund. Key information, including the items listed above, is included in the Fund Facts document. Sales charges are the commissions that you may have to pay when you buy or sell a fund. A front-loaded fund requires you to pay this charge when you purchase the fund. Make sure you speak with your advisor to gain a full understanding of all of the fees associated with your investment.

Mutual Funds vs ETFs

ETFs are investment vehicles that aim to blend the diversification benefits of mutual funds with the trading adaptability of securities. Similar to mutual funds, ETFs allocate funds into a basket of securities, including stocks, fixed income, or commodities. However, unlike mutual funds, ETFs are traded on stock exchanges, leading to fluctuating prices during trading hours. In contrast, mutual fund valuations are computed daily following the market’s closure. Mutual funds typically come with higher expenses.

BMO Mutual Funds

| Mutual Fund | Fund Code | MER | VAB | ZLB | XWD |

|---|---|---|---|---|---|

| BMO SelectTrust Fixed Income Portfolio | BMO471 | 2.18% | 100% | 0% | 0% |

| BMO SelectTrust Income Portfolio | BMO472 | 2.23% | 75% | 10% | 15% |

| BMO SelectTrust Conservative Portfolio | BMO473 | 2.29% | 60% | 15% | 25% |

| BMO SelectTrust Balanced Portfolio | BMO474 | 2.40% | 40% | 20% | 40% |

| BMO SelectTrust Growth Portfolio | BMO484 | 2.50% | 20% | 25% | 55% |

| BMO SelectTrust Equity Growth Portfolio | BMO485 | 2.61% | 0% | 25% | 75% |

Canada Life Mutual Funds

| Mutual Fund | Fund Code | MER | ETF |

|---|---|---|---|

| Canada Life Conservative Portfolio | MAX1270 | 2.25% | XINC |

| Canada Life Moderate Portfolio | MAX1271 | 2.36% | XCNS |

| Canada Life Balanced Portfolio | MAX1272 | 2.44% | XBAL |

| Canada Life Advanced Portfolio | MAX1273 | 2.49% | XGRO |

| Canada Life Aggressive Portfolio | MAX1274 | 2.47% | XEQT |

CIBC Mutual Funds

| Mutual Fund | Fund Code | MER | VAB | XWD |

|---|---|---|---|---|

| CIBC Smart Income Solution | CIB210 | 1.62% | 75% | 25% |

| CIBC Smart Balanced Income Solution | CIB220 | 1.67% | 60% | 40% |

| CIBC Smart Balanced Solution | CIB230 | 1.77% | 40% | 60% |

| CIBC Smart Balanced Growth Solution | CIB240 | 1.82% | 25% | 75% |

| CIBC Smart Growth Solution | CIB250 | 1.93% | 10% | 90% |

Libro Mutual Funds

| Mutual Fund | Fund Code | MER | VAB | ZLB | XWD |

|---|---|---|---|---|---|

| NEI Select Income RS Portfolio | NWT024 | 1.80% | 75% | 7% | 18% |

| NEI Select Income & Growth RS Portfolio | NWT014 | 2.03% | 60% | 12% | 28% |

| NEI Select Balanced RS Portfolio | NWT019 | 2.44% | 40% | 15% | 45% |

| NEI Select Growth & Income RS Portfolio | NWT008 | 2.36% | 30% | 15% | 55% |

| NEI Select Growth RS Portfolio | NWT020 | 2.54% | 15% | 17% | 68% |

| NEI Select Maximum Growth RS Portfolio | NWT90012 | 2.45% | 0% | 20% | 80% |

Manulife Mutual Funds

| Mutual Fund | Fund Code | MER | ETF |

|---|---|---|---|

| Manulife Conservative Portfolio | MMF3575 | 1.83% | XINC |

| Manulife Moderate Portfolio | MMF3577 | 2.15% | XCNS |

| Manulife Balanced Portfolio | MMF3579 | 2.23% | XBAL |

| Manulife Growth Portfolio | MMF3581 | 2.29% | XGRO |

National Bank Mutual Funds

| Mutual Fund | Fund Code | MER | VAB | ZLB | ZDM | CWO | VFV |

|---|---|---|---|---|---|---|---|

| NBI Secure Portfolio | NBC921 | 1.88% | 80% | 7% | 4% | 2% | 7% |

| NBI Conservative Portfolio | NBC922 | 1.93% | 70% | 10.5% | 6% | 3% | 10.5% |

| NBI Moderate Portfolio | NBC923 | 2.05% | 55% | 15.75% | 9% | 4.5% | 15.75% |

| NBI Balanced Portfolio | NBC924 | 2.23% | 40% | 21% | 12% | 6% | 21% |

| NBI Growth Portfolio | NBC925 | 2.41% | 20% | 28% | 16% | 8% | 28% |

| NBI Equity Portfolio | NBC926 | 2.51% | 0% | 35% | 20% | 10% | 35% |

RBC Mutual Funds

| Mutual Fund | Fund Code | MER | VAB | ZLB | VFV | ZDM | PSA | CJP | ZID | CWO |

|---|---|---|---|---|---|---|---|---|---|---|

| RBC Select Very Conservative Portfolio | RBF209 | 1.69% | 73% | 10% | 8% | 3.5% | 2% | 1.9% | 1.6% | 0% |

| RBC Select Conservative Portfolio | RBF461 | 1.84% | 58% | 13% | 15% | 6% | 2% | 3.25% | 2.75% | 0% |

| RBC Select Balanced Portfolio | RBF460 | 1.94% | 38% | 15% | 25% | 7.5% | 2% | 4% | 3.5% | 5% |

| RBC Select Growth Portfolio | RBF459 | 2.04% | 23% | 18% | 30% | 9.5% | 2% | 5.1% | 4.4% | 8% |

| RBC Select Aggressive Growth Portfolio | RBF592 | 2.14% | 0% | 29% | 38% | 10% | 2% | 5.4% | 4.6% | 11% |

Scotiabank Mutual Funds

| Mutual Fund | Fund Code | MER | VAB | ZLB | XWD |

|---|---|---|---|---|---|

| Scotia Selected Income Portfolio | BNS338 | 1.72% | 75% | 10% | 15% |

| Scotia Selected Balanced Income Portfolio | BNS340 | 1.83% | 65% | 15% | 20% |

| Scotia Selected Balanced Growth Portfolio | BNS341 | 1.94% | 45% | 22% | 33% |

| Scotia Selected Growth Portfolio | BNS342 | 2.04% | 25% | 30% | 45% |

| Scotia Selected Maximum Growth Portfolio | BNS344 | 2.16% | 10% | 27% | 63% |

TD Bank Mutual Funds

| Mutual Fund | Fund Code | MER | VAB | ZLB | XWD |

|---|---|---|---|---|---|

| TD Comfort Conservative Income Portfolio | TDB2440 | 1.53% | 80% | 5% | 15% |

| TD Comfort Balanced Income Portfolio | TDB885 | 1.75% | 70% | 8% | 22% |

| TD Comfort Balanced Portfolio | TDB886 | 1.91% | 55% | 13% | 32% |

| TD Comfort Balanced Growth Portfolio | TDB887 | 2.02% | 40% | 16.5% | 43.5% |

| TD Comfort Growth Portfolio | TDB888 | 2.13% | 20% | 22.5% | 57.5% |

| TD Comfort Aggressive Growth Portfolio | TDB889 | 2.23% | 0% | 30% | 70% |

Conclusion

There is an overwhelming number and variety in this type of investment. You earn income from dividends on stocks and interest on bonds held in the mutual fund. That’s why it can be difficult to pick out the ones that offer the most consistent and significant returns. Mutual funds are costly and can be replaced with ETFs for lower fees. A simple portfolio of just a few ETFs will replicate and outperform most mutual funds sold at financial institutions.