NULG ETF Review

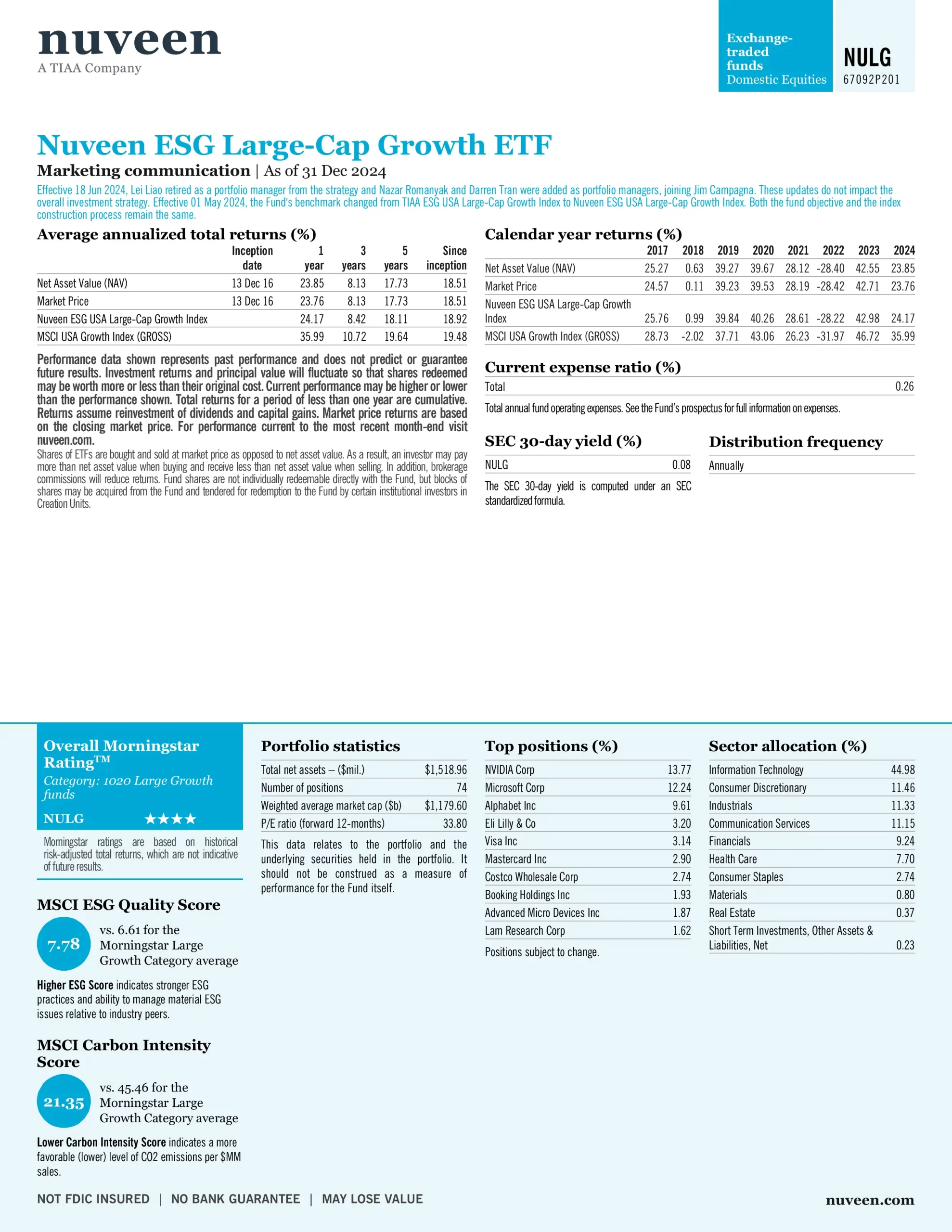

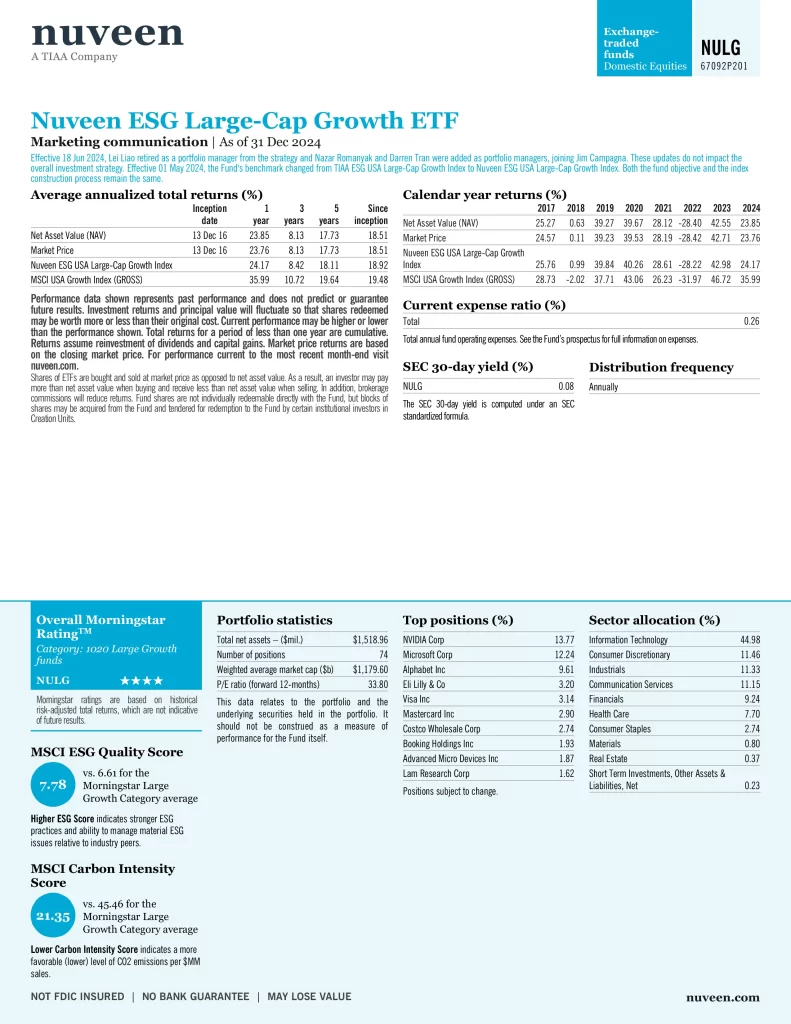

Nuveen ESG Large-Cap Growth ETF (NULG) employs a passive management approach, investing primarily in large-capitalization U.S. equity securities that exhibit overall growth style characteristics and that satisfy certain Environmental, Social & Governance (ESG) criteria.

NULG is primarily composed of equity securities issued by large capitalization companies listed on U.S. exchanges. The Index uses a rules-based methodology that seeks to provide investment exposure that generally replicates that of traditional large-cap growth benchmarks through a portfolio of securities that adhere to predetermined ESG, controversial business involvement and low-carbon screening criteria. The Index is rebalanced quarterly.

Is NULG a Good Investment?

Under normal market conditions, the fund invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in component securities of the index.

| Manager | Ticker | Inception | AUM | MER | Volume | Spread | Holdings | Beta | P/E | P/B | P/S | P/CF | Yield | Distributions | 1Y | 3Y | 5Y | 10Y | 15Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Nuveen | NULG | 2016-12-13 | $1,518,960,000 | 0.26% | 72,181 | 0.13% | 74 | 1.16 | 29.21 | 8.31 | 5.43 | 17.94 | 0.16% | Annually | 14.58% | 13.84% | 18.08% | N/A | N/A |

Top 10 NULG Holdings

This table shows the investment tickers, names and weights of the individual holdings that are subject to change.

| Ticker | Name | Weight |

|---|---|---|

| MSFT | Microsoft Corporation | 11.94% |

| NVDA | NVIDIA Corporation | 11.34% |

| GOOG | Alphabet Inc. | 4.56% |

| GOOGL | Alphabet Inc. | 4.53% |

| LLY | Eli Lilly & Company | 3.96% |

| V | Visa Inc. | 3.56% |

| COST | Costco Wholesale Corporation | 3.05% |

| MA | Mastercard Incorporated | 3.02% |

| AMD | Advanced Micro Devices, Inc. | 1.86% |

| BKNG | Booking Holdings Inc. | 1.83% |

Sector Allocation

This table shows the investment sectors and weights of the individual holdings that are subject to change.

| Sector | Weight |

|---|---|

| Information Technology | 44.98% |

| Consumer Discretionary | 11.46% |

| Industrials | 11.33% |

| Communication Services | 11.15% |

| Financials | 9.24% |

| Health Care | 7.70% |

| Consumer Staples | 2.74% |

| Materials | 0.80% |

| Real Estate | 0.37% |

Distribution History

Most ETFs will distribute net taxable income to investors at least once a year. This is taxable income if generated from interest, dividends and capital gains by the securities within the ETF. The distributions will either be paid in cash or reinvested in the ETF at the discretion of the manager. This information will be reported in an official tax receipt provided to investors by their broker.

| Ex-Dividend Date | Record Date | Payable Date | Distribution |

|---|---|---|---|

| 18 Dec 2024 | 18 Dec 2024 | 19 Dec 2024 | $0.1359 |

| 28 Dec 2023 | 29 Dec 2023 | 04 Jan 2024 | $0.0417 |

| 14 Dec 2023 | 15 Dec 2023 | 18 Dec 2023 | $0.2546 |

| 15 Dec 2022 | 16 Dec 2022 | 19 Dec 2022 | $0.1960 |

| 16 Dec 2021 | 17 Dec 2021 | 20 Dec 2021 | $3.4831 |

| 17 Dec 2020 | 18 Dec 2020 | 21 Dec 2020 | $1.5115 |

| 27 Dec 2019 | 30 Dec 2019 | 31 Dec 2019 | $0.4571 |

| 26 Dec 2018 | 27 Dec 2018 | 31 Dec 2018 | $1.1234 |

| 26 Dec 2017 | 27 Dec 2017 | 29 Dec 2017 | $0.1894 |

Conclusion

More information about Nuveen ESG Large-Cap Growth ETF (NULG) is in its prospectus. Before investing in an Exchange Traded Fund (ETF), it’s important to assess how it fits within your portfolio and aligns with your risk tolerance. ETF prices can also experience higher volatility during market openings and closings and there is always the possibility of losing money. It’s also worth noting that a narrower bid-ask spread generally indicates higher liquidity, meaning you’re more likely to execute trades at expected prices. Always consider these factors carefully when making investment decisions, as even ETFs considered low-risk can experience losses under certain market conditions.