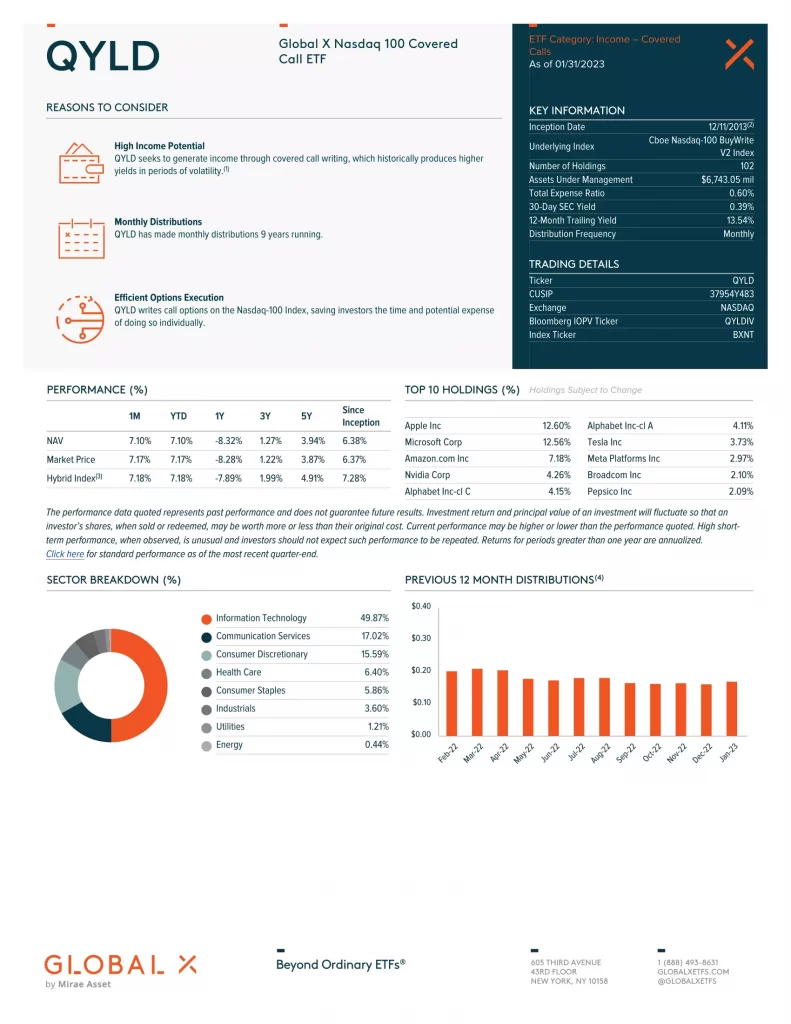

Global X NASDAQ 100 Covered Call ETF (QYLD) seeks to generate income through covered call writing, which historically produces higher yields in periods of volatility.

An Exchange Traded Fund (ETF) is a collection of hundreds or thousands of stocks or bonds in a single fund that trades on major stock exchanges. ETFs combine the diversification of mutual funds with lower investment minimum and real-time pricing.

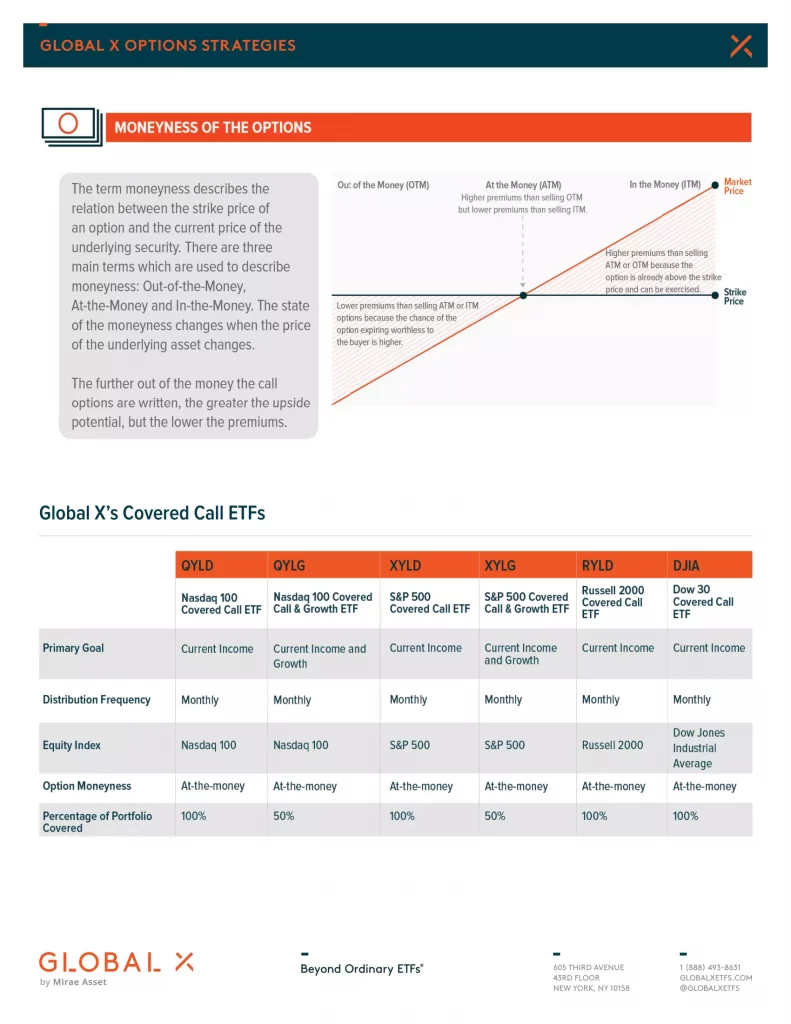

A covered call ETF writes call options on the stocks held within the fund to help reduce investment risk. This also allows investors to take advantage of upside potential in the same way an individual investor trading stock options would do. This is a great strategy during market volatility while still bringing in monthly income from option writing and regular dividends.

|  |  |  |  |  |

|---|---|---|---|---|---|

| Advice | InvestCAN | InvestRESP | InvestUSA | RetireCAN | RetireMGN |

| $500.00 CAD $400.00 USD | $99.99 CAD | $79.99 USD | $99.99 CAD | $12.99 CAD $9.99 USD |

QYLD ETF Review

QYLD has made monthly distributions 8 years running. QYLD writes call options on the Nasdaq-100 Index, saving investors the time and potential expense of doing so individually.

| Price | $16.68 |

| 52-Week Range | $15.00 – $21.09 |

| Dividend Yield | 12.76% |

| Ex-Dividend | 2023-02-21 |

| Dividend Date | 2023-03-01 |

- Dividend Date – the date that a company announces it is paying a dividend

- Ex-Dividend: Ex-Dividend Date – the dividend will be received if bought at least one day before this date

- N/A: Not Applicable or Not Available

- Price: Stock Price – current value to buyers and sellers

- Dividend Yield – the percentage of a corporation’s stock price that it pays in dividends annually

- 52-Week Range – the lowest and highest price at which a stock has traded during the previous 52-weeks

QYLD Top 5 Holdings

- AAPL: Apple Inc.

- AMZN: Amazon.com, Inc.

- GOOG: Alphabet Inc.

- GOOGL: Alphabet Inc Class A

- MSFT: Microsoft Corporation

QYLD Top 5 Sectors

- Technology: 49.87%

- Communication: 17.02%

- Discretionary: 15.59%

- Health Care: 6.40%

- Staples: 5.86%

QYLD vs JEPI vs. QQQ vs. HYLD vs. XYLD vs. RYLD vs. JEPQ vs QYLG vs QQQX vs SCHD vs NUSI

Here is a table comparing similar ETFs as of December 31, 2022. Here is a table comparing Global X NASDAQ 100 Covered Call ETF (QYLD) to JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) and Nationwide Nasdaq-100 Risk-Managed Income ETF (NUSI) as of December 31, 2022

QYLD Pros

- High dividend yield

- Monthly distributions

QYLD Cons

- You could lose money

| ETF | QYLD | JEPI | XYLD | RYLD | JEPQ | QYLG | QQQX | NUSI |

| Manager | Global X | JPMorgan | Global X | Global X | JPMorgan | Global X | Nuveen | Nationwide |

| AUM | $6,790,000,000 | $21,020,000,000 | $2,340,000,000 | $1,450,000,000 | $1,060,000,000 | $68,510,000 | $949,717,669 | $456,059,151 |

| MER | 0.60% | 0.35% | 0.60% | 0.60% | 0.35% | 0.60% | 0.92% | 0.68% |

| Yield | 13.58% | 11.15% | 13.52% | 13.65% | 16.62% | 6.33% | 8.40% | 7.90% |

| Distributions | Monthly | Monthly | Monthly | Monthly | Monthly | Monthly | Quarterly | Monthly |

| 1M | 7.10% | 1.73% | 4.14% | 3.87% | 6.01% | 8.87% | 9.33% | 2.59% |

| 3M | 7.73% | 4.92% | 4.68% | 1.92% | 4.69% | 6.94% | 3.38% | 0.35% |

| YTD | 7.10% | 1.73% | 4.14% | 3.87% | 6.01% | 8.87% | 9.33% | 2.59% |

| 1Y | -8.32% | 1.70% | -6.03% | -4.13% | N/A | -13.67% | -15.91% | -20.86% |

| 3Y | 1.27% | N/A | 3.13% | 4.42% | N/A | N/A | 5.38% | -2.23% |

| 5Y | 3.94% | N/A | 3.94% | N/A | N/A | N/A | 5.00% | N/A |

| 10Y | N/A | N/A | N/A | N/A | N/A | N/A | 10.84% | N/A |

- AUM – Assets Under Management

- Distributions – Dividend Distributions

- ETF – Exchange Traded Fund

- Manager – Fund or Portfolio Manager

- MER – Management Expense Ratio

- N/A – Not Applicable or Not Available

- Risk – Risk Rating (Volatility)

- Yield – Dividend or Distribution Yield

- YTD – Year to Date

- 1MO – 1-Month Performance

- 3MO – 3-Month Performance

- 1YR – 1-Year Performance

- 3YR – 3-Year Performance

- 5YR – 5-Year Performance

- 10YR – 10-Year Performance