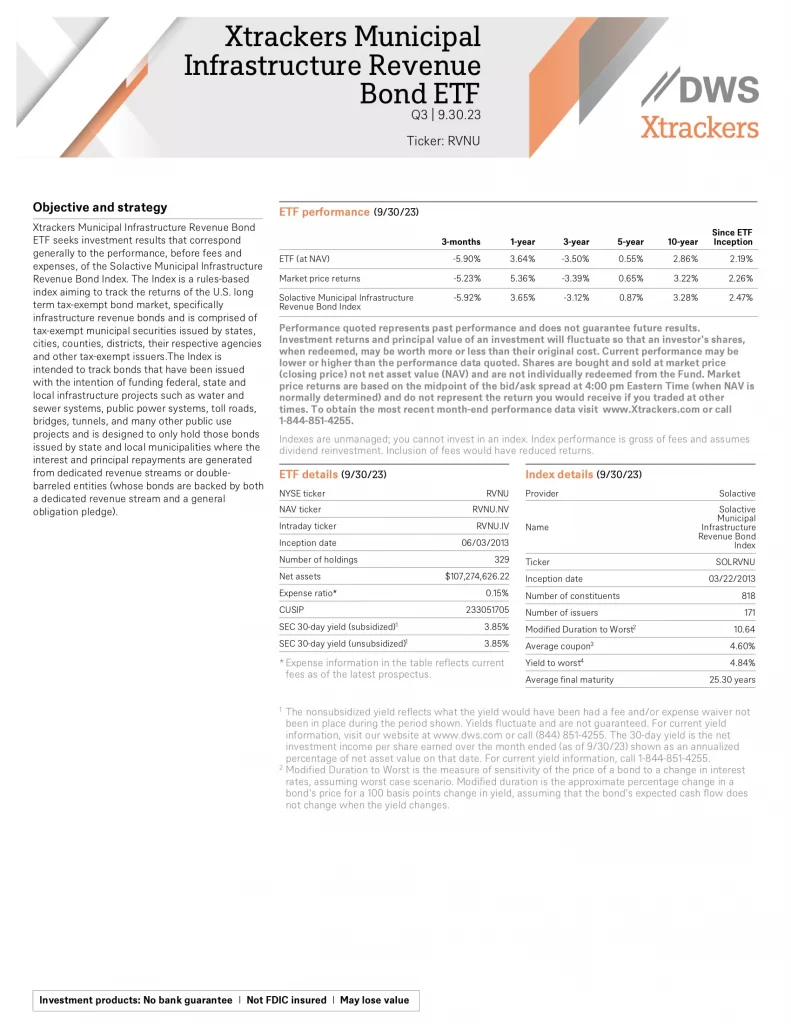

Xtrackers Municipal Infrastructure Revenue Bond ETF seeks investment results that correspond generally to the performance, before fees and expenses, of the Solactive Municipal Infrastructure Revenue Bond Index. The Index is a rules-based index aiming to track the returns of the U.S. long-term tax-exempt bond market, specifically infrastructure revenue bonds. It is comprised of tax-exempt municipal securities issued by states, cities, counties, districts, their respective agencies and other tax-exempt issuers. The Index is intended to track bonds that have been issued to fund federal, state and local infrastructure projects such as water and sewer systems, public power systems, toll roads, bridges, tunnels, and many other public use projects and is designed only to hold those bonds issued by state and local municipalities where the interest and principal repayments are generated from dedicated revenue streams or double-barrelled entities (whose bonds are backed by both a dedicated revenue stream and a general obligation pledge).

|  |  |  |  |  |

|---|---|---|---|---|---|

| Advice | InvestCAN | InvestRESP | InvestUSA | RetireCAN | RetireMGN |

| $500.00 CAD $400.00 USD | $99.99 CAD | $79.99 USD | $99.99 CAD | $12.99 CAD $9.99 USD |

What is the Best Municipal Bond ETF?

- AVMU

- BAB

- BSMV

- CMF: iShares California Muni Bond ETF

- DFNM

- FLMB

- FLMI: Franklin Dynamic Municipal Bond ETF

- FMB

- FMHI

- FMNY

- FSMB

- FUMB

- GMUN

- HMOP: Hartford Municipal Opportunities ETF

- INMU

- ITM

- MBND

- MBNE

- MEAR

- MFLX

- MINN

- MLN

- MMIN

- MMIT

- MUB: iShares National Muni Bond ETF

- MUNI

- MUST

- OVM

- PVI

- PZA

- PZT: Invesco New York AMT-Free Municipal Bond ETF

- RTAI

- RVNU: Xtrackers Municipal Infrastructure Revenue Bond ETF

- SHM

- SHYD

- SMB

- SMI

- SMMU

- SUB

- TAFI

- TAXF

- TFI

- VTEB

- XMPT: VanEck CEF Municipal Income ETF

Here is a table comparing RVNU to similar municipal bond ETFs as of November 30, 2023.

| Manager |  |  |  |  |  | ||

| ETF | CMF | MUB | FLMI | HMOP | PZT | XMPT | RVNU |

| Inception | 2007-10-04 | 2007-09-07 | 2017-08-31 | 2017-12-13 | 2007-10-11 | 2011-07-12 | 2013-06-04 |

| MER | 0.25% | 0.07% | 0.30% | 0.29% | 0.28% | 1.82% | 0.15% |

| AUM | $2,682,981,908 | $37,867,465,069 | $154,850,000 | $388,102,048 | $92,200,000 | $236,820,000 | $116,260,000 |

| Duration | 6.02 | 6.20 | 5.88 | N/A | 8.97 | 10.95 | N/A |

| Coupon | 4.66% | 4.67% | N/A | N/A | 4.45% | 4.05% | N/A |

| Yield | 2.47% | 2.86% | 4.34% | 3.30% | 2.81% | 3.95% | 3.88% |

| Distributions | Monthly | Monthly | Monthly | Monthly | Monthly | Monthly | Monthly |

| 1Y | 3.20% | 3.52% | 4.68% | 4.31% | 4.20% | -3.63% | 5.36% |

| 3Y | -1.36% | -0.81% | -0.36% | -0.60% | -1.89% | -5.98% | -3.39% |

| 5Y | 1.62% | 2.01% | 2.29% | 2.27% | 1.80% | 0.93% | 0.65% |

| 10Y | 2.50% | 2.54% | N/A | N/A | 3.14% | 3.55% | 3.22% |