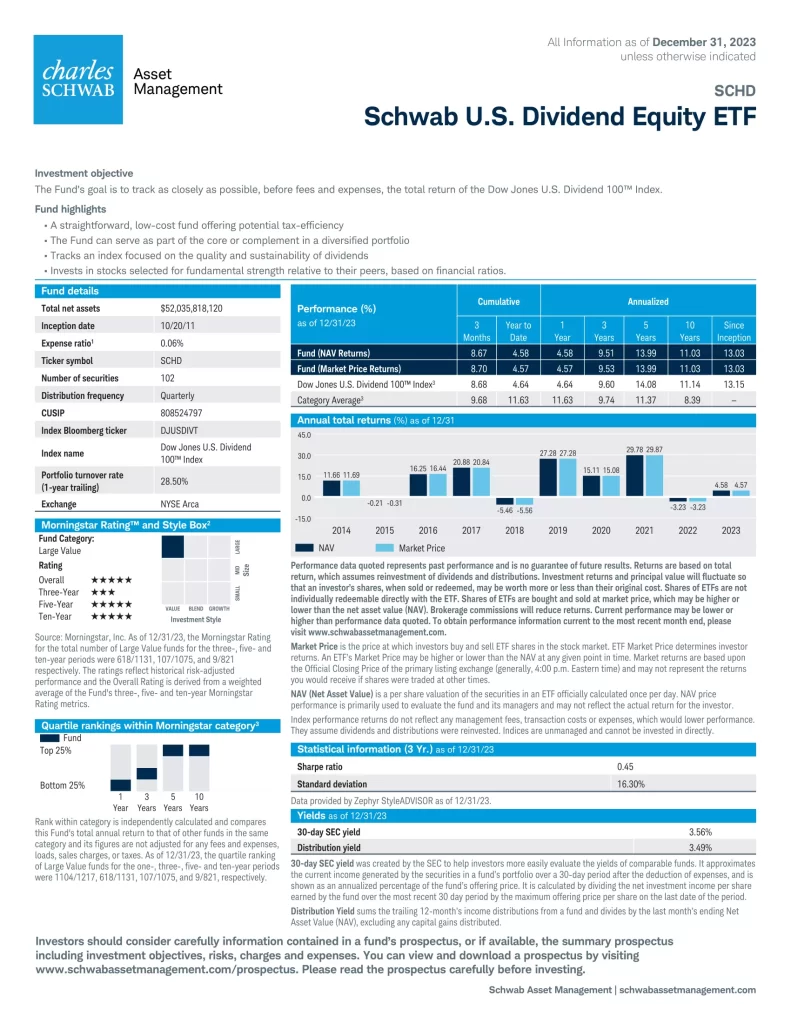

Schwab U.S. Dividend Equity ETF (SCHD) goal is to track as closely as possible the total return of the Dow Jones U.S. Dividend 100 Index.

SCHD ETF Review

- A straightforward, low-cost fund offering potential tax-efficiency

- The Fund can serve as part of the core or complement in a diversified portfolio

- Tracks an index focused on the quality and sustainability of dividends

- Invests in stocks selected for fundamental strength relative to their peers, based on financial ratios

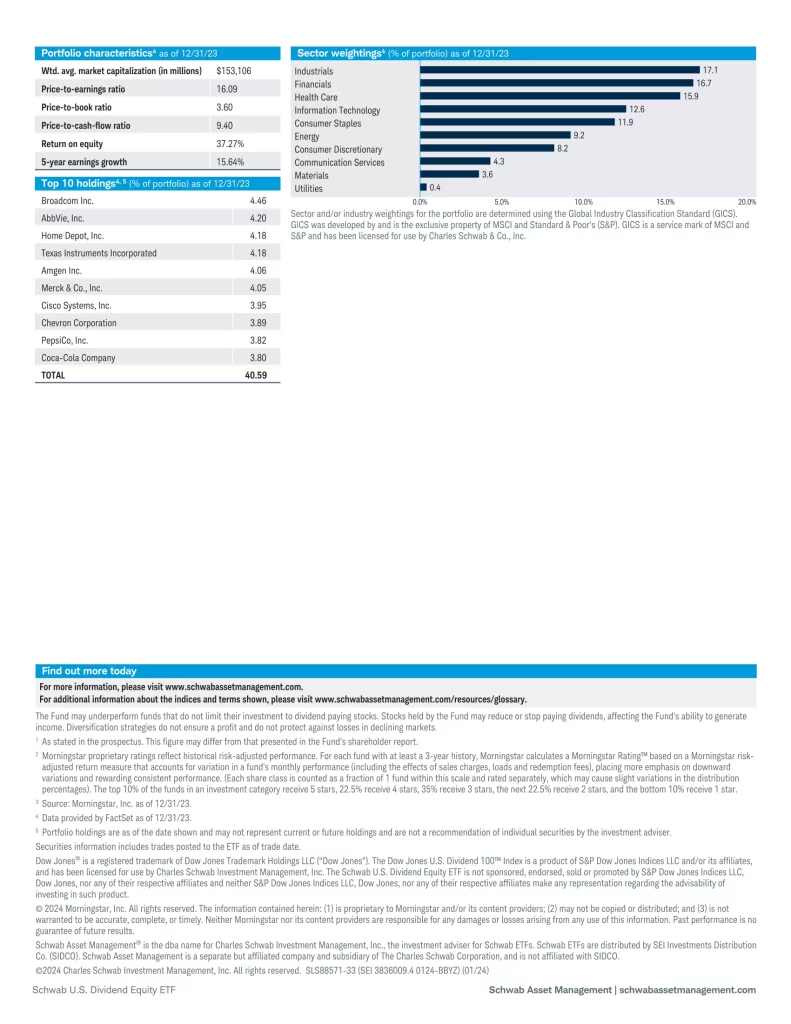

Top 10 SCHD Holdings

| Ticker | Name | Weight |

|---|---|---|

| AVGO | Broadcom Inc. | 4.88% |

| ABBV | AbbVie Inc. | 4.77% |

| HD | Home Depot Inc | 4.39% |

| MRK | Merck & Co., Inc. | 4.34% |

| TXN | Texas Instruments Incorporated | 4.07% |

| CVX | Chevron Corporation | 3.94% |

| VZ | Verizon Communications Inc. | 3.84% |

| KO | The Coca-Cola Company | 3.78% |

| CSCO | Cisco Systems Inc | 3.77% |

| AMGN | Amgen Inc. | 3.71% |

| Manager |  |  |  |  |  |  |

| ETF | DGRO | HDV | SCHD | VYM | VIG | DGRW |

| Inception | 2014-06-10 | Mar 29, 2011 | 2011-10-20 | 2006-11-10 | 2006-04-21 | 05/22/2013 |

| AUM | $24,509,651,121 | $10,741,876,056 | $49,514,103,629 | $60,700,000,000 | $82,400,000,000 | $9,773,035,090 |

| Holdings | 428 | 75 | 104 | 462 | 314 | N/A |

| Expense Ratio | 0.08% | 0.08% | 0.06% | 0.06% | 0.06% | 0.28% |

| Yield | 2.39% | 4.18% | 3.58% | 3.20% | 1.82% | 2.11% |

| Distributions | Quarterly | Quarterly | Quarterly | Quarterly | Quarterly | Monthly |

| 1Y | 11.00% | 4.79% | 5.10% | 7.75% | 15.58% | 19.21% |

| 3Y | 13.60% | 11.60% | 15.83% | 13.89% | 13.61% | 16.26% |

| 5Y | 11.13% | 7.43% | 11.75% | 8.46% | 11.93% | 13.00% |

| 10Y | N/A | 8.10% | 11.72% | 9.90% | 11.60% | 13.36% |

SCHD vs VOO

SCHD is the superior performing, less expensive, higher yielding and less volatile ETF than VOO which is older, more popular and more diversified.

SCHD vs VYM

SCHD is the superior performing and less volatile ETF than VYM which is older, more popular, more diversified, less volatile and costs the same.

SCHD vs JEPI

SCHD is the superior performing, less expensive, more popular, older and less volatile ETF than JEPI which is more diversified and higher yielding.

SCHD vs SPY

SCHD is the superior performing, less expensive, higher yielding and less volatile ETF than SPY which is older, more popular and more diversified.

SCHD vs DGRO

SCHD is the superior performing older, less expensive, higher yielding, more popular, and less volatile ETF than DGRO which is more diversified.

SCHD vs VIG

SCHD is the superior performing and higher yielding ETF than VIG which is older, more popular, more diversified, less volatile and costs the same.

SCHD vs VTI

SCHD is the superior performing, more popular, higher yielding and less volatile ETF than VTI which is older, less expensive and more diversified.

SCHD vs SPHD

SCHD is the superior performing, older, less expensive, more popular, more diversified and less volatile ETF than SPHD which is higher yielding.

Is SCHD a Good Core Investment?

The Schwab U.S. Dividend Equity ETF (SCHD) is an excellent core position for dividend and growth investors. It has outperformed many ETFs in past corrections.

Is SCHD a Monthly Dividend?

SCHD pays a dividend quarterly.

What are the MER Fees for SCHD?

The management expense ratio (MER) fees of SCHD is 0.06%. This is less than most mutual funds charging approximately 2% and low compared to most ETFs.

What is the Yield of SCHD?

A pays a high monthly income yield of SCHD is 3.79%. This is more than most ETFs.