JPMorgan Equity Premium Income ETF (JEPI) seeks to deliver monthly distributable income and equity market exposure with less volatility. This fund considers financially material Environmental, Social and Governance (ESG) factors in investment analysis and investment decisions, with the goal of enhancing long-term, risk-adjusted financial returns.

JEPI ETF Review

| Fund Family | JPMorgan Funds |

| Ticker | JEPI |

| Expense Ratio | 0.35% |

| Inception Date | 2020-05-20 |

| Net Assets | $27,910,000,000 |

| # of Holdings | 136 |

| Yield (TTM) | 10.58% |

| Distribution Frequency | Monthly |

| Dividend | $0.3593 |

| Ex-Dividend | 2023-07-03 |

| Dividend Date | 2023-07-07 |

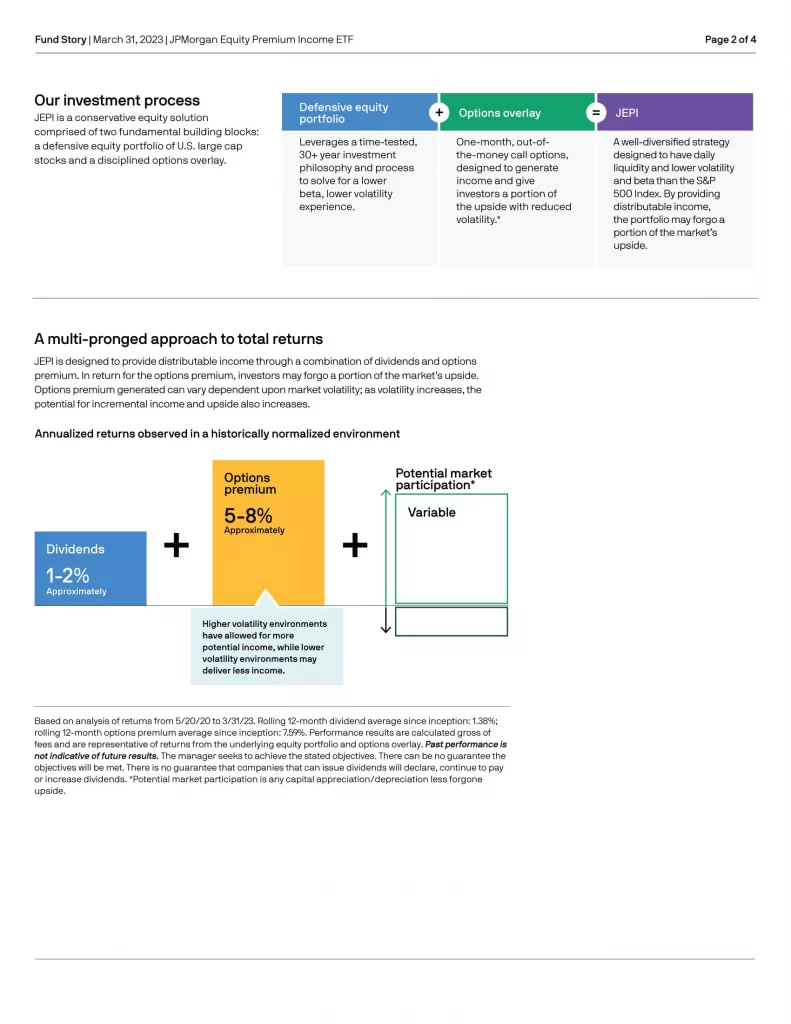

JPMorgan Equity Premium Income ETF (JEPI) continues to navigate risks that could represent headwinds for U.S. equities through the recent volatility.

- Defensive equity portfolio employs a time-tested, bottom-up fundamental research process with stock selection based on our proprietary risk-adjusted stock rankings.

- Disciplined options overlay implements written out-of-the-money S&P 500 Index call options to generate distributable monthly income.

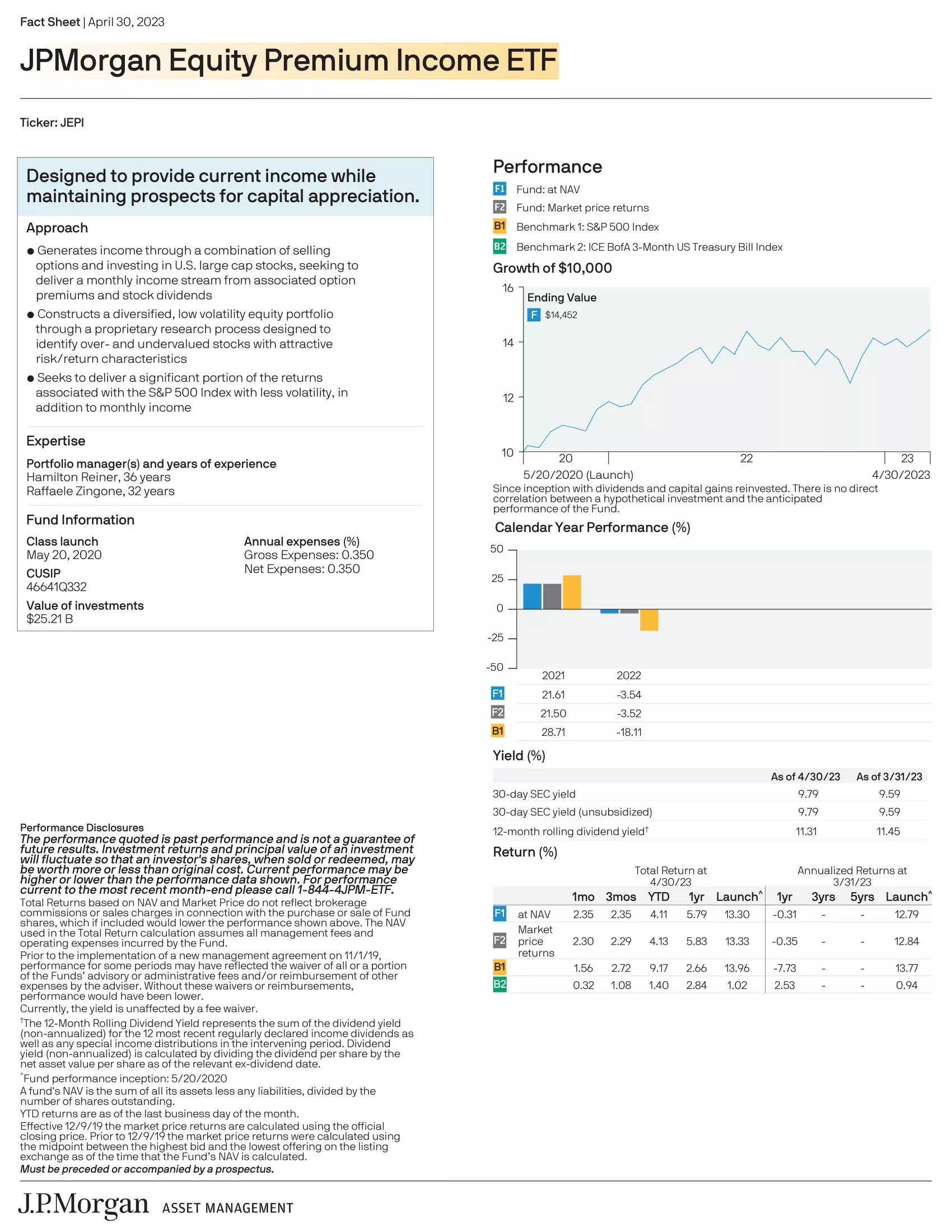

What are the MER Fees for JEPI?

The management expense ratio (MER) fees of JEPI is 0.35% as of June 3, 2023. This is less than most covered call high yield options strategies charging an average of approximately 1%, but slightly expensive compared to most ETFs.

What is the Yield of JEPI?

A consistently paid high monthly income yield of JEPI is 9.79% annualized as of June 3, 2023. This is more than most ETFs, but yields are abnormally high due to covered call options to generate income and help offset volatility.

What Does JEPI Hold?

Within financials, an overweight in Progressive contributed to performance as shares continued to rally at the start of the year. An underweighting in Nvidia and Tesla Motors detracted from performance. Here is a list of JEPI holdings and some of the underlying companies their proprietary ETFs hold:

- ACN: Accenture plc

- ADBE: Adobe Inc

- AMZN: Amazon.com, Inc.

- GOOGL: Alphabet Inc Class A

- HSY: The Hershey Company

- MA: Mastercard Inc

- MSFT: Microsoft Corporation

- PEP: PepsiCo, Inc.

- PGR: The Progressive Corporation

- V: Visa Inc

| Manager |  |  |  |  | ||

| ETF | SCHD | QYLD | JEPI | JEPQ | SPY | VOO |

| Inception | 2011-10-20 | 2013-12-11 | 2020-05-20 | 2022-05-03 | 1993-01-22 | 2010-09-07 |

| AUM | $47,182,542,048 | $8,070,000,000 | $25,480,000,000 | $3,940,000,000 | $415,859,000,000 | $823,100,000,000 |

| Holdings | 104 | 102 | 133 | 87 | 503 | 505 |

| MER | 0.06% | 0.60% | 0.35% | 0.35% | 0.0945% | 0.03% |

| Yield | 3.80% | 12.15% | 11.27% | 12.87% | 1.48% | 1.49% |

| Distributions | Quarterly | Monthly | Monthly | Monthly | Quarterly | Quarterly |

| P/E | 13.86 | 28.57 | 18.97 | 25.19 | 20.19 | 22.1 |

| P/B | 3.66 | 6.47 | N/A | N/A | 4.03 | 3.8 |

| Beta | 0.81 | 0.69 | 0.62 | N/A | 1.00 | 1.00 |

| YTD | -2.15% | 18.38% | 5.51% | 24.44% | 16.83% | 16.87% |

| 1M | 5.32% | 1.81% | 3.04% | 3.19% | 6.58% | 6.57% |

| 3M | 0.18% | 6.55% | 3.73% | 10.53% | 8.70% | 8.74% |

| 1Y | 5.10% | 14.56% | 11.30% | 20.76% | 19.46% | 19.47% |

| 3Y | 15.83% | 6.83% | 12.97% | N/A | 14.47% | 14.55% |

| 5Y | 11.75% | 5.79% | N/A | N/A | 12.16% | 12.25% |

| 10Y | 11.72% | N/A | N/A | N/A | 12.72% | 12.82% |

JEPI vs QYLD

JEPI is the better ETF. Both funds have monthly dividend distributions. JEPI is the better performing, more popular and less expensive ETF than QYLD which is older and higher-yielding.

JEPI vs JEPQ

JEPI is the better ETF. Both funds have monthly dividend distributions and expenses. JEPI is the better performing, older and more popular ETF than JEPQ which is higher-yielding.

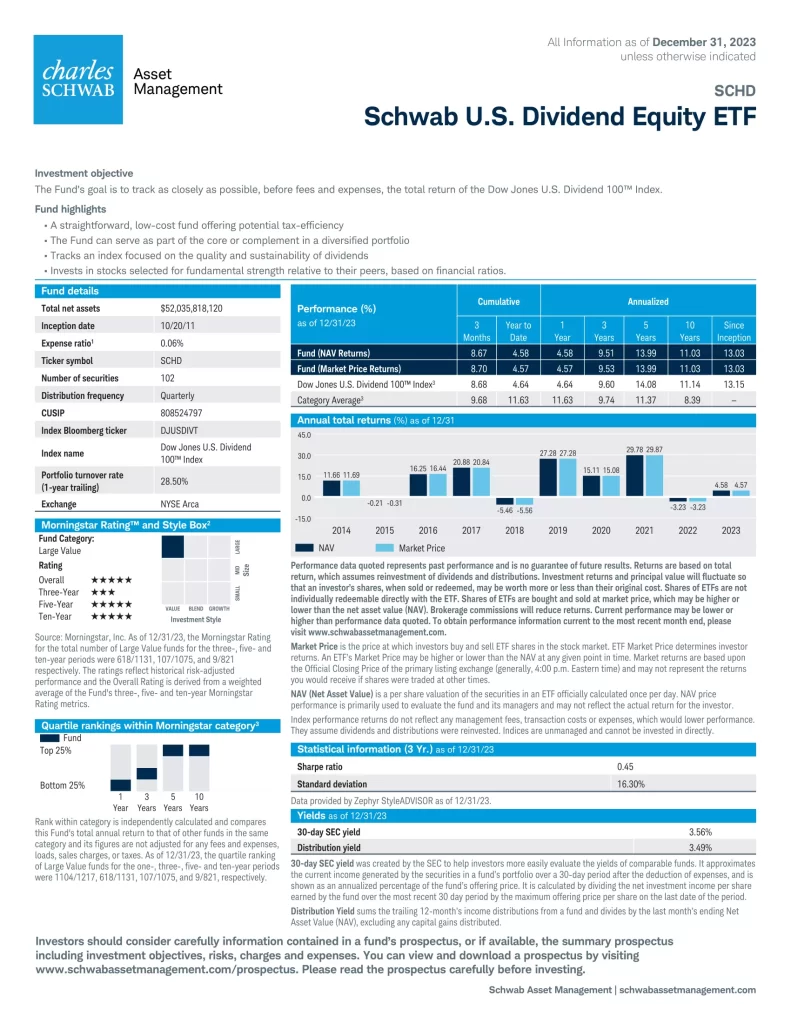

JEPI vs SCHD

SCHD is the better ETF. SCHD is the better performing, older, more popular and less expensive ETF than JEPI which is higher-yielding and has monthly dividend distributions.

JEPI vs SPY

SPY is the better ETF. SPY is the better performing, older, more popular and less expensive ETF than JEPI which is higher-yielding and has monthly dividend distributions.

JEPI vs XYLD

JEPI is the better ETF. Both funds have monthly dividend distributions. JEPI is the better performing, more popular and less expensive ETF than XYLD which is older and higher-yielding.

JEPI vs VOO

VOO is the better ETF. VOO is the better performing, older, more popular and less expensive ETF than JEPI which is higher-yielding and has monthly dividend distributions.

Conclusion

JEPI is a monthly dividend income fund ETF with a very recent 3-year birthday with an MER of 0.35%. I highly recommend using an index strategy using ETFs and developing a retirement withdrawal strategy to spread out and most likely reduce your life’s overall tax bill. SCHD, SPY and VOO are all popular alternatives. JEPI offers a yield that is over double the classic 4% withdrawal stream in retirement negating the argument of owning this income fund.

|  |  |  |  |

|---|---|---|---|---|

| InvestCAN | InvestRESP | InvestUSA | RetireCAN | RetireMGN |

| $99.99 CAD | $12.99 CAD | $79.99 USD | $99.99 CAD | $9.99 USD |