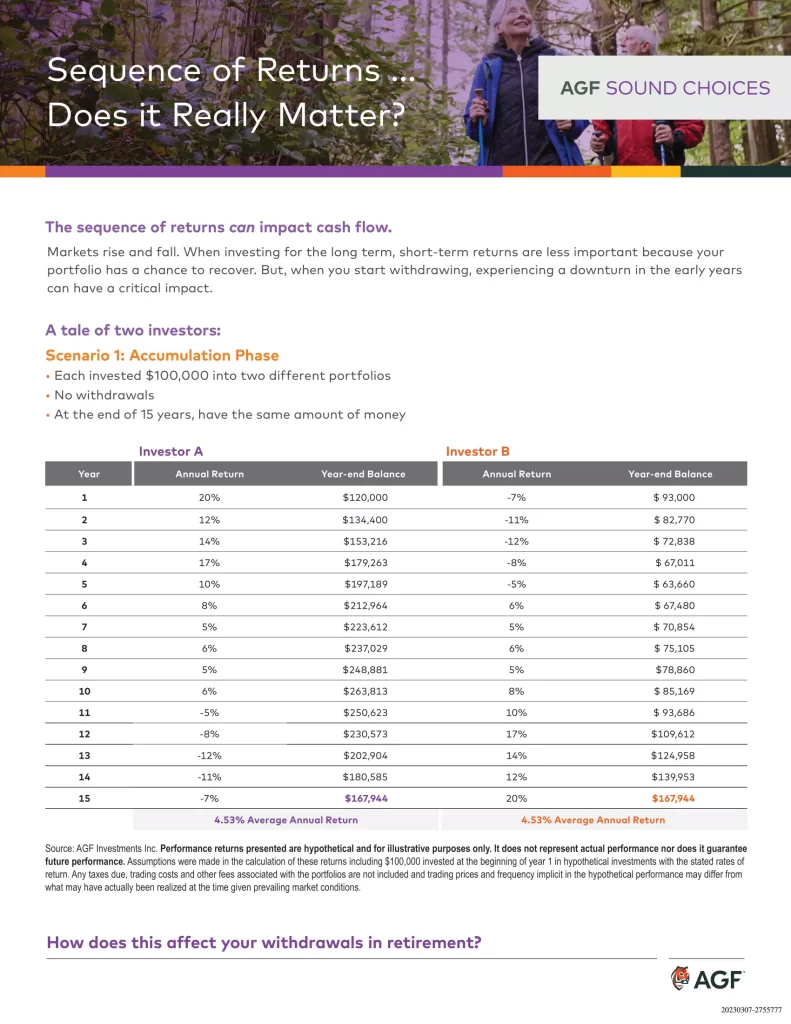

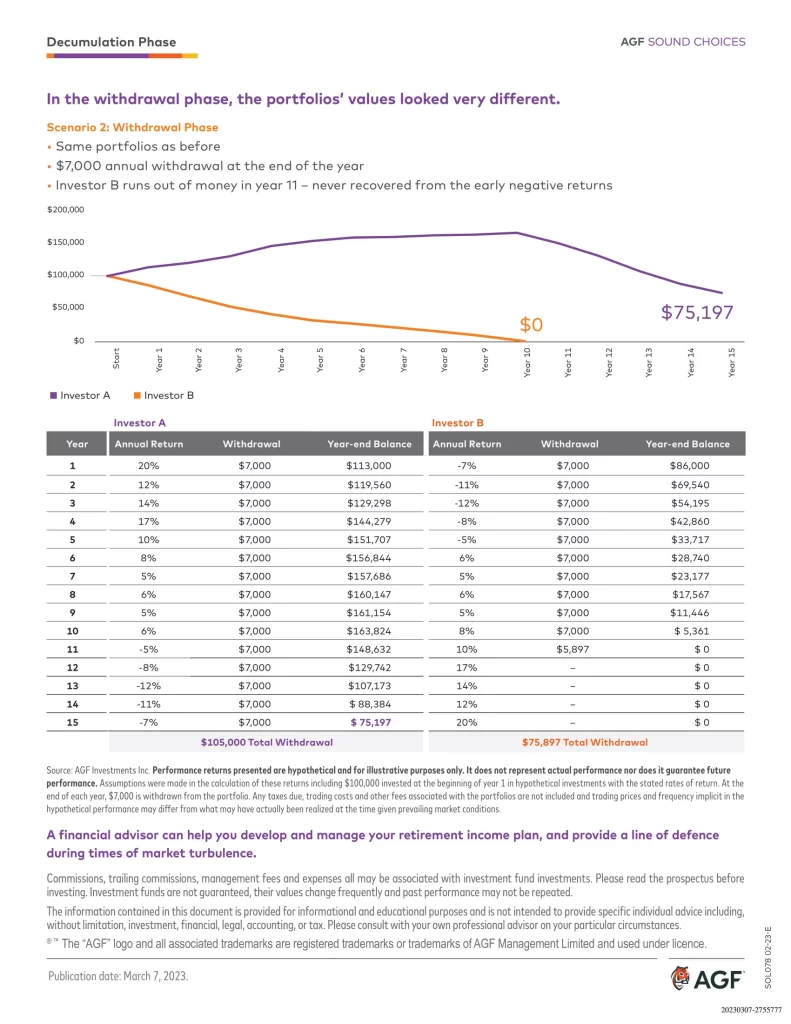

The sequence of returns can significantly impact cash flow, as financial markets fluctuate over time. While short-term returns are less critical when investing for the long term due to potential recovery opportunities, the timing of market downturns becomes crucial when withdrawals begin. Experiencing a market downturn early in retirement can lead to challenges extending beyond immediate portfolio hits, potentially jeopardizing the longevity of your savings, especially in the context of a retirement spanning 25 or 30 years.

A retirement portfolio typically comprises a blend of investments aimed at providing both income and growth over time. Ideally, growth replenishes a portion of withdrawn funds, sustaining withdrawals throughout retirement. However, a significant downturn early in retirement disrupts this balance. Selling investments during a decline to meet cash needs depletes savings faster and reduces assets available for future growth, hindering potential recoveries. Conversely, experiencing a decline later in retirement may have less impact, as the portfolio may not need to sustain withdrawals for as long or continue growing to support a shorter retirement period. Thus, the timing of market fluctuations relative to retirement can significantly influence financial outcomes.

What is a Sequence Risk?

Sequence risk refers to the possibility that the timing and order of your investment returns may be unfavourable, resulting in diminished retirement funds. Upon retirement, you cease contributing new funds but continue withdrawing money regularly. During a bull market, these withdrawals may be partly offset by new gains.

However, in a bear market lasting months or years, each withdrawal erodes the account balance without the buffer of fresh deposits. Consequently, you’re withdrawing from an account that steadily diminishes in size. Sequencing risk is largely a matter of chance: retiring during a bull market may allow your account to grow sufficiently to weather subsequent downturns, while retiring during a bear market may lead to a permanently reduced account balance. While investors cannot control market conditions, there are opportunities to mitigate downside risks.

How Do You Deal With Sequence of Returns Risk?

The best way to combat sequence risk is by adopting a gradual allocation path from more aggressive when you’re young, to slowly becoming less aggressive as you get older. Consider adjusting asset allocation based on market conditions and your proximity to retirement. A more conservative allocation may be appropriate if you foresee higher sequence risk based on your short-term withdrawal needs.

What is Protecting Against Sequence of Returns Risk?

Protecting against sequence risk means anticipating a worst-case scenario. Don’t assume that a bull market will reign through your retirement. Consider working as late as you can in order to contribute more to your retirement account, particularly in your peak earning years. One approach is to maintain a short-term reserve of low-risk liquid investments that you can use to cover your expenses while you avoid tapping your stocks.

Protecting against sequence risk means anticipating a worst-case scenario. Don’t assume that a bull market will reign through your retirement.

- Diversify: Protect your portfolio by investing in high-quality bonds and money market investments

- Emergency Fund: Having a cash reserve can provide a buffer for living expenses during periods of market downturns

- Laddering: Laddering GICs for portion of your fixed-income holdings can also help minimize the sequence of returns risk

- Overtime: Consider working as late as you can to contribute more to your retirement account in your peak earning years

- Rebalance: Conduct regular reviews of your investment portfolio and make necessary adjustments

- Saving: Investing even after you retire in TFSA or Roth IRA

- Scaling Back: Scaling back portfolio withdrawals and spending to avoid selling investments when the market is down

Conclusion

Sequence risk highlights the vulnerability of investment portfolios to poor performance during specific periods, particularly in the early years of retirement. The order in which investment returns occur can significantly impact the long-term sustainability of a portfolio. This means you may end up facing more challenges when trying to pay for expenses during retirement.