So you’ve determined your risk tolerance is a growth investor. Now you are trying to decide which ETFs to buy that invest in an 80% equity / 20% fixed income asset allocation?

An Exchange Traded Fund (ETF) is a collection of hundreds or thousands of stocks or bonds in a single fund that trades on major stock exchanges. ETFs combine the diversification of mutual funds with lower investment minimum and real-time pricing.

Read my latest Canadian mutual fund review to help you with your ETF portfolio construction.

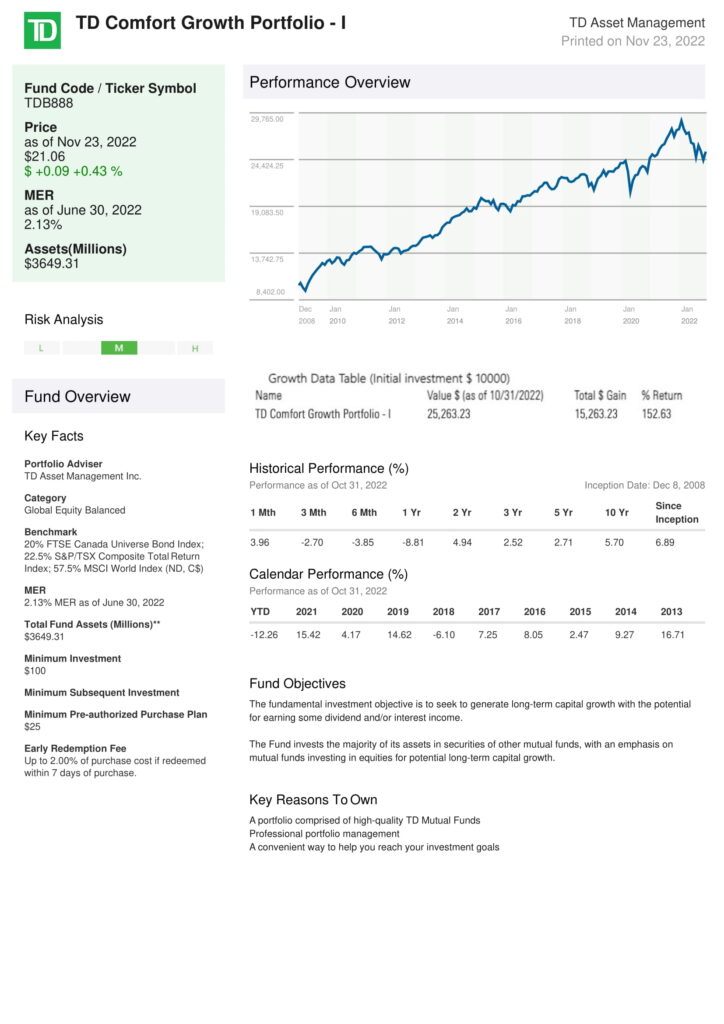

TD Comfort Growth Portfolio vs. VGRO

Here is a table comparing TD Comfort Growth Portfolio (TDB888) to Vanguard Growth ETF Portfolio (VGRO.TO) as of January 31, 2023.

| Mutual Fund/ETF Name | TD Comfort Growth Portfolio | Vanguard Growth ETF Portfolio |

| Fund Code/ETF | TDB888 | VGRO.TO |

| Inception | 2008-12-08 | 2018-01-25 |

| AUM | $3,901,830,000 | $3,774,000,000 |

| MER | 2.13% | 0.24% |

| Risk | Medium | Low to Medium |

| Yield | 0.80% | 2.17% |

| Distributions | Quarterly | Quarterly |

| 1MO | 4.34% | 5.47% |

| 3MO | 6.79% | 7.32% |

| YTD | 4.34% | 5.47% |

| 1 YR | -3.05% | -3.31% |

| 3 YR | 4.46% | 5.73% |

| 5 YR | 3.93% | 6.05% |

| 10 YR | 5.99% | N/A |

| P/E | 15.06 | 13.7 |

| P/B | 2.45 | 2.1 |

| Beta | 1.0 | 1.10 |

- AUM – Assets Under Management

- Beta – the measure of the volatility of a stock compared to the market

- C/S: Cash per Share – the percentage of a company’s share price available to spend on growing the corporation

- Current: Current Ratio – a liquidity ratio that measures a company’s ability to pay short-term obligations or those due within one year

- Distributions – Dividend Distributions

- Dividend Date – the date that a company announces it is paying a dividend

- Earnings: Earnings Date – the next release of a company’s financial report

- ETF – Exchange Traded Fund

- EV/EBITDA: Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization – this ratio compares the value of a company, including debt, to the company’s cash earnings less non-cash expenses

- Ex-Dividend: Ex-Dividend Date – the dividend will be received if bought at least one day before this date

- Holdings: Number of Holdings – the total number of different holdings of a fund

- Inception: Inception Date – the date of the first subscription for units of the fund

- Industry: companies that have a lot in common

- Margin (%): Gross Margin – the percentage of money a corporation has left after subtracting all direct costs of producing or purchasing the goods or services it sells

- Market Cap: Market Capitalization – the total value of all a corporation’s stock

- N/A: Not Applicable or Not Available

- P/B: Price-to-Book – this ratio measures the market’s valuation of a company relative to its book value

- P/E: Price-to-Earnings – this ratio relates a corporation’s share price to its earnings per share

- ROIC (%): Return on Invested Capital – assess a corporation’s efficiency in allocating capital to profitable investments

- Manager – Fund or Portfolio Manager

- Margin (%): Gross Margin – the percentage of money a corporation has left after subtracting all direct costs of producing or purchasing the goods or services it sells

- Market Cap (B): the total dollar market value of a company’s outstanding shares of stock in billions

- MER – Management Expense Ratio

- N/A – Not Applicable or Not Available

- P/B: Price-to-Book – this ratio measures the market’s valuation of a company relative to its book value

- P/E: Price-to-Earnings – this ratio relates a corporation’s share price to its earnings per share

- P/S: Price-to-Sales – this ratio divides the stock price by the underlying corporation’s sales per share

- Payout: Payout Ratio – the percentage of net income a firm pays in dividends

- Price: Stock Price – current value to buyers and sellers

- REV Y/Y (%): Yearly Revenue Growth – the percentage growth of the corporation’s revenue over the trailing twelve months

- Risk – Risk Rating (Volatility)

- Sector: group broadly similar companies

- Yield – Dividend or Distribution Yield

- YTD – Year to Date

- 1M – 1-Month Performance

- 3M – 3-Month Performance

- 1Y – 1-Year Performance

- 3Y – 3-Year Performance

- 5Y – 5-Year Performance

- 10Y – 10-Year Performance

- 15Y – 15-Year Performance

- 52-Week Range – the lowest and highest price at which a stock has traded during the previous 52-weeks

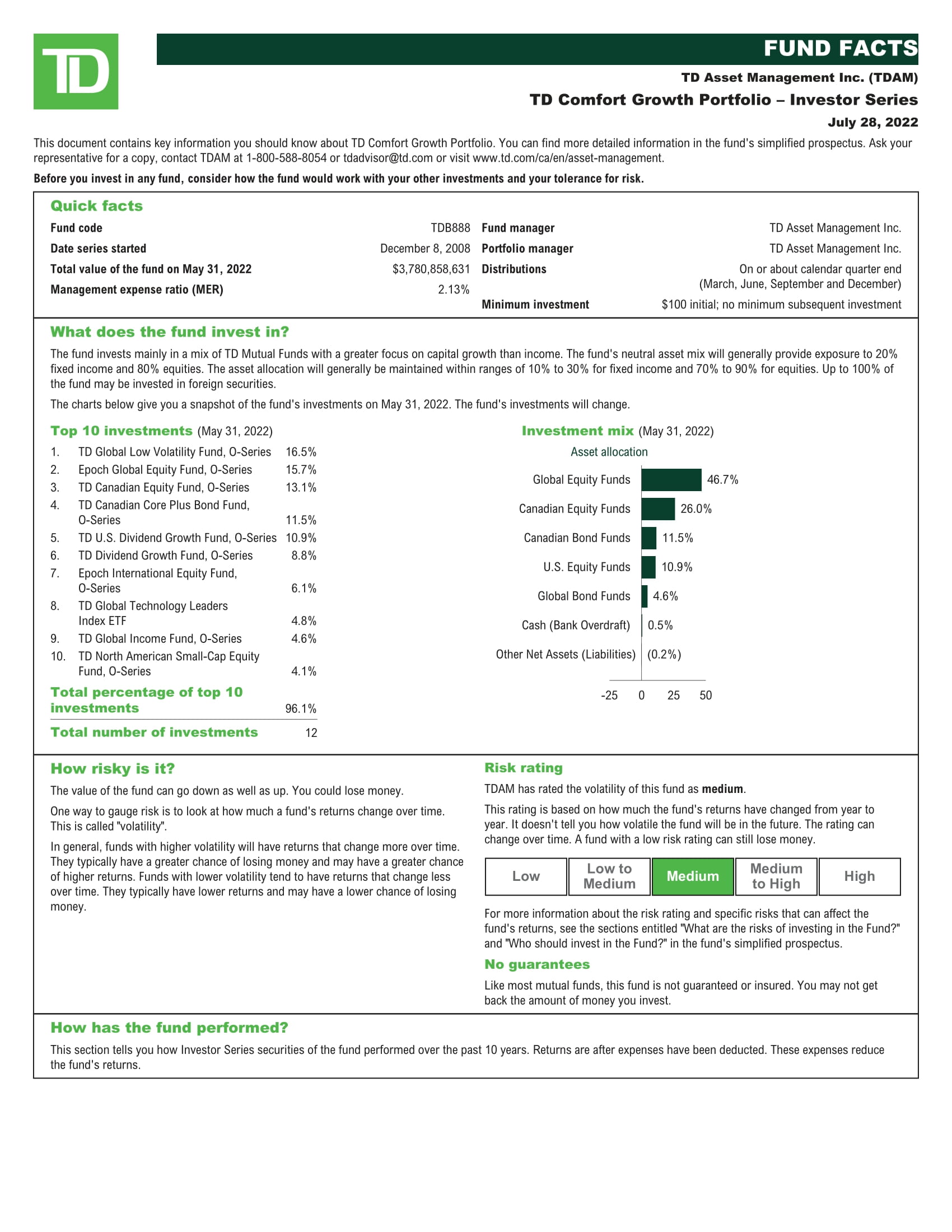

TD Comfort Growth Portfolio Overview

The fund invests mainly in a mix of TD Mutual Funds with a greater focus on capital growth than income. The fund’s neutral asset mix will generally provide exposure to 20% fixed income and 80% equities. The asset allocation will generally be maintained within ranges of 10% to 30% for fixed income and 70% to 90% for equities. Up to 100% of the fund may be invested in foreign securities.

Top Holdings

- TD Global Low Volatility Fund

- Epoch Global Equity Fund

- TD Canadian Equity Fund

- TD Canadian Core Plus Bond Fund

- TD U.S. Dividend Growth Fund

- TD Dividend Growth Fund

- Epoch International Equity Fund

- TD Global Technology Leaders Index ETF

- TD Global Income Fund

- TD North American Small-Cap Equity Fund

What Are the Best Canadian ETFs to Build this Portfolio?

Here is a table how to buy the TD Comfort Growth Portfolio with comparable benchmark ETFs on your own as of January 31, 2023. These investments include Desjardins Canadian Universe Bond Index ETF (DCU.TO), Vanguard FTSE Canadian High Dividend Yield Index ETF (VDY.TO) and iShares MSCI World Index ETF (XWD.TO).

| Benchmark | TD Comfort Growth Portfolio | ETF | MER | 5YR | Benchmark ETF Portfolio % MER | Benchmark ETF Portfolio % Returns |

| FTSE Canada Universe Bond Index | 20% | DCU | 0.10% | 0.95% | 0.020% | 0.19% |

| S&P/TSX Capped Composite Total Return Index | 22.5% | VDY | 0.22% | 9.72% | 0.0495% | 2.187% |

| MSCI World Index | 57.5% | XWD | 0.49% | 8.10% | 0.28175% | 4.6575% |

| Total | 100% | N/A | N/A | N/A | 0.35305% | 7.0345% |

- Benchmark – is a standard with which to measure performance

- ETF – Exchange Traded Fund

- MER – Management Expense Ratio

- 5YR – 5-Year Performance

Replicating the benchmarks with these specific ETFs has proven to be a better solution than VGRO.TO.

My ETF Portfolio Recommendation

Here is a table building a growth (80/20) asset allocation ETF Portfolio. The ETFs include Purpose High Interest Savings Fund (PSA.TO), Vanguard FTSE Canadian High Dividend Yield Index ETF (VDY.TO), Schwab U.S. Dividend Equity ETF (SCHD), BMO MSCI Europe High Quality Hedged to CAD Index ETF (ZEQ.TO) and iShares India Index ETF (XID.TO) as of January 31, 2023.

| Asset Class | Allocation | ETF | MER | 5YR | My ETF Portfolio % MER | My ETF Portfolio % Returns |

| Fixed Income | 20% | PSA.TO | 0.17% | 1.59% | 0.034% | 0.318% |

| Canadian | 20% | VDY.TO | 0.22% | 9.72% | 0.044% | 1.944% |

| American | 35% | SCHD | 0.06% | 11.69% | 0.021% | 4.0915% |

| International | 15% | ZEQ.TO | 0.45 | 9.28% | 0.0675% | 1.392% |

| Emerging Markets | 10% | XID.TO | 0.99% | 5.56% | 0.099% | 0.556% |

| Total | 100% | N/A | N/A | N/A | 0.2655% | 8.3015% |

- Allocation: Asset Allocation – involves dividing your investments among different assets, such as stocks, bonds, and cash

- Asset Class – is a grouping of investments that exhibit similar characteristics

- ETF – Exchange Traded Fund

- MER – Management Expense Ratio

- 5YR – 5-Year Performance

Conclusion

All 3 solutions are better solutions than purchasing this mutual fund. The superior portfolio is my 5 ETF solution with a low 0.2655%MER and 5-year annualized performance of 8.3015%. For simplicity, I recommend the first solution to solely purchase VGRO.TO which is also the least expensive, but worst-performing recommendation.

Related Investing News

|  |  |  |  |  |

|---|---|---|---|---|---|

| Advice | InvestCAN | InvestRESP | InvestUSA | RetireCAN | RetireMGN |

| $500.00 CAD $400.00 USD | $99.99 CAD | $79.99 USD | $99.99 CAD | $12.99 CAD $9.99 USD |