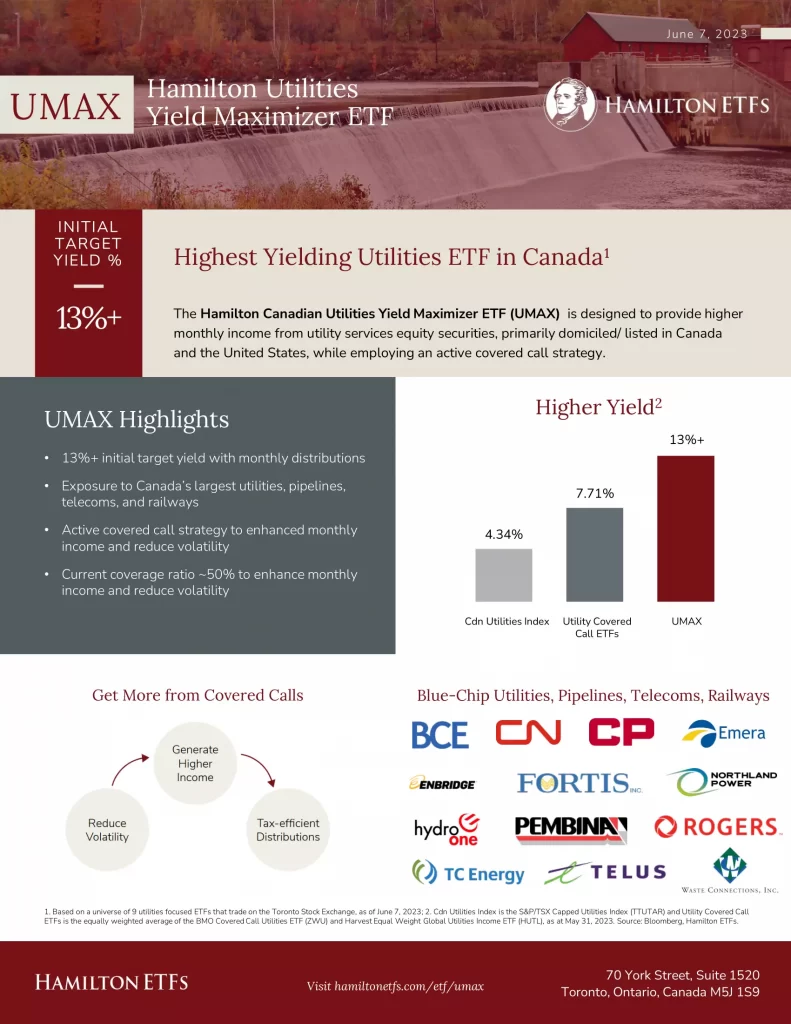

Hamilton Utilities Yield Maximizer ETF (UMAX) is designed for attractive monthly income, while providing exposure to a portfolio of utility services equity securities, primarily domiciled/listed in Canada and the U.S. To reduce volatility and augment dividend income, UMAX will employ an active covered call strategy.

- Diversified exposure to Canadian utilities, pipelines, telecoms, and railways

- Active covered call strategy to increase monthly income

- UMAX does not use leverage

UMAX Utility Holdings

- FTS: Fortis Inc.

- EMA: Emera Incorporated

- H: Hydro One Limited

UMAX Non-Utility Holdings

- BCE: BCE Inc.

- CNR: Canadian National Railway Company

- CP: Canadian Pacific Kansas City Limited

- ENB: Enbridge Inc.

- PPL: Pembina Pipeline Corporation

- RCI.B: Rogers Communications Inc.

- T: TELUS Corporation

- WCN: Waste Connections, Inc.

UMAX ETF Review

Quickly compare and contrast UMAX to other investments focused on Canadian equities by fees, performance, yield, and other metrics to decide which ETF fits in your portfolio.

| Manager |  |  |  |  |  |  |

| ETF | ZUT | ZWU | BMAX | HUTS | UMAX | HUTL |

| Inception | 2010-01-19 | 2011-10-20 | 2022-10-18 | 2022-09-01 | 2023-06-07 | 2019-01-07 |

| AUM | $429,110,000 | $1,801,280,000 | $53,000,000 | $14,497,443 | $18,200,000 | $159,340,000 |

| Holdings | 16 | 69 | 13* | 12 | 13 | 33 |

| MER | 0.61% | 0.71% | 2.59% | 1.87% | N/A | 0.73% |

| Risk | Medium | Low to Medium | Medium | Medium | Medium | Medium |

| Yield | 4.18% | 7.62% | 9.68% | 7.04% | 13%* | 8.18% |

| Distributions | Monthly | Monthly | Monthly | Monthly | Monthly | Monthly |

| YTD | 4.13% | -1.75% | N/A | N/A | N/A | 1.37% |

| 1M | -1.48% | -5.39% | N/A | N/A | N/A | -5.98% |

| 3M | 6.04% | -0.05% | N/A | N/A | N/A | -0.13% |

| 6M | 0.15% | -3.97% | N/A | N/A | N/A | -0.96% |

| 1Y | -9.11% | -11.89% | N/A | N/A | N/A | -8.22% |

| 3Y | 8.00% | 4.47% | N/A | N/A | N/A | 5.21% |

| 5Y | 11.70% | 4.85% | N/A | N/A | N/A | N/A |

| 10Y | 8.53% | 3.96% | N/A | N/A | N/A | N/A |