Wealthsimple builds portfolios of assets that are broadly diversified across markets and don’t try to time the market. To match you with the right portfolio, they ask you a few questions, like what you’re saving for and when you’re going to need the money. In general, the longer you have to invest, the more risk you can take in your portfolio as you will have plenty of time to make up for any short-term losses. They do not charge anything for withdrawals, transferring out, or leaving your account open with a zero balance.

Wealthsimple Managed Portfolios:

- Automatic deposits

- Rebalancing

- Dividend reinvestment

- 0.5% management fee (0.4% management fee with $100,000+)

Wealthsimple Managed Portfolio Holdings

- EEMV: iShares MSCI Emerging Markets Min Vol Factor ETF

- Bank Of China Ltd

- CHT: Chunghwa Telecom Co., Ltd.

- First Financial Holding Co., Ltd.

- President Chain Store Corporation

- Taiwan Mobile Co., Ltd.

- GLDM: SPDR Gold MiniShares

- GLOV: Goldman Sachs ActiveBeta World Low Vol Plus Equity ETF

- AAPL: Apple Inc.

- AZO: AutoZone, Inc.

- ORLY: O’Reilly Automotive, Inc.

- MSFT: Microsoft Corporation

- WMT: Walmart Inc

- QCN.TO: Mackenzie Canadian Equity Index ETF

- CNR.TO: Canadian National Railway Company

- CP.TO: Canadian Pacific Railway Limited

- ENB.TO: Enbridge Inc.

- RY.TO: Royal Bank of Canada

- TD.TO: Toronto-Dominion Bank

- VTI: Vanguard Total Stock Market Index Fund

- AAPL: Apple Inc.

- AMZN: Amazon.com, Inc.

- BRK-B: Berkshire Hathaway Inc.

- GOOGL: Alphabet Inc Class A

- MSFT: Microsoft Corporation

- ZCS.TO: BMO Short Corporate Bond Index ETF

- ZEA.TO: BMO MSCI EAFE Index ETF

- ASML: ASML Holding N.V.

- LVMH Moët Hennessy

- Nestlé S.A.

- NVO: Novo Nordisk A/S

- SHEL: Shell plc

- ZFL.TO: BMO Long Federal Bond Index ETF

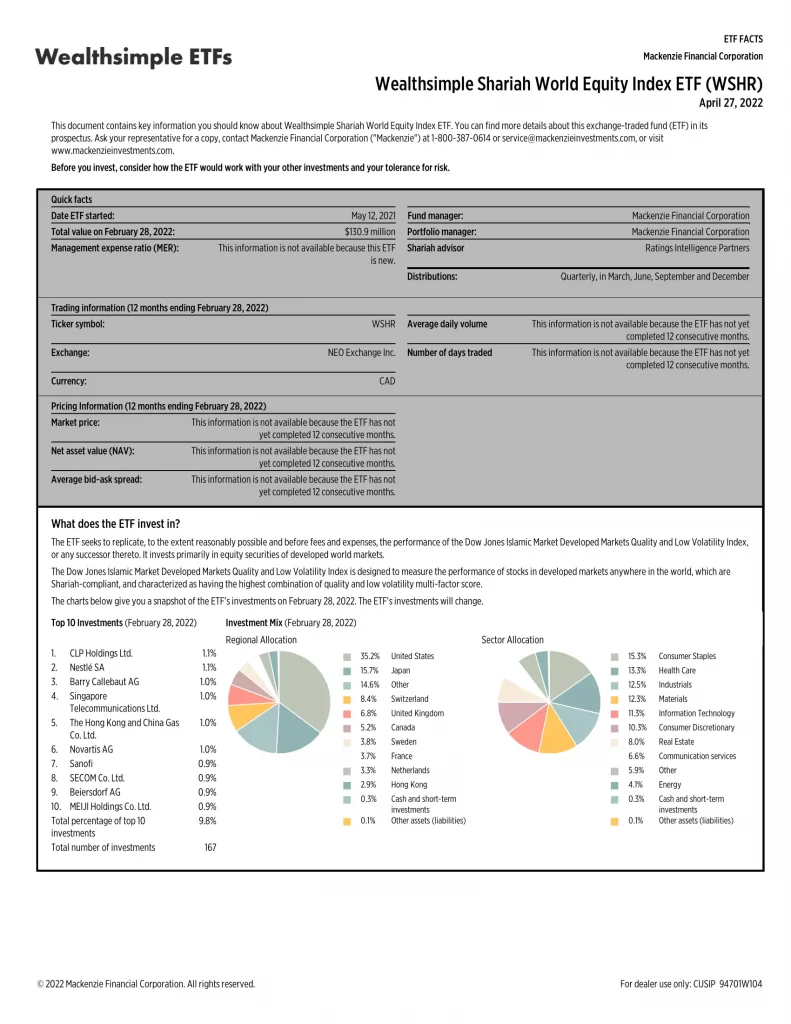

How Do I Build a Growth Robo-advisor Portfolio on My Own?

Here is a table of how to buy the Wealthsimple Managed Growth (80% equity / 20% fixed income) portfolio with individual ETFs on your own as of January 31, 2023. Wealthsimple mentions a modelled 80% equity / 20% fixed income portfolio on their website with 4.21% 5-year annualized as of Jan 31, 2023. Including a robo-advisor fee of 0.5%, the total MER of a Wealthsimple Managed Growth portfolio is 0.6549% (0.5549% with $100,000+). When taking a look at fees and performance, investors would be better off buying VGRO.TO on their own. Unfortunately, 5-year performance was unavailable for Goldman Sachs ActiveBeta(R) World Low Vol Plus Equity ETF (GLOV) and SPDR Gold MiniShares (GLDM), but a close representation of the portfolio was calculated using SPDR Gold Shares (GLD) and Vanguard Developed Markets Index Fund (VEA). With these substitutions, the 5-year performance was 4.26109% before fees, with a total performance of 3.76109% (3.86109% with $100,000+). The displayed returns must be before fees because of the tiered pricing they have for customers with larger assets under management, and similar performance numbers I calculated.

| ETF | Wealthsimple Managed Growth | MER | 5YR | Wealthsimple Managed Growth % MER | Wealthsimple Managed Growth % Returns |

| VTI | 26.0% | 0.03% | 9.03% | 0.0078% | 2.3478% |

| ZEA.TO | 21.7% | 0.22% | 3.86% | 0.04774% | 0.83762% |

| EEMV | 13.2% | 0.25% | -0.40% | 0.033% | -0.0528% |

| GLOV (VEA) | 10.0% | 0.25% (0.05%) | N/A (2.44%) | 0.025% (0.005%) | N/A (0.244%) |

| QCN.TO | 9.7% | 0.04% | 8.6% | 0.00388% | 0.8342% |

| ZFL.TO | 15.4% | 0.22% | -0.92% | 0.03388% | -0.14168% |

| GLDM (GLD) | 2.5% | 0.10% (0.40%) | N/A (6.99%) | 0.0025% (0.01%) | N/A (0.17475%) |

| ZCS.TO | 1.0% | 0.11% | 1.72% | 0.0011% | 0.0172% |

| Cash | 0.4% | 0.00% | 0.00% | 0.00% | 0.00% |

| TOTAL | 100% | N/A | N/A | 0.1549% (0.1424%) | N/A (4.26109%) |

- Benchmark – is a standard with which to measure performance

- ETF – Exchange Traded Fund

- MER – Management Expense Ratio

- 5YR – 5-Year Performance

Wealthsimple Growth vs. TD Growth vs. Vanguard Growth

Here is a table comparing the Wealthsimple Managed Growth product to TD Comfort Growth Portfolio (TDB888) and Vanguard Growth ETF Portfolio (VGRO.TO) as of January 31, 2023.

| Product Name | TD Comfort Growth Portfolio | Vanguard Growth ETF Portfolio | Wealthsimple Managed Growth |

| Fund Code/ETF | TDB888 | VGRO.TO | N/A |

| AUM | $3,901,830,000 | $3,774,000,000 | N/A |

| MER | 2.13% | 0.24% | 0.6549% |

| 5 YR | 3.93% | 6.05% | 3.76109% |

- AUM – Assets Under Management

- ETF – Exchange Traded Fund

- MER – Management Expense Ratio

- N/A – Not Applicable or Not Available

- 5YR – 5-Year Performance

Socially Responsible Investing

Your money is spread across the entire stock market using proprietary exchange traded funds (ETFs) carefully screened for environmental and social impact. The company is essentially charging you to manage your money (robo-advisor) and they also collect the fees for the investment management of the ETFs. I consider this double dipping, as there are better performing ETFs with socially responsible investing objectives. In addition, Wealthsimple is only recommending their proprietary products with this investment. I would technically consider this a very simple fund-of-funds solution with a lower management fee than a brick-and-mortar financial institution product that includes services with a financial advisor.

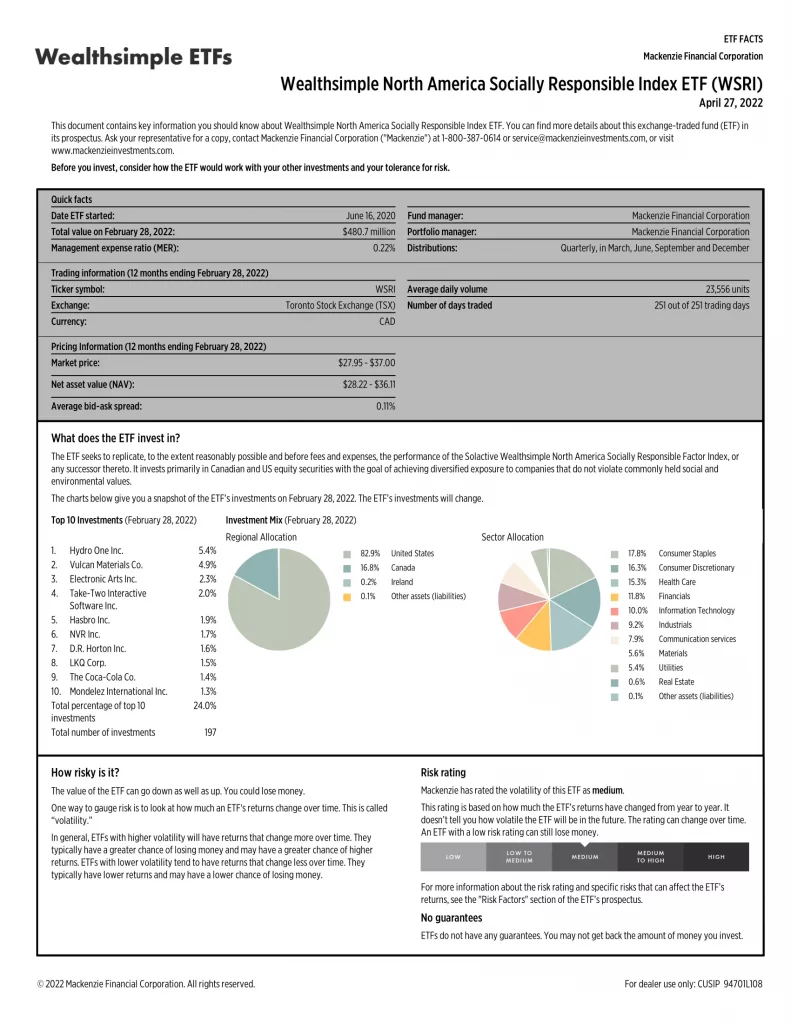

Halal Investing

These are portfolios built to comply with Islamic law.

- All investments are screened by a third-party committee of Shariah scholars

- No investment in companies that profit from gambling, arms, tobacco, or other restricted industries

- No businesses that derive significant income from interest on loans

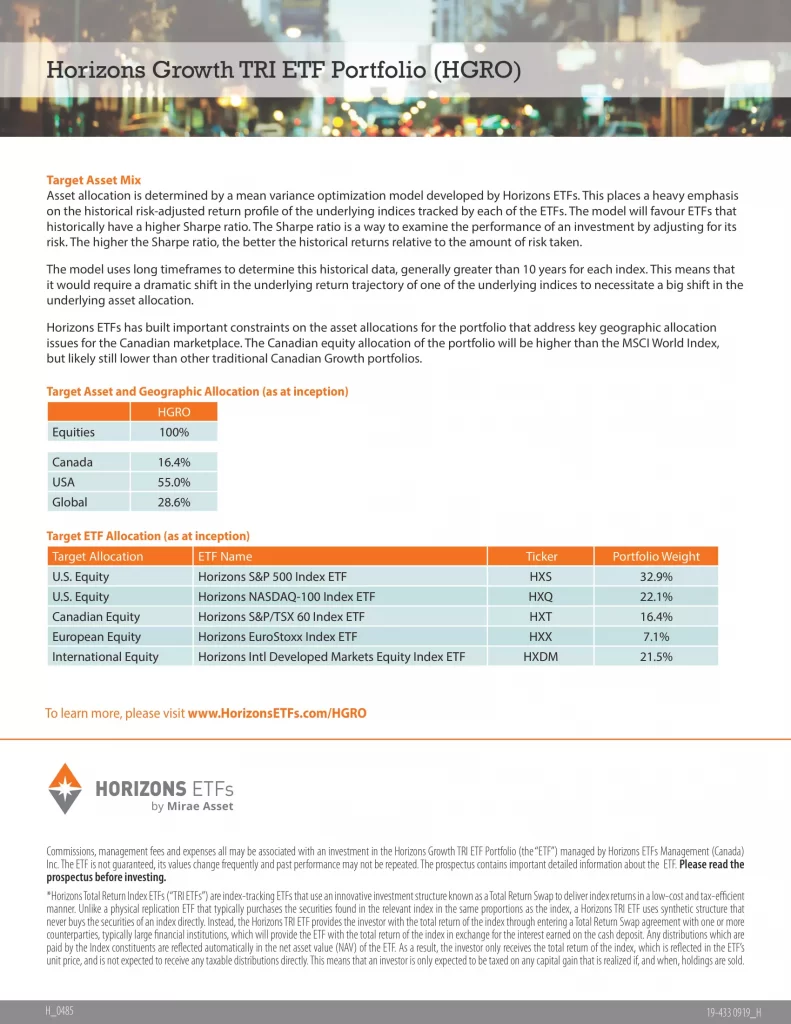

A List of Wealthsimple ETFs

- WSGB.NE: Wealthsimple North American Green Bond Index ETF

- WSHR.NE: Wealthsimple Shariah World Equity Index ETF

- WSRD.TO: Wealthsimple Developed Markets ex North America Socially Responsible Index ETF

- WSRI.TO: Wealthsimple North America Socially Responsible Index ETF

| ETF | WSRI.TO | WSRD.TO | WSHR.TO | WSGB.TO |

| Manager | Wealthsimple | Wealthsimple | Wealthsimple | Wealthsimple |

| Inception | 2020-06-16 | 2020-06-16 | 2021-05-12 | 2022-01-21 |

| AUM | $535,000,000 | $499,000,000 | $130,900,000 | $194,600,000 |

| Holdings | 197 | 130 | 167 | 133 |

| MER | 0.22% | 0.27% | N/A | N/A |

| Risk | Medium | Medium | Medium | Low |

| Yield | 1.21% | 2.17% | 1.46% | N/A |

| Distributions | Quarterly | Quarterly | Quarterly | Monthly |

| 1MO | N/A | N/A | N/A | N/A |

| 3MO | N/A | N/A | N/A | N/A |

| YTD | N/A | N/A | N/A | N/A |

| 1YR | N/A | N/A | N/A | N/A |

| 3YR | N/A | N/A | N/A | N/A |

| 5YR | N/A | N/A | N/A | N/A |

| 10YR | N/A | N/A | N/A | N/A |

| P/E | N/A | N/A | N/A | N/A |

| P/B | N/A | N/A | N/A | N/A |

| Beta | N/A | N/A | N/A | N/A |

- AUM – Assets Under Management

- Distributions – Dividend Distributions

- ETF – Exchange Traded Fund

- Holdings: Number of Holdings – the total number of different holdings of a fund

- Inception: Inception Date – the date of the first subscription for units of the fund

- Manager – Fund or Portfolio Manager

- MER – Management Expense Ratio

- N/A – Not Applicable or Not Available

- Risk – Risk Rating (Volatility)

- Yield – Dividend or Distribution Yield

- YTD – Year to Date

- 1MO – 1-Month Performance

- 3MO – 3-Month Performance

- 1YR – 1-Year Performance

- 3YR – 3-Year Performance

- 5YR – 5-Year Performance

- 10YR – 10-Year Performance

Conclusion

For simplicity and growth, purchasing Vanguard Growth ETF Portfolio (VGRO.TO) is less expensive and better performing than Wealthsimple’s Managed Growth product and TD’s growth mutual fund. Independently utilizing an online brokerage account coupled with my unbiased advice to find you a product that outperforms can keep your money in your pocket.

March 31th, 2023

| ETF | Wealthsimple Managed Growth Allocation | ETF | 1Y | 3Y | 5YR | ETF | 1Y | 3Y | 5Y |

| American | 26.0% | HXS.TO | -0.66% | 16.53% | 11.79% | XUS.TO | -0.35% | 16.23% | 11.84% |

| International | 20.0% | HXDM.TO | 7.33% | 10.69% | 3.77% | CJP.NE | 9.11% | 18.01% | 6.02% |

| Emerging Markets | 14.0% | EEMV | -8.87% | 7.46% | -0.07% | ZID.TO | -5.36% | 24.90% | 9.55% |

| Global | 10.0% | ACWV | -5.55% | 8.43% | 5.26% | XWD.TO | 1.27% | 14.30% | 8.80% |

| Canadian | 10% | HXT.TO | -5.72% | 17.35% | 9.24% | ZLB.TO | 3.14% | 16.62% | 10.10% |

| Government Bond | 16.5% | ZFL.TO | -7.82% | -8.44% | -1.52% | ZMP.TO | 0.06% | -1.30% | 1.35% |

| Gold | 2.5% | CGL-C.TO | 9.81% | 4.78% | 8.81% | CGL-C.TO | 9.81% | 4.78% | 8.81% |

| Corporate Bond | 1.0% | VSC.TO | 1.03% | 1.75% | 1.71% | XHB.TO | -0.98% | 2.37% | 1.97% |

Related Investing News

Book a Coaching Session Today!

For more tips and advice you can book a coaching session with me for assistance building a portfolio and retirement planning.

Download an ETF Portfolio Builder for Canadians & Americans!

Discover exactly whch Exchange Traded Funds (ETFs) to buy for a diversified and risk-adjusted portfolio. Take advantage of irregularities in the market using tactical asset allocation (TAA) instead of purchasing a one-fits-all investment from a financial institution. By making a one-time purchase of this inexpensive app below, you’ll have the recommendations of a financial advisor for the rest of your life. This will avoid you paying management expenses of approximately 0.4 – 1.25%.

HINT: Make sure to adjust your portfolio with each update provided throughout the year.

Book a Coaching Session Today!

For more tips and advice you can book a coaching session with me for assistance building a portfolio and retirement planning.